China’s long-awaited stimulus measures may have been too much for the markets to handle.

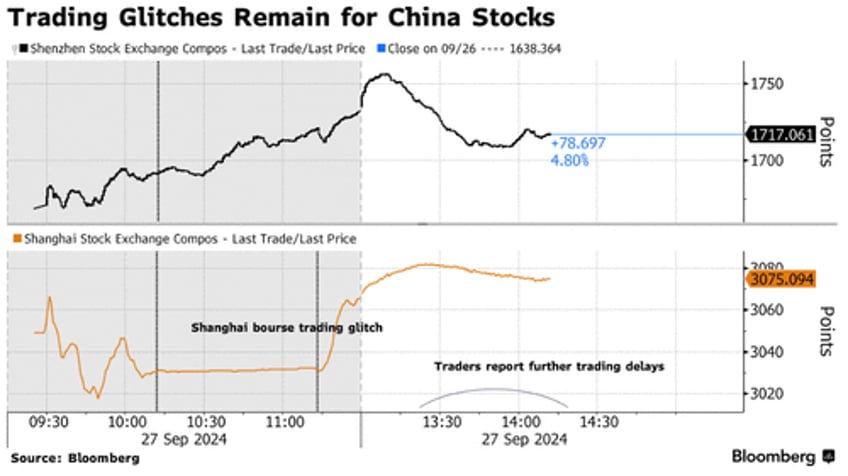

With shares soaring and turnover reaching 710 billion yuan ($101 billion) in the first hour of trading on Friday, Shanghai’s stock exchange was marred by glitches in processing orders and delays, according to messages from brokerages seen by Bloomberg News.

The Shanghai Stock Exchange is investigating reasons for delays, it said in a statement.

“I only recall a trading delay like this one during the 2015 rally, but generally it sends a positive signal,” said Du Kejun, fund manager at Shandong Camel Asset Management Co.

“While it was but a small disruption to our trading, it would have been a big annoyance for firms that were eager to increase their positions today.”

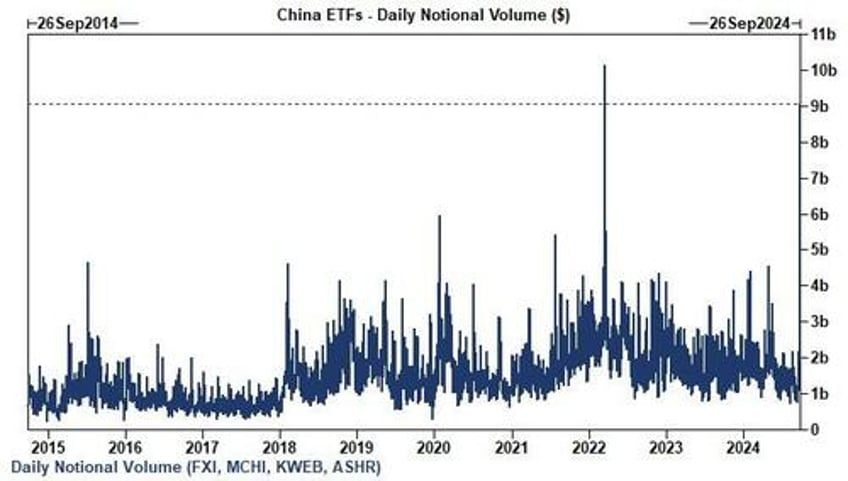

As Goldman Sachs notes, volumes roared +4x vs 20d averages across the complex, totaling to +$9bn in trading volume (larger than Tuesday)...

Source: Goldman Sachs

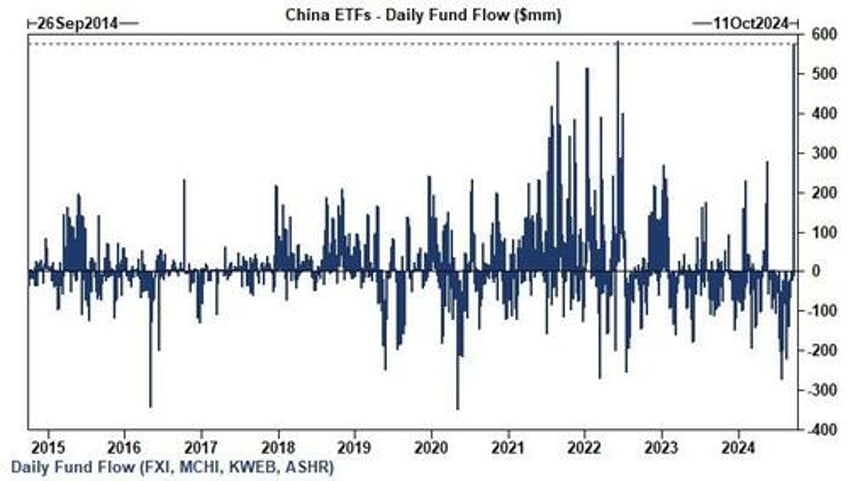

...and +$580mm worth of inflows (KWEB +$414mm) – its 2nd largest day for both in the past 10 years...

Source: Goldman Sachs

Goldman Sachs notes that LOs have been skewed to buy and have been driving activity in the China ETF space (but HF activity has been relatively muted).

This 'glitch' did not go unnoticed as Bloomberg reports a number of quantitative hedge funds in China were hit severely on Friday as the nation’s equities staged their biggest rally in years, according to people familiar with the matter.

Some firms suffered heavy losses because they shorted index futures for their so-called Direct Market Access (DMA) strategies, said the people, asking not to be identified discussing a private matter.

Some saw their losses exacerbated by the Shanghai Stock Exchange glitch that left them unable to sell holdings to meet margin requirements, another person said.

The losses come as many quants are still recovering from record drawdowns suffered during China’s stock market meltdown in February, when their favored small-cap stocks crashed, prompting regulators to push for the DMA products to be phased out.

The DMA strategy typically uses high leverage and involves holding long positions in individual stocks while shorting stock index futures.

A surge in index futures on Friday exceeded gains in stocks, switching a persistent discount to a premium and imposing losses on market-neutral products’ positions, Li said.

“The losses on market-neutral products should be industrywide today, while some DMAs could have been forced to liquidate,” said Li Minghong, founding partner of Shanghai Jiutouxiang Financial Information Services.

Now they have been caught wrongfooted again after China’s latest economic stimulus measures sparked the biggest weekly equity rally since 2008.

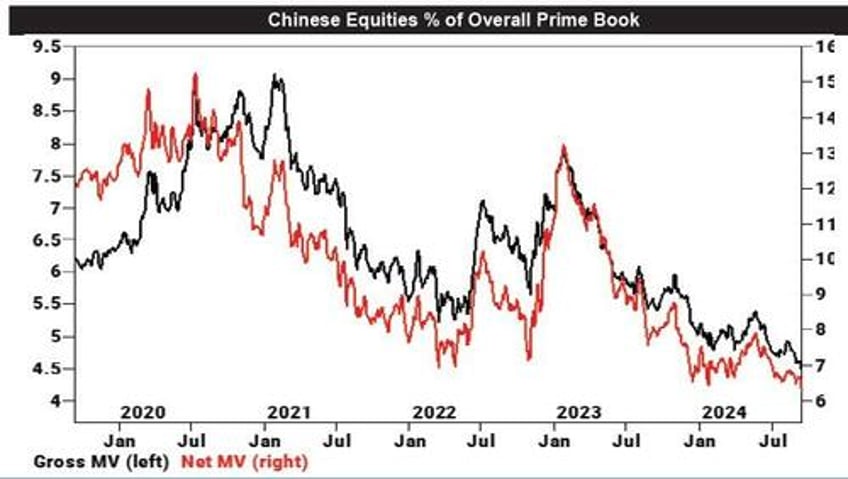

The massive squeeze should come as a major surprise since positioning is practically at record lows. Chinese equities now make up 4.5% and 6.2% of our Overall Prime book’s Gross and Net Exposures, respectively, which are both at fresh 5-year lows...

Source: Goldman Sachs

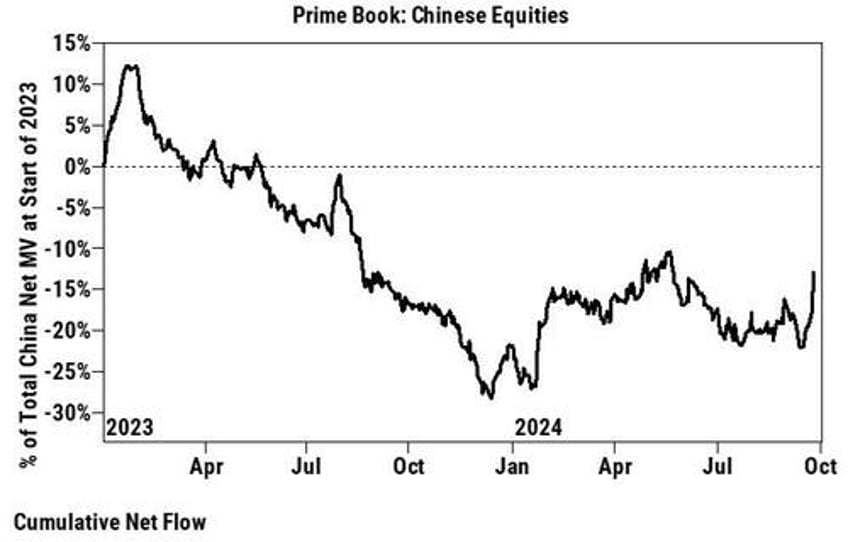

In cumulative notional terms since the start of 2023, however, Chinese stocks remain meaningfully net sold by hedge funds.

Source: Goldman Sachs

“The trading system is simply overwhelmed. There is a huge stampede of stock bulls,” Hao Hong, chief economist at Grow Investment Group, said in a post on X.