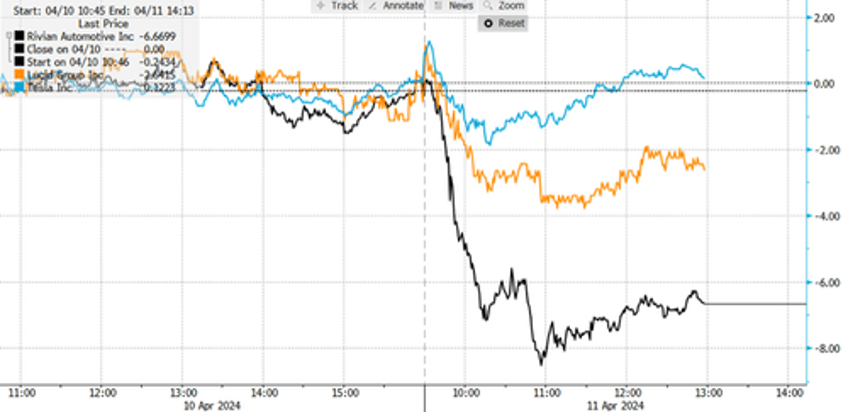

Shares of Rivian Automotive, Lucid Group, and Tesla Motors moved lower during the cash session in the US after Ford Motor announced price cuts for its electric F-150 Lightning pickup truck amid concerns about sliding demand across the EV industry. Meanwhile, an EV price war between the automakers rages on as unprofitable EV startups struggle to survive.

Let's begin with a Bloomberg report that says Ford is reducing the price of its Lightning pickup truck by up to 7.5%. Earlier this year, the company paused production of the truck and is set to resume production later in the month

The largest price cut is on the Flash extended-range model, where customers could expect to save $5,500. The model now starts at around $67,995. Ford told Bloomberg that price cuts will help it "adapt to the market to achieve the optimal mix of sales growth and customer value."

The downshift in EV demand has led Chief Executive Officer Jim Farley to reevaluate Ford's EV strategy by reducing spending on battery-powered vehicles by $12 billion, delaying the launch of various models, and beginning to offer an expanded lineup on gas-electric hybrid propulsion vehicles across North America.

Thousands of auto dealers nationwide recently warned the 'climate change warriors' in the White House: the 2030 EV push is backfiring.

"Currently, there are many excellent battery electric vehicles available for consumers to purchase. These vehicles are ideal for many people, and we believe their appeal will grow over time. The reality, however, is that electric vehicle demand today is not keeping up with the large influx of BEVs arriving at our dealerships prompted by the current regulations. BEVs are stacking up on our lots," the dealers said.

They warned: "Already, electric vehicles are stacking up on our lots which is our best indicator of customer demand in the marketplace."

Many consumers do not embrace the government's and corporate America's forced EV adoption schemes. This is now entirely backfiring, as even Tesla's first-quarter deliveries lagged behind expectations, which may indicate more price cuts are coming.

"Reports of Ford reducing prices for the F-150 Lightning EV are sending shockwaves through the EV market, particularly affecting Rivian and Lucid," Bloomberg Intelligence analyst Steve Man said.

Man said, "Both startups are facing challenges that could be exacerbated by another round of EV price cuts, potentially eroding their profit margins and cash reserves at a time when they need to conserve cash."

Shares of Rivian dropped the most, down 6.5% in early afternoon trade. Shares of Lucid were down around 2.5%, and Tesla was flat on the session.

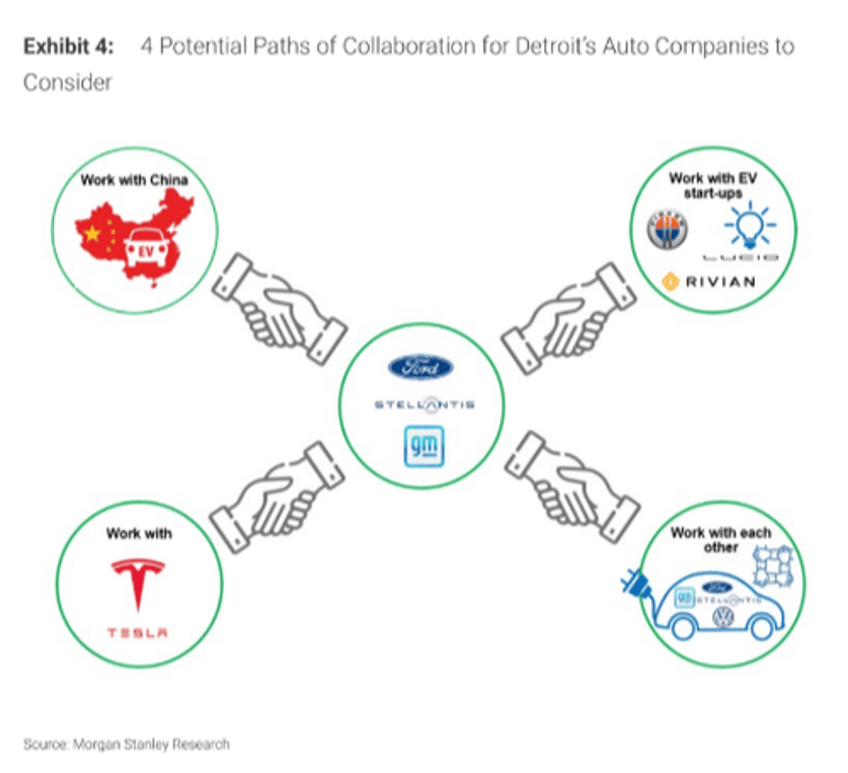

Recall analyst Adam Jonas at Morgan Stanley recently suggested consolidation is coming to the industry:

What a turbulent time for the EV space... Someone tell Biden to tell Powell ... moar rate cuts, please, to reflate the imploding green bubble.