In a bid to shore up political support from the centrists, over the weekend France's surprise political leader Marine Le Pen - who blew president Macron away in the European Parliament elections - assured that she would work with Macron should she prevail in national elections.

“I’m respectful of institutions, and I’m not calling for institutional chaos,” Le Pen told Le Figaro newspaper. “There will simply be cohabitation.”

Le Pen is reaching out to mainstream voters as she aims to cement a majority in the next parliament, a result that would constitute an earthquake in European politics. Her group, the National Rally, is already on track to become the biggest party in the lower house, a prospect which has caused alarm among investors, France’s international partners and a section of the French public.

Tens of thousands of protesters took to the streets across France on Saturday to oppose Le Pen’s stance on human rights, the environment and the economy. Financial markets have also tumbled since Macron dissolved the National Assembly a week ago, with about $210 billion wiped off the value of French stocks.

“The chaos is him,” she told Le Figaro. “Social chaos, chaos on security issues, chaos with migration, and now, institutional chaos.”

As Bloomberg reports, Le Pen said that if she can form a majority — either with National Rally lawmakers alone, or with allies — she would lead her group’s parliamentary caucus and 28-year-old party leader Jordan Bardella will become prime-minister. The two-round election concludes on July 7.

Le Pen has spent years trying to soften the image of her movement, which was founded by her father, and which is viewed by Europe's liberals as extremist and her father is called "a holocaust denier and anti-semite." All the same, in the presidential election of 2022, she proposed a crackdown on immigration that would have involved expelling undocumented migrants. Bardella has portrayed immigration from Africa as a threat to French culture and has at times endorsed the “great replacement” conspiracy theory, which says that White, Christian Europeans are being supplanted by Muslim or non-Western migrants.

On Russia, Le Pen has tried to recalibrate her position as the war in Ukraine transformed public perceptions of Putin. She has praised the “heroic resistance” of the Ukrainian people but she’s also criticized international sanctions on Russia and the National Rally abstained in a vote earlier this year on providing security guarantees to Kyiv.

* * *

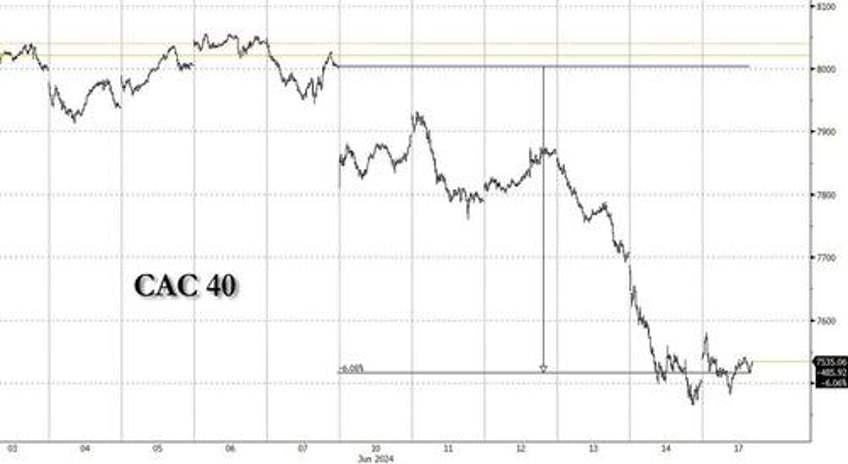

The news of Le Pen's olive branch led to an initial bounce in French stocks as traders initially seized on Le Pen’s comments that she won’t try to push Macron out, but sentiment remains fragile before the first round of voting on June 30. Sure enough, prices quickly trimmed gains and bonds posted small moves as traders weighed assurances from the conservative leader. France’s CAC 40 benchmark bounced as much as 1% before paring the move, near its lowest since January.

Last week’s losses saw France slip behind the UK as the biggest equity market in Europe. The slump erased all of the CAC 40 benchmark’s gains for 2024 — a sharp reversal from scaling record highs a month ago. An index of euro-denominated junk bonds, almost a fifth of which comprises French companies, widened sharply to its highest spread over benchmarks since early April.

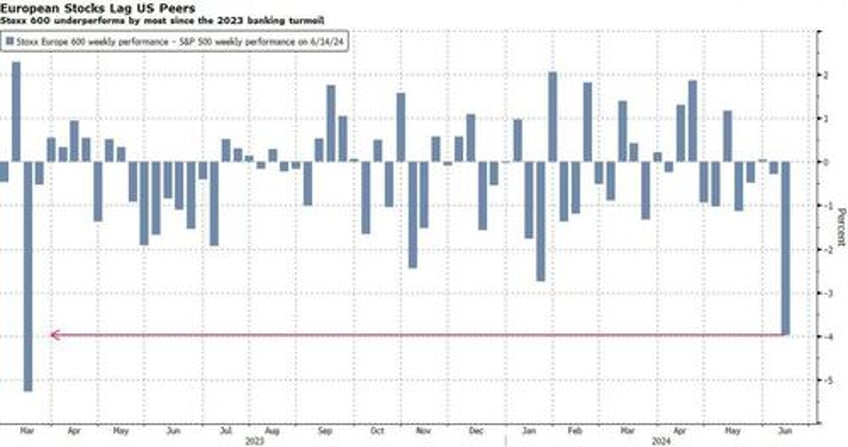

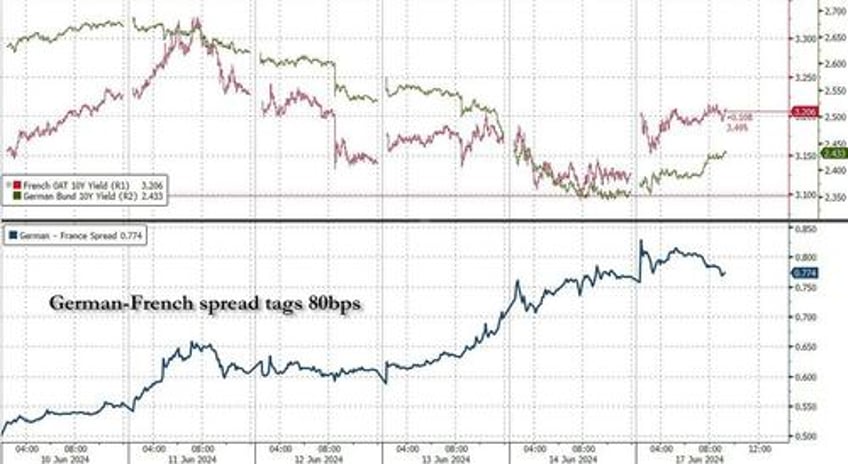

The retreat last week also spread into broader European equity markets, with the benchmark Stoxx Europe 600 Index suffering its worst week since October. The gauge traded flat as of 1:21 p.m. in London after climbing as much as 0.7% earlier as Citigroup downgraded the region’s equities, citing “heightened political risks” among other reasons. Yields on French government bonds advanced again on Monday, while remaining broadly in line with their German peers.

“Investors should stay out of it at the moment,” said Evelyne Gomez-Liechti, rates strategist at Mizuho International. While “there can be some short-term small consolidation,” there’s still huge uncertainty given a lack of clarity over the economic policies of Le Pen’s National Rally, she said referring to concern about political volatility after Macron called a snap vote for later this month spurred a flight to haven assets last week, wiping out $258 billion from the market capitalization of the country’s stocks.

A raft of officials and strategists suggested the declines were overdone.

“What we’re seeing in the markets is, of course, a repricing,” European Central Bank Chief Economist Philip Lane said on Monday at an event organized by Reuters in London. “It’s not, you know, the world of disorderly market dynamics.”

According to Liberum’s Joachim Klement and Susana Cruz, concerns about about a right-wing prime minister are overblown and markets will calm after the vote.

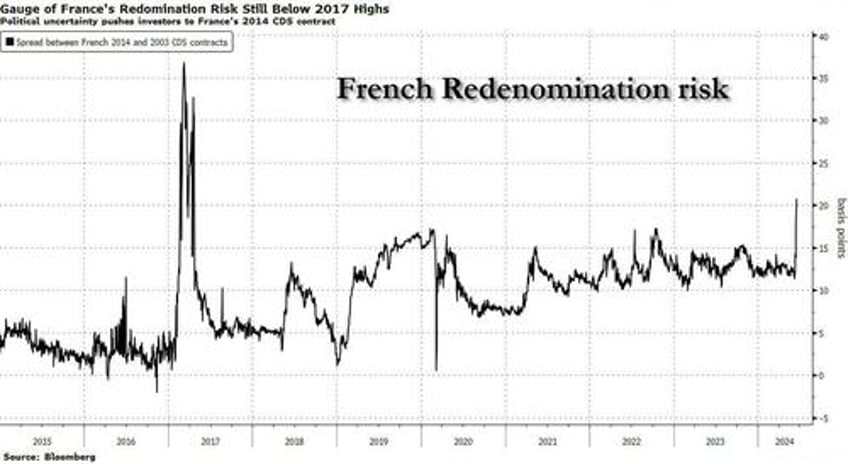

While a gauge of redenomination risk, the risk that France leaves the eurozone, jumped last week, it remains well below the levels seen in 2017 when then-presidential candidate Le Pen advocated leaving the European Union. The party has since softened its stance toward European Union membership.

Frédérique Carrier, head of investment strategy at RBC Wealth Management, noted that populist politicians have a history of moving closer to the center once they reach power and Le Pen’s comments had fueled hopes for that outcome in France.

Still, “foreign investors are nervous about the heightened political risk that the situation in France brings,” she said.

That nervousness is further blurring the lines in Europe’s traditional debt hierarchy, putting French’s bonds on a par with those once at the heart of the region’s debt crisis. According to Bloomberg, Portuguese debt now yields less than comparable French debt, while the gap between Spanish and French 10-year yields has dwindled to just 11 basis points, the least since 2008 on a closing basis.

It’s an extension of a long-term trend that’s been playing out for years, with investors increasingly demanding more compensation given the country’s bloated debt pile. The European Commission is expected to initiate its Excessive Deficit Procedure against France this week, an action designed to force member states to get poor public finances in line with EU rules.