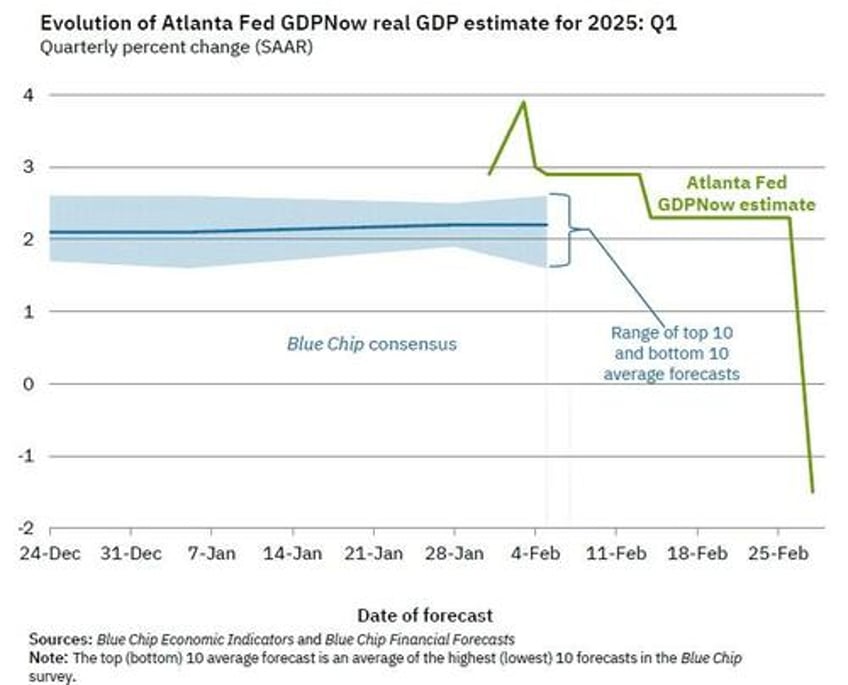

The Federal Reserve Bank of Atlanta’s GDPNow model projection for real GDP growth in the first quarter of 2025 (Q1 2025) is now showing a slump to -1.5%. This marks a significant downward revision from the previous estimate of 2.3% on February 19, 2025.

Such an enormous decline is strange. How did we go from +2.3% to -1.5% in less than a month? That kind of collapse in an economy as large as the United States is exceedingly rare. [ZH: It's even worse now, as we detailed earlier.]

The immediate reaction from the media is to call this the beginning of a “Trump recession” and blame it on President Trump’s policies. Interestingly, on June 1, 2022, the Atlanta Fed GDPNow estimated the second quarter of 2022 growth at +1.3%. By July 1, 2022, it had dropped to -2.1%, a shift of 3.4 percentage points in 30 days. What did the media call it? “Growth scare”. A similar thing happened in the third quarter of 2021. The estimate fell from 6.1% (July 30) to 2.3% (October 1), a 3.8-point drop over two months.

In 2022, real GDP declined for two consecutive quarters under Biden’s administration. According to the Bureau of Economic Analysis, the first quarter saw a decrease of -1.6% in the annualised rate, followed by a 0.6% drop in the second quarter. Hundreds of analysts, commentators, and economists, along with the NBER, swiftly declared that this was not a recession. Thus, it is hilarious to read the hundreds of comments arguing that the Atlanta Fed NowCast means that the new administration’s policies are causing a recession.

As I wrote a few months ago, the United States has been in a private sector recession for months. However, an abnormal increase in government spending during a period of growth and a risky borrowing policy led to a bloated Gross Domestic Product (GDP).

The United States had a $7.59 trillion nominal GDP increase between 2021 and 2024 compared to a rise of $8.47 trillion in government debt. This marks the worst GDP growth adjusted for government debt accumulation since the 1930s.

Many analysts are warning that the Department of Government Efficiency (DOGE) efforts will cause a recession if government spending is aggressively reduced. However, cutting spending may “reduce” GDP but does not harm productive economic growth; it will likely strengthen it.

We must remember that US government spending financed by increasing federal debt accounted for about 22% to 25% of the total US GDP growth over 2021–2024. This extraordinary increase in government spending in the middle of a recovery led to record-high government debt and was the leading cause of money supply growth and, with it, the inflation burst that Americans are suffering today.

A research study from MIT Sloan published on July 17, 2024, by Mark Kritzman et al., titled “The Determinants of Inflation,” concluded that federal spending was the overwhelming driver of the inflation spike in 2022, estimating it was two to three times more significant than any other factors.

Government spending was out of control, leading money supply growth to soar, and the cumulative inflation suffered by Americans in the past four years is over 20.9%, with groceries and gas prices rising by more than 40%.

Excessive government spending was not only the cause of the rise in money supply growth and the burst of inflation but also led to an $8.47 trillion increase in debt and an unsustainable path to financial ruin if policies remained the same. According to the Congressional Budget Office, with no policy changes, the United States would have accumulated deficits of $12.6 trillion between 2025 and 2030. Net interest outlays were expected to grow from $881 billion in 2024 to $1.2 trillion by 2030, even assuming no recessions or unemployment increases.

Cutting government spending is essential to reduce prices, bring inflation under control and stop the looming public finance disaster. By 2024, it became evident that revenue measures would not reduce the United States federal deficit. Deficits are always a spending problem.

We must remember that 2024’s 2.8% GDP growth reflected almost $2 trillion in borrowing, a roughly one-to-one spending-to-growth ratio and a dangerous path to a debt crisis.

Private GDP should measure the economy, as government spending and debt do not drive productive growth. Stripping government spending can give us a more accurate picture of the reality of the productive sector in America. The latest Atlanta Fed estimates show a massive decline in net exports (-3.7%) due to a large increase in imports, a small decline in consumption of goods (-0.09%) but strong services (+0.62%) and rises in government expenditure (+0.34%) and a healthy increase in investment (+0.62%). Thus, the surprising factor is an abnormal slump in exports and a rise in imports that may be revised, because the trade deficit in December 2024 rose to a record $98.4 billion and GDP did not reflect such a massive slump in net exports. The concerning thing is that government spending continues to be excessive, and the United States is running an annualised $2.5 trillion deficit.

The United States will not enter a recession due to the change of administration, but because of the excess spending policies of the Biden years. Reducing federal spending, deficit, and debt accumulation is essential to recover the health of the economy.

Bloating GDP with public spending and debt is not growing; it is the recipe for disaster.