Based on some comments, it appears we scared a few people with A Crisis Is Coming. Our article warns, “A financial crisis will likely follow the Fed’s “higher for longer” interest rate campaign.” We follow the article with more on financial crises to help calm any worries you may have. This article summarizes two interest rate-related crises, Long Term Capital Management (LTCM) and the lesser-known Financial Crisis of 1966.

We aim to convey two important lessons. First, both events exemplify how excessive leverage and financial system interdependences are dangerous when interest rates are rising. Second, they stress the importance of the Fed’s reaction function. A Fed that reacts quickly to a budding crisis can quickly mitigate it. The regional bank crisis in March serves as recent evidence. However, a crisis can blossom if the Fed is slow to react, as we saw in 2008.

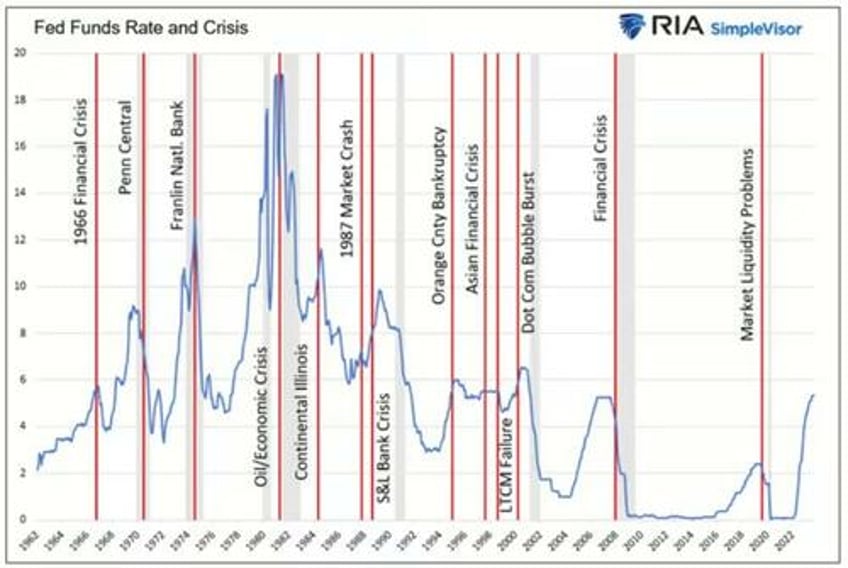

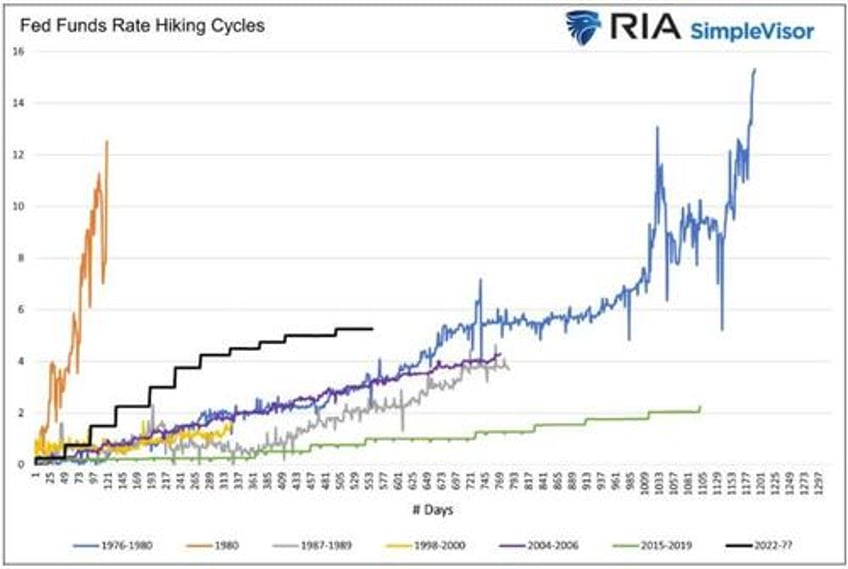

Before moving on, it’s worth providing context for the recent series of rate hikes. Unless this time is different, another crisis is coming.

LTCM’s Failure

John Meriweather founded LTCM in 1994 after a successful bond trading career at Salomon Brothers. In addition to being led by one of the world’s most infamous bond traders, LTCM also had Myron Scholes and Robert Merton on their staff. Both won a Nobel Prize for options pricing. David Mullins Jr., previously the Vice Chairman of the Federal Reserve to Alan Greenspan, was also an employee. To say the firm was loaded with the finance world’s best and brightest may be an understatement.

LTCM specialized in bond arbitrage. Such trading entails taking advantage of anomalies in the price spread between two securities, which should have predictable price differences. They would bet divergences from the norm would eventually converge, as was all but guaranteed in time.

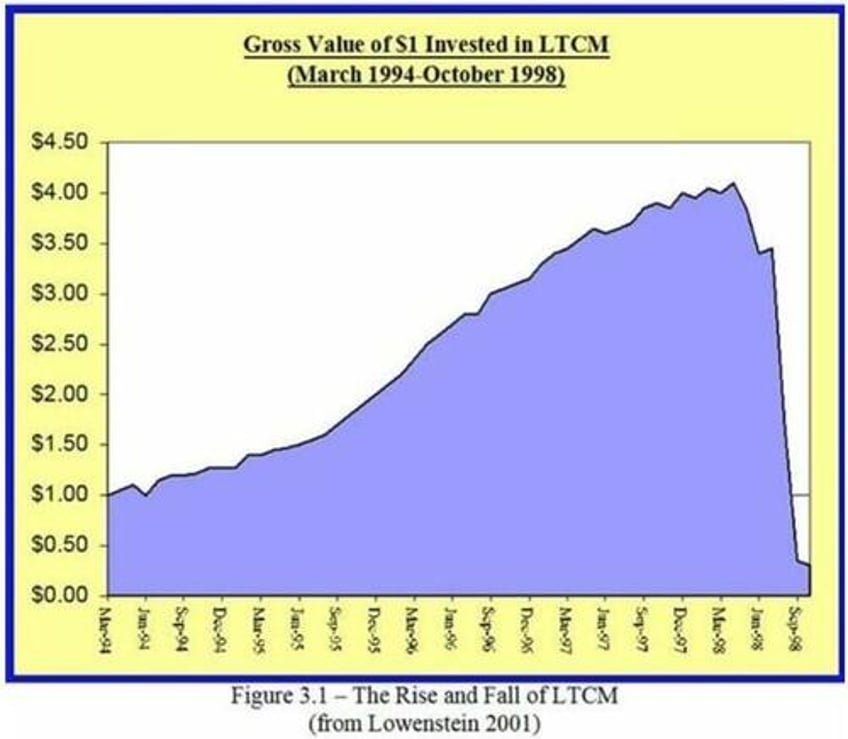

LTCM was using 25x or more leverage when it failed in 1998. With that kind of leverage, a 4% loss on the trade would deplete the firm’s equity and force it to either raise equity or fail.

The world-renowned hedge fund fell victim to the surprising 1998 Russian default. As a result of the unexpected default, there was a tremendous flight to quality into U.S. Treasury bonds, of which LTCM was effectively short. Bond divergences expanded as markets were illiquid, growing the losses on their convergence bets.

They also wrongly bet that the dually listed shares of Royal Dutch and Shell would converge in price. Given they were the same company, that made sense. However, the need to stem their losses forced them to bail on the position at a sizeable loss instead of waiting for the pair to converge.

The Predictable Bailout

Per Wikipedia:

Long-Term Capital Management did business with nearly every important person on Wall Street. Indeed, much of LTCM’s capital was composed of funds from the same financial professionals with whom it traded. As LTCM teetered, Wall Street feared that Long-Term’s failure could cause a chain reaction in numerous markets, causing catastrophic losses throughout the financial system.

Given the potential chain reaction to its counterparties, banks, and brokers, the Fed came to the rescue and organized a bailout of $3.63 billion. A much more significant financial crisis was avoided.

The takeaway is that the financial system has highly leveraged players, including some like LTCM, which supposedly have “foolproof” investments on their books. Making matters fragile, the banks, brokers, and other institutions lending them money are also leveraged. A counterparty failure thus affects the firm in trouble and potentially its lenders. The lenders to the original lenders are then also at risk. The entire financial system is a series of lined-up dominos, at risk if only one decent-sized firm fails.

Roger Lowenstein wrote an informative book on LTCM aptly titled When Genius Failed. The graph below from the book shows the rise and fall of an initial $1 investment in LTCM.

The Financial Crisis of 1966

Most people, especially Wall Street gray beards, know of LTCM and the details of its demise. We venture to guess very few are up to speed on the crisis of 1966. We included. As such, we relied heavily upon The 1966 Financial Crisis by L. Randall Wray to educate us. The quotes we share are attributable to his white paper.

As the post-WW2 economic expansion progressed, companies and municipalities increasingly relied on debt and leverage to fuel growth. For fear of rising inflation due to the robust economic growth rate, the Fed presided over a series of rate hikes. In mid-1961, Fed Funds were as low as 0.50%. Five years later, they hit 5.75%. The Fed also restricted banks’ reserve growth to reduce loan creation and further hamper inflation. Higher rates, lending restrictions, and a yield curve inversion resulted in a credit crunch. Further impeding the prominent New York money center banks from lending, they were losing deposits to higher-yielding instruments.

Sound familiar?

The lack of credit availability exposed several financial weaknesses. Per the article:

As Minsky argued, “By the end of August, the disorganization in the municipals market, rumors about the solvency and liquidity of savings institutions, and the frantic position-making efforts by money-market banks generated what can be characterized as a controlled panic. The situation clearly called for Federal Reserve action.” The Fed was forced to enter as a lender of last resort to save the Muni bond market, which, in effect, validated practices that were stretching liquidity.

The Fed came to the rescue before the crisis could expand meaningfully or the economy would collapse. The problem was fixed, and the economy barely skipped a beat.

However, and this is a big however, “markets came to expect that big government and the Fed would come to the rescue as needed.”

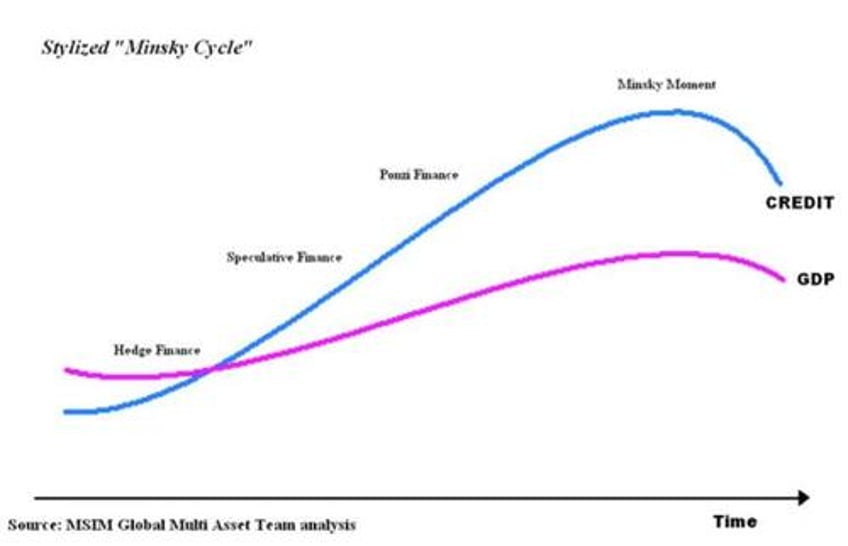

Expectations of Fed rescues have significantly swelled since then and encourage ever more reckless financial behaviors.

The Fed’s Reaction Function- Minksky Fragility

Wray’s article on the 1966 crisis ends as follows:

That 1966 crisis was only a minor speedbump on the road to Minskian fragility.

Minskian fragility refers to economist Hyman Minsky’s work on financial cycles and the Fed’s reaction function. Broadly speaking, he attributes financial crises to fragile banking systems.

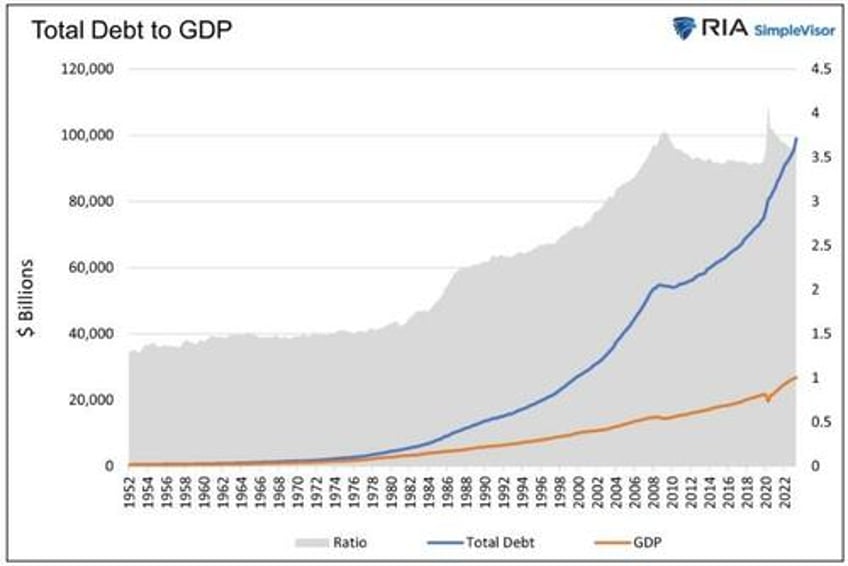

Said differently, systematic risks increase as system-wide leverage and financial firm interconnectedness rise. As shown below, debt has grown much faster than GDP (the ability to pay for the debt). Inevitably, higher interest rates, slowing economic activity, and liquidity issues are bound to result in a crisis, aka a Minsky Moment. Making the system ever more susceptible to a financial crisis are the predictable Fed-led bailouts. In a perverse way, the Fed incentivizes such irresponsible behaviors.

Nearing The Minsky Moment

As we shared in A Crisis Is Coming: Who Is Swimming Naked?:

The tide is starting to ebb. With it, economic activity will slow, and asset prices may likely follow. Leverage and high-interest rates will bring about a crisis.

Debt and leverage are excessive and even more extreme due to the pandemic.

The question is not whether higher interest rates will cause a crisis but when. The potential for one-off problems, like LTCM, could easily set off a systematic situation like in 1966 due to the pronounced system-wide leverage and interdependencies.

As we have seen throughout the Fed’s history, they will backstop the financial system. The only question is when and how. If they remain steadfast in fighting inflation while a crisis grows, they risk a 2008-like event. If they properly address problems as they did in March, the threat of a severe crisis will considerably lessen.

Summary

The Fed halted the crises of 1966 and LTCM. They ultimately did the same for every other crisis highlighted in the opening graph. Given the amount of leverage in the financial system and the sharp increase in interest rates, we have little doubt a crisis will result. The Fed will again be called upon to bail out the financial system and economy.

For investors, your performance will be a function of the Fed’s reaction. Are they quick enough to spot problems, like the banking crisis in March or our two examples, and minimize the economic and financial effect of said crisis? Or, like in 2008, will it be too late to arrest a blooming crisis, resulting in significant investor losses and widespread bankruptcies?