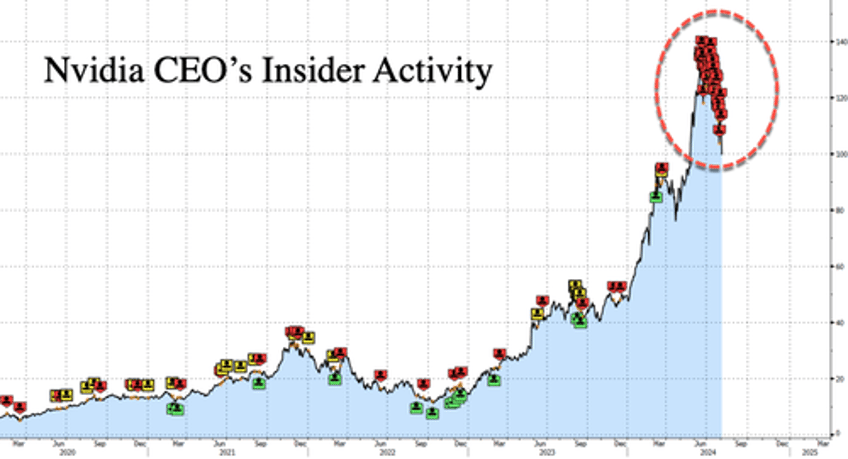

In March, Nvidia Corp. disclosed that CEO Jensen Huang's Rule 10b5-1 trading plan included selling 600,000 shares (or about 6 million shares accounting for the 10-for-1 stock split) by March 31, 2025. He has already sold millions of shares, effectively top-ticking the market. This news should have served as a clear warning sign to investors that the AI bubble was approaching a peak.

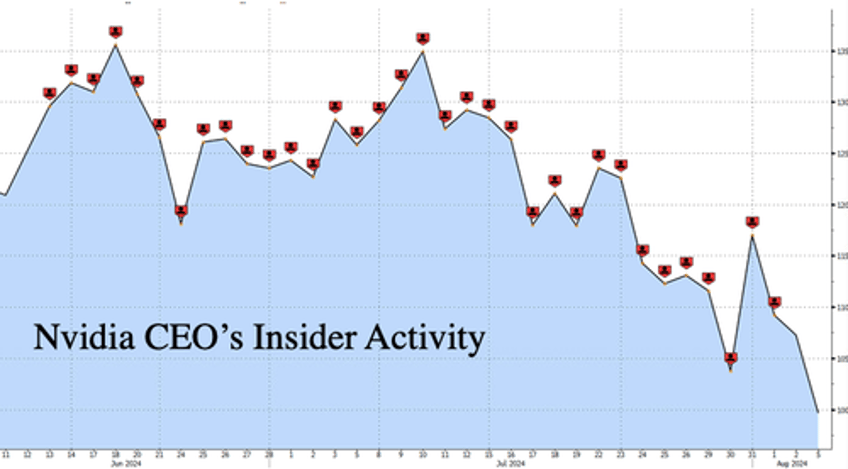

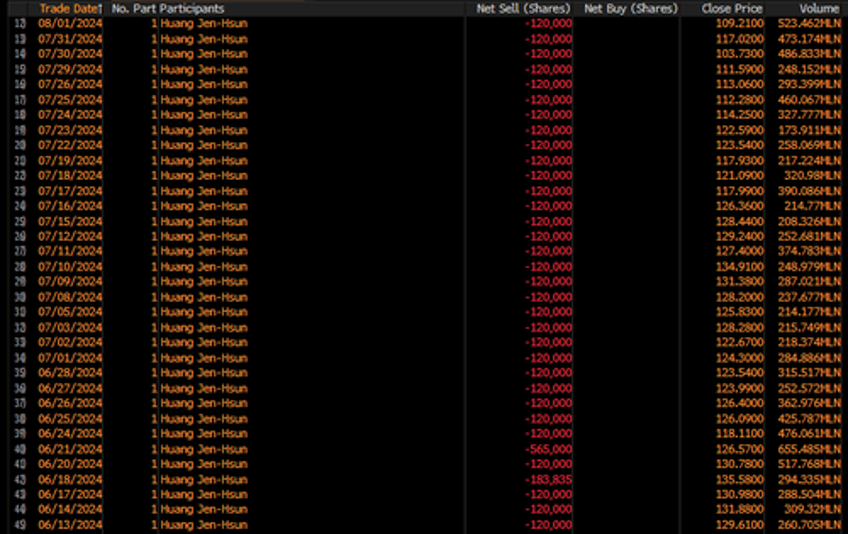

Data from Bloomberg shows Huang's daily sale of 120,000 shares began on June 13. The selling was indiscriminate. Most of it was sold between $135 and $109 from June through July. The selling continued into the downward draft in recent days.

Since the beginning of June, Huang dumped millions of shares.

"While the June and July sales were executed under a 10b5-1 trading plan adopted in March, the timing proved fortunate," Bloomberg noted, adding, "Huang has personally sold about $1.4 billion in shares since the start of 2020, including this summer's sales."

Meanwhile, The Information recently reported that Nvidia has informed Microsoft and other cloud providers that its most advanced AI chip models in the Blackwell series (B200 AI chip) face three months of delays following the discovery of a design flaw "unusually late in the production process."

This is troubling news for Nvidia and the AI bubble, especially after Goldman's head of research admitted just weeks ago that AI is indeed a bubble. Compound this all with global stock market turmoil - and the AI bubble faced more unwinds today.

Another stock market omen of insider dumping was billionaire investor Warren Buffett's Berkshire Hathaway, disposing of 90 million Bank of America shares in recent weeks.

We called Buffett's selling a 'dump-a-thon' last week. It was a warning sign that the billionaire saw trouble ahead.

Furthermore, Buffett quietly dumped half of Berkshire's Apple shares in the second quarter while increasing the company's cash pile by a record $88 billion to an all-time high of $277 billion at the end of last quarter.

The big takeaway is that insiders know best when to sell and when to buy.