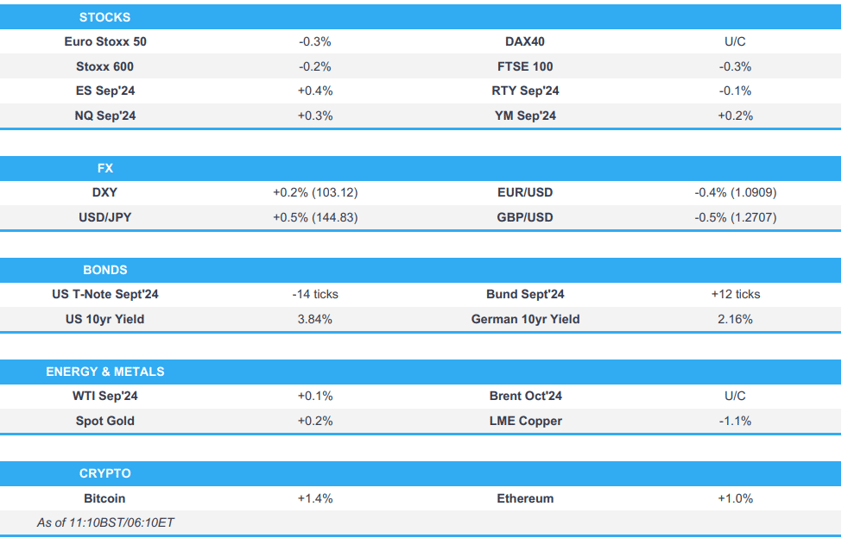

- APAC markets found reprieve from Monday's pressure, a narrative which contained into Europe but has dissipated modestly

- Stateside, US futures modestly in the green as we look ahead to key earnings

- DXY managing to post modest intraday gains with pressure seen across G10 peers ex-AUD which leads after a hawkish RBA

- Fixed benchmarks spent the early morning under pressure but EGBs have lifted off lows following auctions/data; USTs remain pressured as Monday's dovish pricing eases from extremes

- Crude has an underlying positive bias given the initial tone and bullish Aramco CEO remarks, metals mixed

- Looking ahead, highlights include Canadian Trade Balance Supply from the US, Earnings from Caterpillar, Uber & SuperMicro.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- Markets found some reprieve following yesterday's hefty selling, Euro Stoxx 50 U/C; action which was led by a substantial rebound in APAC trade that saw the Nikkei 225 close with gains of over 10%, though not quite paring all of Monday's record move lower.

- However, across the European session this strength has waned with European bourses now flat/lower; a paring which has occurred without a fresh fundamental driver.

- Sectors were primarily in the green, but are becoming increasingly mixed; Tech outperforms as it rebounds with Deutsche Bank also upgrading the European sector while Banks come in a close second place as they trim recent rate-driven downside.

- FTSE 100 -0.3% is the relative laggard, hit by pressure in defensive large-caps and as the housing sector slumps after housebuilder updates, remains afloat overall due to its banking exposure.

- Stateside, futures in the green (ES +0.5%, NQ +0.6%) with the narrative the same as the above after the better-than-expected ISM Services began a rebound which looks set to continue. Numerous key earnings ahead incl. Caterpillar, Uber & more.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is managing to post modest intraday gains following yesterday's choppy session, today's range currently 102.69-103.09, which is well within yesterday's 102.15-103.21 parameter.

- Upside which comes at the expense of GBP, EUR and mostly notable the JPY. Which are down to lows of 1.2700, 1.0908 respectively and USD/JPY as high as 146.36.

- Though, much of that initial JPY-pressure has pared after the morning's meeting with MOF, FSA & BoJ officials did not include anything particularly pertinent in the readout.

- Antipodeans diverge; AUD leads after a hawkish RBA hold with the upside extending a touch as the Governor highlighted that a hike was considered.

- PBoC set USD/CNY mid-point at 7.1318 vs exp. 7.1454 (prev. 7.1345).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Core benchmarks under modest pressure with Bunds holding just under the 135.00 mark having spent much of the session sub-134.74 open. Briefly extended to a 135.12 peak, seemingly as crude slipped a touch before settling and then climbing once more post EZ Retail Sales & supply.

- A similar narrative for Gilts but with upside for the UK benchmark coming after a strong 2043 DMO tap, which came in better than the stellar prior; an auction which lifted the benchmark more convincingly back above the 100.00 handle.

- USTs holding just off 113-12 lows, which mark a new base for the week but markedly above Friday's 112-21 base. As such, market pricing has shifted to no longer entirely price in a 50bp cut in September, with the odds of that back down to circa. 75%.

- US 3yr supply the afternoon highlight, and while USTs are at WTD lows it remains to be seen if this factors as concession after the moves on Friday/Monday

- UK sells GBP 2bln 4.75% 2043 Gilt: b/c 3.37x (prev. 3.29x), average yield 4.372% (prev. 4.519%) & tail 0.2bps (prev. 0.1bps)

- Germany sells EUR 3.284bln vs exp. EUR 4bln 2.50% 2029 Bobl: b/c 1.9x (prev. 2.0x), average yield 2.09% (prev. 2.39%) & retention 17.9% (prev. 18.4%)

- Click for a detailed summary

COMMODITIES

- Crude benchmarks have an underlying positive bias, but are off best levels. A bias which was driven by the overall recovery in sentiment and after bullish remarks from the Aramco CEO re. oil demand.

- Precious metals diverge a touch, XAU firmer but contained at its 21-DMA of USD 2412/oz while XAG slips.

- Base metals are mixed with specifics light and the bounce from yesterday's downside being somewhat offset for the metals by the creeping USD strength.

- Venezuela's Attorney General is to open a criminal investigation against opposition leaders Machado and Gonzalez.

- "Aramco President to Arabian Business: Strong demand returns to market fundamentals coinciding with the entry of the driving season...We expect oil demand to increase in the coming months", via Al Arabiya. Adds, "Strong oil demand from China may continue during the second half of 2024". Expects global oil demand of 104.7mln BPD in 2024 (vs 104.5mln in OPEC July MOMR), seeing more plans to replenish strategic inventories which will aid healthy demand. In July and early August, saw growth in jet-fuel demand and significant growth in China.

- "Iran, Saudi Arabia discuss expansion of bilateral ties", according to IRNA.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK BRC Retail Sales YY (Jul) 0.3% (Prev. -0.5%); Total Sales YY (Jul) 0.5% (Prev. -0.2%)

- UK S&P Global Construction PMI (Jul) 55.3 vs. Exp. 52.8 (Prev. 52.2)

- Barclaycard UK Consumer Spending YY (Jul) -0.3% Y/Y (Prev. -0.6%)

- Swiss Unemployment Rate Adj. (Jul) 2.5% vs. Exp. 2.5% (Prev. 2.4%)

- German Industrial Orders MM (Jun) 3.9% vs. Exp. 0.5% (Prev. -1.6%)

- EU HCOB Construction PMI (Jul) 41.4 (Prev. 41.8)

- EU Retail Sales MM (Jun) -0.3% vs. Exp. -0.1% (Prev. 0.1%); YY -0.3% vs. Exp. 0.2% (Prev. 0.3%, Rev. 0.5%)

NOTABLE EUROPEAN HEADLINES

- UK Chancellor Reeves said she wants to strengthen and deepen trade ties with the US and noted that the tax burden in the UK is too high, according to an interview with Bloomberg.

- UK Chancellor Reeves left the door open to higher borrowing to tackle the UK ‘fiscal hole’, according to FT.

NOTABLE US HEADLINES

- Fed's Daly (voter) said risks to Fed mandates are getting in more balance and minds are open to cutting the rate in coming meetings, while she noted concern is that they will deteriorate from the current place of balance in the jobs report but added that they don't see that right now. Daly said the July jobs report reflected a lot of temporary layoffs and hurricane effect although she noted that if they react to one data point, they would almost always be wrong. Furthermore, Daly said none of the labour market indicators she looks at are flashing red right now but she is monitoring them carefully and said the Fed is prepared to act as it gets more information.

- Federal Reserve finalised the resolution plan guidance for large, non-globally systemic banks, while the Fed action follows joint guidance approved by the FDIC at the July 30th meeting.

- US Vice President Harris officially won the Democrat presidential nomination.

- US plans to award SK Hynix (000660 KS) up to USD 450mln in grants for Indiana chips packaging plant, according to the Commerce department.

- Alphabet (GOOG) - Google will appeal a US District Court ruling that it illegally maintained an online search monopoly by paying companies like Apple (AAPL) to make its search engine the default, TechCrunch reports. The decision, a significant defeat for Google, could reshape its business and the internet’s structure.

GEOPOLITICS

MIDDLE EAST

- US President Biden and VP Harris were told by the national security team it is unclear when Iran and Hezbollah are likely to launch an attack against Israel and the specifics of such an attack, according to a US official.

- "Chairman of Iran's National Security and Foreign Policy Committee Describes Haniyeh's Assassination in Tehran as a Declaration of War", according to Sky News Arabia.

- US officials said US President Biden was informed of the expectation of a scenario for two waves of attacks, one of which is from Iran and another from Hezbollah. However, it is unclear to US intelligence who will attack first or the nature of the attack, while intelligence indicates that Iran and Hezbollah have not yet decided what exactly they want to do, according to Axios.

- US Secretary of State Blinken said the Middle East is at a critical moment and all parties must refrain from escalation, while it is critical that they break this cycle by reaching a Gaza ceasefire and parties should not look for a reason to delay or say no.

- US Secretary of State Blinken spoke to his Egyptian counterpart and Qatar’s PM on Middle East tensions, while Blinken delivered a consistent message to refrain from escalation and calm tensions in the Middle East. Furthermore, Egypt's Foreign Minister called on his Blinken to pressure Israel to seriously engage in ceasefire talks in the Gaza Strip.

- Palestinian President Abbas said the killing of Hamas leader Haniyeh intended to prolong the conflict in Gaza, while it was also reported that Abbas is to visit Russia on August 12th-14th, according to RIA.

- Russia has started delivering advanced radars and air-defence equipment to Iran as the country prepares for a possible war with Israel, according to two Iranian officials familiar with the planning cited by NYT.

- Several US personnel were injured in a rocket attack on a base housing US troops in Iraq, according to three officials cited by Reuters. It was later reported that US Defence Secretary Austin spoke with Israeli Defence Minister Gallant on Monday and they agreed that the Iran-aligned militia attack on US forces stationed in Iraq marked a dangerous escalation.

OTHER

- Explosions were heard in the Ukrainian capital of Kyiv after air raid sirens sounded, according to Reuters.

CRYPTO

- Modestly firmer as the complex attempts to pare the hefty pressure seen on Monday, with the narrative by extension similar to that being seen in other assets.

APAC TRADE

- APAC stocks were mostly positive as the region rebounded from the recent market turmoil - Nikkei futures saw an upside circuit breaker triggered, while the Korea Exchange activated sidecars for the Kospi and Kosdaq after early surges.

- ASX 200 traded higher albeit within a confined range as participants awaited the latest RBA policy announcement, while the central bank provided no major surprises as it kept rates unchanged and maintained its hawkish tone.

- Nikkei 225 bounced back aggressively following its largest-ever daily point drop and reclaimed the 34,000 status.

- Hang Seng and Shanghai Comp. were somewhat lacklustre with the Hong Kong benchmark gave up initial gains, while the mainland lagged after a substantial daily net liquidity drain.

NOTABLE ASIA-PAC HEADLINES

- Japan's Top Currency Diplomat Mimura says no comment on market moves; discussed big moves in financial, stock market with BoJ and FSA; government will work closely with BoJ. Share view that Japanese economy is making a moderate recovery. Discussed forex. Closely watching FX moves. Important for currencies to move in stable manner reflective fundamentals. Held meeting as there we big moves in the stock market. Communicating with authorities overseas on recent market moves.

- RBA kept the Cash Rate Target unchanged at 4.35%, as expected, while it reiterated that the Board remains resolute in its determination to return inflation to the target, is not ruling anything in or out, and inflation remains above target which is proving persistent. RBA added that returning inflation to the target is the priority and policy will need to be sufficiently restrictive until the board is confident that inflation is moving sustainably towards the target range. Furthermore, it upped forecasts for GDP, CPI and the Unemployment Rate with forecasts assuming the Cash Rate will be at 4.3% in December 2024, 3.6% in December 2025, and 3.3% in December 2026.

- RBA Governor Bullock says still risks inflation takes too long to return to target; progress on inflation has been slow for a year; need to stay on course with inflation; near-term cut in rates does not align with Board's thinking. Board did consider a rate rise. Cut is not on the near-term agenda

DATA RECAP

- Japanese All Household Spending MM (Jun) 0.1% vs. Exp. 0.2% (Prev. -0.3%); YY -1.4% vs. Exp. -0.9% (Prev. -1.8%)

- Japanese Labour Cash Earnings YY (Jun) 4.5% vs Exp. 2.4% (Prev. 2.0%)