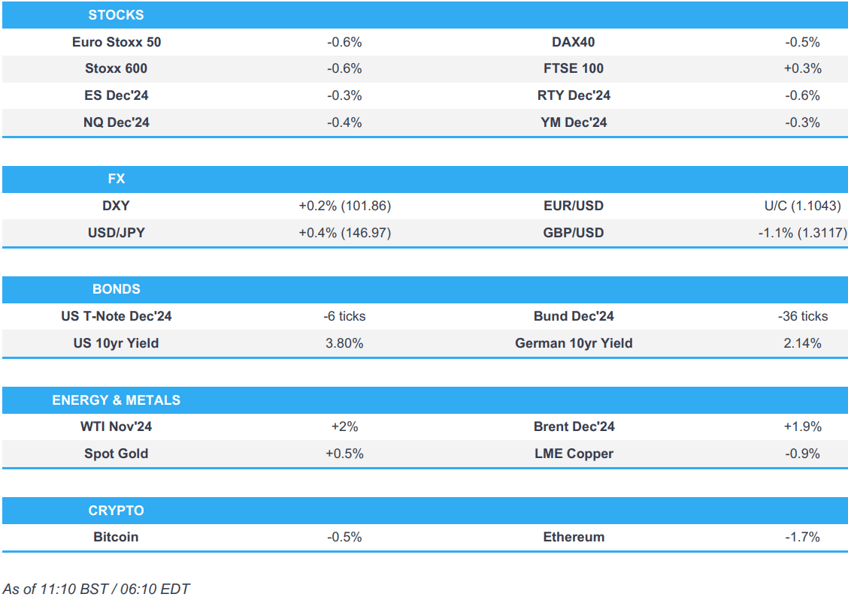

- European bourses are lower across the board (ex-FTSE 100), US futures are in negative terrirtory ahead of today’s US data deluge.

- Dollar is firmer vs G10 peers, GBP underperforms after BoE Governor Bailey said the bank could be a "bit more aggressive" in cutting rates provided the news that inflation continues to be good.

- Bonds are on the backfoot, extending on the pressure seen post-ADP on Wednesday; Gilts outperform following the dovish-leaning Bailey comments.

- Crude oil is continuing the benefit from the geopolitical risk premium, XAU/base metals dip amid the stronger Dollar

- Looking ahead, US Services/Composite PMIs (Final), US Challenger Layoffs, IJC, Durable Goods (R), Factory Orders, ISM Services PMI, Speakers include Fed’s Bostic & Schmid, Supply from the US, Earnings from Constellation Brands.

More Newsquawk in 3 steps:

More Newsquawk in 3 steps:1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-0.7%), opened modestly in negative territory and continued to edge lower as the morning progressed, with indices now generally just off lows. The FTSE 100 (+0.2%) remains in positive territory after BoE Governor Bailey's dovishly-received comments.

- European sectors are negative across the board with Energy also turning red following a positive open. There is no clear theme or bias across European sectors. Autos and Parts once again lag. Basic Resources also resides as one of the losers amid the pullback in base metal prices.

- US Equity Futures (ES -0.4%, NQ -0.5%, RTY -0.7%) are softer across the board amid the broader risk-averse mood despite the lack of any fresh drivers during the session, but ahead of risk events including the weekly jobless claims and ISM Services PMI ahead of tomorrow's US jobs report.

- Barclays has upgraded the EU Autos & Parts sector to neutral from negative

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is broadly stronger vs. peers with DXY up for a fourth consecutive session in a week that has been characterised by geopolitical tensions and comments from Fed Chair Powell guiding markets towards a step down to a 25bps rate cut next month. DXY is currently eyeing the 102.00 mark, and may take impetus from today's US busy data docket, with ISM Services likely the highlight.

- EUR is softer vs. the USD but to a lesser extent than most peers. ECB officials seemingly endorsing a rate cut later this month has definitely acted as a drag on the pair, with attention now on if the pair can hold above the 1.10 mark.

- GBP is the standout laggard across the majors following dovishly-received comments from BoE Governor Bailey; he said in an interview with The Guardian, the bank could be a "bit more aggressive" in cutting rates provided the news that inflation continues to be good.

- JPY is softer vs. the USD after breaching the September peak for USD/JPY at 147.21 overnight. As a reminder, on Wednesday, PM Ishiba downplayed the likelihood of another immediate BoJ rate hike. USD/JPY currently stands at around 146.83.

- Both antipodes are struggling vs. the broadly firmer USD. After an indecisive session yesterday, AUD/USD has extended its move lower on a 0.68 handle.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are extending on yesterday's downside that was triggered in part by Wednesday's strong ADP release in the run-up to Friday's NFP print. Today's US data docket is a busy one with ISM Services PMI the likely highlight. US 10yr yield is currently just above the 3.8% mark but below Wednesday's 3.817% peak.

- Bunds are lower in an extension of Wednesday's US-led price action, but it remains to be seen how long the downside can continue given the increasingly dovish tones seen out of the ECB with comments from hawk Schnabel helping to cement expectations of an increasingly dovish ECB. The German 10yr yield is back above the 2.1% after delving as low as 2.01% earlier in the week.

- Gilts the standout outlier across the fixed income space on account of dovish comments from BoE Governor Bailey who said the bank could be a "bit more aggressive" in cutting rates provided the news that inflation continues to be "good". The UK 10yr yield is currently holding just above the 4% mark.

- Spain sells EUR 4.54bln vs exp. EUR 4-5bln 2.50% 2027, 1.45% 2029 and 4.70% 2041 Bono and EUR 0.512bln vs exp. EUR 0.25-0.75bln 2.05% 2039 I/L.

- France sells EUR 11.98bln vs exp. EUR 10-12bln 1.25% 2034, 3.00% 2034, 3.00% 2049, and 3.25% 2055 OAT.

- Click for a detailed summary

COMMODITIES

- Crude is firmer intraday in a continuation of the upside seen since the recent geopolitical escalation. Updates from the region has been light thus far, as markets still await Israel's response which will reportedly be "harsh". Brent Dec briefly rose above USD 75/bbl to trade in a current USD 74.46-75.11/bbl parameter.

- Softer trade across precious metals as the firmer Dollar and lack of fresh geopolitical escalations (as we await Israel's response) allow traders to book some profits before scheduled risk events such as the US jobless claims and ISM Services PMIs.

- Base metals are softer across the board against the backdrop of a risk-averse mood across the market. Newsflow has been light this morning but the angst surrounding a wider geopolitical escalation in the Middle East remains. As a reminder, Chinese markets were closed overnight as they observe their Golden Week Holiday.

- Kinder Morgan (KMI) reports a mechanical failure on gasoline pipeline repaired at Sacramento County, California; pipeline is shutdown, personnel is on route to the site to get eyes on assessment.

- Kazakhstan's 400k BPD Kashagan repairs reportedly postponed, now due to start on Oct 7th, according to Ifax.

- Click for a detailed summary

NOTABLE DATA RECAP

- EU Producer Prices YY (Aug) -2.3% vs. Exp. -2.4% (Prev. -2.1%, Rev. -2.2%); Producer Prices MM (Aug) 0.6% vs. Exp. 0.3% (Prev. 0.8%, Rev. 0.7%)

- EU HCOB Composite Final PMI (Sep) 49.6 vs. Exp. 48.9 (Prev. 48.9); HCOB Services Final PMI (Sep) 51.4 vs. Exp. 50.5 (Prev. 50.5)

- UK S&P Global PMI Composite Output (Sep) 52.6 vs. Exp. 52.9 (Prev. 52.9); Global Service PMI (Sep) 52.4 vs. Exp. 52.8 (Prev. 52.8)

- Spanish Services PMI (Sep) 57.0 vs. Exp. 54.0 (Prev. 54.6)

- German HCOB Services PMI (Sep) 50.6 vs. Exp. 50.6 (Prev. 50.6); HCOB Composite Final PMI (Sep) 47.5 vs. Exp. 47.2 (Prev. 47.2)

- French HCOB Composite PMI (Sep) 48.6 vs. Exp. 47.4 (Prev. 47.4); HCOB Services PMI (Sep) 49.6 vs. Exp. 48.3 (Prev. 48.3)Italian HCOB Composite PMI (Sep) 49.7 (Prev. 50.8); HCOB Services PMI (Sep) 50.5 vs. Exp. 51.0 (Prev. 51.4)

- Swedish PMI Services (Sep) 49.1 (Prev. 52.9, Rev. 52.4)

- Swiss CPI MM (Sep) -0.3% vs. Exp. -0.1% (Prev. 0.0%); CPI YY (Sep) 0.8% vs. Exp. 1.1% (Prev. 1.1%)

- Turkish CPI MM (Sep) 2.97% vs. Exp. 2.2% (Prev. 2.47%)

NOTABLE EUROPEAN HEADLINES

- BoE Governor Bailey said the bank could be a "bit more aggressive" in cutting rates provided the news that inflation continues to be good, in an interview with The Guardian.

- UK PM Starmer conceded during his first visit to Brussels that his "reset" with the EU won't be easy, according to AFP.

- Riksbank's Jansson said the bank is not too worried about a consumption driven uptick in inflation as a result of rate cuts. Need to see an economic recovery if inflation is not undershoot. Would be good for the economy if fundamental factors were reflected in the value of the crown.

- BoE Monthly Decision Maker Panel data (September 2024). Expectations for CPI inflation a year ahead declined by 0.1 percentage point to 2.6% in the three months to September. The corresponding measure for three-year ahead CPI inflation expectations was also 2.6% in the three months to September, and 0.1 percentage points lower than in the three months to August. Expected year-ahead wage growth remained unchanged at 4.1% on a three-month moving-average basis in September.

GEOPOLITICS

MIDDLE EAST

- IDF orders another 25 villages evacuated in southern Lebanon, according to ELINT News

- "An Israeli infantry group and vehicles retreat beyond the Blue Line after infiltrating towards the town of Maroun al-Ras", according to Al Jazeera

- "Private sources for Sky News Arabia: A positive atmosphere prevailed in the meeting in Doha between Abbas and Hamas leaders", according to Sky News Arabia.

- Israeli Military said it assassinated head of Hamas government Rawhi Mushtaha in Gaza strip.

- Hezbollah said it confronted an attempt by Israeli forces to advance at Lebanese border's Fatima Gate.

- "US sources say Washington is ready to sell F-15s to Ankara", according to journalist Soylu; "Sources say if Turkey finally returns to F-35 program, Ankara might be involved in production line", "Turkey’s F-16 deal is still being finalised".

- Pro-Iranian factions target an international coalition base in north-eastern Syria, via Sky News Arabia.

- Israel conducted raids on 3 sites in the neighbourhoods of Mouawad, Al-Amrikan and Zaghloul in Beirut. It was also reported that an Israeli strike hit central Beirut, while a building targeted by the Israeli raid in Bachoura reportedly housed the office of Beirut's Hezbollah deputy Amin Sherri.

- Israeli army called on residents of several buildings in Haret Hreik, Burj al-Barajneh and Hadath West in the southern suburbs of Beirut to evacuate and a Sky News Arabia correspondent reported a new series of Israeli raids targeting the suburbs of Beirut.

- Israeli Home Front announced sirens sounded in several areas of the Golan and that sirens sounded in Shlomi in the western Galilee in northern Israel. Furthermore, Israeli media reported that 4 marches launched from Yemen exploded at a low altitude in the airspace of Tel Aviv, according to Asharq News.

- Clashes were reported between Hezbollah and Israeli soldiers on the outskirts of Aitaroun, southern Lebanon, according to an Al-Arabiya correspondent.

- Israeli press cited an official who stated that the response to Iran may include more than one option and not necessarily through airstrikes. The official added it is not certain that Washington will agree with them but it knows that they have to respond, while they should not go too far in our response although it will be much stronger than the response to the April attack.

- Israeli official cited by Yedioth Ahronoth said there are no limits to the response to Iran, according to Al Arabiya.

- Iran’s President vowed a stronger response if Israel retaliates.

CRYPTO

- Bitcoin is on the backfoot and holds just above USD 60.6k; Ethereum is incrementally above USD 2.3k, and underperforms vs BTC.

APAC TRADE

- APAC stocks traded mixed amid the backdrop of several holiday closures and ongoing geopolitical tensions, while Hong Kong participants booked profits.

- ASX 200 lacked direction alongside varied data releases including downward PMI revisions and mixed trade figures.

- Nikkei 225 outperformed on the back of a weaker currency after yesterday's dovish-leaning remarks from Japanese PM Ishiba who said they are not in an environment for an additional rate hike following a meeting with BoJ Governor Ueda, while Ueda said the BoJ will adjust the degree of monetary easing if the outlook is realised, but will take careful steps to determine that as it takes time.

- Hang Seng suffered heavy losses amid profit taking and in a possible sign that the China stimulus euphoria has finally worn out.

NOTABLE ASIA-PAC HEADLINES

- BoJ Board Member Noguchi said they must patiently maintain loose monetary conditions and it will take a considerable time for the public to shift to a mindset where inflation can sustainably hit 2%, while he believes the consumption uptrend is likely to become clearer and noted the cost pressure from wage hikes is gradually being reflected in service price rises. Furthermore, he said the BoJ will likely gradually adjust the degree of monetary support while cautiously examining whether inflation stably hits 2%, accompanied by wage gains, as well as noted that the BoJ can spend time and move cautiously, in reducing its balance sheet. Does not comment of PM Ishiba's remarks on monetary policy; expects BoJ to adjust degree of monetary policy if economy moves in line with forecast, even at a very slow pace. "personally feel we need to proceed very carefully in adjusting degree of monetary support". "Need to scrutinise whether consumers' sentiment will shift to one where they can swallow price hikes.". "As Governor Ueda has said, we have time to scrutinise economic developments, before contemplating rate hike.". "The current financial environment is sufficiently easy." "Japan’s economy can withstand if the JPY becomes stronger gradually.". "Will not deny there is room to adjust the degree of monetary support further.". "Given it is hard to come up with a concrete estimate on the neutral rate, the BoJ must check the impact of the past rate hike before carefully proceeding with the next one.". "The one-sided, sharp JPY fall seen in July has subsided.". "The upside inflation risk from a weak JPY has subsided."

- Japanese PM Kishida is to direct a compilation of economic package on Friday, according to Kyodo.

- Japan's Finance Minister Kato has affirmed the government, BoJ will continue to coordinate closely; also said he wants to watch the FX market with a sense of urgency including speculative moves. "We will communicate thoroughly with markets". Will aim to exit deflation soon, working closely with BoJ.

- Japan's Economy Minister Akazawa said in broad terms, policy rate of 0.25% is an accommodative state. "We are moving towards monetary policy normalisation but existing deflation is a top priority". "We must not cool down the economy".

DATA RECAP

- Australian Trade Balance (AUD)(Aug) 5.6B vs. Exp. 5.5B (Prev. 6.0B)

- Australian Goods/Services Exports MM (Aug) -0.2% (Prev. 0.7%)

- Australian Goods/Services Imports MM (Aug) -0.2% (Prev. -0.8%)

- Australian Judo Bank Services PMI Final (Sep) 50.5 (Prev. 50.6)

- Australian Judo Bank Composite PMI Final (Sep) 49.6 (Prev. 49.8)