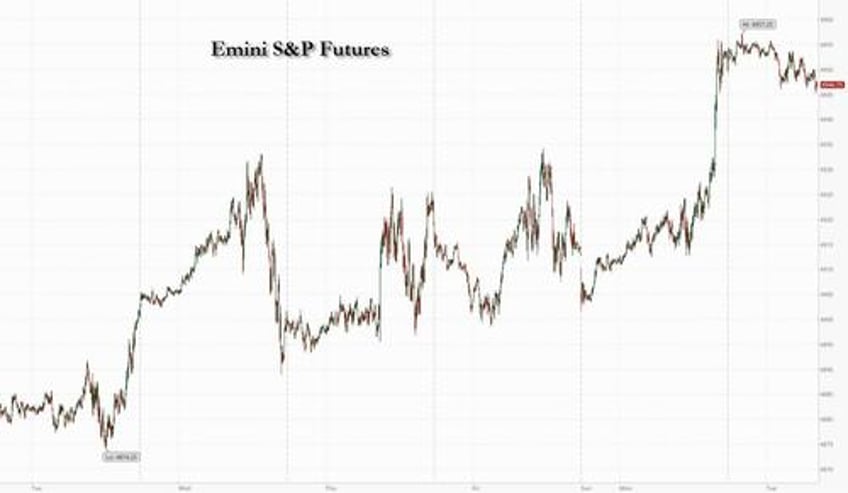

After yesterday's late day meltup, sparked by an overly optimistic forecast of Treasury supply, which sent stocks to a new all time high, US equity futures drifted lower in a tight range as investors looked ahead to the flood of tech earnings (Alphabet and Microsoft are due after the close) for insights on whether the record-breaking rally in equities can continue, while bracing for key announcements from the Fed and Labor department. Monday's latest record close pushed the S&P 500’s gains this month to 3.3%, while the Nasdaq 100 has surged 4.6%. Europe’s Stoxx 600 index crept to a new two-year high as autos and banking stocks led gains. Bitcoin is on course to advance for a fifth straight month, after rising 2% in January; The last time the largest digital asset managed a winning streak like this was the October 2020 to March 2021 stretch oiled by pandemic-era easy money. As stocks dropped, both 10Y TSY yields and the US dollar traded largely unchanged. Oil dipped as Biden refuses to retaliate against Iranian proxies, terrified any escalation will send gas prices soaring and crush his reelection chances.

In premarket trading, General Motors jumped 8% after beating profit expectations, while United Parcel Service fell as its revenue guidance missed projections. Here are some of the other notable premarket movers:

- Calix plunges 19% after the communication software company’s first-quarter forecast disappointed.

- Danaher falls 2.5% after the company forecasted core sales for the full year 2024 that disappointed Wall Street.

- General Motors gains 7% after beating Wall Street expectations for the fourth quarter. The automaker expects profits this year to grow on improved sales in the US.

- Johnson Controls slips 2% after cutting its adjusted earnings per share forecast for the full year.

- Spotify rises 1.8% after UBS upgraded its rating to buy, saying the stock has “room to run” as efficiency gains fully play out.

- Super Micro Computer jumps 13% after the server maker beat estimates on second-quarter net sales and raised its revenue forecast for the year.

- Tesla climbs 2%, poised to extend gains for a third consecutive session, as exchange-traded funds managed by Cathie Wood’s Ark Investment Management bought more shares of the EV maker.

- United Parcel Service falls 7% after posting fourth-quarter sales below analysts’ estimates and providing 2024 guidance that missed expectations.

- Whirlpool drops 4.7% after the home appliance manufacturer issued weaker-than-expected projections for revenue and earnings per share for the year.

- Woodward rises 5.8% after boosting its full-year profit and sales outlook. First-quarter profit and sales also beat estimates.

The busiest week so far of this reporting season is about to kick into gear: Microsoft and Alphabet will offer the first evidence later of whether the bullish sentiment around the so-called Magnificent Seven looks sustainable. By the time Apple, Amazon.com and Meta Platforms are done reporting Thursday, five tech giants with a combined market value exceeding $10 trillion will have updated the market.

While earnings will be a key test of the continued market meltup, as will the Fed’s decision tomorrow with bulls hoping for further dovish signals from Chair Jerome Powell, some of Wall Street’s biggest optimists are growing concerned that the good vibes are sending a contrarian signal on the market. Yet even as they issue warnings at the market level, at a sector level banks are turning even more bullish, with Morgan Stanley analysts turning - surprise - bullish on major US banks (such as Morgan Stanley of course), saying regulatory changes for higher capital levels may be less onerous that current proposals — allowing for more stock buybacks down the road (translation: please buy our stock).

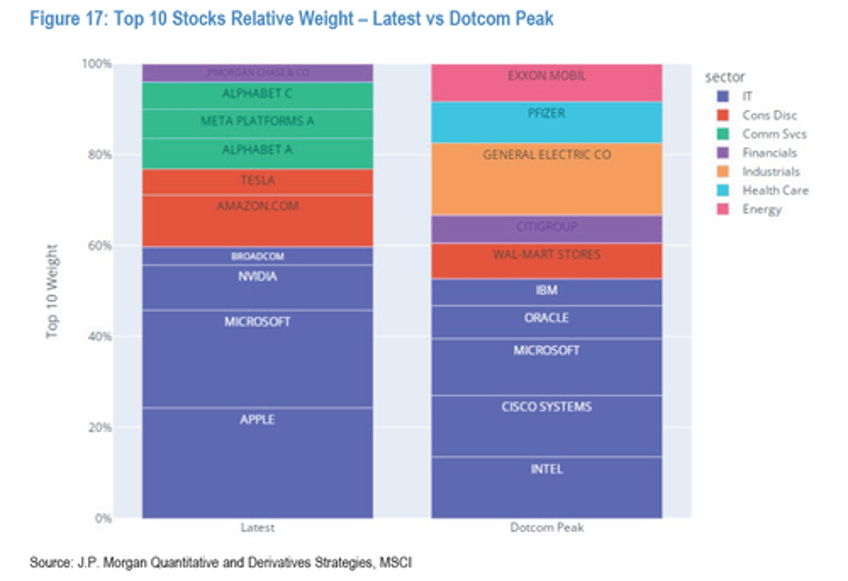

The tech rally, which according to JPM increasingly looks like the dot com bubble, has been fueled by expectations that interest-rate cuts from the Federal Reserve will help boost earnings growth. While the Fed is expected to hold rates this week, investors are keenly awaiting comments from Chair Jerome Powell after Wednesday’s decision for clues on the policy outlook. Traders are assigning roughly even odds to the prospect that the central bank will start lowering borrowing costs at its next meeting in March.

“Everything will play out in the next three days between the Fed meeting and the US tech results,” said Alexandre Baradez, chief market analyst at IG Markets in France. “The market is waiting for Powell to open the door for a rate cut in March, but it could very well be signaled for the second quarter.”

And speaking of another tech bubble, JPM quant Khuram Chaudhry said that the role of a small number of stocks in driving the advance on Wall Street poses a risk to the market and has a lot in common with the dot-com bubble. The share of the top 10 stocks on the MSCI USA Index, including all of the Magnificent Seven — Apple, Microsoft, Nvidia Corp., Alphabet, Amazon, Meta and Tesla — has risen to 29.3% as of the end of December. That’s just moderately below the historical peak share of 33.2%, which occurred in June 2000, the strategists wrote. And just four sectors are represented in the top 10 stocks, against a historical median of six.

“The key takeaway is that extremely concentrated markets present a clear and present risk to equity markets in 2024,” Chaudhry said. “Just as a very limited number of stocks were responsible for the majority of gains in the MSCI USA, drawdowns in the top 10 could pull equity markets down with them.”

Meanwhile, the spotlight continues to be on oil prices - that key catalyst that will determine whether the Fed will be allowed to be dovish or whether prices spike, sparking a hawkish reversal - as the market waits for how the US will respond to the deadly attack on American troops in Jordan, with Iran urging the White House to use diplomacy to ease tensions in the Middle East. A big surprise for oil traders came from Saudi Aramco, which abandoned a plan to boost its oil output capacity in a significant reversal that suggests the kingdom is becoming serious about curbing supply. Bloomberg Economics estimates Saudi Arabia needs an oil price of $108 a barrel to balance its budget and meet domestic spending by the sovereign wealth fund. Crude is steady in London today, trading near $82 a barrel.

European stocks look set to rise for a fifth straight session as data showed the euro zone unexpectedly avoided a recession in the latter half of 2023. The Stoxx 600 rises 0.3% to a fresh two-year high, led by gains in retail, bank and media shares. The Estoxx 50 climbed 0.5%, supported by euro-zone GDP data. Here are some of the most notable European movers:

- Avolta shares rise as much as 7.3%, the most since November, after the world’s largest duty-free operator got upgraded to buy at Stifelwhich says the stock is too cheap to ignore

- Skanska rises as much as 6.9% to lead gains on the Stoxx 600 construction and materials index, as Jefferies double-upgraded to buy from underperform

- DKSH shares rise as much as 4.8% after UBS upgrades its recommendation to buy, saying the Swiss distribution company’s stock is undervalued as execution is improving

- WPP jumps as much as 6.9%, the most intraday since 2022, as analysts embraced the advertising giant’s updated guidance for the medium term and await further details at today’s CMD

- SSP rises as much as much as 4.3% to hit its highest level in over six weeks after the company, which sells food in high-footfall traffic travel destinations, kept up the momentum in 1Q

- Synthomer gains as much as 3.9% as Morgan Stanley highlights a decline in net debt and improvement in free cash flow generation at the firm, offsetting the company’s negative forecasts

- Deliveroo falls as much as 5.7% as Germany’s Delivery Hero exits its stake in the food delivery company at a discount to last close; Delivery Hero meanwhile falls as much 11%

- Diageo drops as much as 4.3% after the spirits maker’s 1H profit and sales missed estimates, with demand remaining weak. Morgan Stanley said they show a continued loss of market share

- European and Saudi drilling services stocks fall after Saudi Aramco, the world’s largest oil company, abandoned plans to boost its output capacity

- Pets at Home drops as much as 6.3% after the pet supplies firm reported 3Q results RBC said were softer than expected, with the retail segment being the main driver of disappointment

- Jungheinrich drops as much as 6.2% as Oddo downgrades to neutral, with Kion Group rising 5% as it is upgraded to outperform and now the broker’s preferred name among the two

Earlier in the session, Asian equities declined, driven by a slump in Hong Kong and mainland China amid renewed concerns over the country’s property sector and as earnings disappoint. The MSCI Asia Pacific Index fell as much as 0.3%, with Tencent, AIA Group and TSMC among the biggest drags. Chinese stocks continued their slide as Evergrande’s liquidation order intensified worries about the embattled real estate sector given the lack of forceful policy support. “Ongoing news flow confirms that the property crisis is still hot and not easy to fix, or else it already would be,” said Kieran Calder, head of Asia equity research at Union Bancaire Privee. “Valuations are clearly cheap, but for good reasons including self-inflicted damage to the tech and real estate sectors,” he said. Hong Kong benchmarks were also weighed by BYD after the EV maker missed earnings forecast.

In FX, the dollar was little changed; the Bloomberg dollar index steadied. The pound is the weakest of the G-10 currencies, falling 0.2% versus the greenback. The Swedish krona is the strongest.

- EUR/USD pared an earlier drop of 0.2% to trade flat at 1.0828, after euro-area GDP data showed the region unexpectedly avoided a recession; Italy and Spain posted surprisingly strong results offsetting German weakness

- GBP/USD slumped as much as 0.3% to a session low of 1.2672, as the pound led G-10 losses against the dollar; Inflation in UK stores fell to the lowest level in more than 18 months

- NZD/USD crept up to its highest level in nearly a week before reversing gains to trade flat at 0.6134; RBNZ chief economist Paul Conway said the central bank has a way to go to get inflation under control, dashing hope for a pivot to rate cuts

Elsewhere, Nigeria’s naira plunged to a record against the dollar following a revision of the methodology used to set the exchange rate, in effect the second devaluation of the currency in seven months. The local unit depreciated 31% to 1,413 naira a dollar on Monday in the official foreign exchange window.

In rates, Treasury yields reversed an earlier drop after a cut in the quarterly borrowing estimate by the US Treasury eased concerns about the flood of debt being issued to cover the federal deficit. US yields were flat, after earlier dropping by as much as 2bp across long-end of the curve with 5s30s spread flatter by 2bp on the day; 10-year yields around 4.07%, slightly richer vs Monday’s close and outperforming bunds by 2.5bp on the day. Dollar swap spreads extend related widening move. Bunds are little changed, having pared gains after Spanish inflation unexpectedly accelerated in January. US session includes JOLTS job openings data. Dollar issuance slate includes three names already; nine deals priced $19.5b Monday, taking January new issue volume above $188b, a new all time high.

In commodities, oil was steady as the market waited for a US response to the deadly attack on American troops in Jordan, which could risk an escalation of tensions in a region key to global crude production. Spot gold rises 0.2%.

Looking tot he day ahead, US economic data includes November FHFA house price index, S&P CoreLogic home prices (9am), January consumer confidence, December JOLTS job openings (10am) and January Dallas Fed services activity. In Europe, there’s the Q4 GDP data from the Euro Area, along with UK mortgage approvals for December. From central banks, we’ll hear from the ECB’s Vujcic, Lane, Vasle and Nagel. Lastly, today’s earnings releases include Microsoft, Alphabet, Pfizer, UPS, Starbucks and General Motors.(10:30am)

Market Snapshot

- S&P 500 futures down 0.1% to 4,949.25

- STOXX Europe 600 up 0.3% to 486.35

- MXAP down 0.4% to 165.95

- MXAPJ down 0.8% to 505.58

- Nikkei up 0.1% to 36,065.86

- Topix down 0.1% to 2,526.93

- Hang Seng Index down 2.3% to 15,703.45

- Shanghai Composite down 1.8% to 2,830.53

- Sensex down 1.2% to 71,113.89

- Australia S&P/ASX 200 up 0.3% to 7,600.19

- Kospi little changed at 2,498.81

- German 10Y yield little changed at 2.25%

- Euro little changed at $1.0824

- Brent Futures up 0.2% to $82.58/bbl

- Gold spot up 0.2% to $2,037.33

- U.S. Dollar Index little changed at 103.54

Top Overnight News

- China’s 10-year yield briefly broke below 2.5% on Tues, the lowest level in more than two decades as confidence in the country’s growth/inflation backdrop fades (and expectations build for additional stimulus). WSJ

- TikTok said it has spent $1.5 billion building an operation intended to convince U.S. lawmakers that the popular video-sharing app is safe. TikTok executives publicly promised to voluntarily wall-off American user data and bring in engineers and third parties to certify the app’s algorithm delivered content without interference from China, where its parent company, ByteDance, is located. So far, TikTok is struggling to live up to those promises. WSJ

- Aramco abandoned a plan to boost its oil output capacity, a major U-turn that Vanda said suggests Saudi Arabia is moderating its view for global demand growth. BBG

- Spain’s CPI for Jan unexpectedly accelerates, coming in +3.4% Y/Y on the headline (vs. the Street +3% and vs. +3.1% in Dec), although core cooled to +3.6% (down from +3.8% in Dec but ahead of the Street’s +3.3% forecast). DJ

- The euro-area economy stagnated in the fourth quarter, unexpectedly avoiding further contraction. France’s economy was flat, buoyed by exports. As expected, Germany was the weak spot with GDP falling 0.3%. Spain’s growth came in hot — and so did inflation. Italy also outperformed. BBG

- Antony Blinken, the US secretary of state, has warned that the Middle East faces its most “dangerous” conditions since at least 1973, as Washington considers its response to an attack that killed three service members at the weekend. FT

- White House is weighing three broad options for retaliation against the Jordan attack: strike Iranian territory or waters; strike Iranian proxy groups in the Middle East (but not in Iran itself); or impose significant financial sanctions on the Iranian government/economy. WSJ

- Elon Musk said the first human received a Neuralink brain implant, a potential milestone in the development of “brain-computer interface” technology that could one day help those suffering from debilitating conditions such as paralysis to interact with their surroundings. WSJ

- Supermicro +12% in pre mkt (SMCI) provided very guidance for the Mar Q and raised its revenue forecast for the fiscal year (fdrom $10-11B to $14.3-14.7B). RTRS

- US venture capitalists are sitting on $311bn in unspent cash, as they shy away from risky bets on Silicon Valley start-ups and concentrate on finding ways to return capital to their own backers. American VC groups have deployed just half of a record $435bn they raised from investors during the pandemic-era boom between 2020 and 2022. FT

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed as weakness in China offset the momentum from Wall St's record highs. ASX 200 finished positive albeit with upside capped after disappointing retail sales data and as financials lagged. Nikkei 225 was initially lifted after a surprise decline in Japan's unemployment but gradually pared most of its gains. Hang Seng and Shanghai Comp were pressured as the focus turned to earnings releases with underperformance in Hong Kong amid losses in property and tech, while the Hong Kong government also began the process of passing new national security laws.

Top Asian News

- Hong Kong government started the process to pass new national security laws this year with consultations on Article 23 to last until February 28th and some chapters of the new law will include actions that would endanger national security. Furthermore, one chapter is related to treason and actions with seditious intentions and another chapter relates to state secrets and espionage behaviour, while the law will also relate to using computers or electronic systems to conduct actions to endanger national security, according to Reuters.

- Two US lawmakers asked the Biden administration to impose export restrictions on four Chinese companies involved in the planned Ford (F) Michigan battery plant, according to a letter seen by Reuters.

- RBNZ Chief Economist Conway said recent economic data suggests that monetary policy is working with the economy slowing and inflation easing, but they still have a way to go to get inflation back to the target midpoint of 2%.

European bourses, Stoxx600 (+0.3%), are on a modestly firmer footing, albeit contained within recent ranges as markets await impetus from this week’s key events. European sectors hold a positive tilt; Media takes the spotlight, largely helped by gains in WPP (+4.2%) after its trading update whilst Food Beverage & Tobacco is hampered by losses in Diageo (-3.6%), post-earnings. US equity futures trade incrementally in the red and within a tight range which resides towards the prior day’s peak; focus for today will be on US JOLTs and key earnings from Microsoft, Alphabet, Starbucks & AMD. Click here and here for the sessions European pre-market equity newsflow, including earnings from BBVA, Diageo, Hapag Lloyd & more.

Top European News

- Ifo says the German economy is expected to contract by 0.2% in Q1.

- UK Kantar supermarket data: Grocery price inflation fell slightly to 6.8% in January, down from 6.9% in December 2023.

- Government advisers says German debt brake is "too rigid" and "restrict the fiscal space for future oriented expenditure", according to the FT.

- Northern Ireland DUP leader Donaldson said the party executive endorsed proposals from negotiations with the UK government and the package of measures provides a basis to return to a devolved government, while the measures including new legislation will be published by the UK government in due course. Donaldson said he believes the package safeguards Northern Ireland's place in the UK and it will remove checks for goods moving with the UK and remaining in Northern Ireland, according to Reuters.

FX

- Once again, DXY continues to pivot around the 103.50 mark with the index awaiting fresh catalysts. Yesterday's best of 103.82 was the highest since Dec 13th (FOMC day).

- EUR is supported by hotter Spanish GDP and CPI metrics as attention then turned to the EZ-wide data which showed that the EZ just about avoided a recession; EUR/USD is contained within yesterday's 1.0796-1.0851 range.

- Cable has slipped back from the 1.27 handle with UK-specific drivers light ahead of BoE on Thursday; currently trades in a 1.2672-1.2721 range with yesterday's low at 1.2662.

- AUD the weaker of the Antipodes post-soft Retail Sales data overnight. AUD/USD remains in close proximity to 0.66 level whilst NZD/USD remains supported above the 0.61 mark.

- PBoC set USD/CNY mid-point at 7.1055 vs exp. 7.1763 (prev. 7.1097).

- SNB's Chair Jordan said his expectation is inflation will again rise a little but noted the situation regarding inflation has improved and looks relatively good. Jordan also said that inflation should be below 2% in 2024 and that it probably accelerated in January.

Fixed Income

- USTs are firmer after Monday's Treasury Financing Estimates implied a lower net issuance amount than forecast for Wednesday's Quarterly Refunding; the accompanying yield is yet to approach 4.0% to the downside.

- Bunds initial bullish bias from Treasury estimates faded quickly as supply-side pressure emerged via Greece (10yr) and German (30yr) syndications. Further pressure occurred on the firmer Spanish GDP & HICP figures and upward revision to Germany's Q3 figure; currently holds just below the 135.00 mark.

- Gilt price action is in-fitting with EGBs directionally but remain in the green alongside USTs and were unreactive to their own data points via the BoE.

- UK sells GBP 900mln 0.125% 2051 I/L: b/c 3.10x (prev. 3.18x), real yield 1.333% (prev. 1.314%)

- Italy sells EUR 7bln vs exp. EUR 5.5-7bln 4.10% 2029, 4.35% 2033, 3.35% 2035 BTP & sells EUR 2bln vs exp. EUR 1.5-2bln 2031 CCTeu.

- New German 30yr EUR-denominated benchmark guided +5.5bps, set to price today, via IFR

- Germany sees over EUR 51bln of demand for syndicated 30-year bond sale, via Reuters citing lead managers

Commodities

- Crude benchmarks are modestly firmer given the Aramco update, but overall remain towards the low-end of Monday's parameters as newsflow has been somewhat light; Brent futures holds just below the USD 82/bbl mark.

- Spot gold is a touch firmer, holding above the technical levels eclipsed on Monday but yet to advance towards a test of USD 2050/oz, current peak of USD 2040/oz.

- Base metals are mixed in-fitting with the risk tone seen in APAC trade overnight; LME copper was unreactive to EZ and regional data.

- Brazilian miner Vale reported Q4 iron ore production of 89.4mln tons (prev. 80.85mln tons Y/Y) and nickel production of 44.9k tons (prev. 47.4k tons Y/Y).

- Saudi Aramco received a directive to maintain maximum sustainable capacity at 12mln BPD and not to continue increasing it to 13mln BPD, according to Reuters.

Geopolitics: Middle-East

- US President Biden asked advisers for options to respond that would deter any further attacks against US forces, while the Pentagon's response options include striking Iranian personnel in Iraq and Syria or Iranian naval assets in Gulf waters. Furthermore, a response is likely to come in waves against a range of targets and will likely be initiated in a couple of days after President Biden gives the green light, according to sources cited by Politico.

- US Secretary of State Blinken said response against Iran could be multi-levered, come in stages and be sustained over time, while he added that work on Gaza hostage talks has been important and hopeful with the proposal on the table is strong and compelling.

- Hamas Chief says has received the Paris ceasefire proposal and will study it

Geopolitics: Other

- North Korea fired cruise missiles towards the sea off its west coast, according to South Korea's military.

- Chinese Vice Foreign Minister Sun met with Ukraine's Ambassador to China and said that China and Ukraine should promote stability and long-term development of bilateral ties, while they exchanged views on issues of common concern including the Ukraine crisis, according to Reuters.

- Russian Former President Medvedev says Russia plans to deploy new weapons on Kuril Islands, via Tass

US Event Calendar

- 09:00: Nov. S&P CS Composite-20 YoY, est. 5.80%, prior 4.87%

- Nov. S&P/CS 20 City MoM SA, est. 0.50%, prior 0.64%

- 09:00: Nov. FHFA House Price Index MoM, est. 0.3%, prior 0.3%

- 10:00: Jan. Conf. Board Consumer Confidenc, est. 114.5, prior 110.7

- Conf. Board Present Situation, prior 148.5

- Conf. Board Expectations, prior 85.6

- 10:00: Dec. JOLTs Job Openings, est. 8.75m, prior 8.79m

- 10:30: Jan. Dallas Fed Services Activity, prior -8.7

DB's Jim Reid concludes the overnight wrap

Yesterday we released our latest chartbook, which is called “When central banks cuts rates… what happens next?” It looks at what happens to markets as central banks cut, how inaccurate markets are around turning points in the rate cycle, and some other historical trends. So with markets pricing rate cuts this year across lots of central banks, it’s a topical pack for the coming months. See the full chartbook here.

In addition, today I’m hosting Adrian Cox in a webinar on the outlook for AI in 2024. It’s at 2pm London time and you can register here. This could be timely ahead of a 48-hour period from tonight where 2 4% of the S&P 500 report across only five companies worth $10.5tn with Microsoft and Alphabet today and Apple, Amazon and Meta on Thursday. So in a week with the FOMC tomorrow and payrolls on Friday these earnings could have more of an influence on where the S&P 500 and global sentiment actually finishes on Friday.

One other topic bubbling under surface at the moment is the tension in the Red Sea. Adrian Cox has brought together experts from across DB Research to publish a “Red Sea red alert 101”. This is the latest in our series of guides for generalists and reviews how the Red Sea crisis came about, why the conflict in Gaza is spilling into the wider region, and what it means for global oil supplies and trade. It builds on his report from last year on the Five weak links in the globalised economy. You can read the Red Sea 101 here.

In terms of markets, we were in a holding pattern ahead of the big events to come this week until an adrenaline shot came through in the last hour of US trading last night as the US Treasury announced lower-than-expected borrowing estimates for Q1 and Q2 2024. 1 0yr Treasuries saw their strongest day of the year so far (-6.3bps) and are another -2.3bps lower overnight at 4.05%. Meanwhile, the S&P 500 posted another solid gain (+0.76%) and another all-time high. Earlier in the day, there was a significant sovereign bond rally in Europe as investors priced in a growing likelihood the ECB would be cutting rates shortly.

Starting with the borrowing announcement, the US Treasury lowered its quarterly borrowing estimate for Jan-Mar from $816bn to $760bn, a larger decline than expected by the market and our US rates strategists. It also announced a modest $202bn borrowing estimate for the Apr-Jun period. These estimates suggest an improvement in the Treasury’s expectation of the budget deficit path. The market will next be watching the details of the Treasury’s coupon auction sizes in tomorrow's refunding statement. Recall that the last quarterly refunding announcement on 1 November marked the start of the dramatic bond rally into year-end.

This news really helped markets into the close with the S&P 500 gaining nearly half a percent in the final hour of trading, with a +0.76% rise on the day leaving the index above 4900 for the first time. Small caps outperformed with the Russell 2000 up +1.67% on the day (gaining nearly one percent after the Treasury’s announcement). Other major indices also posted solid gains, including the Dow Jones (+0.59%) and the NASDAQ (+1.12%). The Magnificent 7 (+1.59%) also outperformed, led by a +4.19% gain for Tesla. Equities had been more subdued during the European session, though the STOXX 600 (+0.21%) did post a 4th consecutive gain for the first time since November, which took the index up to a 2-year high.

Over in the bond market, US Treasuries had already seen a moderate rally prior to the 3pm EST announcement, and yields then fell by c. 3bps in its immediate aftermath. They did reverse a portion of this decline late on, but the 10-year yield still closed -6.3bps lower at 4.075%. The rally was more modest at the front end, with the 2yr yield down -3.0bps.

Over in Europe, rates also rallied, aided by comments from several ECB officials, who collectively pointed in a dovish direction. For instance, as we reported yesterday, France’s Villeroy said over the weekend that “everything will be open at our next meetings”, and yesterday morning saw ECB Vice President Luis de Guindos point out that the good news on inflation “will end up being reflected in the monetary policy”. Later on, Portugal’s Centeno then said in an interview that “We don’t need to wait for May wage data to get an idea about the inflation trajectory”.

These overpowered Knot’s more hawkish comments over the weekend and comments by Slovakia’s Kazimir who saw a June cut as more likely than April. Investors dialled up the likelihood of rate cuts from the ECB, with a move now fully priced in by April again. Moreover, investors have even been open to the idea of a cut as soon as the next meeting in March, with the probability up from 18% at the close on Friday to 28% yesterday, so that will heighten the attention on this week’s flash CPI release for January. These growing expectations of a rate cut meant sovereign bonds rallied across the continent, with yields on 10yr bunds (-6.4bps), OATs (-6.9bps) and BTPs (-9.0bps) all seeing noticeable declines.

In oil markets, after reaching their highest level in nearly three months on Friday, Brent traded above $84.50 early on Monday (up +1.5% at the peak) amid increased concerns over Middle East tensions. But this supply risk sentiment eased during the day, also helped by an industry report suggesting that OPEC+ supply cuts this month might have been smaller than scheduled. Brent closed -1.38% lower on the day at $82.40/bbl, while WTI was -1.58% to $76.78/bbl. Both are back up around half a percent this morning.

Asian equity markets are mixed this morning with Chinese stocks resuming losses as Evergrande’s liquidation order has kept a lid on risk appetite. As I check my screens, the Hang Seng (-1.95%) is leading losses across the region with the CSI (-0.79%) and the Shanghai Composite (-0.62%) also falling while the Nikkei (+0.30%) and the KOSPI (+0.15%) are marching to a different beat. US equity futures are broadly flat.

Early morning data showed that Japan ’s labour market showed further signs of tightness as the jobless rate unexpectedly dropped to 2.4% in December from 2.5%. Also, the job availability ratio edged down 0.01 from November to 1.27 in December (v/s 1.28 expected). Meanwhile, Australian retail sales contracted -2.7% m/m in December (v/s -1.7% expected) as against a downwardly revised increase of +1.6% last month.

Elsewhere, China’s benchmark 10yr yield dropped to 2.47%, its lowest in over two decades on rising expectations of additional monetary easing.

There was very little DM data to speak of yesterday, although we did get the Dallas Fed’s manufacturing outlook survey for January. That fell to an 8-month low of -27.4 (vs. -11.0 expected), whilst the employment component fell to -9.7, which is the lowest reading since May 2020 at the height of the pandemic. The market has seemingly grown immune to these very bad manufacturing surveys that have punctuated through over the last year or so, so this was largely ignored.

To the day ahead now, and US data releases include the Conference Board’s consumer confidence reading for January and the JOLTS job openings for December. Meanwhile in Europe, there’s the Q4 GDP data from the Euro Area, along with UK mortgage approvals for December. From central banks, we’ll hear from the ECB’s Vujcic, Lane, Vasle and Nagel. Lastly, today’s earnings releases include Microsoft, Alphabet, Pfizer, UPS, Starbucks and General Motors.