Born in the 90s and tested to destruction during the Great Financial Crisis, modern-day central bank independence is effectively over in all but name. Persistently large government deficits, central banks with trillions of dollars of sovereign debt and the political toxicity of elevated inflation make it impossible any longer for the Federal Reserve, ECB et al to set monetary policy fully independently from their government overseers.

Look no further than Wednesday to see monetary independence’s erosion and fiscal dominance’s re-ascendancy play out in microcosm. A rate-setting meeting would normally be top billing for the market, but the Fed is likely to be overshadowed by the Treasury’s refunding and auction-size announcement on the same day. The wind is changing.

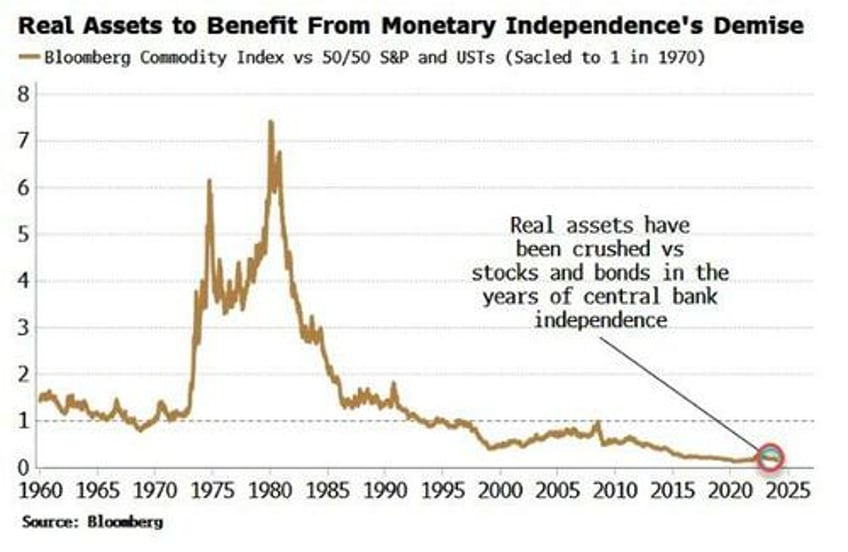

The market implications are far-reaching. Secularly higher inflation, the end of the nominal Fed put, a structurally weaker dollar, and the reversal of the relentless underperformance of real assets versus stocks and bonds are all themes poised to play out in the coming months and years.

Central banks’ independence is being challenged for two, linked, main reasons: high inflation and large fiscal deficits. Governments, since their dalliance with Modern Monetary Theory (MMT) in the late 2010s, have massively expanded their spending. The pandemic justified a war-like response in sovereign outlays, but large deficits have continued long after the emergency ended.

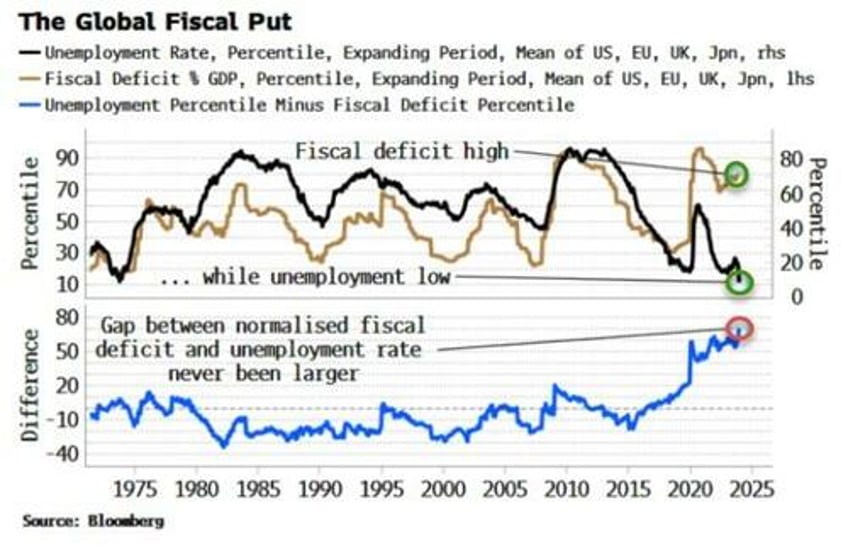

A “fiscal put” is effectively in place as Covid altered expectations for what governments should underwrite: not just unemployment in the event of a recession, but business solvency, consumption, even life itself.

This is not just a US phenomenon. Across much of the developed market, budget deficits have never been as high while unemployment has been as low.

As the chart above shows, the divergence began around 2016, and then rose as MMT-lite policies came into in vogue, before being turbo-charged by the pandemic. We are in an era of large, highly pro-cyclical government spending.

That is existential for central-bank independence.

Their political independence is under creeping threat from populist politicians. But it is their operational independence that is already fatally circumscribed. There are three key reasons why (these relate to the US, but similar arguments can be made for Europe, the UK et al):

The swelling amount of Treasury debt outstanding, driving a rapidly rising interest bill

The large size of the Treasury’s account at the Fed

The high proportion of shorter-term debt, i.e. bills

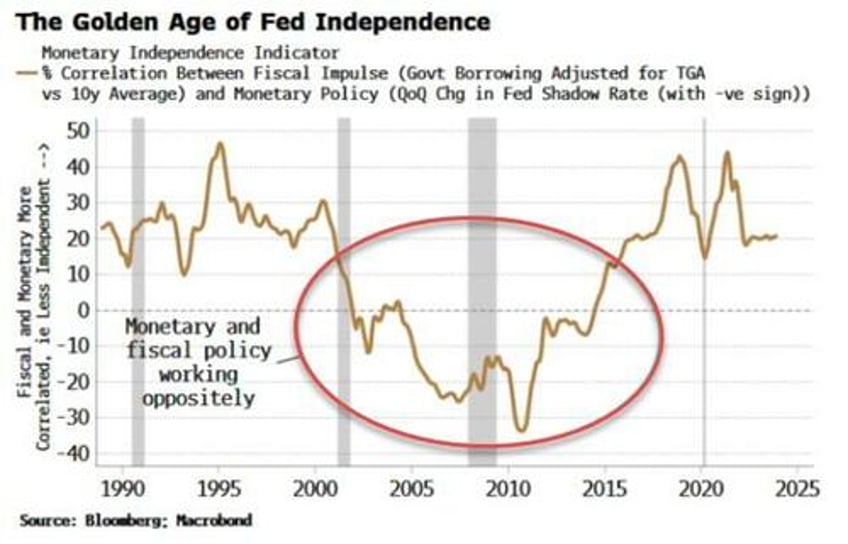

First, we need to quantify central-bank independence. Governments are inherently inflationary as large, voter-pleasing fiscal deficits typically lead to a structural rise in inflation. Thus the policy of an inflation-targeting independent central bank should be counter to fiscal policy overall through the cycle.

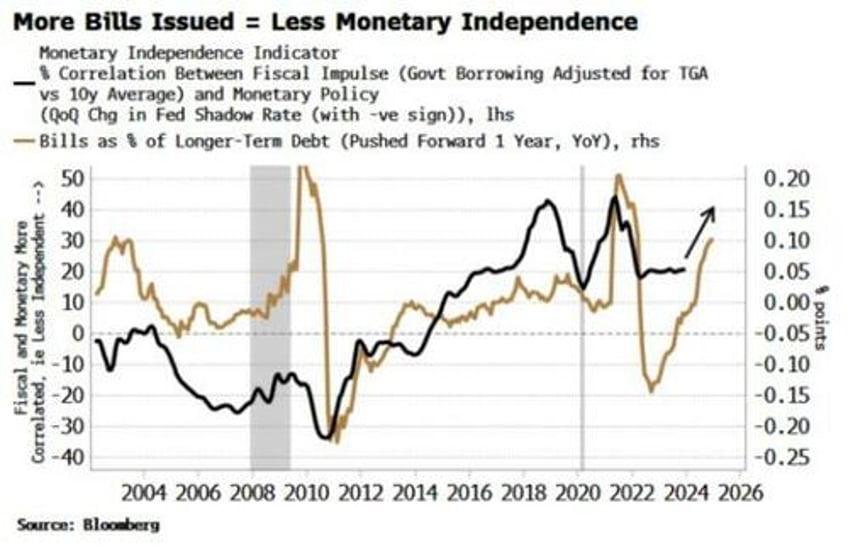

The Monetary Independence Indicator (MII) for the US, shown below, is the correlation between the change in government borrowing and the change in the Fed’s Shadow Rate (so as to include the effects of QE). As we can see, the golden age of Fed independence was from the late 1990s to the mid 2010s, when monetary policy acted contrary to its fiscal counterpart.

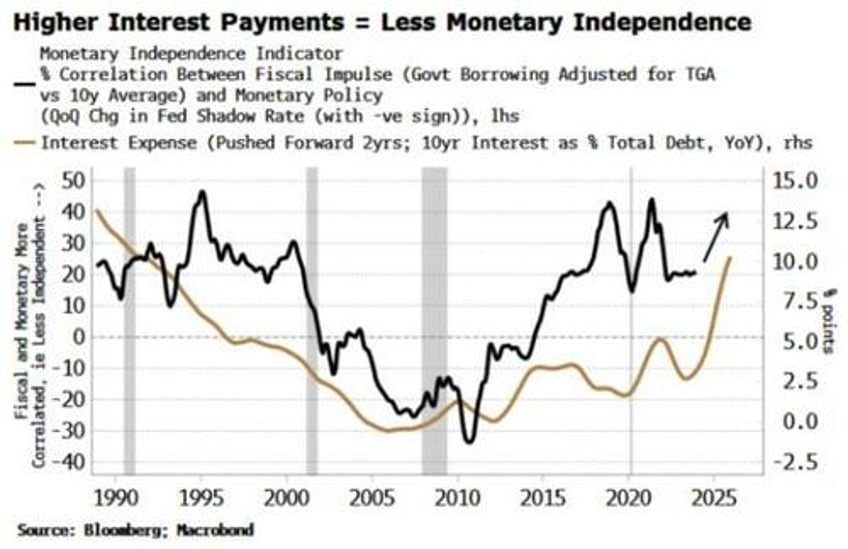

Since then, monetary independence has been slowly eroded and will be further compromised by the government’s bulging interest bill. Interest must be paid for either with more borrowing or higher taxes. Both of these are bad for liquidity by draining reserves out of the system or by reducing their velocity. The central bank ultimately must accommodate this by easing policy.

Overlaying US interest expense on to the MII shows that when the interest bill is high it leads to a rise in the latter, signifying the Fed is acting less independently, and vice-versa. Today’s rise in interest costs shows the Fed’s independence will be increasingly constrained.

The Treasury’s account at the Fed (the TGA) further inflames the outlook. Since the GFC and a monetary system of superabundant reserves (created by trillions of dollars of QE), the Treasury has used its Fed account more. But it was not until the pandemic its size grew to over $1.7 trillion.

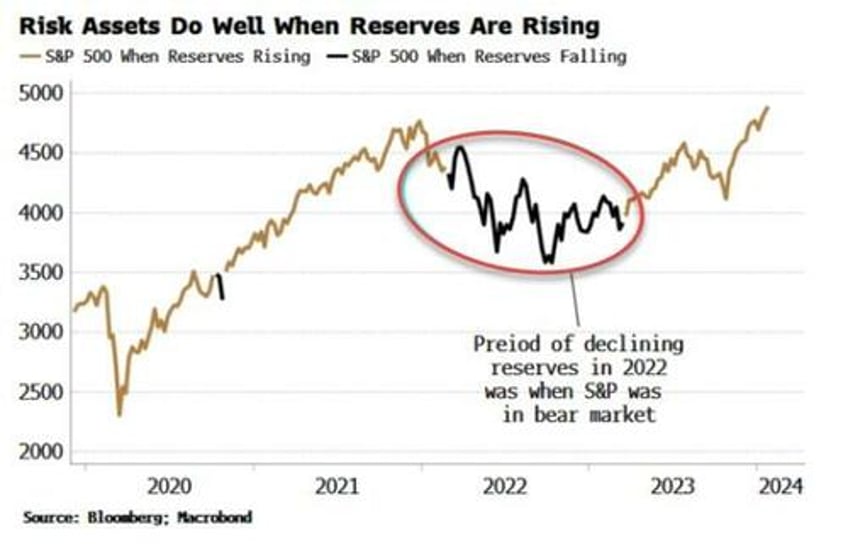

At ~$830 billion it’s lower now, and the Treasury aims to keep it around $750 billion. But that’s still a huge lake of liquidity, and the Treasury either significantly adding to it – i.e. taking reserves out of the system and reducing liquidity – or drawing it down, boosting liquidity, has a consequential market impact.

The effect is not merely theoretical. The period of poor S&P returns in the 2022 bear market were accompanied by a worsening trend in reserves, driven by, among other things, a high and generally rising TGA.

The Fed cannot indefinitely overlook this assault on liquidity, as when assets fall as there is a greater risk of a recession-inducing feedback loop between markets and the economy. The TGA is a direct impediment to the Fed’s operational freedom.

The Fed’s room for maneuverability is further limited by the rapid rise in bill issuance, and thus the drop in the average maturity of the Treasury’s outstanding debt. The Yellen pivot, when the Treasury massively increased bill issuance to fund its deficit, allowed money market funds to lend to the Treasury using inert liquidity parked at the Fed’s reverse repo facility (RRP).

That supported markets in the face of the crowding-out effects of large government issuance, but it also means that bills are now over 20% of Treasury debt outstanding.

When the average maturity of government debt is very low and the central bank raises rates, it creates a fiscal squeeze as the government’s funding costs rise almost immediately. The central bank thus has to re-loosen policy to offset the unintended fiscal tightening.

By overlaying the MII with bills outstanding in the US as percentage of longer-term debt we can see this in action. Typically, when the ratio of bills to longer-term debt is high, Fed independence is low.

A less independent Fed and a spendthrift government is structurally inflationary. This means the end of the nominal Fed put – a backstop for financial assets, i.e. stocks and bonds – as elevated inflation eats away at real values. Elevated inflation will thus make real assets, such as commodities, increasingly attractive, reversing their decades of extreme underperformance.

High inflation and a compromised Fed is also a recipe for a structurally weaker dollar, as the Fed’s balance sheet - on which the dollar is a liability – is further vitiated by assets of poorer quality, including the bonds of an increasingly indebted US government.

There is an irony to all of this. Central banks might argue that losing their independence will make inflation even worse. But perhaps the only reason they won it in the first place was the world was in an era of structurally weaker inflation driven mainly by demographics and globalization.

Either way, inflation will be much harder to tame now as these themes reverse, and the era of autonomous central banks de facto draws to a close.