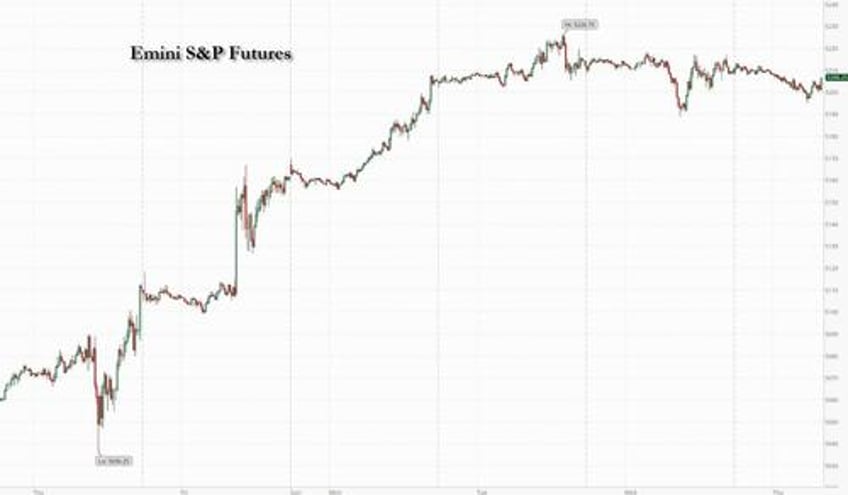

US equity futures are weaker as yields resume their rise and the USD strengthens after the BOE signaled it was ready to cut rates. As of 7:45am, S&P futures were down 0.2% and Nasdaq futures dipped 0.3% as all Mag7 names and most semis were red in the premarket. Most European markets are lower, tracking US futures and Asian stocks in what appears to be de-risking in a catalyst-light week. 10Y treasuries ticked lower for a second day, pushing the yield about 2bps higher to 4.51% after a $42 billion sale of 10-year notes received tepid demand. Commodities are stronger with Ags/Energy outperforming Metals. Jobless data is not expected to be market moving but keep an eye on the 30Y bond auction.

In premarket trading, US-listed shares of Arm Holdings plunged 8.5% after the chip-design company gave a full-year forecast that is seen as mixed relative to consensus, especially given the market’s high expectations. Airbnb shares also tumbled 8.7% after the home-rental company’s Q2 revenue forecast trailed the average analyst estimate, ahead of the peak summer season. Here are some other notable premarket movers:

- AppLovin shares are up 15% after the software maker’s quarterly sales and earnings came in comfortably above forecasts.

- Bumble shares jump 12% after the online dating company affirmed its full-year forecast, which Citi said offset a weak second-quarter guide.

- Cardlytics shares drop 27% after the application software company reported revenue for the first quarter that missed the average analyst estimate.

- Cheesecake Factory shares rise 1.6% after the restaurant chain operator reported adjusted earnings per share for the first quarter that beat the average analyst estimate. Raymond James raised the recommendation on the stock to outperform from market perform.

- Compass stock climbs 13% after the real estate technology firm delivered a revenue forecast range for the second-quarter that beat the average analyst estimate at the midpoint.

- Duolingo shares fall 12% after the education software provider’s daily active user growth cooled. Analysts note that it was about time for the company’s growth to normalize after years of upside.

- Magnite shares rise 11% after the advertising technology firm posted 1Q profit and revenue that beat estimates.

- Robinhood shares gain 5.0% after the fintech’s results beat expectations thanks to strength in crypto trading.

- SolarEdge shares plunge 9.1% after the solar power company reported a wider-than-expected 1Q loss and provided guidance for 2Q that came in below even the most pessimistic forecasts, according to analysts.

- Trade Desk shares are up 1.1% after the advertising technology company reported first-quarter results that beat expectations and gave an outlook that is above the analyst consensus.

- Warner Bros. shares rise 3.3% after Chief Executive Officer David Zaslav ordered his lieutenants to find additional opportunities for cost-cutting in order to hit financial targets for the next couple years.

- Zai Lab ADRs soar 19% after the Chinese biopharmaceutical company reported estimate-beating sales.

The recent stock bounce is fading as the earnings season winds down, leaving investors to wait for new data - especially next week's CPI report - for clues to gauge how fast policymakers will be able to begin cutting rates. The pound fell against all of its Group of 10 peers after the Bank of England edged closer to cutting interest rates from a 16-year high, with two of the nine committee members voting for lower borrowing costs. US initial jobless claims data later Thursday will be another focal point for investors seeking more evidence that the labor market is finally softening, allowing the Federal Reserve to begin lowering rates by the end of the year. Prospects for a Fed rate cut improved after softer-than-expected US payrolls last week.

“We still see potential rate cuts to be some months out and with no probable actions occurring prior to September,” Louise Dudley, portfolio manager for global equities at Federated Hermes, said in a note to clients. “US economy figures have generally been hot.”

The CPI figures due next week will offer fresh insights about the US economy after recent employment data showed the labor market is cooling. Fed Bank of Boston President Susan Collins signaled Wednesday that interest rates will likely need to be held at a two-decade high for longer than previously thought to damp demand and reduce price pressures.

European stocks fell 0.2%, hovering near record highs after rising in the prior four sessions. The energy sector outperformed, while autos were the worst laggards. Markets in Denmark, Finland, Norway, Sweden and Switzerland are closed for a holiday. Banco de Sabadell SA rose after Banco Bilbao Vizcaya Argentaria SA commenced a $12 billion hostile bid for the lender. Here are the most notable movers:

- BAE Systems shares rise as much as 0.9% in a fourth day of gains after the defense and aerospace systems manufacturer delivered results in line with expectations.

- Prysmian shares gain as much as 1.3%, pushing the stock to a record high, after narrowing its guidance to the upper end of the range and producing first-quarter results which analysts view as solid.

- Banco de Sabadell shares rise as much as 7.1% after BBVA made an €11.5 billion hostile bid for its smaller Spanish banking rival, days after having an initial approach rejected. BBVA drops.

- BE Semiconductor shares jump as much as 8% after the Dutch chip equipment maker said it receives an order for 26 hybrid bonding systems from a “leading semiconductor logic manufacturer.”

- Nexi shares rise as much as 7.7% after the payments firm reported estimate-beating results, helped by a stronger card issuing business and cost controls.

- IMI shares rise as much as 1.4%, on track to close at a fresh record high, after the engineering group delivered a solid trading update and reiterated its full-year guidance.

- ITV shares rise as much as 3% after the UK broadcaster issued stronger-than-expected advertising guidance for 2Q, leading brokers to raise their price targets on the stock.

- Harbour Energy shares rise as much as 6.2%, the most in four months, after the oil and gas company’s update showed it remains on track to meet expectations this year.

- Balfour Beatty shares rise as much as 1.7% after the group released a short trading update confirming trading has been in line with expectations since the start of 2024.

- 3i shares fall as much as 3.6% after total return for the full year missed the average analyst estimate, with RBC analysts noting misses in operating cash profit and net debt at year-end coming in a little above forecasts.

- Argenx shares fall as much as 10%, the steepest drop this year, after first-quarter results from the biotech firm failed to provide much in the way of fresh catalysts.

- BPER Banca shares decline as much as 6.1% in Milan as the bank’s key trends look weaker, according to Deutsche Bank analysts.

- Wood shares fall as much as 3.5%, paring Wednesday’s rally after the Scottish engineering firm rejected a preliminary 205p/share acquisition proposal from Sidara.

Asian stocks resumed gains on Thursday, lifted by optimism around key offshore Chinese tech companies as they report earnings next week. The MSCI Asia Pacific Index climbed as much as 0.4% after its four-day winning streak was halted in the previous session. Hong Kong-listed shares were among the best performers in the region, with Tencent giving the biggest boost to the index ahead of earnings next week. Meituan shares jumped nearly 5% after Citi raised its price target on expectation that earnings will show growth in the food delivery business. Japan’s Topix gained nearly 0.9% after BOJ Minutes revealed a desire from at least one member to sell all ETFs and an acknowledgement that a weaker JPY may lead to more inflation; the Australian benchmark fell after rising for five consecutive sessions. Stocks in Korea traded lower. Earnings of top Chinese technology companies will be key for the bounce-back in the nation’s stocks from their multi-year lows to continue. Tencent and Alibaba both publish results next Tuesday, followed by JD.com and Baidu two days later.

- Hang Seng & Shanghai Comp were underpinned amid resilience in the tech sector and after China's eastern city of Hangzhou lifted all home purchase restrictions, although there were headwinds from default concerns as Country Garden Holdings (2007 HK) failed to make coupon payments on a yuan-denominated bond due today but still has a grace period.

- Nikkei 225 recovered from an early dip with trade contained as participants digested BoJ rhetoric and soft wages.

- ASX 200 was dragged lower by underperformance in consumer stocks and financials with the latter pressured after Australia's largest lender CBA reported a decline in profits.

In FX, the Bloomberg Dollar Spot Index rose 0.1% as the greenback gained against all Group-of-10 peers; Treasury yields rose 1-3bps across the curve.

- USD/JPY rose as much as 0.3% as the Japanese yen led losses against the dollar, earlier in the Asian session the currency pair fell 0.2%; a BOJ April meeting summary indicated the weak yen is being closely watched and could result in a faster pace of rate hikes

- GBP/USD steadied around 1.2480 after falling as much as 0.4% to 1.2450 after the BOE kept rates unchanged but signaled that the time for cuts is approaching

Treasuries are lower on the day, but have pared declines as gilts jump on Bank of England’s 7-2 vote to keep rates on hold, with Ramsden joining Dhingra in supporting a cut. UK curve steepens with 2-year yields dropping around 3bp on the day. US long-end yields remain cheaper by about 3bp with front-end outperforming slightly. 10-year around 4.51%, also cheaper by 3bp on the day; gilt yields reached day’s lows and GBP/USD fell as much as 0.4% to 1.245% after BOE policy announcement. US session includes weekly jobless claims and $25b 30-year bond sale, last of week’s three auctions.

In commodities, oil prices advance, with WTI rising 0.6% to trade near $79.40. Spot gold is little changed.

Bitcoin softer on the session and holds just shy of USD 61k, whilst Ethereum unable to climb back above USD 3k.

To the day ahead now, and the main highlight will be the Bank of England’s latest policy decision and Governor Bailey’s press conference. Other speakers will include ECB Vice President de Guindos, the ECB’s Cipollone, Bank of Canada Governor Macklem, the Fed’s Daly, and BoE chief economist Pill. Otherwise in the US, we’ll get the weekly initial jobless claims, and there’s a 30yr Treasury auction taking place.

Market Snapshot

- S&P 500 futures down 0.2% to 5,201.50

- STOXX Europe 600 down 0.1% to 515.19

- MXAP down 0.2% to 176.15

- MXAPJ down 0.3% to 549.14

- Nikkei down 0.3% to 38,073.98

- Topix up 0.3% to 2,713.46

- Hang Seng Index up 1.2% to 18,537.81

- Shanghai Composite up 0.8% to 3,154.32

- Sensex down 1.1% to 72,646.43

- Australia S&P/ASX 200 down 1.1% to 7,721.64

- Kospi down 1.2% to 2,712.14

- Brent Futures up 0.6% to $84.11/bbl

- Gold spot up 0.1% to $2,311.61

- US Dollar Index up 0.16% to 105.71

- German 10Y yield little changed at 2.50%

- Euro down 0.2% to $1.0728

- Brent Futures up 0.6% to $84.12/bbl

Top Overnight News

- China’s efforts to revive homebuyer demand gathered steam on Thursday when two major cities scrapped all their remaining curbs on residential property purchases, a move that more local governments are expected to follow. Developer stocks surged after Hangzhou, the capital of eastern Zhejiang province, said it will remove eight-year-old restrictions on residential property purchases and no longer review the qualifications of homebuyers. Xi’an, the capital of Shaanxi province, announced similar steps hours later. BBG

- China’s central bank seems very likely to make a bond purchase in the secondary market for the first time in two decades. SCMP

- The BOJ’s board is becoming more concerned about the inflation outlook as a sharply weaker yen threatens to drive up import prices, a summary of its latest meeting showed. WSJ

- EU countries have agreed to use an estimated €3bn in profits arising from Russia’s frozen state assets to jointly buy weapons for Ukraine. The deal struck by the bloc’s 27 ambassadors on Wednesday only targets profits made by Belgium’s central securities depository Euroclear, where about €190bn of Russian central bank assets are held. Western nations immobilized Russia’s state assets abroad in 2022, in response to its full-scale invasion of Ukraine. FT

- President Biden trails former President Trump by roughly 1pp in national polling and by around 2pp in the swing state that would currently provide the winning electoral vote. Prediction markets imply around a 52% chance of a Democratic win. Biden’s lead over Trump in some prediction markets has retraced somewhat this month and Biden's approval rating has ticked down to 38%, not far off the 37% low and below Trump’s average approval in the six months before he lost the 2020 election. GIR

- Speaker Mike Johnson on Wednesday easily batted down an attempt by Representative Marjorie Taylor Greene of Georgia to oust him from his post, after Democrats linked arms with most Republicans to fend off a second attempt by G.O.P. hard-liners to strip the gavel from their party leader. NYT

- Roughly one in 37 US homes is now considered seriously underwater, real estate data firm ATTOM said. That share is much higher — and growing at a faster pace — across a swath of southern states. But nationally, it’s still lower than before the pandemic. BBG

- Tim Cook will likely stay AAPL's CEO for at least another three years and his most likely successor at that time would be John Ternus, the current head of hardware engineering. BBG

A more detailed look at global markets courtesy of Newqsuawk

APAC stocks were mixed as the region took its cue from the indecisive performance stateside owing to mixed earnings and as markets await the next major catalysts, while the somewhat mixed but improved Chinese trade data had little impact. ASX 200 was dragged lower by underperformance in consumer stocks and financials with the latter pressured after Australia's largest lender CBA reported a decline in profits. Nikkei 225 recovered from an early dip with trade contained as participants digested BoJ rhetoric and soft wages. Hang Seng & Shanghai Comp were underpinned amid resilience in the tech sector and after China's eastern city of Hangzhou lifted all home purchase restrictions, although there were headwinds from default concerns as Country Garden Holdings (2007 HK) failed to make coupon payments on a yuan-denominated bond due today but still has a grace period.

Top Asian News

- PBoC said it could either buy or sell treasury bonds in the secondary market depending on market conditions, as such trades can be used to manage liquidity, according to Reuters.

- China's eastern city of Hangzhou lifted all home purchase restrictions, according to its housing authority.

- Country Garden Holdings (2007 HK) said it cannot make payments on a yuan-denominated bond, while it aims to pay onshore coupons due today and additional interests by May 13th. Furthermore, it stated that if it fails to make payments within the grace period, China Bond Insurance Co. will undertake credit enhancement obligations and it is still raising funds due to sales recovery lagging expectations.

- US Commerce Secretary Raimondo said the US could ban Chinese-connected vehicles or impose guardrails, while it was separately reported that US Senator Brown is seeking a US ban on all Chinese internet-connected vehicles, according to Bloomberg.

- Hong Kong and Saudi Arabia are exploring an ETF to track Hong Kong stock indices, while Hong Kong is working with several financial institutions to develop the ETF and the government is considering establishing an economic and trade office in Riyadh.

- BoJ Summary of Opinions from the April meeting noted that a member stated if trend inflation accelerates, the BoJ will adjust the degree of monetary easing but an accommodative financial environment is likely to continue for the time being and a member said if forecasts under quarterly report are met, interest rates might rise to levels higher than markets currently price in. It was also stated that one option would be to hike rates moderately in accordance with economic, price and financial developments to avoid a shock from an abrupt policy shift. Furthermore, a member said they must hike rates at an appropriate time as the likelihood of achieving forecasts heightens and a member said the BoJ must deepen the debate on the timing and pace of a future rate hike.

- BoJ Governor Ueda said a low real rate supports the economy and inflation, while he added that they need to monitor FX and oil for real wages. Ueda also stated the BoJ could adjust the degree of monetary accommodation via rate hikes if trend inflation accelerates gradually, as well as noted that a sharp, one-sided yen fall is undesirable and bad for the economy. Furthermore, he reiterated if FX volatility affects or risks affecting trend inflation, the BoJ must respond with monetary policy and will scrutinise the recent weak yen in guiding monetary policy.

- Japanese Finance Minister Suzuki said it is important for currencies to move in a stable manner reflecting fundamentals and rapid FX moves are undesirable, while they are closely watching FX moves and will take thorough response in forex. Suzuki also stated they will take all necessary measures and continue to analyse the FX impact on the economy and livelihoods and take appropriate action.

- Japanese top currency diplomat Kanda said no comment on intervention and if necessary, they will take appropriate action and are ready for currency intervention at any time, while he added that comments about Japan's limitations are wrong when asked about FX intervention reserves.

- Nissan (7201 JT) FY23/24 (JPY): Net Profits 426.65bln (+92.3% Y/Y), Operating Profit 568.72bln (+50.8%), Recurring Profits 702.16bln (+36.2%); Sees FY24 global retail sales at 3.7mln and North America sales of 1.43mln.

- China is said to be considering a proposal to exempt individual investors from paying dividend taxes on Hong Kong stocks bought via Stock Connect, Bloomberg sources say

European bourses, Stoxx600 (-0.2%) are mixed and unable to find direction, taking lead from an indecisive session in APAC trade with newsflow somewhat light thus far on account of Ascension Day. European sectors are mixed and with the breadth of the market fairly narrow, though with the exception of Autos, which has been weighed on by Mercedes-Benz (-5.5%). Energy is found at the top of the pile, propped up by broader strength in crude prices. US Equity Futures (ES -0.2%, NQ -0.3%, RTY -0.5%) are in the red, with slight underperformance in the RTY continuing the weakness seen in the prior session. In terms of stock specifics, Arm (-9%) is lower in the pre-market, despite beating on top/bottom line, though its guidance failed to impress investors & Tesla (-1.5%) on reports around China job reductions. Goldman Sachs raises 12-month FTSE 100 cash target to 8,800 from 8,200 (last close 8,354)

Top European News

FX

- USD is firmer vs. all peers in quiet newsflow with the DXY eclipsing yesterday's 105.64 best. Interim resistance ahead of the 106 mark comes via the 2nd May high at 105.89.

- EUR is once again on the backfoot vs. the USD in a third consecutive session of losses. Currently trading within a 1.0751-27 range.

- Pound is softer vs. the broadly stronger USD but flat vs. the EUR. BoE looming large for the pair with markets on the lookout for any hints of a move in June. If this materialises, yesterday's low sits at 1.2468 with the MTD low just below at 1.2466. To the upside, 1.25 would be the immediate target with the 200DMA at 1.2542.

- JPY unaffected by ongoing jawboning from Japanese officials and is the marginal laggard across the majors. 155.84 the session high thus far for USD/JPY.

- Antipodeans are both relatively contained vs. the USD with macro drivers on the light side. AUD/USD is consolidating around its 100DMA after two sessions of losses and respecting yesterday's 0.6557-99 range. NZD/USD a touch softer.

- PBoC set USD/CNY mid-point at 7.1028 vs exp. 7.2238 (prev. 7.1016).

- Brazil Central Bank cut the Selic rate by 25bps to 10.50%, as expected, whereby 5 members voted in favour of a 25bps cut and 4 members voted for a 50bps reduction. The committee unanimously judged that the uncertain global scenario and the domestic scenario, marked by resilient economic activity and de-anchored expectations, require greater caution. It also stated that monetary policy should continue being contractionary until the consolidation of both the disinflation process and the anchoring of expectations around the targets.

Fixed Income

- USTs are softer, in a continuation of the general bearish tone that was in place yesterday and one that appears to be driven by a pause-for-breath from the post-NFP move, lack of geopolitical escalation, relatively average 10yr before today's 30yr and an increase in corporate issuance activity.

- Gilts are pressured ahead of the BoE policy announcement. Gilts are toward the 97.50 trough and are underperforming EGBs somewhat, underperformance that appears to be a function of the UK catching up to the relatively average US 10yr auction late on Tuesday.

- Bunds are softer, with action and drivers perhaps a touch thinner thus far on account of Ascension Day. Bunds down to a 130.90 base which marks a new low for the week and has taken the 10yr yield back to the 2.50% mark

Commodities

- Firmer trade across energy contracts after futures settled with modest gains on Wednesday amid tailwinds from crude stocks drawing more than anticipated. Brent Jul'24 sits at the upper end of a USD 83.71-84.25/bbl range.

- Mixed trade across precious metals with spot silver the outperformer, spot palladium the laggard, and spot gold flat. XAU is contained to a current USD 2,307.59-2,319.85/oz intraday range, within yesterday's USD 2,303.75-2,321.53/oz range.

- Base metals have turned lower since European traders entered the fray amid the cautious risk tone coupled with a rising Dollar.

- Iraq sets the June 2024 Basrah medium crude OSP to Asia at USD +1.00/bbl vs Oman/Dubai, via SOMO; to North and South America at -0.65/bbl vs ASCO; to Europe at -3.35/bbl vs dated Brent

Geopolitics: Middle East

- Yemeni Houthis targeted two ships with rockets in the Gulf of Aden yesterday, according to the spokesperson.

- "Israel Broadcasting Corporation quoting a military source: Israel must reconsider its military plans in Rafah after Biden's statements", according to Sky News Arabia

- US President Biden said if Israel goes into Rafah, he won't supply them with weapons and artillery shells, while he added that Israel will not get their support if they go into those population centres and that bombs the US had supplied to Israel and now paused have been used to kill civilians. Biden also commented that Israel has not gone over the red line yet, while he is working with Arab states that are prepared to build Gaza and prepared to help transition to a two-state solution.

- Hamas senior official said the movement sticks to its approval of the truce proposal.

- Egyptian media said Israel deleted the phrase 'permanent ceasefire' and kept it 'sustainable', while Hamas, Islamic Jihad and Popular Front are participating in negotiations and are open to maturing and succeeding the Egyptian effort to reach a deal. Furthermore, work is underway to overcome the controversial points during the negotiations, which will be completed on Thursday, according to Asharq News.

- Israeli senior officials warned their US counterparts that the Biden administration's decision to pause a weapons shipment to Israel could jeopardise hostage negotiations, according to two sources briefed on the issue told Axios' Ravid.

- Syria shot down Israeli missiles fired from Golan Heights towards Damascus's surroundings.

- Adviser to Iran's Supreme Leader said Tehran will have to change its nuclear doctrine if its existence is threatened and has the capability to build a nuclear weapon, according to SNN.

Geopolitics: Other

- Ukraine drone attack sparked a fire and damaged oil tanks at a refinery in Russia's Krasnodar, according to regional officials.

- Russian President Putin says tactical nuclear weapon drills are planned, according to Interfax.

- Russia's Gazprom says its Salavat plant was attacked by a drone but the plant is working normally, according to Ria

US Event Calendar

- 08:30: April Continuing Claims, est. 1.78m, prior 1.77m

- 08:30: May Initial Jobless Claims, est. 212,000, prior 208,000

Central Bank Speakers

- 14:00: Fed’s Daly Participates in Fireside Chat

DB's Jim Reid concludes the overnight wrap

Morning from an early morning taxi to Heathrow en route to Madrid. After a remarkable Champions League semi-final last night I'm expecting a party in half the city at least today!

A little like Bayern last night, markets finally ran out of steam yesterday, with the S&P 500 (-0.00%) narrowly ending its run of four consecutive gains. If you're looking for the dullest stat ever then the -0.03 points move was the smallest in either direction since the -0.02 points decline in September 2018.

The pause for breath was partly due to some disappointing earnings releases, but it also comes on the back of its strongest 4-day rally since November, so it was always going to be hard to maintain that pace. It was much the same story for sovereign bonds too, as the 10yr Treasury yield (+3.7bps) moved higher after a run of five consecutive declines. However, it wasn’t all bad news, as Europe’s STOXX 600 (+0.34%), the UK’s FTSE 100 (+0.49%) and Germany’s DAX (+0.37%) all hit fresh record highs.

Amidst all this, there were fresh signs that rate cuts were moving back into fashion yesterday, as the Swedish Riksbank became the second central bank with a G10 currency to cut rates in this cycle. The move was expected, but it was the first rate cut they’d delivered since 2016, so it was a big milestone, which took the policy rate down by 25bps to 3.75%. In addition, their statement signalled that more cuts were likely ahead, saying that if the inflation outlook held up, then they expected two more cuts in the second half of this year. It’s also worth noting that they’re in a better position than some other central banks, as their preferred measure of inflation (CPIF) was at 2.2% in March, so just above their 2% target.

The Riksbank’s decision follows the Swiss National Bank’s cut back in March, and it comes with mounting anticipation that the larger central banks are soon about to follow. In particular, the focus is turning to the ECB, who are increasingly expected to cut rates in four weeks’ time, marking the first cut since before the pandemic. Likewise, investors are now pricing in a 68% chance the Bank of Canada will cut at their next meeting in June. So it’s plausible that within a couple of months, we could have several central banks easing policy, with the global monetary policy cycle in easing mode with the considerable exception of the US. Yesterday's CoTD (here) stretching back nearly 7 decades shows how rare it is for Europe to be easing before the US so we'll have to see the implications in the months ahead. The obvious one is for dollar strength to continue.

Central banks will remain in focus today, as we’ve got the Bank of England’s latest policy decision at 12:00 London time. In terms of what to expect, it’s widely anticipated they’ll leave rates unchanged at 5.25%, where they’ve been since August. So the focus will instead be on the vote split, their new forecasts, and what their forward guidance signals about potential cuts in the future. DB’s UK economist thinks the vote will be 7-2 to remain on hold, with 2 voting to cut, and he also expects a further dovish tilt in the forward guidance, which would set the stage for a June rate cut. See his full preview here

But even as central banks are pivoting towards rate cuts, yesterday saw sovereign bonds lose ground on both sides of the Atlantic, ending a run of gains since the Fed’s decision last week. For instance, the 10yr US Treasury yield was back up +3.7bps to 4.495% and is trading at 4.515% as I type in Asia hours. Marginally adding to the bond sell-off was the latest 10yr Treasury auction, that saw $42bn of bonds issued at 4.48%, 1bp above the pre-sale yield. And over in Europe, yields on 10yr bunds (+4.3bps), OATs (+4.1bps) and BTPs (+3.6bps) all moved higher, whilst Swedish 10yr yields (+3.5bps) saw a similar move despite the rate cut.

For equities, there was a more divergent performance on either side of the Atlantic, with those in Europe holding up and seeing the fresh records mentioned above and those in the US losing a touch of momentum. The S&P 500 was essentially flat on the day (-0.00%). Moderate losses from the Magnificent 7 (-0.29%) were counterbalanced by advances among sectors including utilities (+1.05%) and banks (+1.22%). But the overall tone was titled to the negative side with 7 of the 11 S&P 500 sector groups down on the day and the small cap Russell 2000 underperforming (-0.46%).

Elsewhere, it was a volatile day for oil prices, which reversed their earlier losses to leave Brent crude up +0.51% at $83.58/bbl ($83.95 overnight). At first they had seen a sharp decline, hitting an intraday low of $81.71/bbl, which is the lowest they’ve been in almost a couple of months. But then we had the latest weekly data from the EIA showing that US crude oil inventories were down by 1.36m barrels, leading to a recovery in prices.

Asian equity markets are notably higher this morning even if US futures are edging slightly lower. Chinese stocks are outperforming with the Hang Seng (+1.23%) leading gains followed by the CSI (+1.03%) and the Shanghai Composite (+0.91%) after Chinese property stocks surged after Hangzhou removed home buying restrictions, in a move that created speculation that other cities might follow. Elsewhere, the Nikkei (+0.33%) is reversing its previous session losses while the KOSPI (-1.05%) is retreating, bucking the regional trend. S&P 500 (-0.09%) and NASDAQ 100 (-0.16%) futures are trading slightly lower.

Coming back to China, export growth surpassed market expectations in April with exports rebounding +1.5% y/y (v/s +1.3% expected) after falling -7.5% in March, its first contraction since November. Imports increased +8.4% (v/s +4.7% expected), reversing the prior month’s -1.9% decline. April trade surplus stood at US$72.4 billion, compared with US$58.6 billion in March.

Moving to Japan, the latest salary data showed that real wages fell -2.5% y/y in March (v/s -1.4% expected), notching the sharpest drop in four months and extending the streak of declines to exactly 24 months. It followed the previous month’s -1.8% drop, as the rising cost of living outpaced nominal wages. Nominal wages rose +0.6% y/y in March, slowing from a downwardly revised +1.4% increase seen in February.

Elsewhere, government bonds are seeing losses in Asia with yields notably higher in Australia, New Zealand and Japan. As I type, 10yr government bond yields are over +7bps higher in Australia and New Zealand with 10yr JGB yields is +2.9bps higher at +0.90%, not far from the multi-year highs seen briefly in January.

There wasn’t much data yesterday, although German industrial production fell by -0.4% in March (vs. -0.7% expected), whilst Italian retail sales were unchanged (vs. +0.1% expected). Separately in the US, weekly data from the MBA showed that the contract rate on a 30yr mortgage was down -11bps to 7.18% over the week ending May 3, ending a run of four consecutive weekly increases.

To the day ahead now, and the main highlight will be the Bank of England’s latest policy decision and Governor Bailey’s press conference. Other speakers will include ECB Vice President de Guindos, the ECB’s Cipollone, Bank of Canada Governor Macklem, the Fed’s Daly, and BoE chief economist Pill. Otherwise in the US, we’ll get the weekly initial jobless claims, and there’s a 30yr Treasury auction taking place.