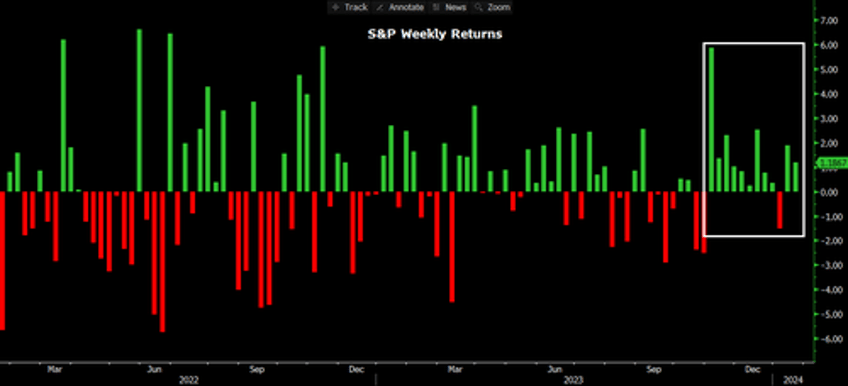

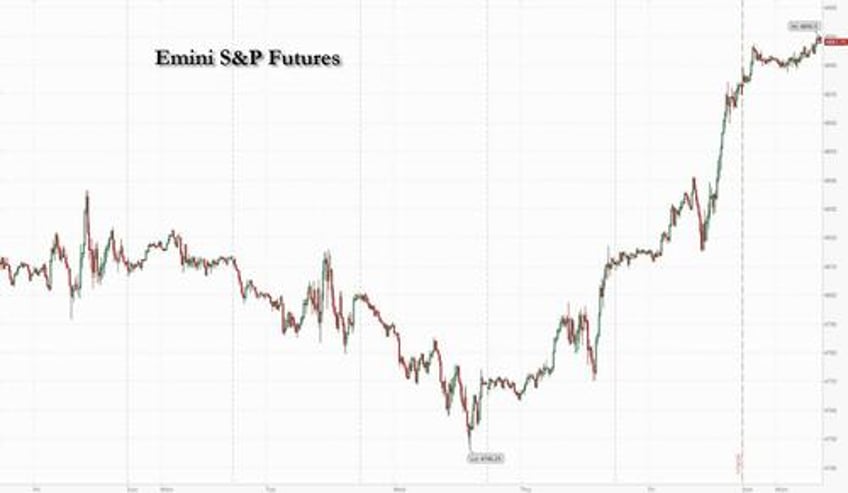

The market meltup is now entering its blow-off top phase, with the tech-led rally pushing US index futures to a fresh all-time high for S&P 500 cash, which reclaimed their Jan 2, 2022 record after 746 days and following gains in 11 of the past 12 weeks!. European stocks are also higher, the Estoxx 50 up 0.5% with info tech sector outperforming.

As of 8:00am, S&P 500 futures were higher by around 0.4% after gaining 1.2% Friday, with Nasdaq futures outperforming as usual led by chatbot enablers and chipmakers. Oil steadied, with Brent holding above $78 a barrel, while the dollar dipped.

In premarket trading, Tesla, Intel and PayPal all advanced. Shares of Boeing fell again, sliding 2.5% after the regulator recommended door plug inspections on another 737 model after many of the aerospace company’s 737 Max 9 aircraft were grounded following a mid-flight blowout of a panel earlier this month. Here are some other notable premarket movers:

- Algoma drops 5.2% after saying there was a collapse of a structure supporting utilities piping at a coke-making plant.

- Archer-Daniels-Midland Co. falls 13% after the company placed its chief financial officer on leave and cut its earnings outlook pending an investigation into the agricultural trading giant’s accounting practices.

- B Riley tumbles 13% as the SEC is said to be probing the company’s deals with a key client who was linked to a securities fraud.

- Digital World Acquisition, the blank-check firm seeking to take Donald Trump’s media company public, rose 7.4% after Bloomberg reported on Sunday that Ron DeSantis had dropped out of the 2024 US presidential race and endorsed Trump.

- Macy’s Inc. gains 3.2% after rejecting a bid from Arkhouse Management Co. and Brigade Capital Management to take over the retailer, claiming the offer lacked “compelling value.”

- Spirit Air soared 5.7% as the airline joined JetBlue Airways in appealing a federal judge’s decision to block their planned $3.8 billion merger.

The rout in China was about to take out key knock-in levels before Beijing's Plunge Protection Team, i.e., the Naitional Team, stepped in. Turnover on a handful of ETFs tracking the CSI 300 Index and the SSE 50 Index jump in afternoon trading, a sign that state-led buying continues as the CSI 300 falls as much as 1.5%.Trading on the China AMC CSI 300 Index ETF was 5.6 billion yuan, the E-Fund CSI 300 ETF was 6.5 billion yuan and Harvest CSI 300 was 6.2b yuan, with all hitting their highest levels on record as of 2:18 p.m. local time.

The intervention was triggered after the CSI 500 Index slipped 2.2% to 4,911 points on Monday, taking it less than 1% away from an earlier estimated threshold that would possibly result in a mass knock-in level for so-called snowball derivatives ties to the gauge. CICC estimated that the average knock-in threshold for the CSI 500 Index is 4,865 points, a breach of which would mean a loss at maturity, and could bring wave of selling in index futures.

Turning back to US equity markets, they are shaking off a rocky start to the year amid conviction that the Federal Reserve will soon cut interest rates and bets that the artificial-intelligence boom is set to continue. Meanwhile, earnings season continues to get underway with companies including Netflix Inc., Tesla and Intel due to release results this week.

“The equity rally we are seeing is based on on the soft-landing scenario that’s being priced,” said Charles Diebel, head of fixed income at Mediolanum International Funds Ltd, adding this view has helped markets overcome their disappointment over central bankers dismissing swift interest rate cuts.

“If the economy does well, then why would you sell equities? And the counterfactual for equity markets is that if things do weaken, they will get rate cuts.”

While only 11% of the S&P 500’s market value has reported earnings so far, there are positive signs. About 85% of companies in the index have beat profit estimates, according to data compiled by Bloomberg.

European stocks bounced after suffering their biggest weekly decline in three months. The Stoxx 600 was up 0.4%, led by gains in technology, real estate and travel names. European bond markets rallied, shrinking the yield spread for Italian and German 10-year notes to the narrowest level since 2022. Sectors sensitive to rates are rising the most, with tech and real eastate among the biggest gainers, while utilities lag. ASML rises to a two-year high after a Bernstein upgrade and Kindred Group gets a boost as French lottery group La Francaise des Jeux offers to buy it. Here are the biggest European movers:

- ASML shares rise as much as 2.7% to the highest in two years after Bernstein upgraded its recommendation to outperform, saying the stock looks “increasingly attractively priced.” The gain pushed the company’s market capitalization back beyond Nestle to make it the third most-valuable stock in Europe.

- Kindred shares jump as much as 19% after La Française des Jeux offered to acquire the Stockholm-listed online gambling operator for a total value of about SEK28 billion. Analysts see the deal as likely to go through given the level of irrevocable undertakings, while they note it would help FDJ diversification.

- Alphawave IP shares soar as much as 13% after the connectivity specialist reiterated its guidance for 2023 and reported significantly higher-than-anticipated bookings in the final quarter of the year in an update welcomed by analysts at Barclays.

- BW Energy shares ascend as much as 11% after BW Offshore agreed to sell its entire 22.52% stake in the company to BW Group at a price of NOK32/share.

- Worldline shares gain as much as 6.1%, the most in a month, after Credit Agricole acquires a 7% stake in the payments firm for an undisclosed price.

- Sandoz shares rise as much as 3.6% after the Swiss pharmaceutical company agreed to buy an ophthalmology business from Coherus BioSciences. Vontobel says the deal makes financial and strategic sense.

- Autoneum shares rise as much as 3.3%, after the Swiss car-parts supplier said cash flow development was better than expected. Vontobel said Autoneum’s profitability and cash flow for 2023 should lead to positive revisions.

- Commerzbank shares decline as much as 4.1%, biggest drop in the Stoxx 600 Banks Index, as BofA cut the German lender to underperform from neutral, citing lower earnings and capital distributions.

- Porsche AG shares fall as much as 1.1% as Barclays reduces its price target on the German carmaker to a Street low.

- Belimo shares slump as much as 11%, the most since March 2020, after it reported a sales miss. Analysts flag a significant slowdown in the second half of the year for the Swiss manufacturer of heating, ventilation and air conditioning equipment. ZKB revises estimates for Ebit margin and revenue growth lower.

- Sage shares drop as much as 2.4%, touching an almost two-month low, after Barclays downgraded the accounting software firm to underweight from equalweight, saying that the shares have peaked.

Earlier in the session, Asian stocks gained, led by Japan, as investors awaited the Bank of Japan’s policy decision due Tuesday, while Chinese shares again tumbled after the nation’s banks kept their benchmark lending rates unchanged. The MSCI Asia Pacific Index rose as much as 0.7%, led by technology shares such as Samsung Electronics and Sony Group. Japanese stocks climbed, partly boosted by a lower yen. The Bank of Japan is widely expected to leave its monetary policy unchanged, with the pressure to end negative interest rates easing amid signs of sustainable inflation. Shares in Taiwan and South Korea also advanced. The rout in Chinese stocks intensified on Monday as investor pessimism deepened. The Hang Seng China Enterprises Index fell 2.4%, approaching a 2005 low. Chinese commercial lenders held their benchmark lending rates on Monday, disappointing investors hoping for more aggressive stimulus.

In FX, the Bloomberg Dollar Spot Index fell 0.1%, easing for third day; against the yen it fell as much as 0.3% ahead of the Bank of Japan’s policy decision on Tuesday. Markets are pricing for the Fed to start cutting rates in May, and deliver 134bps of cuts through year-end, less than around 162bps a week ago.

- USD/JPY little changed at 147.86 (range 147.74 - 148.33)

- EUR/USD unchanged at 1.0898 (range 1.0889 - 1.0909)

- GBP/USD little changed at 1.2702 (range 1.2688 - 1.2725)

“US Q4 GDP numbers due Thursday should show a resilient economy, even if having slowed compared to Q3. This stands in contrast to ongoing sluggishness elsewhere,” Paul Mackel, head of global FX research at HSBC wrote in a note, adding that US exceptionalism “has not changed." “The euro zone flash PMIs and German Ifo survey on Wednesday and Thursday, respectively, should support our view that there is little fundamental reason to favor EUR upside,” he adds.

In rates, Treasuries are richer on the day from belly out to long-end of the curve amid steeper gains core European rates. Yields are 2bp-3bp lower on the day from 5-year to 30-year with front-end little changed, flattening 2s10s spread by around 2.5bp; the 10-year is around 4.10%, pulling back from 4.20% hit on Friday, its highest since Dec. 13; bunds and gilts outperform by 2.2bp and 1bp in the sector. The Treasury auction cycle for 2-, 5- and 7-year notes begins Tuesday, and Fed official are in self-imposed quiet period ahead of Jan. 31 policy decision. Treasury sales this week include $60b 2-year notes followed by $61b 5-year and $41b 7-year Wednesday and Thursday.

In commodities, oil steadied, as the restart of output at OPEC member Libya’s largest field countered concerns about tensions in the Red Sea that look set to keep disrupting shipping. WTI gained 0.2% to trade near $73.60. Spot gold falls 0.3%.

Today's US economic calendar is quiet and only includes December Leading index at 10am; ahead this week are January manufacturing and services PMIs, first estimate of 4Q GDP, and December durable goods orders and personal income and spending

Market Snapshot

- S&P 500 futures up 0.3% to 4,883.25

- STOXX Europe 600 up 0.6% to 471.86

- MXAP up 0.1% to 163.99

- MXAPJ down 0.6% to 495.56

- Nikkei up 1.6% to 36,546.95

- Topix up 1.4% to 2,544.92

- Hang Seng Index down 2.3% to 14,961.18

- Shanghai Composite down 2.7% to 2,756.34

- Sensex down 0.4% to 71,423.65

- Australia S&P/ASX 200 up 0.7% to 7,476.57

- Kospi down 0.3% to 2,464.35

- German 10Y yield little changed at 2.30%

- Euro little changed at $1.0896

- Brent Futures down 0.8% to $77.90/bbl

- Gold spot down 0.3% to $2,022.84

- US Dollar Index little changed at 103.23

Top Overnight News

- China/HK suffered another session of acute losses as global confidence in the country’s economic prospects continues to diminish. China left its 1/5-year Loan Prime Rates unchanged overnight, a move that was widely expected but one which underscores the government’s lack of stimulus options. RTRS

- China’s major state-owned banks stepped in to support the yuan on Monday during the collapse in stock prices. RTRS

- Chinese purchases of semiconductor equipment surges as the country’s industry races to avoid fresh restrictions from the US. BBG

- Israel warns the White House it will escalate its battle against Hezbollah unless a border agreement with Lebanon is achieved soon. WaPo

- Investment-grade groups have issued $153bn worth of bonds this month, according to data from London Stock Exchange Group, the highest year-to-date figure for dollar-denominated debt in records going back to 1990. Borrowers are rushing to lock in lower interest costs, while investors are keen to buy new bonds before policymakers start cutting US interest rates later this year. FT

- Supply-side drivers of disinflation, including on the labor front, are likely over, which means additional downside price pressure may need to come from demand (which will impede growth). WSJ

- Drug prices (and efforts to control them) are considered by the White House to be among Biden’s most potent political issues heading into the Nov election, and it’s something they plan to talk a lot about in the months ahead. Also, Biden is considering a plan to raise taxes on upper-income Americans with the money going toward bolstering Social Security, a proposal that has no chance of becoming law, but which would (the White House hopes) create a contrast with Trump. WaPo

- Nikki Haley finally secured the one-on-one matchup against Donald Trump that she had long sought after Ron DeSantis dropped out of the Republican presidential nomination race two days before the New Hampshire primary. It might be too late. The Florida governor, who endorsed the former president, wasn’t expected to be a significant factor in Tuesday’s GOP primary. A poll released Sunday showed him at 6% in the state. WSJ

- Macy’s rejected a $5.8 billion bid from Arkhouse and Brigade, saying the offer of $21 a share lacked “compelling value.” BBG

- US Info Tech was by far the most net bought sector on the Prime book last week and saw the largest net buying since early November (+1.2 SDs vs. the past year), driven by short covers and long buys (~2 to 1). US Software long/short ratio now stands at 3.08 (up +6.3% from a 5-year low seen in the first week of the year), yet still in the 4th percentile vs. the past five years. US Semis & Semi Equip long/short ratio now stands at 1.23 (up +8.1% from the start of year), which is in the 23rd percentile vs. the past five years.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed following a catalyst-light weekend and as weakness in Chinese stocks clouded over the early momentum from last week's record levels on Wall Street. ASX 200 was led higher by consumer and real estate sectors which benefitted from slightly lower yields, while miners were pressured after weaker quarterly output by South32 and Lynas. Nikkei 225 rallied and broke above 36,500 ahead of tomorrow's BoJ announcement. Hang Seng and Shanghai Comp underperformed amid notable weakness in tech and property which saw the Hang Seng Mainland Properties Index hit a record low, while sentiment remained pressured in the mainland amid ongoing economic concerns and the benchmark LPRs were kept unchanged, as expected.

Top Asian News

- Chinese major state-owned banks are curtailing lending to tighten CNY liquidity in the offshore market, according to Reuters sources; banks are seen selling USD in the onshore FX market.

- Shipments of smartphones within China are nearly flat Y/Y in December at 26.84mln handsets, according to CAICT.

- Japanese PM Kishida says wage growth outpacing prices is a requirement for a virtuous cycle, requests firms provide larger pay rises this year. Wage hikes at small/medium firms are seen as essential.

- Chinese Loan Prime Rate 1-Year (Jan) 3.45% vs. Exp. 3.45% (Prev. 3.45%)

- Chinese Loan Prime Rate 5-Year (Jan) 4.20% vs. Exp. 4.20% (Prev. 4.20%)

European bourses, Stoxx600 (+0.5%), started the session on a firmer footing though have been edging lower since, despite the absence of any pertinent catalysts. European sectors have a strong positive tilt; Tech continues to build on the prior week's strength whilst Basic Resources and Energy are both hampered by broader losses in the commodities complex. US equity futures are modestly firmer across the board, with slight outperformance in the NQ (+0.7%), as the Tech-heavy index continues to build on the prior week’s strength.

Top European News

- EU’s Dombrovskis said the EU must find ways to prevent the bloc’s most sensitive technologies, companies and assets from “ending up in the wrong hands”, as the EU prepares to unveil economic security proposals, according to FT.

- UK's defined pensions market is likely to see GBP 80bln in pension de-risking transactions in 2024, via WTW.

FX

- Contained action for the Dollar in catalyst-light trade; DXY sits in a tight 103.11-33 range as markets await Q4 GDP and monthly PCE later this week.

- EUR is steady vs. the USD as the pair oscillates around the 1.09 mark and in a 1.0888-1.0909 range.

- JPY is flat against the Dollar, USD/JPY pivots the 148 mark with traders mindful of the BoJ tomorrow and noteworthy OpEx; trough at 147.74.

- AUD is softer on account of Chinese equity selling overnight. Support in NZD/USD holding at 0.6100 for now.

Fixed Income

- USTs are incrementally firmer but still towards the lower-end of last week's bounds, Fed blackout is underway but the week does have US GDP & PCE.

- A slightly firmer start for the Bund with a 134.17 open vs Friday's 134.00 close, lifting further from the 133.71-73 double-bottom from Thurs/Fri; EZ syndication to be announced today, expected to price later in the week.

- Gilts are a touch firmer, in-fitting with peers; there is a potential for headline volatility as the pre-meeting blackout is yet to begin though nothing scheduled ahead of the Feb meeting.

Commodities

- WTI and Brent are modestly firmer, though spent the majority of the morning subdued given the recommencement of production at Libya's El Sharara oilfield (300k BPD), support seemingly stemming from the overall tone and bouts of modest USD pressure.

- Gold is under modest pressure as the tone overall remains constructive, despite a China-hindered APAC handover, alongside a firmer USD and retreat in yields.

- Base metals are entirely in the red amid downbeat trade in China overnight, with particular underperformance in property names.

- Libya’s El Sharara oilfield output restarted after protestors ended the sit-down which had shut down production, while the NOC declared lifting of a force majeure and resuming full production from the El Sharara field.

- Russian energy company Novatek was forced to suspend some operations at a huge Baltic Sea fuel export terminal due to a fire following a suspected Ukrainian drone attack, according to Reuters.

- UBS says in 2024 Platinum will again become moderately more expensive than Palladium; Sees Platinum at USD 1025/oz by end 2024; Sees Gold at USD 2250/oz by end-Q4'2024. Sees Silver at USD 28/oz by end-Q4'24.

Geopolitics: Middle East

- Israel conducted a strike on southern Lebanon which killed a Hezbollah member and one other Lebanese person, according to security sources cited by Reuters.

- Israel conducted an air strike on Damascus which killed 4 Iranian Revolutionary Guards, while Iranian President Raisi said the Israeli strike that killed Revolutionary Guards will not go unanswered, according to state media.

- US, Egypt and Qatar are pushing Israel and Hamas to join a phased diplomatic process that would begin with the release of hostages and eventually lead to the withdrawal of Israeli forces and an end to the war in Gaza. However, the report also noted that a media adviser to Hamas said there was no real progress, while Israeli PM Netanyahu rejected Hamas’s demands which included an end to the war and said they would not be able to ensure the security of their citizens if they would have agreed to this.

- Saudi’s Foreign Minister said they are very focused on de-escalation in Gaza and need to focus on a solution for the Palestinian issue, according to CNN.

- US Central Command forces conducted air strikes against a Houthi anti-ship missile that was aimed at the Gulf of Aden on January 20th, according to Reuters.

- US personnel suffered minor injuries and an Iraqi security forces member was wounded following an attack on the Ain al-Asad air base on Saturday which involved multiple ballistic missiles and rockets that were launched by Iranian-backed militants in western Iraq, although most of the missiles were intercepted, according to Reuters.

- UK Defence Minister Shapps said the UK military scientists shot down drones for the first time by using DragonFire laser to cut through incoming targets at the speed of light. It was also reported that the UK Defence Ministry said it will spend GBP 405mln to upgrade its warship defence missile system currently being used in the Red Sea.

Geopolitics: Other

- Russian President Putin reportedly showed his intention to visit North Korea soon, while it was also reported that North Korea and Russia expressed concern over provocation acts by the US and its allies, Furthermore, North Korea and Russia agreed on cooperation in regional affairs and agreed that cooperation and joint assistance would be in accordance with the UN Charter and international laws.

- Eight people were killed following an attack on Russian-controlled Donetsk, according to TASS. It was also separately reported that Russia took control of the village of Krokhmalne in the Karkiv region, according to IFX.