And just like that the momentum-driven buying frenzy is over: S&P 500 futures are down 0.3%, and Nasdaq 100 futures slide 0.6%, jeopardizing the ridiculous stock market rally which is up 16 of the pat 18 weeks, as Apple shares tumbled more than 2% in premarket trading after reporting 24% drop in iPhone sales in China over first six weeks of year. Large-cap technology companies were also pressured by the selling in Apple, while sentiment was also dented by the lukewarm response to China’s new growth target which for the 2nd year in a row was "around 5%"; finally the mood turned more dour after hawkish comments on Monday by Atlanta Fed president Bostic who said he sees a Q3 cut and then a pause and then one more for the year. Bond yields are down 2bps across the curve, taking the 10Y to 4.18% while the USD is flat and bitcoin continues to trade just shy of its all time high of $68,888.99. Commodities are mixed with Ags/Energy lower and metals higher, while gold is also making a new ATH. Today's macro data focus will be on ISM-Srvcs and Durable/Cap Goods, plus we get some Consumer-sector earnings including Target.

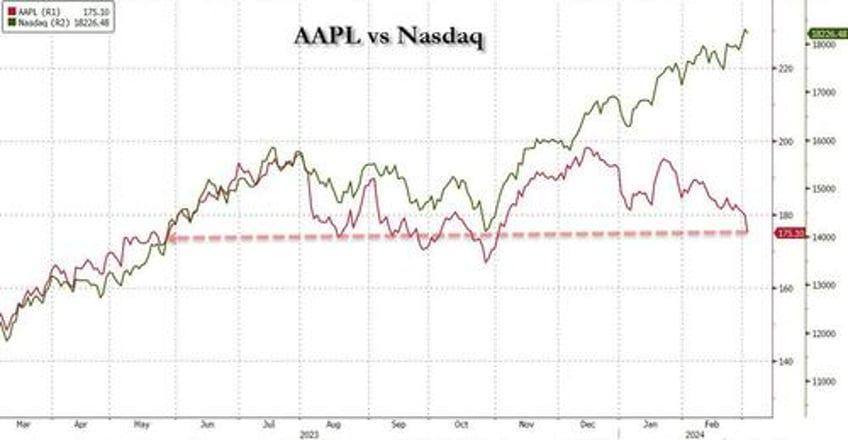

In premarket trading, Apple fell more than 2%, set to extend losses for a fifth consecutive session as Counterpoint Research says iPhone sales in China declined by 24% over the first six weeks of this year. The divergence between AAPL and the Nasdaq is getting rather glaring.

Also in premarket trading, AMD slipped more than 2.5%, after Bloomberg reported it has hit a US government roadblock in its plan to sell an artificial intelligence chip tailored for China. Tesla fell 2.2%, set to extend losses after dropping 7.2% on Monday following disappointing China vehicle shipment figures. Additionally, Tesla halted production at its factory near Berlin and sent workers home after a fire - which appears to have been the result of industrial sabotage - at a high-voltage pylon caused power failures throughout the region. Here are the other notable premarket movers:

- AeroVironment (AVAV US) rose 19% after the defense contractor reported adjusted earnings per share that beat the average analyst estimate.

- Gitlab (GTLB US) shares sink 24% after the application software company gave a full-year forecast that is weaker than expected. Analysts noted that the tepid outlook overshadowed otherwise strong 4Q results.

- MicroStrategy (MSTR US) leads cryptocurrency-linked stocks lower in premarket trading on Tuesday as Bitcoin’s blinding rally takes a breather. The largest corporate holder of Bitcoin also proposed to sell $600 million in convertible senior notes to buy more of the largest cryptocurrency.

- Paymentus (PAY US) shares climbed 16% after the provider of cloud-based bill payment technology issued stronger-than-expected adjusted Ebitda forecasts for the current quarter and full year. The company’s fourth-quarter revenue and adjusted Ebitda also topped the average analyst estimates.

- Stitch Fix (SFIX US) shares slumped 14% after the online personal styling service cut its full-year net revenue from continued operations guidance, which missed analyst estimates. Additionally, the company reported a heavier-than-expected loss per share from continuing operations for the second quarter.

Investors are also jittery ahead of Congressional testimony from Fed Chair Jerome Powell on Wednesday and Thursday. That will be followed on Friday by monthly payrolls data. Powell is expected to double down on the message that the Fed will be patient in cutting rates. That’s especially so after Atlanta Fed President Raphael Bostic said Monday he expects the first cut — which he has penciled in for the third quarter — to be followed by a pause. A string of strong economic data has already forced markets to push back the first rate cut to at least mid-year and trim the number of reductions this year to three.

"If Bostic wants one cut then a pause, you can’t help but wonder if the Fed is wavering on three cuts,” said Societe Generale strategist Kenneth Broux. “The data is doing the talking and it’s really not screaming for the Fed to cut rates. We have taken out three Fed cuts in the past two months, so now the question is: do we need to take out more?"

In Europe, the Stoxx 600 index slipped 0.2%, with automotive and mining shares the hardest hit as China’s latest market-support measures, announced Tuesday, failed to reassure investors. Among individual stocks, defense firm Thales SA jumped after forecast-beating results and Spirent Communications Plc soared after Viavi Solutions Inc. agreed to buy the electronic solutions provider.

Earlier in the session, Chinese equities were mixed and yuan little changed after China’s National People’s Congress delivered a slew of announcements on growth and inflation targets, as well as steps to shore up the economy and fiscal goals for 2024 which were very much as expected if somewhat on the disappointing side. The CSI 300 index close 0.7% and Shanghai Composite also eked out modest small gain, while Hong Kong tech shares pull Hang Seng 2.2% lower. Japanese equities grind higher; South Korean stocks were modestly weaker

“Overall, I would say it probably disappoints more based on announcements thus far,” said Xin-Yao Ng, an investment director at abrdn. “Investors still will like more forceful fiscal measures to boost the economy.”

In FX, the Bloomberg Dollar Spot Index is flat while the Aussie is the worst performer among the G-10’s, falling 0.3% versus the greenback. The yen modestly advanced after Tokyo price growth rising above the Bank of Japan’s target in February

In rates, treasury yields slipped after rising across the curve on Monday, when buyers shied away from US three-and six-month bill auctions amid uncertainty over Powell. Treasuries are richer by 2bp-3bp across the curve with 10-year around 4.185%, trailing gilts, which lead gains in European rates, by around 3.5bp in the sector. Curve spreads little changed. Core European rates likewise better on the day after French industrial production data were weaker than expected. IG credit issuance slate includes Israel multi-tranche $benchmark, continuing the YTD corporate borrowing binge. IG dollar issuance slate also includes EIB $4b 3Y and EBRD $1b 10Y; 14 issuers priced $21.5b across 29 tranches Monday, taking YTD volume past $400 billion. At least 1-2 borrowers stood down and intend to look again Tuesday

In commodities, oil prices are little changed, with WTI trading near $78.70. Spot gold rises 0.5%

Bitcoin takes a breather and holds just beneath its record high of $69k, while Ethereum (+3.6%) continues to advance higher.

Looking at the US economic calendar, data today includes February S&P Global services PMI (9:45am), January factory orders and February ISM services index (10am). Fed speakers scheduled include Barr at 12pm and 2:15pm. Today’s earnings releases include Target. And in US politics, it’s Super Tuesday, with lots of primaries taking place for both Republicans and Democrats

Market Snapshot

- S&P 500 futures down 0.3% to 5,124.25

- STOXX Europe 600 down 0.2% to 496.40

- MXAP down 0.4% to 173.99

- MXAPJ down 0.9% to 525.75

- Nikkei little changed at 40,097.63

- Topix up 0.5% to 2,719.93

- Hang Seng Index down 2.6% to 16,162.64

- Shanghai Composite up 0.3% to 3,047.79

- Sensex down 0.2% to 73,750.62

- Australia S&P/ASX 200 down 0.1% to 7,724.20

- Kospi down 0.9% to 2,649.40

- German 10Y yield little changed at 2.37%

- Brent Futures little changed at $82.81/bbl

- Gold spot up 0.5% to $2,124.82

- U.S. Dollar Index little changed at 103.85

- Euro little changed at $1.0855

Top Overnight News

- China’s 2024 economic objectives/targets were largely inline with expectations (no new incremental stimulus measures), including growth of “around 5%” and a fiscal deficit of ~3% (the country will issue CNY1T in special ultralong gov’t bonds, which aren’t counted in the deficit). WSJ

- China drops “peaceful reunification” language with regards to Taiwan as it pledges to boost defense spending by 7.2% this year. RTRS

- Apple Inc.’s iPhone sales in China fell by a surprising 24% over the first six weeks of this year, according to independent research that may stoke fears about worsening demand for the marquee but aging device. BBG

- Japan’s Tokyo CPI came in at +2.6% Y/Y on the headline (up from +1.8% in Jan, and firmer than the consensus forecast of +2.5%) while core (ex-food/energy) cooled to +3.1% (down from +3.3% in Jan and inline with the Street). BBG

- Gaza ceasefire talks end in Cairo without a breakthrough as pressure builds for a deal before the start of Ramadan on 3/10. RTRS

- Hawkish policymakers at the European Central Bank have been emboldened to resist calls for an imminent cut to interest rates at their meeting this week after inflation proved stickier than expected in February. FT

- Bitcoin ETFs are seeing assets rise at a record pace – total inflows have been nearly $50B since the approvals arrived on Jan 11 (BlackRock’s product became the fastest new ETF in history to hit $10B). WSJ

- TGT +6% pre market after reporting strong FQ4/Jan EPS upside, w/a ~60% Y/Y spike to 2.98 (vs. the Street’s 2.40 forecast). The EPS beat was driven primarily by margins while comps were inline (comps fell 4.4% vs. the Street -4.5%, with brick-and-mortar down 5.4% and digital down 0.7%). RTRS

- AMD fell after its plan to sell an AI chip tailored for the Chinese market hit a roadblock. US officials found the low-performance chip was still too powerful and AMD must obtain a license to sell it, people familiar said. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed as the region digested China's Work Report and Caixin Services PMI data. ASX 200 closed slightly lower as strength in mining and health care was offset by losses in the consumer sectors. Nikkei 225 initially retreated beneath the 40,000 level after the latest Tokyo CPI data showed an acceleration in price growth, but then gradually recovered its losses and returned to positive territory. Hang Seng and Shanghai Comp. were mixed with notable underperformance in the Hong Kong benchmark amid weakness in tech and health care, while the miss on Chinese Caixin Services PMI also provides a headwind for risk appetite. Conversely, the mainland just about remained afloat after the announcement of the government Work Report with the GDP growth target maintained at around 5%, as expected, although Premier Li noted the foundation of China's economic recovery is not solid yet and domestic demand is not strong.

Top Asian News

- China unveiled the government work report with the 2024 GDP growth target set at around 5%, as expected, but noted achieving this year's economic growth target will not be easy, while it will continue to implement proactive fiscal policy and prudent monetary policy, as well as noted that China should intensify cross-cyclical and counter-cyclical adjustments through macro policies. China will launch a year-long program to stimulate consumption and roll out a "worry-free consumption" initiative to improve the consumption environment and will make concerted efforts to defuse local government debt risks. Furthermore, China will take tough measures against illegal financial activities and will move faster to foster a new development model for real estate.

- Chinese Premier Li said the foundation of China's economic recovery is not solid yet and China's domestic demand is not strong with social expectations relatively weak. Li also commented that some small and medium-sized enterprises are facing operational difficulties but added that China will stabilise and expand private investment.

- China's state planner said it will lift all foreign investment restrictions in the manufacturing sector and it will relax market access restrictions in service industries such as telecoms and medical services, according to Reuters.

- Japan Minister of State for Economic and Fiscal Policy Shindo said they are not thinking now of declaring anything when asked whether the government could call an end to deflation, while Finance Minister Suzuki also said there was no truth to the media report that government is considering announcing the end of deflation.

- Japan's Top Currency Diplomat Kanda must brace for higher interest rates environment given assumed interest rates raised to 1.9% from 1.1%; must strive for responsible fiscal management by achieving primary budget balancing in FY25/26.

European bourses, Stoxx600 (-0.3%) began the session mostly in modest negative territory, and EZ Composite/Services PMIs (which were revised higher) did little to sway the indices. European sectors hold a strong negative tilt, with the typical Defensive sectors (Utilities/Healthcare) able to remain afloat. Autos is found at the foot of the pile, with sentiment hampered following poor Tesla Chinese shipments data yesterday, with a factory fire at the Co's German plant also not helping. US Equity Futures (ES -0.4%, NQ -0.7%, RTY -0.4%) are entirely in the red, taking impetus from a downbeat sentiment in Europe. The NQ underperforms, hampered by losses in Tesla (-1.9%), after news that its plant in Germany was powerless, following a fire caused by “eco-activists”. Elsewhere, Apple (-1.5%) continues to sink lower, on reports that iPhone sales in China plunged.

Top European News

- Barclays said UK consumer spending in February rose 1.9% Y/Y and was dampened by wet weather, while it noted that consumer confidence about non-essential spending was the highest since November 2021, according to Reuters.

- ECB insider expects inflation forecasts to be cut this year and maybe next year, according to Econostream Media.

- UK Chancellor Hunt will cut national insurance by 2pp in the Spring Budget on Wednesday, according to Times' Swinford.

FX

- Uneventful trade for the dollar with DXY consolidating on a 103 handle and respecting yesterday's 103.72-96 range. Downside sees the 200DMA at 103.73. Upside focus is on reclaiming 104.

- EUR is steady vs. the USD and contained within a tight 1.0842-58 range and yesterday's 1.0837-67 parameters. Final PMIs had little sway on the EUR with attention turning to Thursday's ECB announcement.

- Contained trade for Cable with a range of 1.2672-94 which sits within yesterday's 1.2650-1.2707 bounds. PMIs had little sway on the pound with traders more mindful of tomorrow's budget and potential forthcoming tax cuts, latest via the Times seemingly cements a National Insurance cut.

- JPY a touch firmer vs. the USD following hot Tokyo inflation metrics overnight, which were followed up by comms from Japanese officials that markets must brace for higher rates. That being said, still remains above 150.50 and close to 150.88 YTD peak.

- Antipodeans are both softer vs. the USD with potential disappointment out of China weighing on sentiment. AUD/USD has lost 0.65 status and gone as low as 0.6478. If downside extends, YTD trough at 0.6442 could come into view.

- PBoC set USD/CNY mid-point at 7.1027 vs exp. 7.1961 (prev. 7.1020).

Fixed Income

- Bunds began the session on the front foot, extending to a 133.28 peak before stalling and as such remained shy of 133.30 & 133.37 from 21st & 23rd February. Thereafter, EZ Final PMIs spurred a gradual hawkish move across the regional and pan-EZ figures, a move which was sufficient to bring Bunds back to the 133.00 mark, though still remain firmer on the day.

- USTs are in-fitting with European peers and pulled back alongside EZ PMIs. Holds towards the upper end of a 110-23-111-00 range. A high point which resides just a tick shy of Monday's best.

- Gilts initially moved in tandem with EGBs, awaiting its own PMI release, which saw a modest revision lower and as such lifted Gilts by a handful of ticks to just above 98.50 but shy of the earlier 98.61 peak.

- UK sells GBP 3.75bln 3.75% 2027 Gilt: b/c 3.01x (prev. 3.04x), average yield 4.314% (prev. 4.131%) & tail 0.5bps (prev. 0.5bps)

- Germany sells EUR 3.316bln vs exp. EUR 4bln 2.10% 2029 Bobl: b/c 2.50x (prev. 2.30x), average yield 2.40% (prev. 2.30%), and retention 17.10% (prev. 17.68%)

Commodities

- Crude futures are choppy after seeing little notable fallout from the China Two-Session and as geopolitical updates remain sparse, though crude prices clambered off lows as EZ PMIs saw upward revisions. Currently crude holds below USD 83/bbl.

- Precious metals see modest gains despite a flat Dollar and relatively light macro and geopolitical newsflow this morning, with prices seemingly continuing the momentum from yesterday; XAU rose above yesterday's peak (2,119.97/oz) as it continues to hone in on the 2023 peak near USD 2,148/oz.

- A mixed session for base metals after some APAC weakness following the underwhelming China Two-Sessions which provided little in the way of policy details, particularly for the Real Estate sector; 3M LME copper briefly dipped under USD 8,500/t before finding support, currently printing a USD 8,496.00-8,541.50/t range.

- Alberta oil production fell by 380k BPD M/M to 3.81mbpd in January amid to cold weather, according to the Alberta energy regulator

Geopolitics: Middle East

- Hamas said in a message they will be flexible on the issue of the number of prisoners if Israel is flexible on the issue of returning Palestinians to northern Gaza, according to Axios' Ravid on X.

- US Central Command said Yemen's Houthis fired an anti-ship ballistic missile from Yemen into the southern Red Sea on March 4th although there were no reported damages or injuries to commercial or US Navy ships. Houthis also fired two anti-ship ballistic missiles into the Gulf of Aden at M/V MSC Sky II which is a Liberian-flagged, Swiss-owned container vessel, while one of the missiles impacted the vessel and caused damage but initial reports indicated no injuries. Furthermore, CENTCOM said its forces conducted strikes against two anti-ship cruise missiles that presented an 'imminent threat' to merchant vessels and US Navy ships in the region.

- Gaza ceasefire talks between Hamas and mediators broke up on Tuesday in Egypt with no breakthrough as the Ramadan deadline looms, according to Reuters

Geopolitics: Other

- China's coastguard took control measures against Philippine vessels that 'illegally' intruded into waters adjacent to the Second Thomas Shoal, according to state media. Philippines coastguard spokesperson said vessels faced dangerous manoeuvres and blocking from China's coastguard and maritime militia during a resupply mission, while the reckless and illegal actions led to a collision between the Philippines and Chinese coastguard vessels in which the Philippine vessel sustained minor structural damage.

- North Korea’s Defence Ministry said South Korean-US military drills are not defensive and should stop, while it added that South Korea and the US will face consequences for their wrong choice, according to KCNA.

US Event Calendar

- 09:45: Feb. S&P Global US Services PMI, est. 51.4, prior 51.3

- Feb. S&P Global US Composite PMI, est. 51.4, prior 51.4

- 10:00: Jan. Durable Goods Orders, est. -6.1%, prior -6.1%

- Jan. Durables-Less Transportation, est. -0.3%, prior -0.3%

- Jan. Cap Goods Orders Nondef Ex Air, prior 0.1%

- Jan. Cap Goods Ship Nondef Ex Air, prior 0.8%

- 10:00: Jan. Factory Orders Ex Trans, est. -0.1%, prior 0.4%

- Jan. Factory Orders, est. -3.0%, prior 0.2%

- 10:00: Feb. ISM Services Index, est. 53.0, prior 53.4

- Feb. ISM Services New Orders, prior 55.0

- Feb. ISM Services Employment, prior 50.5

- Feb. ISM Services Prices Paid, est. 62.0, prior 64.0

Central Bank Speakers

- 12:00: Fed’s Barr Speaks on Panel about CRA Modernization

- 14:15: Fed’s Barr Participates in Roundtable Listening Session

DB's Jim Reid concludes the overnight wrap

After posting 16 weekly gains out of 18 for the first time since 1971, yesterday saw the S&P 500 (-0.12%) get the week off to a subdued start as we await several key events later this week, including appearances from Chair Powell, the US jobs report, and the ECB decision.

One of the clearest moves yesterday was the selloff among US Treasuries, which took place across the curve and reversed the bulk of Friday’s rally. That saw the 10yr yield rise +3.2bps to 4.21%, whilst the 2yr yield was up +7.2bps to 4.60%. Bear in mind that today also marks exactly 20 months ago since the 2s10s curve closed back in inversion territory (after a brief period as the Fed started hiking), where it’s remained continuously since. So we’re now just a couple of weeks from exceeding the lengthy 1978-80 inversion, which is the longest continuous inversion in available data back to 1940.

Over in Europe, it was the mirror image for long-end yields, with those on 10yr bunds (-2.2bps), OATs (-4.0bps) and BTPs (-8.0bps) all falling back. The main exception to that were UK gilts, where the 10yr yield was up +0.4bps ahead of tomorrow’s budget announcement. That said, one consistent theme on both sides of the Atlantic was a curve flattening, and front-end yields inched higher in Europe as investors continued to dial back the chance of an ECB rate cut in the near term. For instance, only 4bps of easing are now priced by April – that is a 17% chance of a 25bps cut – with investors increasingly focusing on the summer as the timing for a first cut. More than 40bps of cuts had been priced by April at the start of the year.

The quiet start to the week for US equities did see the Magnificent 7 (-0.85%) under-perform, with slightly more moderate losses for the NASDAQ (-0.41%). There were contrasting moves within the Magnificent 7, with Tesla down -7.16% amid new price cuts and discounts by EV maker, while Nvidia (+3.60%) overtook Saudi Aramco to become the third largest company in the world by market cap. On the other hand, the equal-weighted version of the S&P 500 was up +0.24% on the day, as utilities (+1.65%) and banks (+1.58%) outperformed. Back in Europe, the STOXX 600 (-0.03%) was flat on the day, but there was a noticeably underperformance from the FTSE 100 (-0.55%). That continued the FTSE 100’s trend of being the worst-performing major equity index in Europe so far this year, with a YTD performance of -1.20%, in contrast to the +3.85% gain for the STOXX 600, and a +5.76% gain for the German DAX.

Looking forward, today will be a pivotal one in the US election calendar as it’s Super Tuesday, which is the day when the single-biggest number of primaries take place. Indeed, for both the Republicans and Democrats, over a third of the total delegates are up for grabs. So depending how things pan out, it might be just a couple of weeks until one candidate has a delegate majority. On the Republican side there are 15 states voting, and the only two major candidates left are Donald Trump and Nikki Haley. But Trump has already built a substantial delegate lead in the early states, and now leads Nikki Haley by 273 delegates to 43. Haley did win the primary in Washington DC over the weekend, giving her all 19 delegates there, but she continues to lag far behind Trump in the national polls. And even though the precise rules vary by state, several have some sort of winner-takes-all format. So if Trump can get at least 50% of the vote in many of those states, he’ll get all the statewide delegates, offering him the potential to really widen his lead today. Maybe the most interesting thing today is whether he performs in line with polling as so far in the primaries he has perhaps slightly underperformed in what were mostly big victories still. In turn this may help shape how people interpret his national standings in the polls as the year progresses.

On the Democratic side, President Biden isn’t facing a serious challenge and currently has 206 delegates, with just 2 others uncommitted, and none for any other candidate.

Asian equity markets are mixed this morning as China’s National People’s Congress (NPC) is fully underway. In terms of specific moves, the Hang Seng Tech Index (-3.18%) is the biggest underperformer across the region with the Hang Seng (-1.95%) also trading sharply lower partly due to a new ban by the US government on AMD selling its AI chips to China. Elsewhere, the KOSPI (-0.64%) is also trading in the red while the Nikkei (+0.21%), the CSI (+0.50%) and the Shanghai Composite (+0.26%) are holding on to gains. S&P 500 (-0.18%) and Nasdaq (-0.35%) futures are ticking lower.

Coming back to China, the nation has set its GDP growth target at 5% for 2024. Premier Li Qiang pledged that China would remove restrictions for foreign investment in manufacturing while announcing the issuance of “ultra-long” special government bonds worth 1trillion yuan ($138.9 billion) for major projects. Other measures mentioned during the meeting included a 7.2% rise in defense spending, the biggest in five years. See our economist's take on what's been announced so far here. The market's big question will be whether they can back up their growth target with enough stimulus.

Early morning data showed that inflation in Tokyo reaccelerated, advancing +2.6% y/y in February (v/s +2.5% expected) as against a revised rise of +1.8% the previous month. Core inflation rose from an upwardly revised +1.8% y/y to +2.5% y/y in February, in-line with the market consensus. Separately, Japan’s services PMI was finalised at 52.9 in February, edging down from 53.1 but staying in expansionary territory for the 18th month in a row. The composite PMI was finalised at 50.6, down from 51.5.

Otherwise yesterday, there was a fresh milestone for gold (+1.62%), which closed above $2,100 for the first time ever. That said, it’s worth noting that in real terms, gold is still some way beneath its other peaks, such as in 1980, 2011 and 2020. Elsewhere, we also saw Bitcoin again rally past the $65,000 level and has got within half a percent of its all-time intraday peak of $68,992 overnight, which was seen back in November 2021. However it's back at $66,527 as I type.

In energy markets, oil prices retreated at the start of the week, with WTI down -1.54% to $78.74/bbl, after reaching a near-three-month high on Friday. This decline came even as Sunday’s (widely expected) extension of existing OPEC+ production cuts into Q2 was accompanied by Russia pledging additional output reduction of up to 471k barrels a day.

To the day ahead now, and data releases include the ISM services index for February in the US, as well as the global services and composite PMIs for February. Otherwise, there’s January data for US factory orders, Euro Area PPI, and French industrial production. From central banks, we’ll hear from Fed Vice Chair for Supervision Barr. Today’s earnings releases include Target. And in US politics, it’s Super Tuesday, with lots of primaries taking place for both Republicans and Democrats.