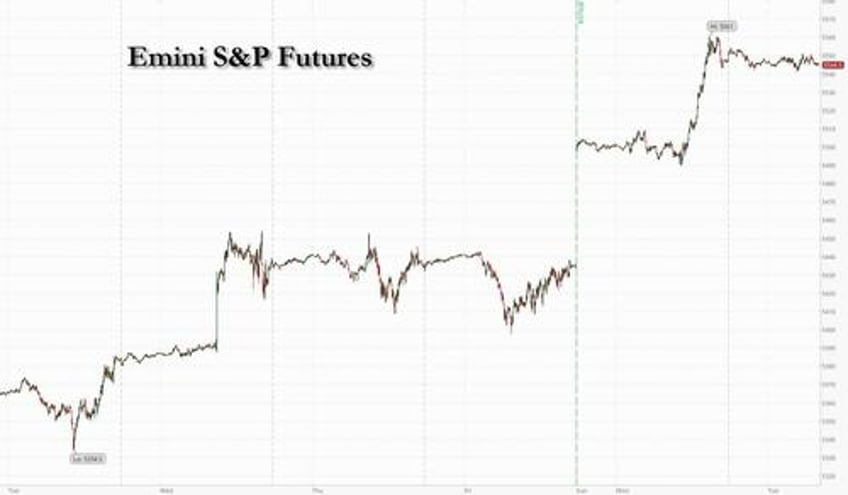

Futures are flat with gigatech naturally outperforming into today’s retail sales print where the expectations are for beats to resume after last month's sharp miss. As of 8:00am ET, S&P futures were completely flat, while Nasdaq futures were up for the 7th day in a row as it nudges toward the 20,000 mark, with semi shares higher of course, while Mag7 names are also up small. European stocks rise for a second session as political premium fades while French government bonds drift as investors keep a close eye on political developments. Bond yields are up 1-2 bps across the curve after falling Monday amid a flurry of high-grade corporate bond sales that exceeded $21 billion. A gauge of the dollar was higher with EUR, GBP, and JPY weaker. Commodity markets are mostly lower, but WTI remains above $80/bbl with CTAs now set to buy over $30BN. The macro data focus is on Retail Sales but there is another batch of Fedspeakers; yesterday’s speakers indicated a still strong economy with no consensus among the path of inflation with risks tilted more towards a growth slowdown rather than another inflation spike.

In premarket trading, Broadcom rose 2.4%, putting the stock on track for an eighth consecutive session of gains, a rally that has added more than $200 billion to the stock’s market capitalization. Chegg jumped 20% after the online-education firm announced a cut to its workforce and a growth plan that includes developing a “single platform” with artificial-intelligence tools. Here are some other notable premarket movers:

- La-Z-Boy (LZB) rises 9.4% after the furniture company reported quarterly profit and sales that topped estimates.

- Lennar (LEN) slips 2.7% after the homebuilder’s orders outlook missed estimates.

- NextEra Energy (NEE) falls 4.3% on plans to sell $2 billion of equity to raise money for new energy projects and to pay down its short-term debt.

- Philip Morris (PM) declines 2.9% after the company stopped online sales of its popular nicotine pouch brand Zyn in the US after an affiliate received a subpoena in the District of Columbia.

- Rocket Lab USA (RKLB) rises 7.4% after the space systems company signed the largest Electron launch agreement in the firm’s history.

- Silk Road Medical (SILK) rallies 23% after Boston Scientific agreed to acquire the medical device maker.

- Zentalis Pharma (ZNTL) drops 28% after the FDA placed a partial hold on azenosertib studies.

Optimism over a resilient economy and improving corporate earnings have helped push US equities up about 15% this year. Ahead of Wednesday’s holiday in the US, traders geared up for retail-sales data and a slew of Federal Reserve speakers for more pointers on the potential start of rate cuts.

“The picture being painted is that despite the fading prospects of sizeable interest rate cuts from the Fed this year, the economic outlook remains upbeat and this means that corporate earnings should continue to hold up,” said Stuart Cole, the head macro economist at Equiti Capital UK Ltd. “But everybody - the Fed, the markets, etc. - is in ‘data dependency’ mode, and this sentiment could potentially sour if we get a soft set of retail sales data from the US this afternoon.”

Europe's Stoxx 600 benchmark staged a modest rebound and rose for a second session, up 0.5% last with travel and leisure and banks are the best performing sectors while mining and consumer stocks lag behind. Whitbread Plc rose following a trading update. Danish biotech company Novonesis (Novozymes) B jumped after lifting its outlook for the year. Carrefour SA fell after a report that France’s finance ministry is seeking a €200 million civil fine from the supermarket chain. The CAC 40 adds 0.3% amid lingering concern about political turmoil in France. European stocks have retreated since French President Emmanuel Macron called a snap legislative ballot following a drubbing by Marine Le Pen’s National Rally in the European Parliament elections. The two-round election will conclude on July 7. Here are some of the biggest movers on Tuesday:

- Whitbread shares gain as much as 5% after it reported mild growth in total sales in 1Q and said it remains confident about its outlook for the full year.

- DocMorris shares jump as much as 7.6% after Zuercher Kantonalbank raised the stock to outperform, saying the risks around data protection and mobilization of doctors for the Swiss pharmaceutical products retailer are “significantly reduced.”

- Novonesis shares rise as much as 6.4% after the Danish company increased its outlook for the year. Novonesis is holding a capital markets day in London on Tuesday.

- SAF-Holland shares rise as much as 6.1%, extending Monday’s gain, as several analysts boost their price targets on the German truck parts manufacturer.

- Qiagen shares rise as much as 2.5%, extending Monday’s gains, after the German life sciences and diagnostics firm set 2024-2028 guidance above market expectations.

- Moncler shares fall as much as 4% after analysts at Oddo BHF trimmed their price target and earnings estimates due to concerns the luxury company will see a sharp slowdown in 2Q.

- Ashtead shares fall as much as 5.1% to hit a three-month low, after the equipment rental giant’s earnings fell short of expectations in the fourth quarter due to an unexpected provision booked after one of its customers went bankrupt.

- Coloplast shares drop as much as 3.5% after Nordea downgraded the stock to sell from hold, citing a “negatively skewed” risk/reward.

- Komax shares fall as much as 8%, touching the lowest since June 2020, after the Swiss machinery manufacturer issued a warning, saying its 2024 revenue will decline by about 20%.

- Paradox Interactive drops as much as 8.3%, the most since October, after the Swedish game publisher decided to cease further operations in the wholly-owned studio Paradox Tectonic.

“A portion of the recent risk-off moves has been driven by fears of ‘Frexit’ and euro-area breakup. In our view, those fears are overblown, and we would be fading the fear-driven moves,” said Mohit Kumar, a strategist at Jefferies. “We remain positive on risky assets, but would skew our positions more toward the US in view of the coming French elections.”

Asian stocks advanced on Tuesday, led by gains in Japanese equities while chip-related shares followed US peers higher. The MSCI Asia Pacific Index rose as much as 0.8%, on track for its best day in more than a week, with TSMC and Samsung among the biggest contributors. Most markets in the region advanced, with notable gains in Taiwan and South Korea. Australian stocks mostly held gains after the nation’s central bank left its key interest rate unchanged at a 12-year high. Hong Kong equities edged lower. Chip stocks rose after the Philadelphia Semiconductor Index climbed 1.6% to a record high. Locally, TSMC gained after a number of brokers raised their price targets for the Taiwanese foundry. Samsung and SK Hynix advanced on bullishness over AI-related demand for memory.

Investors will keep a close watch on the implications of China’s latest move in its trade tensions with Brussels, after Beijing launched an anti-dumping probe on pork imports from the European Union. That comes as the bloc looks at Chinese subsidies across a range of industries and will impose tariffs on electric car imports from July.

In FX, the Bloomberg Dollar Spot Index inched higher, with economists estimating month-on-month growth in American retail sales rebounded in May; the Swiss franc tops the G-10 FX pile, rising 0.2% against the greenback. The Aussie dollar also edges up after the RBA stood pat on interest rates but revealed they did discuss a hike; the EUR, GBP, and JPY are all weaker. USD/JPY rose 0.2% to 158.11 and back to intervention territory after BOJ governor Ueda said that the reduction in bond buying and a policy rate hike are separate issues.

In rates, treasuries dip ahead of retail sales and a busy day for Fedspeak. US 10-year yields rise 2bps to 4.30% broadly in line with German counterpart while French outperforms by ~3bp. Gilts yields are richer on the day with the curve flatter. French government bonds drift as investors keep a close eye on political developments. OATs are slightly outperforming their German counterparts, tightening the 10-year spread by 2bps to ~77bps. Gilts are steady. US session includes several Fed speakers, May retail sales data and 20-year bond auction. Coupon issuance resumes with $13b 20-year bond reopening at 1pm; WI 20-year yield at around 4.540% is 9.5bp richer than last month’s auction, which stopped through by 0.2bp

In commodities, oil held the biggest advance in a week Monday as risk-on sentiment in wider markets countered a mixed outlook for crude. Brent last traded around $84.25 and erasing an earlier loss. Copper rose from its lowest close since mid-April. Spot gold falls ~$7 to around $2,312/oz.

Looking at today's economic calendar, we will get the June New York Fed services business activity, May retail sales (8:30am), May industrial production (9:15am), April business inventories (10am) and April TIC flows (4pm). Fed officials scheduled to speak include Barkin (10am), Collins (11:40am, 4:40pm), Logan and Kugler (1pm), Musalem (1:20pm) and Goolsbee (2pm)

Market Snapshot

- S&P 500 futures little changed at 5,475.25

- STOXX Europe 600 up 0.2% to 512.41

- MXAP up 0.6% to 178.99

- MXAPJ up 0.6% to 565.12

- Nikkei up 1.0% to 38,482.11

- Topix up 0.6% to 2,715.76

- Hang Seng Index down 0.1% to 17,915.55

- Shanghai Composite up 0.5% to 3,030.25

- Sensex up 0.3% to 77,255.02

- Australia S&P/ASX 200 up 1.0% to 7,778.08

- Kospi up 0.7% to 2,763.92

- German 10Y yield little changed at 2.43%

- Euro down 0.1% to $1.0719

- Brent Futures down 0.5% to $83.86/bbl

- Gold spot down 0.3% to $2,312.38

- US Dollar Index up 0.18% to 105.51

Top Overnight News

- Elon Musk plans a Venmo-like payments feature for X across the US, documents show. Users will be able to store money on their accounts, pay other users or businesses, and even buy goods in physical stores. BBG

- Australia’s central bank kept interest rates at a 12-year high and highlighted sticky inflation, suggesting it’ll be some time before it’s ready to signal easing. BOJ chief Kazuo Ueda kept the door open to a possible rate increase in July. BBG

- Bank of Japan Governor Kazuo Ueda said the central bank could raise interest rates next month depending on economic data available at the time, underscoring its resolve to steadily push up borrowing costs from current near-zero levels. RTRS

- France’s corporate bosses are racing to build contacts with Marine Le Pen after recoiling from the radical tax-and-spend agenda of the rival leftwing alliance in the country’s snap parliamentary elections. FT

- Petrobras agreed to pay 19.8 billion reais ($3.5 billion) in back taxes, boosting Brazilian President Luiz Inacio Lula da Silva’s efforts to balance the budget. BBG

- UK grocery inflation declined for the 16th consecutive month to 2.1 per cent in June, according to data that will come as welcome news to consumers hit by the cost of living crisis. FT

- Biden to announce an initiative Tues whereby undocumented immigrants married to US citizens will be able to apply for legal residency. WaPo

- Apartment rents are starting to firm in several Northwest and Midwest cities, creating complications for the Fed (this is a situation where elevated rates might be helping to fuel inflation by dampening demand for home purchases). WSJ

- Last week's benign US inflation data reinforced our view that the Q1 spike was an aberration. Meanwhile, the labor market stands at a potential inflection point where a further softening in labor demand would hit actual jobs, not just open positions, and could therefore push up the unemployment rate more significantly. Goldman

A more detailed look at global markets

APAC stocks took impetus from the gains in the US where the S&P 500 and the Nasdaq notched record highs once again despite the lack of any major fresh macros drivers and as a deluge of Fed rhetoric looms. ASX 200 was underpinned with financials and defensives front-running the broad advances seen across sectors, while attention turned to the RBA decision where the central bank provided no surprises and kept the Cash Rate target unchanged at 4.35%. Nikkei 225 recovered some of the prior day's notable losses amid the rising tide across global equity markets and was unfazed by the latest comments from BoJ Governor Ueda who suggested the potential for a July rate hike depending on the data. Hang Seng and Shanghai Comp. were ultimately mixed as the Hong Kong benchmark later deteriorated after failing to sustain the 18,000 level, while the mainland conformed to the positive mood after the PBoC upped its liquidity efforts.

Top Asian News

- Hong Kong will start to permit trading through typhoons from September 25th.

- BoJ Governor Ueda said underlying inflation is to gradually accelerate and they must be vigilant to financial market moves and the impact on the economy, while he added that they need to scrutinise data a bit more to judge whether underlying inflation will heighten on a firm note and if they become more convinced that underlying inflation will accelerate towards the price target, they will adjust the degree of monetary easing by raising the short-term policy rate. Furthermore, Ueda said they cannot say now how much the BoJ will trim bond buying and they will not send a strong policy message by cutting JGB purchases, while he added that depending on economic, price and financial data and information available at the time, there is a chance we could raise interest rates at July meeting.

- China's latest property support measures have boosted transactions in the largest cities, but activity in smaller localities struggles get off the ground which suggests more pain ahead for most of the country's real estate market, according to Reuters.

- China Output (May) Gasoline 13.8mln/MT, +2.9% Y/Y; Diesel 17.35mln/MT, -6.4%; Crude Iron Ore 88.48mln/MT, +9.0%; Refiner Copper +0.6%.

- China's Securities Regulator says they will enrich policy tools to manage market fluctuations, will resolutely prevent abnormal stock market volatility. To strengthen strategic reserves and market stabilisation mechanism

European bourses, Stoxx 600 (+0.2%) began the session entirely in the green, taking impetus from a positive APAC session overnight, continuing the strength seen in the US on Monday. Since, stocks have slipped off best levels though remain modestly firmer. European sectors are mostly in the green, and hold a risk on bias, with Travel & Leisure topping the pile, whilst Consumer Products lags. US Equity Futures (ES U/C, NQ +0.1%, RTY -0.3% are mixed, taking a breather from the prior day’s strength which saw the S&P 500 and the Nasdaq notch record highs once again.

Top European News

- EU leaders concluded their summit with no agreement on key political positions, while EU's Michel said EU leaders will continue to work in the coming days for a deal on top jobs and that they need to agree on a program for the next five years at EU summit next week.

RBA

- Cash Rate Target unchanged at 4.35%, as expected, while it reiterated that the Board remains resolute in its determination to return inflation to the target and inflation remains high and is above target which is proving persistent. RBA said inflation is easing but has been doing so more slowly than previously expected and the Board expects that it will be some time yet before inflation is sustainably in the target range, while it added the path of interest rates that will best ensure that inflation returns to the target in a reasonable timeframe remains uncertain and the Board is not ruling anything in or out.

- Bullock: need to a lot to go our way too bring inflation back to range; board discussed whether to hike rates at this meeting, board decided to stay the course on policy. Wanted to make the point that they are alert to upside risks on inflation. Need to look across the economy, not just at Q2 CPI. Difficult to get a read on CPI with only quarterly data. Would not say the case for a rate hike is increasing, board did not consider the case for a rate cut at the gathering

FX

- Dollar is on a firmer footing today, benefiting from the slightly higher yield environment, and trading towards the upper end of today’s 105.25-47 range. Next up, US Retail Sales, with headline M/M expected at 0.3%.

- EUR is slightly softer vs the Dollar, with some of the political concerns out of France subsiding in recent trade. The Single-currency currently holds towards the bottom end of today’s 1.0715-41 range, and more resilient to the recent Dollar strength than other G10 peers.

- GBP began the session on a 1.27 handle, before succumbing to Dollar-led pressure, dragging the Pound down to lows of 1.2676. UK-specifics have been light today, though the docket picks up tomorrow in the form of UK CPI, ahead of the BoE a day later.

- A stronger session for the USD/JPY, breaching 158.00 to the upside, finding slight resistance at 158.10, before taking another leg higher towards the session’s best at 158.22; a level just shy of the 14th June high at 158.25.

- Differing performances for the Antipodeans today, on RBA day. The Bank kept rates unchanged though some upside was seen after Governor Bullock said that rate hikes were discussed at the meeting. The Kiwi is the G10 underperformer, which has been dragged lower by the AUD/NZD cross, which is currently at 1.0830.

Fixed Income

- USTs are softer by only a handful of ticks and resides just off today's lows, ahead of US Retail Sales and a slew of Fed speakers. USTs in a narrow 110-08+ to 110-16 band, which has edged to a new WTD base by a tick.

- Bunds are also slightly subdued, in-fitting with the initial bias on Monday. Specifics light aside from ZEW, which came in softer than expected with the Current Conditions surprisingly falling and printing below the forecast range. Data lifted Bunds back to the unchanged mark, but markedly shy of their 132.68 overnight peak. Thereafter, a poor German auction prompted some modest EGB pressure.

- Gilts are flat awaiting impetus from Wednesday's CPI and then Thursday's BoE. Supply this morning came via a 2029 DMO tap which was well received and spurred a very modest move higher for Gilts, though the move proved shortlived.

- UK sells GBP 4bln 4.125% 2029 Gilt: b/c 3.59x (prev. 3.2x), average yield 4.083% (prev. 4.199%), tail 0.3bps (prev. 0.6bps)

- Germany sells EUR 3.36bln vs exp. EUR 4bln 2.10% 2029 Bobl: b/c 2.1x (prev. 2.8x), average yield 2.45% (prev. 2.56%) & retention 16.00% (prev. 16.75%)

Commodities

- Crude benchmarks are just underwater with specifics light, largely at the whim of the firmer Dollar, with the complex taking a breather from yesterday's geopolitics driven gains. Brent currently just shy of USD 84/bbl.

- Precious metals are contained with specifics light and the mentioned USD strength weighing on the space. At the low end of thin USD 2313-2325/oz parameters, a low which holds just above Monday's USD 2310/oz.

- Base metals are weighed on by the USD which is overshadowing any support for the complex from the PBoC's latest liquidity measures.

Geopolitics: Middle East

- Israeli negotiator said tens of Gaza hostages are alive with certainty, according to AFP News Agency.

- US National Security Adviser Sullivan said they need to give and take in negotiations, as well as bridge the differences between Hamas and Israel, while he added that the current proposal represents a roadmap for a ceasefire in Gaza.

- Top US Democrats approve massive arms sales to Israel including 50 F-15 fighter jets, according to Washington Post.

- "US President Biden's senior adviser Amos Hochstein's paper seeks a truce agreement with Israel after removing Hezbollah forces from the border", via Al Hadath citing Lebanese press

Geopolitics: Other

- US National Security Adviser Sullivan said their approval of Kyiv's use of US weapons inside Russia extends to any place used by Russian forces to strike Ukraine, according to Al Jazeera.

- Russian President Putin said Russia and North Korea will develop trade and mutual settlements mechanism uncontrolled by the West and will jointly resist sanctions, while he added that Russia highly appreciates North Korea's support in Moscow's special operation in Ukraine and that the West is pushing Ukraine to strike Russia's territory, according to TASS.

- South Korea's military fired warning shots after North Korean soldiers crossed the military demarcation line, while the North Korean military suffered multiple casualties due to the explosion of land mines within the demilitarized zone, according to Yonhap.

- Chinese spokesperson criticised the Philippines' submission on its undersea shelf in the South China Sea, claiming it infringes on China's sovereign rights, violates international law and contradicts the Declaration on Conduct of Parties in the South China Sea.

US Event Calendar

- 08:30: June New York Fed Services Business, prior 3.0

- 08:30: May Retail Sales Advance MoM, est. 0.3%, prior 0%

- May Retail Sales Ex Auto MoM, est. 0.2%, prior 0.2%

- May Retail Sales Control Group, est. 0.5%, prior -0.3%

- 09:15: May Industrial Production MoM, est. 0.3%, prior 0%

- May Manufacturing (SIC) Production, est. 0.3%, prior -0.3%

- May Capacity Utilization, est. 78.6%, prior 78.4%

- 10:00: April Business Inventories, est. 0.3%, prior -0.1%

- 16:00: April Total Net TIC Flows, prior $102.1b

DB's Jim Reid concludes the overnight wrap

Risk assets put in a stronger performance over the last 24 hours, with the S&P 500 (+0.77%) advancing to yet another record high, while European markets also stabilised after last week’s slump. That included France’s CAC 40 (+0.91%), which posted a recovery following its worst weekly performance in over two years, and sovereign bond spreads also narrowed across Europe. But even as risk assets managed to recover, the risk-on tone meant that sovereign bonds lost ground again, and comments from central bank officials meant investors dialled back the amount of rate cuts they expected over the rest of the year.

In terms of the situation in France, the Franco-German 10yr spread finally tightened again yesterday, having risen every single day over the previous week. By the close, it was down by -2.8bps, and alongside that, the Euro strengthened by +0.29% against the US Dollar. Equities also recovered, despite some weakness in the middle of the day, and the CAC 40 was supported by an outperformance among financials. That included AXA (+1.87%), BNP Paribas (+1.25%) and Société Générale (+1.17%), all of whom had experienced double-digit losses last week. And when it came to the politics, a poll out from Ifop yesterday showed that Marine Le Pen’s RN party was on 33% for the first round on June 30, the left-wing New Popular Front was in second place on 28%, and President Macron’s group was on 18%.

With increasing attention on the first round vote, we also heard from some ECB policymakers on the situation, although they didn’t seem too perturbed by the recent moves. For instance, ECB President Lagarde said that “ We are attentive to the good functioning of financial markets, and I think that today in any case we’re continuing to be attentive, but it’s limited to that.” Elsewhere, chief economist Lane said that this was “a repricing” and said it was not in “the world of disorderly market dynamics.” For more from DB Research on the developments in France, yesterday saw Chief European economist Mark Wall look at what this could mean from an economic and policy perspective (link here), while I took a look at some of the broader market takeaways (link here). Our rates strategists have also written about the OAT-bund spread (link here).

When it comes to the ECB, investors also got a reminder that they may not be in a hurry to cut rates rapidly, despite the turmoil in markets last week. For instance, chief economist Lane pointed out that the ECB wouldn’t know much more by the time of its July meeting, and Croatia’s Vujcic said that “July is always an option, but much more data will be available in September. Everything is open at that meeting”. That backdrop and the stabilisation in French assets saw investors very slightly dial back their expectations for ECB rate cuts, with the amount priced in by the December meeting falling by -0.3bps on the day to 43bps. Alongside that, yields on 10yr bunds (+5.3bps), OATs (+2.5bps) and BTPs (+1.5bps) all moved higher as well.

Over in the US, Treasuries saw an even larger selloff, with the 10yr yield up +6.0bps on the day to 4.28%. That came amidst some better-than-expected data, with the Empire State manufacturing survey up to a four-month high of -6.0 in June (vs. 10.0 expected). A sizeable amount of corporate issuance on Monday, which tends to lead to increased hedging activity, may have also contributed to the rise in yields. The data flow will continue today, as we’ve got retail sales, industrial production and capacity utilisation for May, so that will give us a better sense of economic performance into the middle of Q2. However, yields have reversed course overnight, with the 10yr Treasury yield (-1.4bps) back down to 4.27%.

In the meantime, the rally in US equities showed no sign of abating yesterday, as the S&P 500 (+0.77%) closed at an all-time high for the fifth time in six sessions (and for the 30th time this year), taking itsYTD gains to +14.75%. The advance was once again led by tech stocks, with the Magnificent 7 (+1.16%) extending its YTD gains to +36.47%. Broadcom (+5.41%) and Tesla (+5.30%) were two of the three top performers in the S&P 500 on the day. The equity rally was fairly broad, with the equal-weighted S&P 500 up +0.66% yesterday. But the equal-weighted index is still only up +4.04% YTD, so there’s a gap of more than ten percentage points with the market-cap weighted index, while the Russell 2000 is still in the red on a YTD basis (-0.25% despite a +0.79% gain yesterday). For European equities, it was France that led the way, and Italy’s FTSE MIB (+0.74%) also put in a solid performance. However, the broader STOXX 600 was only up +0.09%.

In the commodity space, oil prices extended last week’s advance, with Brent (+1.97% to $84.25/bbl) and WTI (+2.40% to $80.33/bbl) crude closing the session at their highest levels since April.

Overnight, the Reserve Bank of Australia left their policy rate unchanged at 4.35%, in line with expectations. Their statement acknowledged ongoing inflationary pressures, saying that labour market conditions “ remain tighter than is consistent with sustained full employment and inflation at target ”, whilst it said wage growth was “still above the level that can be sustained given trend productivity growth.” Later on, they kept their options open for policy, saying that “the Board is not ruling anything in or out”. Yields on 10yr Australian government bonds are just over a basis point higher since the decision was announced, and are currently up +3.2bps on the day to 4.14%.

Elsewhere overnight, markets in Asia have put in a strong performance, following the lead from Wall Street. That includes gains for the Nikkei (+0.90%), the KOSPI (+0.79%), the Shanghai Comp (+0.36%) and CSI 300 (+0.27%), although the Hang Seng (-0.18%) has fallen back. Looking forward, US equity futures are basically flat this morning, with those on the S&P 500 only down -0.02%.

To the day ahead now, and data releases include US retail sales, industrial production and capacity utilization for May, along with the German ZEW survey for June. From central banks, we’ll hear from the Fed’s Barkin, Collins, Logan, Kugler, Musalem and Goolsbee, ECB Vice President de Guindos, and the ECB’s Knot, Vujcic, Cipollone and Villeroy.