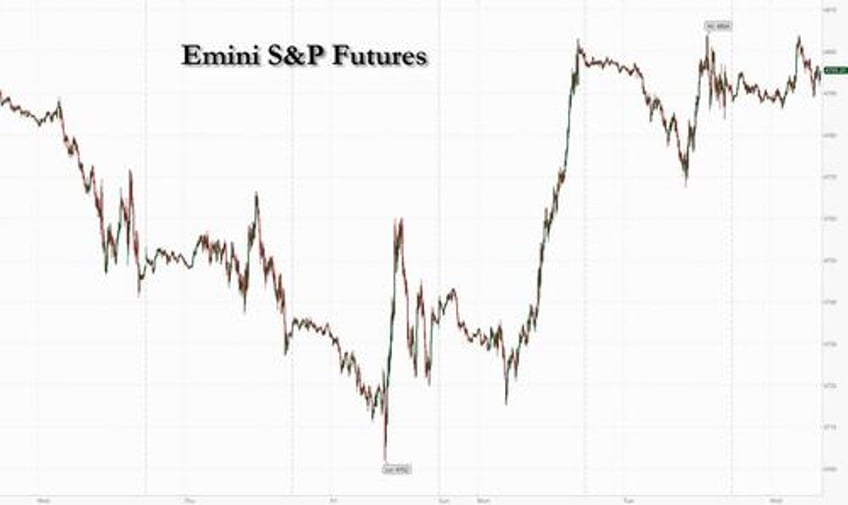

US stock futures were unchanged, trading in a narrow range and shifting between modest gains and losses, as investors clung to the sidelines ahead of a key US inflation report. As of 7:50am, Nasdaq 100 futures gained 0.1% while S&P 500 index futures were little changed. The Treasury 10-year yield crept back under 4%, before recovering much of the move. The Dollar was also unchanged while the yen tumbled after the latest Japanese wage data confirmed there will be no rate hikes soon, if not ever. Brent crude rose 0.5% and was trading just below $78 a barrel in a choppy session following more attacks on vessels in the Red Sea that could upset both oil supplies and trade flows. Bitcoin dropped to trade around $45K after a hacked post on the SEC’s X/twitter account prompted large price swings on Tuesday. Today's calendar is sparse: just wholesale inventories and trade on deck.

In premarket trading, it was a mixed picture for semiconductor companies: Smart Global rose 9.5% after the semiconductor device company posted record gross margins; on the other hand, Aehr Test Systems tumbled 18% after the semiconductor manufacturing company reduced its revenue forecast for fiscal 2024. Here are some other notable premarket movers: