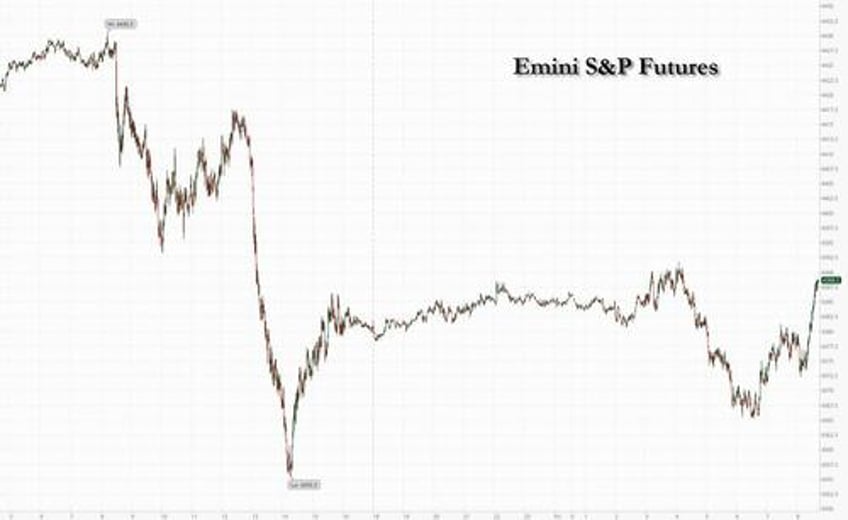

US equity futures reverased earlier losses, thanks to solid results from JPM and Citi...

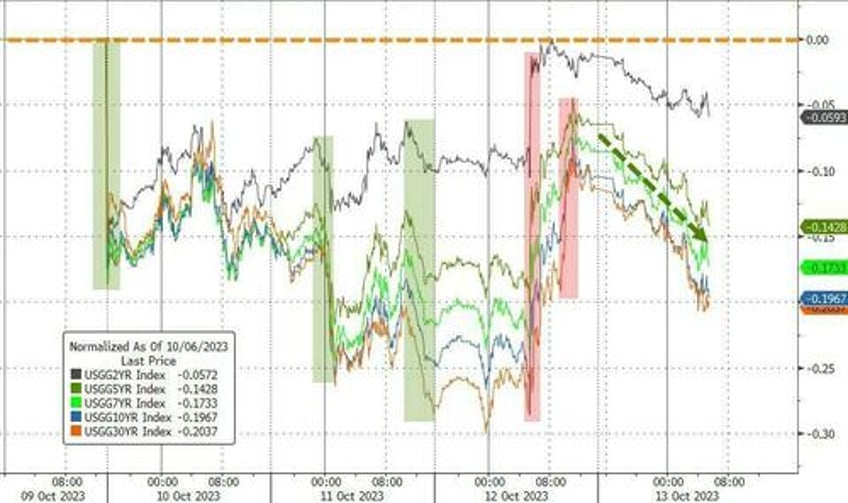

... while treasuries rallied with 10Y yields tumbling more than 10 basis point to session lows below 4.59% and paring almost all of Thursday’s sharp rise in the wake of hotter-than-expected US consumer price data.

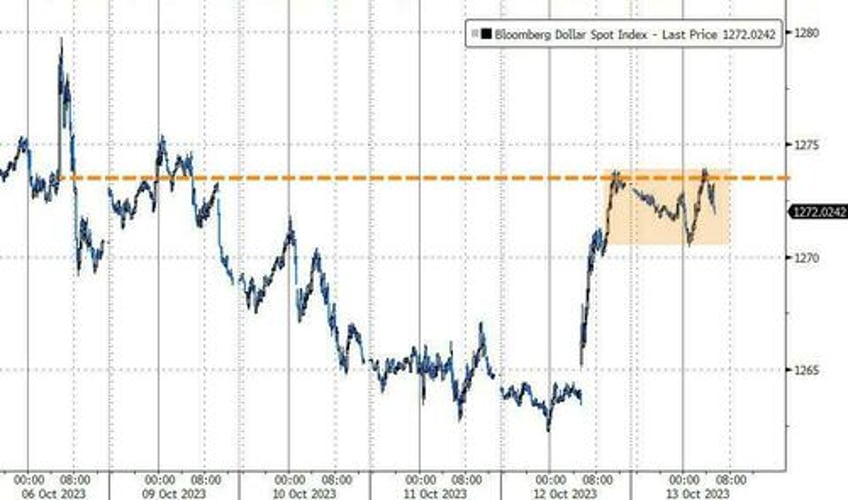

... and while the dollar was largely flat...

... oil soared, with Brent about to rise above $90 again...

... and gold surged...

... as investors scramed to safe havens amid warnings that Israel is preparing for an imminent ground invasion of Gaza.

Helping nudge futures to session highs, JPMorgan, Citigroup and Wells Fargo all gained in premarket trading after earnings beats. Data showing that import prices rose less than expected in September also lifted the mood. Among other US premarket movers, Boeing fell after Ryanair Holdings Plc said delivery delays of 737 Max aircraft have worsened as the aircraft maker grapples with supplier quality-control issues. BlackRock declined after clients pulled a net $13 billion from long-term investment funds, the first outflows since the onset of the pandemic in 2020.

European bonds also gained, with the German 10-year yield falling seven basis points. Crude oil climbed more than 4% in New York, rising above $86 a barrel on fears the Israel-Hamas war could destabilize the Middle East and crimp global supply. “Bonds are rallying ahead of the weekend as traders likely want to hedge geopolitical risk,” said Christophe Barraud, chief economist and strategist at Market Securities LLP.

The Stoxx Europe 600 dropped about 0.8%, led by travel and leisure shares. The energy sector was the only one ini the green as oil majors gained. Among individual movers, Tryg A/S jumped after the Danish insurer reported an earnings beat. Ubisoft Entertainment advanced after the UK approved Microsoft Corp.’s deal to buy Activision Blizzard Inc., which will see the sale of some gaming rights to the French video-game maker. Here are the most notable European movers:

- Tryg gains as much as 6.7%, the most since March 2021, after the Danish insurance company reported 3Q earnings that beat estimates. Analysts notes that its DKK1 billion share buyback was larger and earlier than expected.

- Dufry shares climb as much as 2.1% after JPMorgan lifted its price target for the Swiss manager of airport duty-free shops to a new street high of CHF62, saying recent weakness in sentiment now presents a buy opportunity.

- Porsche rises as much as 1.8% after the luxury carmaker reported its global deliveries for the last nine months rose 10% year-on-year.

- Sabadell rises rise as much as 1.9% after loan management servicer doValue announced that the bank was among Spanish majors that it had secured €689 of new contracts from.

- CD Projekt climbs as much as 2.4% after the Polish video game developer said it used AI technology in its latest release to recreate the voice of an actor who passed away.

- BPER Banca shares advance as much as 4.3% to the highest since August after it was upgraded to overweight from equal-weight at Barclays, with the broker saying it’s getting more constructive on Italian banks.

- St James’s Place shares tumble 16% to the lowest since March 2020 as the UK wealth manager said it’s reviewing its fees and charges.

- Sartorius shares slide as much as 15% to the lowest since June 2020, while its French-listed subsidiary Sartorius Stedim Biotech drops as much as 19% after both cut guidance for the full year, with the companies citing lower volume expectations and product mix effects. Morgan Stanley says the magnitude of the profit warning is more significant than expected.

- Spirax drops as much as 4% to the lowest since May 2020 after Sartorius’s reduced sales forecast put pressure on the UK pumps manufacturer.

- Orsted drops as much as 8.3% as the stock is hit by New York State Public Service Commission’s unwillingness to support price increases for projects being developed alongside the state. The immediate implication for the Danish power generator is a greater likelihood of further write-down of Sunrise Wind, Citigroup says.

- Exor falls as much as 2.4%, the most since July, after the Agnelli family said a tender offer, part of its €1 billion buyback plan, went oversubscribed in a statement.

- British American Tobacco shares dip as much as 2.8% after the US Food and Drug Administration said it was prohibiting the marketing and distribution of some of its Vuse vape products.

Earlier in the session, Asian stocks fell for the first time in more than a week after brisk US inflation data bolstered rate-hike bets and weakness in China’s economy further soured sentiment. The MSCI Asia Pacific Index slid as much as 1.1%, with Chinese tech giants Tencent, Alibaba and JD.com among the biggest drags. Most markets were in the red as stronger-than-expected US inflation reading reinforced jitters about higher-for-longer rates. Gauges in Hong Kong were the worst performers after China’s consumer and producer prices came in below estimates, underscoring weak demand. Mainland shares only briefly pared losses following a report that China is considering forming a state-backed stabilization fund to shore up confidence in the stock market. The CSI 300 Index was back down more than 1%.

Hang Seng and Shanghai Comp. were lower with tech the worst hit in Hong Kong amid broker downgrades and as the US reportedly eyes closing a loophole that gives Chinese companies access to American AI chips via units located overseas. Furthermore, Chinese inflation data underwhelmed with consumer inflation flat and factory gate prices at a deeper-than-forecast decline, while participants digested mixed trade data in which exports beat expectations but remained in contractionary territory.

- Australia's ASX 200 was pressured with underperformance in real estate and tech alongside rising yields and as markets reflected on the latest gauges into the economic health of Australia’s largest trading partner.

- Japan's Nikkei 225 traded negatively but with price action choppy and downside stemmed as Japan plans to release an economy security plan to protect vital industries like semiconductors and with index heavyweight Fast Retailing boosted by earnings.

- India stocks closed lower, trimming their weekly gains, as bank stocks saw selling after UBS warned of rising default risks for unsecured retail loans. Index major Infosys slumped. The S&P BSE Sensex fell 0.2% to 66,282.74 in Mumbai, while the NSE Nifty 50 Index declined by a similar magnitude. The MSCI Asia Pacific Index was down 1.3%. Stock benchmarks eked out gains for the second week running as consumer-facing companies rallied on optimism

“Asia markets are facing a double whammy that casts significant doubt on the optimism-driven rally of the past few days,” said Hebe Chen, an analyst at IG Markets. “The earlier optimism, built on the assumption of a dovish turn by the Fed, now seems much vulnerable. Additionally, China’s disappointing zero CPI figures signal a yellow-light alarm.”

In FX, the Bloomberg Dollar Index falls 0.1%. The Swedish krona is the best performer among the G-10’s, rising 0.4% versus the greenback after CPI topped estimates.

In rates, treasuries held gains across the curve, unwinding a portion of Thursday’s sharp bear-steepening move, with yields richer by 4bp-8bp as US session begins. Intermediates lead, flattening 2s10s back to middle of Thursday’s range. US 10-year yields down more than 8bp at 4.60%, at session lows, outperforming gilts and bunds by ~3bp and ~1bp in the sector; front-end lags, with 2-year yields richer by ~4bp on the day. Haven demand is among the catalysts a ground invasion of Gaza by Israel appears likely. US session includes University of Michigan sentiment data, while 3Q earnings season starts with reports from JPMorgan, Citigroup and Wells Fargo. Meanwhile, the prospect of higher-for-longer US interest rates also weighed on risk appetite. Swap contracts pushed the odds of another quarter-point Federal Reserve hike to about 40% — from closer to 30% Wednesday. US economic data slate includes September import/export price index (8:30am) and October preliminary University of Michigan sentiment (10am).

In commodities, crude futures jumped over 4% to trade above $86. The risk-off tone has also benefited spot gold which adds 1%. An escalation of Israel’s war with Hamas, drawing in Iran, could send crude oil to $150 a barrel and cut about $1 trillion off world economic output, according to Bloomberg Economics.

Looking to the day ahead now, and data releases include Euro Area industrial production for August, whilst in the US we’ll get the University of Michigan’s preliminary consumer sentiment index for October. From central banks, we’ll hear from ECB President Lagarde, Bundesbank President Nagel, BoE Governor Bailey, Deputy Governor Cunliffe, and the Fed’s Harker. Finally, today’s earnings releases include JPMorgan, Citigroup, Wells Fargo and BlackRock.

Market Snapshot

- S&P 500 futures little changed at 4,384.50

- MXAP down 1.2% to 157.23

- MXAPJ down 1.2% to 492.87

- Nikkei down 0.5% to 32,315.99

- Topix down 1.4% to 2,308.75

- Hang Seng Index down 2.3% to 17,813.45

- Shanghai Composite down 0.6% to 3,088.10

- Sensex down 0.2% to 66,272.36

- Australia S&P/ASX 200 down 0.6% to 7,051.03

- Kospi down 1.0% to 2,456.15

- STOXX Europe 600 down 0.4% to 451.95

- German 10Y yield little changed at 2.75%

- Euro up 0.3% to $1.0557

- Brent Futures up 2.6% to $88.24/bbl

- Gold spot up 0.8% to $1,884.33

- U.S. Dollar Index down 0.28% to 106.31

Top Overnight News

- China’s CPI for September was 0.0%, down from +0.1% in Aug and below the Street’s +0.2% forecast, while PPI deflation improved modestly to -2.5% (vs. -3% in Aug and vs. the Street forecast of -2.4%). FT

- China is considering forming a state-backed stabilization fund to shore up confidence in its $9.5 trillion stock market. After at least two rounds of consultation with industry participants over a period of months, financial regulators including the China Securities Regulatory Commission recently submitted a preliminary plan to the nation’s top leadership. BBG

- The Biden administration is considering closing a loophole that gives Chinese companies access to American artificial intelligence (AI) chips through units located overseas, according to four people familiar with the matter. RTRS

- Israel’s military warned more than 1mn Palestinians to leave Gaza City and its outskirts, in a move the UN said would cause a “calamitous” mass civilian displacement. FT

- Microsoft’s acquisition of videogame company Activision Blizzard won approval from U.K. competition authorities, clearing a path for the companies to close the $75 billion deal after a lengthy struggle with regulators. WSJ

- Americans didn’t pay an estimated $688 billion in taxes due on their 2021 returns—the largest shortfall ever. Audits and other enforcement will be stepped up to reduce the gap, the Internal Revenue Service said Thursday. WSJ

- Majority Leader Steve Scalise (R-La.) dropped out of the race for House speaker Thursday night, further throwing the House into chaos as Republicans openly ponder whether their fractured conference is capable of electing anyone as speaker. WaPo

- House Republicans are considering plans to give McHenry formal powers for a limited period so he can help pass a budget bill before the 11/17 deadline and deal with emergency spending requests. The Hill

- The biggest US banks face the worst write-offs in three years as JPMorgan, Citi and Wells Fargo kick off earnings today. They’re set to post combined net charge-offs almost twice last year’s levels. As well as deteriorating credit quality, analysts will be watching NII and investment banking revenue. BBG

A more detailed look at global markets courtesy of Newsquawk

Asia-Pacific stocks were mostly lower amid headwinds from the US where headline CPI data topped forecasts, while the region also digested softer-than-expected inflation and mixed trade data from China. ASX 200 was pressured with underperformance in real estate and tech alongside rising yields and as markets reflected on the latest gauges into the economic health of Australia’s largest trading partner. Nikkei 225 traded negatively but with price action choppy and downside stemmed as Japan plans to release an economy security plan to protect vital industries like semiconductors and with index heavyweight Fast Retailing boosted by earnings. Hang Seng and Shanghai Comp. were lower with tech the worst hit in Hong Kong amid broker downgrades and as the US reportedly eyes closing a loophole that gives Chinese companies access to American AI chips via units located overseas. Furthermore, Chinese inflation data underwhelmed with consumer inflation flat and factory gate prices at a deeper-than-forecast decline, while participants digested mixed trade data in which exports beat expectations but remained in contractionary territory.

Top Asian News

- PBoC set the USD/CNY mid-point at 7.1775 vs exp. 7.3179 (prev. 7.1776).

- PBoC Governor Pan met with Fed Chair Powell in Morocco on October 12th and exchanged views on cooperation, according to Reuters citing the PBoC.

- PBoC official said stable CNY has a solid foundation; and will resolutely prevent the risk of CNY overshooting; China will maintain a current account surplus, according to Reuters.

- PBoC said it will implement monetary policy in a precise and forceful manner. The official said the central bank still has ample room to support the economy. PBoC said recent interest rate reductions for the property sector have achieved significant results, and expects total social finance and credit to maintain steady growth in Q4, according to Reuters.

- China's NPC Standing Committee is to hold a meeting between Oct 20-24th; to discuss offer for new local government debt quota, according to Xinhua.

- Chinese Vice Premier Zhang called for efforts to vigorously develop advanced manufacturing and accelerate new industrialisation, according to Chinese press.

- China is said to weigh a new stabilisation fund to prop up the stock market with the plan calling for the fund to have access to up to hundreds of billions of yuan in capital, according to Bloomberg.

- US eyes closing loophole that gives Chinese companies access to American AI chips via units located overseas, according to Reuters sources

- China's Customs said China's trade still faces many difficulties and challenges, while it added that China's trade also faces a complex and severe external environment.

- Monetary Authority of Singapore maintained the width, centre and slope of the SGD NEER policy band, as expected, while it announced to shift to a quarterly schedule of policy reviews. MAS said it will closely monitor global and domestic economic developments amid uncertainty on inflation and growth, as well as noted that prospects for the Singapore economy are muted in the near term but should improve gradually in H2 2024.

- S&P said Japan is robust enough for rising JPY rates, expects a gradual increase in Japan's interest rates, and added that rates will rise from 2024, according to Reuters.

- IMF said BoJ's YCC tweak led to spillover in global bond market; could become larger in event of more substantial policy normalisation, according to Reuters.

European bourses have been tilting lower since the cash open despite a lack of major headlines during the European morning, with traders cognizant of geopolitical risks heading into the weekend. Sectors in Europe are mostly in the red with clear outperformance in energy as crude prices continue marching higher, while Banks, Financials and Healthcare lag. US futures have tilted lower alongside the European equity markets as broader sentiment deteriorates, albeit losses across US futures are modest.

Top European News

- German Chancellor Scholz reportedly faces renewed pressure to stem the property rout in a standoff with the industry, according to Reuters sources. Germany's building industry will present the chancellor with a new set of proposed measures this month to cushion the downside in the property sector.

- European Foreign Policy Commissioner Borrell says European investments in China have seen a sharp downturn and today they are at the lowest level since 2018, according to Reuters.

- Italian Economy Minister, when asked about a potential rating downgrade, said they have had discussions with rating agencies and cannot rule anything out, according to Reuters.

- ECB's Kazaks said he is quite happy with where rates currently are, via CNBC; would not close the door on further rate increases.

- ECB's Nagel said inflation has peaked in Germany, the labour market remains strong, and expects consumer demand to increase, according to Reuters.

- ECB's Visco said there are no signs that Italian spreads will be reaching levels for the ECB to take action, according to Bloomberg.

- BoE Governor Bailey said he is seeing progress that inflation is being tackled but there is work left to do, and added policy is restrictive and it needs to be, according to Reuters.

- UK Chancellor Hunt said the Autumn Budget statement will be "balanced with caution about the international situation"; needs to show in the statement that there is a path to lower taxation. He added the Autumn statement will lay out a plan to get out of the low growth trap, according to Reuters.

FX

- Dollar loses some inflation momentum as DXY slips from a double top into a softer 106.510-280 range.

- The Pound rebounds around the 1.2200 pivot vs Buck and the Euro steadies on the 1.0500 handle amidst massive EUR/USD option expiries.

- Franc holds above 0.9100 as yields retreat and the Loonie is over 1.3700 as oil recovers.

- Yen still defending 150.00 and the Kiwi in danger of losing 0.5900 on the eve of New Zealand election.

Fixed Income

- Bonds futures have extended their recovery from post-US CPI lows in what could be described as a risk revival given a marked downturn in equities.

- Bunds have reclaimed more than half of yesterday’s heavy losses to suggest more than a technical correction.

- Gilts have overcome a few wobbles to track their Eurozone counterpart.

- T-note is nudging new peaks amidst a return to bull-flattening regardless of a poor long bond auction to continue the run of weak sales this week.

Commodities

- Crude futures are on the grind higher on Friday despite a lack of fresh fundamentals, with traders likely wary to bet against crude heading into the weekend as geopolitical risk remains at the forefront for the complex.

- Dutch TTF is firmer intraday as prices for the Nov contract eye USD 54/MWh to the upside, potentially partially buoyed by action in the crude complex.

- Spot gold edged higher to eventually top yesterday’s USD 1,884.79/oz high, while the 50 DMA today coincides with the USD 1,900/oz psychological mark. Spot silver also benefits and is back on a USD 22/oz handle.

- Base metals are mixed with little reaction seen to the release of Chinese inflation and trade data overnight, with the data showing iron ore and copper imports fell in September.

- Australia union official said progress has been made with Chevron (CVX) in LNG labour talks, but there is no deal yet; further talks are planned for Monday, according to Reuters.

- Russian Deputy PM Novak says there are no discussions about an OPEC-like cartel for natural gas; says settlements in USD and EUR for Russian oil trade remain but have declined significantly. Discount to Russian oil on the global market to international benchmarks stabilised at USD 11-12/bbl from USD 35-38/bbl in early 2023, according to Reuters. Novak added that there is limited potential for further narrowing of the Urals prices discount.

Geopolitics

- Israel's ground military is building up on the Gaza Strip border, Sky News Arabia reports.

- The Israeli military called for an evacuation of all civilians in Gaza City from their homes southwards and said Gaza City is an area where military operations take place, while it will operate significantly in Gaza City in the coming days, according to Reuters.

- Israeli military informed the UN that all Palestinians north of Wadi Gaza should relocate to southern Gaza in the next 24 hours which amounts to approximately 1.1mln people, while the UN strongly appealed for any such order to be rescinded to avoid a calamitous situation, according to a UN spokesman. Furthermore, a Hamas official said the Gaza relocation warning is fake propaganda and it urged its citizens not to fall for it, according to Reuters.

- Iran's Foreign Minister said the continuation of war crimes will receive a response from the rest of the axes and 'the Zionist entity' will be responsible for that, while he added that the displacement of tens of thousands of Palestinians and cutting off water and electricity is considered a war crime.

- US, Japanese and South Korean officials are to discuss North Korean matters on October 17th in Jakarta, Indonesia, while it was separately reported that North Korea warned of the consequences of US drills in South Korea, according to KCNA.

- Indian Trade Secretary said a Free Trade Agreement with the UK is in an advanced stage of negotiations, according to Reuters.

- Russian President Putin proposes hosting peace talks between Azerbaijan and Armenia in Moscow, according to Reuters.

US Event Calendar

- 08:30: Sept. Import Price Index MoM, est. 0.5%, prior 0.5%

- Sept. Import Price Index YoY, est. -1.4%, prior -3.0%

- Sept. Export Price Index YoY, est. -4.0%, prior -5.5%

- Sept. Export Price Index MoM, est. 0.5%, prior 1.3%

- 10:00: Oct. U. of Mich. Sentiment, est. 67.0, prior 68.1

- Oct. U. of Mich. Current Conditions, est. 70.3, prior 71.4

- Oct. U. of Mich. Expectations, est. 65.7, prior 66.0

- Oct. U. of Mich. 1 Yr Inflation, est. 3.2%, prior 3.2%

- Oct. U. of Mich. 5-10 Yr Inflation, est. 2.8%, prior 2.8%

DB's Jim concludes the overnight wrap

After a big rally for sovereign bonds at the start of the week, the sell-off resumed once again yesterday, thanks to an upside surprise in the latest US CPI print. The release showed that core CPI was at a 5-month high, and offered a fresh reminder that the road back to target is unlikely to be a smooth one. In turn, investors grew more confident that the Fed might raise rates again this year, and we even saw the 30yr Treasury yield experience its biggest daily rise since the Covid turmoil of March 2020, with a +16.0bps increase to 4.85%. That adjustment in rates meant that equities lost ground as well, with the S&P 500 ending its run of 4 consecutive gains to fall -0.62% .

Looking at the details of that CPI print, it was mostly bad news from a market perspective. The main story was that headline CPI came in at +0.40%, which was above the consensus of economists at 0.3%, along with market pricing via inflation swaps, which were expecting +0.25%. It wasn’t just the headline number that came in strong however, as the core CPI measure was running at +0.32%, with decent increases in some of the stickier categories as well. It was also a broad-based move, as the Cleveland Fed’s trimmed mean CPI measure that excludes the biggest outliers rose to +0.40%. So the data cemented the picture that inflation has been ticking up in recent months, and if you just look at the last 3 months, the annualised rate of CPI is now at +4.9%, which is the highest it’s been since August 2022. That’s offering some pushback against the more positive inflation narrative from a couple of months ago, and on the back of the release, our US economists have upgraded their near-term expectations for inflation, largely because of a stronger trajectory in rental inflation. See their reaction note here for details.

When it comes to the Fed, there’s still pretty strong scepticism about a hike in November, which is only priced as a 10% chance. But when it comes to December, futures raised the chance of a hike to 39% by that meeting, up from 30% the day before. That was also supported by the latest jobless claims data, which came in at 209k (vs. 210k expected) over the week ending October 7, in line with the lower levels of more recent weeks.

We didn’t hear much from Fed officials themselves, apart from Boston Fed President Collins, who echoed other recent Fedspeak in saying that if the recent rise in yields persists, it “likely reduces the need for further tightening”. But she wouldn’t take further tightening off the table and said that “today’s CPI release is a reminder that restoring price stability will take time”. Chair Powell is due to speak on Thursday next week, just before the pre-meeting blackout period begins, so that’ll be an important event on the calendar.

For sovereign bonds, the CPI proved to be a tough backdrop, and the 10yr yield was up +14.0bps by the close to 4.70%. That was its biggest daily increase since early May, back when the 10yr yield was still below 3.5%, and the move was led predominantly by higher real yields, which rose +10.8bps on the day. For the 30yr yield the move was even more dramatic, with a +16.0ps rise to 4.85%, which was the biggest daily rise since March 2020 at the height of the financial turmoil around the Covid-19 pandemic. That wasn’t helped by a 30yr auction, which was awarded at a post-2007 high of 4.837%, as weak end-investor demand led to the largest primarily dealer take up of a 30-year auction since December 2021. 30yr yields spiked by around 5bps following the auction results.

Over in Europe, the sell-off also had a clear impact, with yields on 10yr bunds (+6.8bps), OATs (+7.5bps) and BTPs (+9.8bps) all moving higher. That wasn’t helped by the latest rise in natural gas prices, which were up another +15.05% to €53.00 per megawatt-hour, which is the highest they’ve closed at since February. The latest moves follow several concerns about global supply over recent days, as well as forecasts showing much cooler weather in Europe over next week. Fortunately, gas prices are still some way beneath their levels from this time last year, and European gas storage is also fuller than at this point in 2021 and 2022, but this is still a concerning trend at a time when recent CPI prints have already been returning the focus back to inflationary pressures.

Whilst equities had initially been resilient, they took a tumble in the US after the 30yr auction, and the S&P 500 ended the day -0.62% lower. T he declines were fairly broad-based, but small-caps took a particular hit and the Russell 2000 ended the day -2.20% lower, which is its worst daily decline since April. By contrast, the FANG+ index of megacap tech stocks still lost ground, but was only down -0.28%, whilst European markets closed before the worst of the US losses, meaning the STOXX 600 ended the day up +0.10%. Today will see earnings season begin to get going, so plenty to keep an eye out for, including releases from several US financials.

That downbeat mood has continued overnight in Asia, where the major equity indices have all lost ground. The Hang Seng (-2.11%) is the biggest underperformer, but other indices including the CSI 300 (-1.11%), the KOSPI (-0.98%), the Shanghai Comp (-0.64%) and the Nikkei (-0.42%) have also declined. The moves come as China’s inflation data was weaker than expected, with CPI at 0.0% in September on a year-on-year basis (vs. +0.2% expected). Looking forward however, US equity futures have stabilised overnight, with those on the S&P 500 up +0.11%.

In the political sphere, the US House of Representatives remains without a speaker for the time being, and the latest news is that House Majority Leader Steve Scalise has withdrawn his name. He’d previously won the GOP nomination for speaker by a 113-99 vote, but there was clear opposition to his candidacy from some other Republicans, and to become Speaker, they would need to win a majority of the entire House of Representatives, meaning they could only lose a very small number of Republicans given their narrow majority. Currently, the House is unable to conduct business until a new speaker is elected.

Looking at yesterday’s other data, UK GDP grew by +0.2% in August, in line with expectations. Later on, we also heard from BoE chief economist Pill, who said that interest rate decisions were becoming “finely balanced”.

To the day ahead now, and data releases include Euro Area industrial production for August, whilst in the US we’ll get the University of Michigan’s preliminary consumer sentiment index for October. From central banks, we’ll hear from ECB President Lagarde, Bundesbank President Nagel, BoE Governor Bailey, Deputy Governor Cunliffe, and the Fed’s Harker. Finally, today’s earnings releases include JPMorgan, Citigroup, Wells Fargo and BlackRock.