- APAC stocks traded mostly higher following gains on Wall St. and China's various stimulus measures.

- PBoC cut the RRR and 7-day reverse repo rate, whilst also announcing measures for the property sector and stock market.

- RBA kept its Cash Rate Target unchanged at 4.35%, as expected, while it reiterated that it is not ruling anything in or out.

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.5% after the cash market closed higher by 0.3% on Monday.

- Looking ahead, highlights include German Ifo, US Richmond Fed Index, NBH Policy Announcement, Speakers including Fed's Bowman & BoC's Macklem, Supply from UK, Germany & US.

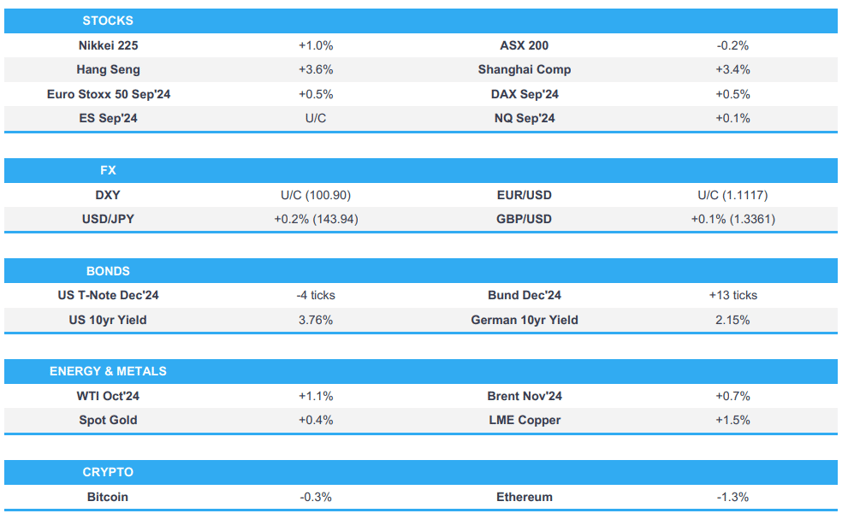

SNAPSHOT

More Newsquawk in 3 steps:

More Newsquawk in 3 steps:1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were choppy and the major indices eked mild gains to notch fresh record closes for the S&P 500 and the DJIA, although the small-cap Russell 2000 lagged as attention centred on a slew of weak PMI data releases from Europe, while the US figures were mixed and accompanied by inflationary commentary within the report. As such, the US release spurred two-way price action in T-Notes which ultimately settled flat ahead of supply this week, as well as a plethora of Fed speak on Thursday and key US PCE data on Friday.

- SPX +0.29% at 5,718, NDX +0.31% at 19,852, DJIA +0.15% at 42,125, RUT -0.34% at 2,220.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US intelligence official said foreign actors are using AI to influence the outcome of the US presidential election and that Russia has generated the most AI content to influence the US presidential election whereby the content is consistent with the broader Russian effort to boost Republican candidate Trump over Democrat Harris, while the US has not yet seen China using AI for any specific operations targeting US election outcomes.

APAC TRADE

EQUITIES

- APAC stocks traded mostly higher following gains on Wall St. and China's various stimulus measures.

- ASX 200 was subdued amid the RBA rate decision where the central bank unsurprisingly opted for a hawkish hold.

- Nikkei 225 gapped above the 38,000 level as it played catch up on its return from the long weekend.

- Hang Seng and Shanghai Comp were boosted after the PBoC, NDRC and NRFA press briefing where PBoC Governor Pan announced a cut in the RRR by 50bps and the 7-day reverse repo rate by 20bps to 1.50%, while it will reduce the MLF rate and guide the LPR lower. Furthermore, support measures were also announced for the property industry and China will create new tools to support the stable development of the stock market, as well as allow funds and brokers to tap PBoC funds to buy stock.

- US equity futures (ES U/C) were lacklustre and largely ignored China's support efforts.

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.5% after the cash market closed higher by 0.3% on Monday.

FX

- DXY lacked firm direction after failing to sustain the prior day's initial momentum with headwinds amid dovish Fed rhetoric.

- EUR/USD remained subdued and retested the 1.1100 level to the downside after the bloc's recent dismal PMI releases.

- GBP/USD traded sideways after yesterday's gains which coincided with the momentum in activity currencies.

- USD/JPY was choppy following the recent indecision and as comments from BoJ Governor Ueda loom.

- Antipodeans were contained amid a quiet data calendar but with mild support seen after the RBA kept rates unchanged and stuck to a hawkish tone.

FIXED INCOME

- 10yr UST futures were lacklustre after recent price swings owing to somewhat mixed US PMI data which included inflationary comments and with mostly dovish rhetoric from Fed officials who left the door open for further large interest rate cuts.

- Bund futures held on the prior day's gains but remained below the 135.00 territory ahead of German Ifo data and a Schatz auction.

- 10yr JGB futures were underpinned on return from the long weekend as a report noted that San-in Godo Bank, which operates in Japan's least populated area, is planning to return to government bonds after being stung by Fed hikes which could have major ramifications if its peers follow suit.

COMMODITIES

- Crude futures gradually gained amid heightened geopolitical tensions and China stimulus.

- BP (BP/ LN) cut oil and gas production at two US Gulf of Mexico platforms and curtailed output at two others, while it is removing non-essential staff from five US Gulf of Mexico platforms ahead of a predicted hurricane.

- Chevron (CVX) announced it was evacuating non-essential personnel from all Gulf of Mexico platforms including Anchor, Big Foot, Blind Faith, Jack/St. Malo, Petronius and Tahiti.

- Shell (SHEL LN) said it was monitoring tropical disturbance 35 for potential impacts to its assets and operations in the Gulf of Mexico where it has shut in production at its Stones asset and curtailed output at Appomattox.

- Russia sees oil and gas revenue shrinking for the next three years and is considering lifting an extra output tax on Gazprom in 2025, according to Bloomberg.

- Ukrainian President Zelensky said he held talks with Japanese PM Kishida on energy supplies in light of Russian attacks.

- Spot gold was little changed and retested all-time highs after the recent dovish rhetoric from some Fed officials.

- Copper futures were higher alongside the mostly positive risk appetite and China's policy support measures.

CRYPTO

- Bitcoin marginally declined and briefly dipped beneath the USD 63,000 level before recouping some of the losses.

NOTABLE ASIA-PAC HEADLINES

- PBoC Governor Pan announced to cut RRR by 50bps which will provide CNY 1tln worth of long-term capital and cut the 7-day reverse repo rate by 20bps to 1.50%, while he said they will guide LPRs lower and reduce the mortgage rate for existing mortgages in which the average reduction in the interest rate of existing mortgages will be about 0.5 percentage points. PBoC also lowered downpayments for second homes to 15% from 25% and will no longer distinguish between down payments for first and second homes which will be unified at 15%. Pan said they must support the steady recovery of prices in the economy and must coordinate monetary policy and fiscal policy, while he added the financial weighted reserve ratio for large banks will be reduced to 8% after the RRR cut and they might further cut RRR by year-end. Furthermore, he stated the MLF rate will be lowered by 0.3ppts and LPR will be lowered by 0.2-0.25ppts.

- China Securities Regulatory Commission Chairman said they will issue guidance for medium-term and long-term funds to enter the market and will issue measures to promote mergers, acquisitions and reorganisations. China will also release six new measures to support M&A soon and allow funds and brokers to tap PBoC funds to buy stock, while China reportedly plans at least CNY 500bln of liquidity to support stocks and is studying setting up a stock stabilisation plan.

- China NFRA head said China is to increase core tier-1 capital of the country's six largest commercial banks and will broaden the amount and proportion of equity investment restrictions, as well as establish a mechanism for coordinating financing of micro and small enterprises.

- Former US President Trump said he will call Chinese President Xi if elected to discuss the Phase One deal and added that China is not living up to the agreement. It was separately reported that Trump said regarding his tariff plans that he doesn't need Congress and would have the right to impose them himself, according to Washington Post's Stein.

- Germany's Economy Minister said a big part of the auto market problem lies in demand from China and it does not seem that this problem will be solved soon.

- RBA kept its Cash Rate Target unchanged at 4.35%, as expected, while it reiterated that the Board remains resolute in its determination to return inflation to the target and is not ruling anything in or out. RBA also repeated that inflation remains above target and is proving persistent, as well as stated that returning inflation to target is the priority. Furthermore, it said inflation is still some way above the midpoint of the 2–3% target range and the Board will rely upon the data and the evolving assessment of risks to guide its decisions.

- BoJ Governor Ueda says appropriate to increase rates if trend inflation heighten in line with our forecast. Will raise interest rate if economy and price move in line with forecasts shown in quarterly outlook report. Uncertainty surrounding the economy and prices is high. BoJ must conduct monetary policy in a timely and appropriate fashion without having a pre-set schedule, taking into account various uncertainties. Will watch with strong sense of urgency of US and overseas economic outlook, still unstable market developments. One-sided JPY falls have been reversed since August, and rise in import prices moderating. Can afford to spend time scrutinising market moves and overseas developments behind market developments. Must prevent a return to deflation.

GEOPOLITICS

MIDDLE EAST

- Israeli army chief said they launched a proactive offensive targeting combat infrastructure and are preparing for the next phases, while the Lebanese health ministry said the death toll from Monday’s IDF airstrikes rose to 492 with 1,645 wounded.

- Hamas armed wing said field commander Mahmoud Al-Nader was killed in an Israeli strike on southern Lebanon on Monday.

- It was initially reported that senior Hezbollah Leader Ali Karaki was reportedly killed in the latest raid in southern Beirut suburbs. However, a report later stated that Ali Karaki was injured during the targeting in Beirut but did not die, according to Al-Arabiya citing sources. Hezbollah also confirmed that its senior leader Ali Karaki was safe after the targeted Israeli strike on him in Beirut.

- US will reportedly send additional troops to the Middle East amid escalation, according to AP.

- US President Biden and UAE's leader said after their meeting that a two-state solution is the only framework for resolving the conflict, while it was also reported that the UAE expressed deep concern over Israeli attacks on southern Lebanon.

- US State Department senior official said the US has been working hard in recent days to find a diplomatic solution to the spike in fighting between Israel and Hezbollah, while the key focus for Secretary of State Blinken's discussion with allies is on finding an off-ramp to prevent further escalation and the US has some "concrete ideas" that it is going to be discussing to prevent escalation in the region.

- US Deputy Treasury Secretary told the Bank of Israel Governor of US concern about threats by some within the Israeli government to sever correspondent banking relationships between Israeli and Palestinian banks, while the Deputy Treasury Secretary insisted these relationships should be extended for at least a year and stressed these relations would be critical to preventing an economic crisis in the West Bank.

- EU's Borrell said the escalation in Lebanon is extremely worrying and that they are almost in a full-fledged war, while he added that they are still working to stop escalation in Lebanon but the worst expectations are becoming reality.

- Iran’s President said US policies support and encourage Israel in its open war and Washington's actions contradict its words, while Iran reaffirms that an open regional war will not be in the interest of anyone in the region and the world. Furthermore, he said Iran has sufficient capacity to strike Israel and their response will be at the right time and in the appropriate way, while he added that Israel's assassination of Haniyeh will not be without a response and their reply is coming.

- Iran’s President said at the UN Summit of the Future that Tehran aspires to “a world free of nuclear weapons and a Middle East free of weapons of mass destruction, without any preconditions”, according to journalist Abas Aslani via X.

- Iran's Foreign Minister denied statements attributed to Iran's President about a willingness to reduce tensions with Israel, while the Foreign Minister added that Israel will receive a response to attacks in due course, according to Al-Arabiya.

OTHER

- Ukrainian President Zelensky said Ukraine's war with Russia is 'closer to the end' and separately commented that US decisive action now could hasten an end to Russian aggression next year, according to ABC News and Reuters.

- EU's Borrell said it is clear that Russia has been receiving new weapons in particular, missiles from Iran, while he added that G7 will hold talks about providing long-range missiles to Ukraine to strike Russian territory.

- Venezuela's highest court approved an arrest warrant for Argentine President Milei who is a vocal critic and ideological rival of Venezuelan President Maduro, according to AFP News Agency. Argentine Justice requests international arrest of Venezuelan President Maduro for alleged human rights violations

EU/UK

NOTABLE HEADLINES

- UK PM Starmer is to argue that tough decisions are needed for the UK national renewal and say in his speech on Tuesday that there are no easy answers, according to FT. It was also reported by Huffington Post that PM Starmer is to warn of more pain to come as he pledges a new Britain.

- UK Chancellor Reeves is considering changing how the government’s fiscal rules are calculated to allow billions of pounds more in capital spending, according to The Guardian citing government sources.