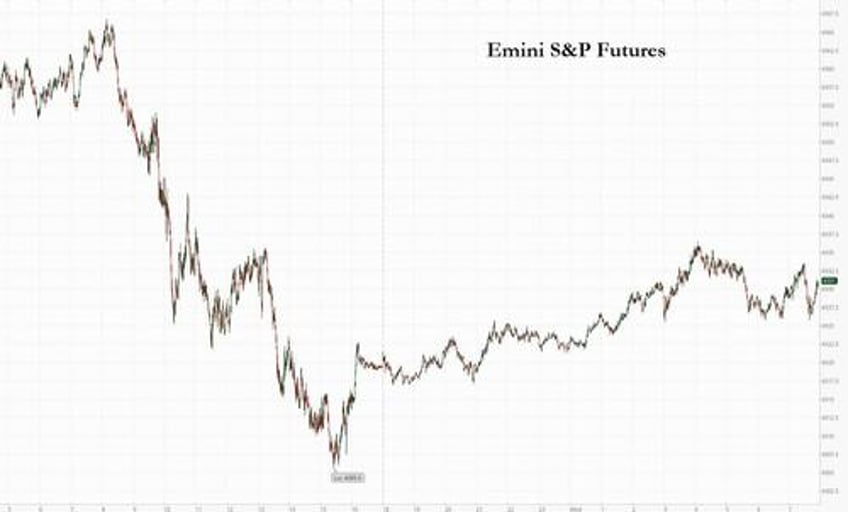

After Tuesday's sharp rout, US equity futures are higher despite another slump in Asian markets and mixed European bourses, potentially setting up a relief rally as yields are lower with 10Y under 4.50% even as investors keep a close eye on the risk of a government shutdown and the Dollar keeps rising to the point where another Plaza Accord may be required.

As of 7:45am ET, S&P futures were 0.4% higher while Nasdaq futures rose 0.3%; on Tuesday the DJIA fell below its 200-day moving average, a technical signal that suggests the index has become oversold while the VIX retreated after hitting its highest level since May. Commodities are mostly higher with WTI back above $91, leading Energy. Today's macro data focus is on durable goods and the 5Y Treasury auction ($49bn). Tomorrow we resume with Fed speakers and Friday’s PCE/Consumption data are the most impactful data points of the week.

In premarket trading, Costco fell 2% despite beating earnings estimates. The firm held back from commenting on the timing of its membership-fee increase, something Morgan Stanley sees as a slight disappointment. US cryptocurrency-related stocks rise in premarket trading while European peers also gain as Bitcoin jumps, halting a three-day losing streak. Bitcoin was up 2.5% at $26,790.63, as of 7:53 a.m. in New York.

Treasury yields slipped two basis points, backtracking from a 16-year high sparked by speculation the Federal Reserve will keep policy restrictive into next year, or longer. A gauge of the dollar traded near its highest this year. As Bloomberg notes, much rests on the bond market, which is guiding the direction for stocks and currencies, and ultimately the economy, according to Derek Halpenny, head of global markets research at MUFG Bank Ltd.

"If yields continue to move higher, at some point relatively soon we will see even larger equity market declines and a hit to the main engine of the US economy – the consumer,” Halpenny wrote in a note. “Falls in equity markets would impact expectations further and begin to impact consumers’ appetite to spend.”

As Bloomberg notes, US stocks are heading for their biggest monthly decline since December as investors worry the Fed would keep interest rates higher for longer at a time when economic growth is slowing. The Federal Reserve Bank of New York’s measure of how much bond investors are compensated for holding long-term debt turned positive for the first time since June 2021, suggesting traders are betting on elevated policy rates.

And in bad news for inflation, oil resumed its climb to $92 a barrel even as US consumer confidence has taken a knock from higher costs at the pump and the spreading impact of aggressive rate hikes. Consumer sentiment dropped to 103 from a revised 108.7 in August, missing the median estimate of 105.5 in a Bloomberg survey of economists.

Meanwhile, Senate Democratic and Republican leaders agreed Tuesday on a plan to keep the government open through mid-November and provide $6 billion in assistance to Ukraine. The plan to avert a shutdown on Oct. 1 still needs to overcome gridlock in the House.

European stocks are in the green, the Stoxx 600 is up just barely 0.1% and set to snap a four-day losing streak with technology, media and industrial names leading gains. Here are the biggest European movers:

- Adyen shares gain as much as 8% after Barclays upgrades the stock to overweight from equal weight, saying the Dutch payment processor has potential for growth.

- H&M shares rise as much as 6.8% after the Swedish apparel retailer reported third-quarter operating profit ahead of analysts’ estimates and announced a stock buyback. Morgan Stanley analysts called Wednesday’s update “better than feared.”

- Ithaca Energy shares gain as much as 9.1% after the UK approved the Rosebank offshore development, despite objections from climate groups and pressure on the government to block the oil and gas field.

- Logitech shares rise 4.3% after BNP Paribas Exane restarts coverage of the PC accessories maker at neutral, citing the potential benefit from a rebound in the gaming market and PC sales.

- Roche shares gain as much as 3.4%, the most in over a month, after Citigroup opened a positive catalyst watch on the pharmaceutical giant, citing the potential for royalty upside from its antibody engineering technologies subsidiary Chugai.

- Senior shares rise as much as 1.9% as the engineering products manufacturer receives a 12-year contract extension from Rolls-Royce, which Jefferies says is “helpful for sentiment.”

- Helvetia shares gain as much as 1.4% after the Swiss insurer reported what ZKB termed “operationally robust” key numbers for 1H23, while saying the profit contribution from life insurance was slightly worse than expected.

- Flutter Entertainment shares rise as much as 1.2% after the gambling operator announced the acquisition of a 51% stake in Serbia’s second-biggest omni-channel sports betting and gaming operator MaxBet for €141m in cash.

- Voltalia shares slump as much as 18%, the most on record, as Morgan Stanley says even the new lower full-year Ebitda guidance will require a very strong performance in the second half.

- NN Group shares plunge as much as 14% after a Dutch court ruling concluded that it shouldn’t have imposed certain costs and deductions on some unit-linked insurances. ASR Nederland falls as much as 9.4%.

- Centrica drops as much as 5.3% after Morgan Stanley downgrades the British Gas owner to equal-weight, saying it is now approaching fair value following a strong run.

- British Land falls as much as 2.9% and peers Derwent London, Great Portland and Land Securities all slid in early trading after Jefferies cuts its ratings on the four stocks, predicting offices to be the next major casualty in the real estate sector.

Earlier in the session, Asian equities declined, headed for a third-straight day of losses, as a bounce in Chinese stocks on strong economic data failed to offset investor concerns including higher US interest rates. The MSCI Asia Pacific Index declined as much as 0.6% before paring much of the loss, with industrials and financials the biggest drags. Stocks rose in Hong Kong and mainland China after data showed industrial profits for August grew at the fastest pace in at least a year. “There is quite a lot of negative sentiment and people are waiting to see good news before they are willing to jump in in China,” Alexander Treves, investment specialist at JPMorgan Asset Management, told Bloomberg Television. “There is just so much fear in the market, I think people are just nervous,” he said.

- Hang Seng and Shanghai Comp were positive after the PBoC pledged to step up policy coordination at its quarterly policy meeting and noted the need to enhance efforts of macro policy adjustments, while sentiment was also underpinned by the improvement in Industrial Profits which returned to growth for August.

- Australia's ASX 200 was lower albeit with downside stemmed as participants digested the monthly CPI data from Australia which matched expectations at 5.2% Y/Y but accelerated from the prior.

- Japan's Nikkei 225 initially underperformed and briefly dipped below 32,000 before bouncing off lows.

In FX, the Bloomberg Dollar Spot Index rises 0.1%. The Norwegian krone is the best performer among the G-10’s, rising 0.2% versus the greenback. USD/JPY is little changed around 149.10. The Scandinavian currencies led gains as short-covering set the tone while quarter-end flows made their way through the market as spot transactions cover month-end value date. EUR/SEK fell as much as 0.5% to 11.5609, its lowest level since July 31; EUR/NOK fell as much as 0.6% to 11.3684, its lowest since Aug. The pound fell against the US dollar for a sixth session, hitting its lowest since March, as traders home in on a diverging outlook for the US and UK economies; GBP/USD -0.1% to 1.2149. AUD/USD reversed gains to fall 0.3% to 0.6381; it rose earlier after data showed Australia’s inflation quickened last month, bolstering the case for the Reserve Bank to hike at least one more time. The yen remained steady after weakening beyond 149 per dollar for the first time since October 2022 on Tuesday

In rates, treasuries are slightly richer across the curve with gains led by long-end, following bull-flattening move in core European rates. US yields have pulled back from cycle highs with 30-year borrowing costs falling 4bps to 4.63%. Long-end yields richer by more than 3bp on the day, flattening 5s30s spread by 1.5bp as belly lags; 10-year, down 3bp at 4.51%, outperforms bunds by ~1bp in the sector while gilts keep pace. Treasury auctions resume with $49b 5-year note sale at 1pm; cycle concludes Thursday with $37b 7-year note. The US session includes 5-year note auction poised to draw highest yield since 2007; Tuesday’s 2-year sale stopped on the screws. Dollar IG issuance slate includes World Bank 7Y with moderate issuance expected; five companies sold about $10b of new debt Tuesday, bringing weekly volume to $14.4b vs $15b-$20b estimate.

In commodities, crude futures advance, with WTI rising 1.2% to trade near $91.40. Spot gold falls 0.3%.

Looking to the day ahead, data releases include the Euro Area money supply for August, and in the US there’s the preliminary August reading for durable goods orders and core capital goods orders.

Market Snapshot

- S&P 500 futures up 0.5% to 4,335.00

- STOXX Europe 600 up 0.4% to 449.51

- German 10Y yield little changed at 2.80%

- Euro little changed at $1.0565

- MXAP up 0.2% to 158.03

- MXAPJ up 0.1% to 489.20

- Nikkei up 0.2% to 32,371.90

- Topix up 0.3% to 2,379.53

- Hang Seng Index up 0.8% to 17,611.87

- Shanghai Composite up 0.2% to 3,107.32

- Sensex up 0.2% to 66,082.34

- Australia S&P/ASX 200 down 0.1% to 7,030.35

- Kospi little changed at 2,465.07

- Brent Futures up 0.8% to $94.75/bbl

- Gold spot down 0.2% to $1,896.53

- U.S. Dollar Index little changed at 106.19

Top Overnight News

- China's central bank said it would step up policy adjustments and implement monetary policy in a "precise and forceful" manner to support an economy whose recovery was improving with "increasing momentum". The PBOC will keep liquidity reasonably ample and maintain stable credit expansion, the bank said in a statement after a quarterly meeting of its monetary policy committee. RTRS

- Evergrande Chairman Hui Ka Yan was placed under Chinese police control, people familiar said. It's not clear why Hui is under residential surveillance, a type of police action that falls short of formal detention, but the move is the latest sign that the Evergrande saga has entered a new phase involving the criminal justice system. BBG

- UBS will seek today to convince France's top court to overturn a conviction and €1.8 billion penalty for helping wealthy French clients stash away undeclared funds in Swiss accounts. BBG

- Italy is seeking to turn Monte Paschi into the country's third-largest bank by merging it with one of its peers, people familiar said. The government's favorite option would be a merger between Paschi and firms of a similar size such as Banco BPM or BPER Banca. There are so far no formal talks with those lenders, which have denied any interest in Paschi. BBG

- France will cut public spending only slightly in its proposed budget for next year and faces rising interest costs on its national debt, raising questions about President Emmanuel Macron’s government’s ability to clean up the public finances. FT

- The US is on track for an Oct. 1 government shutdown given incremental progress in both the House and Senate on rival spending bills. And neither stopgap measure has a clear path to passage in the other chamber. A shutdown would be an obvious drag on growth, as private contractors and federal workers aren't paid (including 1.3 million active-duty military) and consumer uncertainty grows. BBG

- Hospitality workers in Las Vegas have voted overwhelmingly to authorize a strike against major resorts along the Strip, a critical step toward a walkout as the economically challenged city prepares for major sporting events in the months ahead. NYT

- The second GOP primary debate kicks off at 9 p.m. Eastern in California. Frontrunner Donald Trump has again chosen to skip the event. Ron DeSantis has the most at stake — can he recover from a lackluster showing last month to prove himself a viable Trump alternative? Vivek Ramaswamy, Nikki Haley and Mike Pence will look to repeat fiery performances. BBG

- TikTok Employees Say Executive Moves to U.S. Show China Parent’s Influence. U.S. staff have raised questions internally about recent personnel transfers from ByteDance. WSJ

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed as a rebound in Chinese Industrial Profits partially offset the subdued handover from Wall St. where the major indices extended on losses heading closer to month-end. ASX 200 was lower albeit with downside stemmed as participants digested the monthly CPI data from Australia which matched expectations at 5.2% Y/Y but accelerated from the prior. Nikkei 225 initially underperformed and briefly dipped below 32,000 before bouncing off lows. Hang Seng and Shanghai Comp were positive after the PBoC pledged to step up policy coordination at its quarterly policy meeting and noted the need to enhance efforts of macro policy adjustments, while sentiment was also underpinned by the improvement in Industrial Profits which returned to growth for August.

Top Asian News

- China is able to achieve economic growth of slightly higher than 5% this year, according to a PBoC advisor cited by Reuters. PBoC advisor added that China has relatively ample policy room to support economic growth. China's economy can avoid "Japanification", said the PBoC Advisor.

- PBoC's policy committee held a meeting on Q3 monetary policy and vowed to step up policy coordination, while it stated that they need to enhance efforts of macro policy adjustment and will implement monetary policy in a precise and forceful manner. PBoC also pledged to keep prices at a reasonable level and prevent excessive adjustments in exchange rates. Furthermore, it is to promote a healthy and stable development of the property market and will implement financial support measures to improve the healthy development of the platform economy according to Bloomberg and Reuters.

- PBoC Governor Pan met with EU trade chief Dombrovskis on China-EU financial cooperation.

- China put Evergrande's (3333 HK) Chairman Hui under police control, while Hui was taken away by Chinese police earlier this month and is being monitored at a designated location, according to Bloomberg.

- China's funding round to support the semiconductor industry is struggling in the initial phases to raise the target of USD 41bln, according to FT.

- "China is expected to see 190mln railway passenger trips during the 12-day travel rush starting Wed for the National Day holiday, which will peak on Sept 29", according to People's Daily, "with over 20mln trips to be made on a single day."

- "China will further pursue high-level market opening up with services sector opening up as a focus and shorten negative list for investment in the free trade zones, according to Vice Commerce Minister" cited by Global Times.

- PBoC set USD/CNY mid-point at 7.1717 vs exp. 7.3103 (prev. 7.1727)

- Chinese state banks were said to be selling dollars onshore to boost the yuan.

- RBI likely sold dollars in the NDF market at around 83.24-83.25 ahead of the spot market open, according to traders cited by Reuters.

- BoJ July meeting minutes noted it is important to continue easing and members also agreed it was important to check whether wage hikes will continue next year and onwards, while a few members said the chance of firms continuing to raise wages next year was high. Furthermore, many members said stable and sustained achievement of the price target accompanied by wage growth was not yet in sight.

- Japanese PM Kishida said Japan is to create next tax break for domestic investments in strategic areas including batteries, EV and semiconductors, according to Reuters.

European bourses are firmer in early trade, albeit it is hard to see today’s bounce as much more than a reprieve from recent losses with not a great deal changing since yesterday’s close other than a rebound in Chinese industrial profits which helped buoy sentiment overnight. Sectors in Europe are mostly firmer with Tech top of the pile alongside Autos and Banks. On the downside, Utilities sit at the foot of the leaderboard. US futures are trading firmer, with sentiment improving following yesterday's sell-off, which was ultimately void of any pertinent data releases. The docket remains lacklustre for the remainder of the day, with a focus on US MBAs and Durable Goods.

Top European News

- German institute sees 2025 inflation at 1.9% and GDP at 1.5%, according to Handelsblatt.

- Italy's Energy Authority Chairman expects a rise in electricity bills with a three-monthly update on Thursday, according to Reuters.

FX

- DXY consolidates gains on the 106.00 handle within a 106.16-32 range as month/quarter-end rebalancing demand offsets negative factors.

- Aussie lags below 0.6400 vs Buck irrespective of upturn in CPI, Kiwi loses momentum above 0.5950.

- Pound flounders under 1.2200 and edges closer to Fib protecting round number below, while EUR/USD trades sub-1.0600 post weak Eurozone M3.

- Yen pivots 149.00 against the Greenback with some support from bull-flattening in USTs

Fixed Income

- Price action is decidedly more encouraging or less destructive than it has been for a while and decent blocked curve flatteners underpinned Treasuries overnight.

- Bonds have bounced a bit further and Bunds could garner more momentum given a well-received German 10-year offering that was twice oversubscribed, but there are gaps still to fill before making a full recovery from Tuesday’s trough

- The same applies to Gilts in wake of a strong 2073 DMO auction and T-notes are awaiting 2-year FRN plus 5-year conventional issuance.

- UK sells GBP 0.75bln 1.125% 2073 Gilt: b/c 2.88x, tail 0.1bps and average yield 4.289%.

- Germany sells EUR 3.247bln vs exp. EUR 4bln 2.60% 2033 Bund: b/c 2.0x (prev. 1.7x), average yield 2.78% (prev. 2.63%) & retention 18.83% (prev. 18.04%)

- French Net Debt issuance seen at EUR 285bln in 2024 (vs EUR 270bln in 2023), according to the AFT.

Commodities

- Crude futures are firmer intraday and not far off session highs after resisting yesterday’s risk aversion to settle higher by around USD 0.70/bbl apiece, buoyed by bullish fundamentals and the prospect of a tighter market in Q4.

- Dutch TTF prices are softer intraday, with the October contract back under EUR 40/MWh but off worst levels at the time of writing, with newsflow for the complex light whilst desks eye the upcoming winter season.

- Spot gold is subdued after finally falling back under USD 1,900/oz in APAC trade, although losses at the time of writing, are minimal as markets await the next catalyst.

- Base metals are mostly softer as DXY remains firm, although the complex saw a leg higher overnight after Chinese Industrial Profits were better than expected.

- US Energy Inventory Data (bbls): Crude +1.6mln (exp. -0.3mln), Gasoline -0.1mln (exp. -0.1mln), Distillates -1.7mln (exp. -1.3mln), Cushing -0.8mln.

- Polish Farm Minister said talks are at a final stage with Lithuania regards to getting Ukrainian grain to ports in Lithuania; talks are going in a good direction, according to Reuters.

Geopolitics

- US Secretary of State Blinken spoke with Azerbaijan President Aliyev to emphasise the need to refrain from further hostilities in Nagorno-Karabakh and to provide assurances to residents there, while Binken urged Aliyev to commit to broad amnesty and allow observer missions, according to the State Department.

- The US restricted imports from three more companies in China's Xinjiang connected to forced labour.

- China's Taiwan Affairs Office said the aim of Chinese drills near Taiwan is to resolutely combat the arrogance of separatist forces, according to Reuters.

- Chinese Foreign Ministry, on the Philippines removing barriers in disputed waters, said the islands are Chinese territory, will safeguard territorial sovereignty over the area, according to Reuters.

- Chinese Foreign Ministry, on US restricting imports from China on forced labour concerns, said China will take measures to safeguard Chinese companies' legitimate rights, according to Reuters.

- North Korea's UN Envoy told the UN General Assembly that 2023 is an extremely dangerous year as the Korean peninsula was driven closer to the brink of nuclear war and blamed the US and South Korea for the current dangerous situation.

US Event Calendar

- 07:00: Sept. MBA Mortgage Applications, prior 5.4%

- 08:30: Aug. Durable Goods Orders, est. -0.5%, prior -5.2%

- Aug. Durables Less Transportation, est. 0.2%, prior 0.4%

- Cap Goods Ship Nondef Ex Air, est. 0%, prior -0.3%

- Cap Goods Orders Nondef Ex Air, est. 0.1%, prior 0.1%

Fed speakers

- 08:00: Fed’s Kashkari Speaks on CNBC

DB's Jim Reid concludes the overnight wrap

It was another rough session in markets over the last 24 hours, with a fresh sell-off taking place across several asset classes that accelerated into the US close. Multiple factors were responsible, but an important one was the US Conference Board’s latest consumer confidence data, which showed a larger-than-expected decline in September. That led to growing concern about the economic outlook, and it meant the S&P 500 (-1.47%) fell to a 3-month low, having now shed -3.83% over the last week alone. It also pushed the VIX index of volatility up to a 3-month high of 18.94pts. But despite the weak numbers on the economy, sovereign bonds saw little respite either, with 10yr yields inching their way to new highs on both sides of the Atlantic. So a tough backdrop across the board, and overnight we’ve also seen oil prices move back up to their recent highs, with Brent crude at $94.90/bbl .

When it came to that Conference Board data, the main takeaway was the decline in the consumer confidence measure to 103.0 in September (vs. 105.5 expected). Not only was that the lowest reading since May, but it also marked the biggest decline relative to the previous month (-5.7pts) since August 2021. And looking at the components, we also saw the expectations reading fall to a 4-month low of 73.7, suggesting that the cautious optimism of the summer months might turn out to have been short-lived. To be fair though, it wasn’t all bad news from that release. For instance, the difference between those saying jobs are plentiful compared with those who say they’re hard to get actually improved in September, rising to +27.3%.

That weakness in consumer confidence comes as the US government is still days away from a potential government shutdown, unless Congress can agree to pass funding beyond September 30. In terms of the latest, a bipartisan deal has emerged in the Senate, which would keep the government open until mid-November. However, it’s uncertain as to whether that would be brought to a vote in the Republican-controlled House, and Speaker McCarthy said that he’d put a different stopgap funding measure on the floor this week, saying that a vote would probably be on Friday. If there is a shutdown, that could affect several upcoming data releases depending on how long it lasted, including the September jobs report on October 6 .

Rising pessimism about the near-term outlook meant that equities lost significant ground yesterday. That included the S&P 500 (-1.47%), which hit a 3-month low thanks to a broad-based decline. Furthermore, the losses yesterday mean that the equal-weighted S&P 500 is now in negative YTD territory again at -0.16%, which just shows how narrow this year’s rally has been, given the overall index is still up +11.30% YTD. Tech stocks saw a slight underperformance, mostly due to a -4.03% fall for Amazon on news of an antitrust case being launched by the Federal Trade Commission. Elsewhere, European equities saw further losses as well, and the STOXX 600 (-0.61%) closed at a 2-month low. Amid the broad equity weakness, the MSCI All Country World Index (-1.20%) fell for an eighth day in a row. Likewise, there were also signs of the risk-off tones weighing on credit markets, with US HY spreads (+9bps) widening to a 2-month high of 396bps .

Whilst this backdrop might have seemed more favourable for sovereign bonds, yesterday saw modest losses for long-end bonds, and Bloomberg’s aggregate bond index hit a fresh low for 2023 so fa r. In the US, the 10yr Treasury yield rose +0.2bps to 4.54%, which is their highest closing level since 2007, although they’ve slipped overnight and are back down to 4.52%. Similarly, the 30yr yield (+2.3bps) also hit a new cycle high of 4.68%. Moreover, it was real yields that continued to drive those moves, leading to another set of milestones across the curve. Among others, yesterday saw the 2yr real yield (+5.9bps) close at 3.19%, the 5yr real yield (+4.0bps) close at 2.43%, and the 10yr real yield (+4.5bps) close at 2.22%. In every case, that’s their highest level since the GFC, and it demonstrates how the impact of higher borrowing costs is still filtering through into the economy.

Sovereign bonds also struggled in Europe, but it was Italian BTPs that saw the biggest underperformance, with 10yr yields up +8.0bps. That comes as the Italian government is set to present its latest budget projections today, and the focus will be on what deficit level is expected. Bloomberg reported yesterday that the deficit could be as wide as 4.5%, and our own European economists examine the issue in more depth here. Ahead of the announcement, the spread of Italian yields over bunds widened to 193bps, which is its highest closing level since March. Nonetheless, the sell-off among European sovereign bonds wasn’t confined to Italy, and yesterday saw yields on 10yr bunds (+1.1bps) close at 2.80%, which is the highest they’ve been since 2011 .

Asian equity markets have posted a mixed performance this morning, with losses for the Nikkei (-0.36%) and the KOSPI (-0.22%), alongside advances for the Hang Seng (+0.64%), the CSI 300 (+0.31%) and the Shanghai Comp (+0.33%). In part, that boost for Chinese equities followed data showing that industrial profits in China were up +17.2% year-on-year in August, up from a -6.7% year-on-year reading in July. Elsewhere, the main data release was the Australian CPI for August, which saw an uptick to +5.2%, in line with expectations .

Lastly, we had a few data releases on US housing, which painted a divergent picture. On the one hand, new home sales fell to an annualised rate of 675k in August (vs. 698k expected). That’s the lowest they’ve been in 5 months, and the -8.7% decline on the previous month was the largest since September 2022. But on the other hand, the July house price data showed faster-than-expected growth. For example, the S&P CoreLogic Case-Shiller 20-City index was positive for a 5th consecutive month, at +0.87% (vs. +0.70% expected), which took the year-on-year number back into positive territory for the first time since February, at +0.13%. Meanwhile, the FHFA house price index was up +0.8% in July (vs. +0.4% expected).

To the day ahead now, and data releases include the Euro Area money supply for August, and in the US there’s the preliminary August reading for durable goods orders and core capital goods orders.