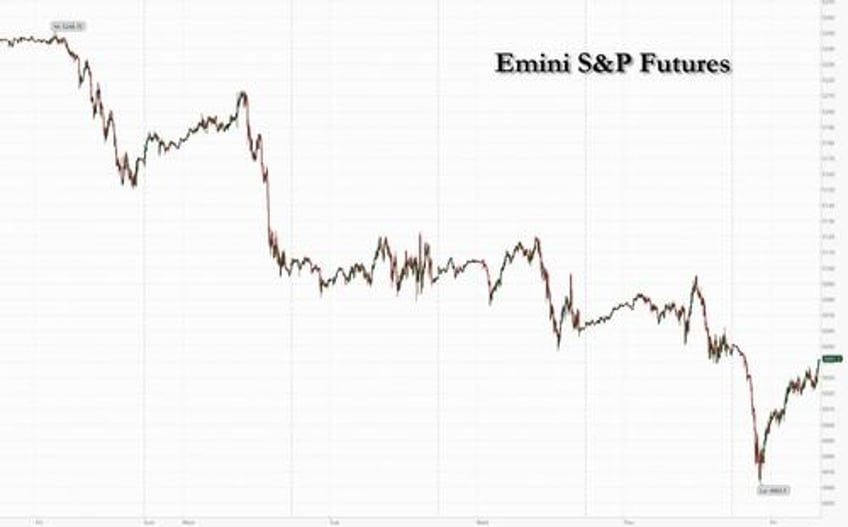

While US futures are still modestly in the red, they are not only well off the worst overnight levels, but they are almost unchanged since yesterday's close following a performative Israeli retaliation. which followed a performative Iranian attack, which appears to be the end of the story. For those who missed it, early on Friday local time, explosions echoed over an Iranian city on Friday in what sources described as an Israeli attack, but Tehran played down the incident and indicated it had no plans for retaliation - a response that appeared gauged towards averting region-wide war. The limited scale of the attack and Iran's muted response both appeared to signal a successful effort by diplomats who have been working round the clock to avert all-out war since an Iranian drone and missile attack on Israel last Saturday. And so, after a whole lot of nothing overnight, as of 730am, S&P futures are practically unchanged at 5,045, Brent is actually lower compared to Thursday's close after briefly rising above $90 earlier, gold is unchanged, bonds are modestly firmer though have pared the majority of the overnight advances, and bitcoin is higher after aggressively dumping late on Thursday. There is nothing of significance on today's calendar.

Premarket, megacap tech are mostly lower: TSLA -1.8%, NVDA -1.1%, AMZN -95bp, META -91bp. NFLX tumbled fall 6.6% after the streaming-video company reported its first-quarter earnings. While the results were better than expected, with customer additions especially strong, its second-quarter revenue forecast was a slight disappointment. Here are some other notable premarket movers:

- First Solar shares gain 1.8% after an upgrade to overweight at Wells Fargo.

- Intuitive Surgical shares climb 2.2% after the medical equipment manufacturer reported adjusted earnings per share for the first quarter that beat the average analyst estimate.

- ON Semi shares slip 3.1% after a downgrade to underperform at BNPP Exane.

- Paramount shares jump 11% as Apollo Global and Sony are said to be considering a joint offer for the media company.

- Shopify advances 3.2% after the e-commerce company was upgraded to overweight from equal-weight at Morgan Stanley, which said upmarket share gains “support confidence in the durability of growth against tempered consumer-spending expectations.”

The latest fake escalation cap a dismal week for markets after solid economic readings and hawkish Fedspeak that have overturned Powell's December pivot and have forced investors to revise the timing of a keenly anticipated pivot to easier policy and the scale of potential rate cuts.

“With inflation sticky, central banks don’t have the option to look through spikes in oil prices, should they happen,” said Rajeev De Mello, a global macro portfolio manager at GAMA Asset Management. “They will have to revert to higher for longer rates which at this stage will be a shock to all markets.”

The latest the spook the market was NY Fed President John Williams who said while it isn’t his baseline expectation, even a rate hike is possible if warranted. His Atlanta counterpart Raphael Bostic said he doesn’t think it will be appropriate to ease until toward the end of 2024. The Fed may hold rates steady all year, Minneapolis Fed chief Neel Kashkari told Fox News Channel.

Meanwhile, on the geopolitical front, an Iranian military official signaled Tehran doesn’t feel compelled to react to the blasts which US officials say were caused by Israeli strikes, with semi-official Mehr agency quoting Army Commander-in-Chief Abdolrahim Mousavi saying Tehran has already reacted to Israeli threats. Despite Friday’s moves to allay fears of a wider war in the Mideast, the events are unsettling and will keep investors from taking bold bets, according to Michael Brown, strategist at Pepperstone Group Ltd. in London.

“No one will want to be short of crude and the havens ahead of the weekend,” he said. “From a risk-management perspective you can’t say definitively that geopolitical risk is done and dusted. So we may see another bout of de-risking. Ultimately it’s a case of people being reluctant to take on too much exposure.”

Europe's Stoxx 600 is down 0.4%, but it too reversed most of the overnight losses. The food, beverage and tobacco sub-index leads gains whlie retail stocks decline the most. In company news, L’Oreal surged after better-than-expected quarterly sales. Here are the most notable European movers:

- L’Oreal (OR FP +4.3%) rises after the cosmetics maker’s like-for-like sales beat in the first quarter, quelling worries over a slowdown in the beauty market

- Royal Unibrew (RBREW DC +12%) soars after the brewer reported preliminary net revenue and Ebit that came ahead of consensus expectations

- Warehouses De Pauw (WDP BB +4.2%) rises after releasing 1Q earnings, with Oddo BHF seeing results broadly in line with expectations

- Sodexo (SW FP +1.9%) advances after the food services firm reported an organic revenue growth beat for the first half and raised its sales growth guidance

- Suess MicroTec (SMHN GY +4.4%) gains after Stifel upgraded its view on the semiconductor equipment maker to buy on its strong preliminary first-quarter

- Volvo (VOLVB SS -4.6%) falls after holder Geely sells the entirety of its class B shares in the truckmaker. Kepler Cheuvreux says the move is not much of a surprise

- Man Group (EMG LN -5.3%) falls after first quarter results showed net outflows of $1.6 billion in the period, mainly from the hedge fund firm’s alternative money pools

- Sartorius Stedim (DIM FP -4.8%) drops following results that disappointed investors. Intron Health cut its price target to the lowest among analysts tracked by Bloomberg

- EssilorLuxottica (EL FP -1.5%) falls after the glasses manufacturer reported revenue for the first quarter broadly in line with market expectations

- Schneider Electric (SU FP -2.6%) falls after announcing discussions with Bentley Systems on a potential strategic transaction. Oddo says it would be a good fit, but flags some questions surrounding the valuation

- Eurocash (EUR PW -4.8%) drops as the food retailer and wholesaler reported a 16% Ebitda deterioration in 1Q due to higher wages and a price war between discounters

In FX, the Bloomberg Dollar Spot Index is little changed while the Swiss franc remains the best performer among the G-10’s, rising 0.4% versus the greenback. The pound gains 0.1% with little reaction shown to weaker-than-expected UK retail sales data.

In rates, treasuries remain richer across the curve after paring the Asia-session advance sparked by reports Israel launched retaliatory strike on Iran. Yields lower by 4bp to 6bp as US trading gets under way, back toward middle of day’s range. US 10-year yields around 4.58% after briefly dropping below 4.50% during Asia session; inverted 2s10s spread remains near lows of the day as intermediates outperform, flatter by around 2bp. Fed rate-cut expectations edged higher, with OIS pricing in 41bp of easing by year-end vs 38bp at Thursday’s close. Treasury coupon auctions next week — final ones of the February-to-April financing quarter — include 2-, 5- and 7-year notes Tuesday to Thursday.

In commodities, WTI crude oil futures are down ~1% near $82/bbl after erasing a more than 4% surge above $86/bbl as media in both countries appeared to downplay the severity of the incident. Gold is unchanged around $2377.

Bitcoin rises 2% ahead of the halving event expected later Friday.

US economic data slate empty for the session; Fed speakers include Goolsbee at 10:30am, and Fed releases Financial Stability Report at 4pm.

Market Snapshot

- S&P 500 futures down 0.5% to 5,024.25

- MXAP down 1.7% to 167.50

- MXAPJ down 1.6% to 514.79

- Nikkei down 2.7% to 37,068.35

- Topix down 1.9% to 2,626.32

- Hang Seng Index down 1.0% to 16,224.14

- Shanghai Composite down 0.3% to 3,065.26

- Sensex up 0.7% to 73,010.87

- Australia S&P/ASX 200 down 1.0% to 7,567.28

- Kospi down 1.6% to 2,591.86

- STOXX Europe 600 down 0.7% to 496.11

- German 10Y yield little changed at 2.47%

- Euro little changed at $1.0647

- Brent Futures little changed at $87.12/bbl

- Gold spot up 0.1% to $2,382.51

- US Dollar Index little changed at 106.10

Top Overnight News

- Israel launched a retaliatory strike on Iran less than a week after Tehran’s rocket and drone barrage, according to two US officials. Iran downplayed the incident and said an attack by Israeli drones failed. The IAEA said no nuclear sites were damaged. Iran said it has no plans to retaliate immediately. BBG

- China ordered Apple to remove some of the world’s most popular chat messaging apps from its app store in the country, the latest example of censorship demands on the iPhone seller in the company’s second-biggest market. “We are obligated to follow the laws in the countries where we operate, even when we disagree,” an Apple spokesperson said. WSJ

- China to impose increased fees on imports of propionic acid from the US, a move that comes just days after Biden called for higher tariffs on Chinese steel/aluminum imports. WSJ

- Japan’s national CPI undershoots the Street in Mar, coming in at +2.9% (ex-food/energy) vs. the Street’s +3% forecast (and down from +3.2% in Feb). RTRS

- Raphael Bostic reiterated his view that the Fed shouldn’t lower rates until closer to the end of the year, while Neel Kashkari raised the prospect of holding all year. BBG

- A full panel of 12 jurors has now been selected to decide Donald Trump’s criminal trial in Manhattan, the first for a former American president and a crucial challenge to his bid to regain the Oval Office. Several more alternate jurors still need to be chosen, but the judge overseeing the case indicated that opening statements could begin on Monday. NYT

- NVDA is the subject of a somewhat cautious cover story in Barron’s, with the article focused on the intense competition facing the company, from both 3rd parties (like AMD) and some of its largest customers. Barron's

- US bank reserves fell by $286 billion in the week through Wednesday — the largest drop in two years — as Americans paid income tax, Fed data show. Total holdings in the banking system were $3.33 trillion, a level Fed officials weighing the path for QT may characterize as abundant, though reserves are pushing nearer to scarcity. BBG

- Tesla recalled 3,878 Cybertrucks, an NHTSA notice showed. It said the accelerator pedal pad may dislodge and become trapped, causing the vehicle to accelerate unintentionally and increasing the risk of a crash. BBG

Earnings

- Netflix Inc (NFLX) Q1 2024 (USD): EPS 5.28 (exp. 4.52), Revenue 9.37bln (exp. 9.28bln), Q1 Subscriber Additions 9.33mln (exp. 5.11mln). Guides Q2 EPS USD 4.68 (exp. 4.54). Guides Q2 revenue USD 9.49bln (exp. 9.51bln). Guides Q2 Subscriber Additions to be lower in Q2 vs Q1 due to typical seasonality (exp. 3.51mln). Guides Q2 operating margin 26.6% (exp. 25.4%).Will stop reporting quarterly member ship number and ARM starting from Q1 2025 earnings. Shares -6.1% pre-market

- L'Oreal shares gained as much as 4.2% in the European session after strong results and making note of strong growth in China.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were lower across the board as the initial tech-related selling stemming from Wall St was exacerbated by reports of explosions in Iran following an Israeli operation although stocks are off today's worst levels as Iran downplayed and later denied the attack. ASX 200 was pressured with losses led by underperformance in tech and amid the bout of geopolitical-related turmoil. Nikkei 225 suffered intraday losses of around 3% and briefly dipped beneath the 37,000 level.

Hang Seng and Shanghai Comp. were lower but with losses only mild compared to the regional counterparts

Top Asian News

- BoJ Governor Ueda said there is a chance weak Yen may affect trend inflation and if so, could lead to a policy shift.

- Nissan (7201 JT) downgrades guidance: revises 2023/24 forecasts (JPY): Net 370bln (prev. 390bln), Operating 530bln (prev. 620bln); revision lower due to lower sales volume from and various cost reliefs made to suppliers e.g. inflation & other factors.

- Japanese Cabinet Secretary Hayashi says continue to closely monitor impact from oil prices on Japanese economy with a sense of urgency.

- South Korean regulator chief says will closely monitor markets and prepare to deploy market stabilising measures as needed

European bourses, Stoxx600 (-0.6%) are entirely in the red, with sentiment hit after Israel conducted an operation against Iran on a military airbase near Isfahan; though Iran later downplayed the attack, which helped to lift sentiment off worst levels, with contracts continuing to pare losses in otherwise quiet newsflow. European sectors hold a strong negative tilt; Industrials is found at the foot of the pile, with Schneider Electric (-1.9%) leading the losses. Autos are also lagging, after Nissan downgraded its guidance citing lower sales volume. US Equity Futures (ES -0.6%, NQ -0.8%, RTY 0.7%) are entirely in the red, though very much off worst levels seen overnight, sparked by the Israeli attacks on Iran. As for stock specifics, Netflix (-6.1%) is lower in the pre-market despite reporting strong headline metrics; however, the Co’s Q2 guidance fell short of expectations.

Top European News

- ECB's Vujcic said so far FX market has been very calm about the risk of Fed-ECB divergence.

- ECB's Kazaks says it is too soon to declare victory on inflation, economy isn't strong by confidence is improving. ECB takes the Fed into account.

- German government expects GDP to grow 0.3% in 2024 (prev. forecast of 0.2%), according to Reuters sources; sees inflation at 2.4% (prev. 2.8%).

- US President Biden weighs more than USD 1bln in new arms for Israel; Considering supply tank shells, mortars and vehicles, via WSJ

FX

- USD is mixed vs peers, with the Dollar softer against safe-havens JPY and CHF but out-muscling risk-sensitive AUD and NZD. DXY went as high as 106.35 before scaling back gains.

- EUR is firmer vs. the USD after recovering geopolitically-inspired losses overnight which dragged the pair to a 1.0611 trough; currently off lows at 1.065.

- Yen slightly firmer vs. the USD despite softer-than-expected Japanese inflation metrics overnight. Safe-haven status is likely playing a role here but ultimately the pair remains on a 154 handle after delving as low as 153.60.

- Antipodeans are both lower vs. the USD and suffering in the current risk environment. AUD/USD printed a fresh YTD trough at 0.6362, though has since pared.

- CBRT Survey: End 2024 CPI 44.16% (prev. 44.19%), 12-month CPI 35.17% (prev. 36.7%), 2024 GDP 3.3% (prev. 3.3%), end-2024 USD/TRY 40.0098 (prev. 40.5344). 12-month Repo Rate 38.18% (prev. 36.96%)

Fixed Income

- USTs have pulled back from overnight geopolitics-induced highs of 108-22+ with newsflow otherwise limited and the docket sparse as we approach the Fed blackout. USTs climbed over 20 ticks during the initial reporting of an Israel strike on Iran, before peaking and beginning to pullback as Iran downplayed the attacks.

- Gilts gapped higher by 20 ticks as the benchmark reacted to overnight developments, though USTs had already pared much of their move by this point hence the somewhat modest open. Further dovish-impetus drawn from another broadly unchanged UK Retail Sales M/M print. Gilts currently around the mid-point of 96.68-97.01 parameters.

- Bund price action has mimicked that of USTs, with little regional catalysts to spark a reaction. Currently just into the green and at the mid-point of the week's 130.97-132.55 range with the 10yr yield similarly holding a few bps shy of the 2.50% mark.

Commodities

- Brent futures rose as much as 4.2% on fears nuclear sites in Iran have been targeted, although as details emerged, the event proved to be much milder than initially reported, and thus crude future backtracked most of the upside. Currently higher by USD 0.50/bbl intraday, with Brent holding around USD 87.60/bbl.

- Precious metals are mixed trade across precious metals with spot gold well off best levels amid an unwind of the geopolitical risk premium after Israel's strike on Iran was found to be limited in nature whilst Iran has no immediate plans to retaliate.

- Base metals are mostly firmer amid the pullback in the Dollar and recovery in risk after Israel's attack on Iran was seemingly non-escalatory. Meanwhile, mainland Chinese markets were somewhat unfazed by geopolitics overnight vs regional peers.

- Commerzbank says for H2, expects Brent price level of USD 90-95/bbl; raises copper, sees year-end USD 9.8k/ton (prev. USD 9.2k).

Geopolitics: Middle East

- IAEA confirms that there was no damage to Iranian nuclear facilities.

- Senior Iranian Official says there is no plan for an immediate retaliation; no clarification on who is behind the incident.

- Israel's Channel 12 says "Army and security services estimate that the attack on Iran is over, but Israel maintains high alert", via Al Jazeera Breaking.

- "Jerusalem Post: Israeli planes fired long-range missiles targeting a facility belonging to Iranian forces in Isfahan", according to Sky News Arabia.

- Israel conducted an operation against Iran which an Iranian official said was on a military airbase near Isfahan. However, Iran's press TV later cited informed sources denying reports of a foreign attack in Iranian cities including Isfahan, according to Reuters.

- Initial reports on social media platform X noted explosions were heard near the city of Isfahan and Natanz in Central Iran where there are nuclear facilities, while Iranian state TV noted 'big explosions' were heard near Isfahan and there were also reports of Israeli strikes in southern Syria and Israeli warplane activity in Iraq. Furthermore, Iran International noted several flights were diverted over the Iranian airspace amid reports of an Israeli attack against a site in Iran and it was also reported that Israel told the US on Thursday it planned to conduct its response against Iran in 24-48 hours. However, it was later reported the explosions in Isfahan were drones being shot down and there were no ground explosions, while a US official noted that Israel conducted a strike on Iran but did not target nuclear facilities.

- Iran's senior commander Mihandoust said 'noise heard in Isfahan overnight was caused by air defence targeting one suspicious object', while he added 'there was no damage caused', according to Reuters.

- Iranian Foreign Minister told the UN Security Council that Iran "had no other option" but to attack Israel, while he added Iran's defence and countermeasures have concluded and Israel must be compelled to stop any further military adventurism against their interests. Furthermore, he warned if there is any use of force by Israel or violation of Iran's sovereignty, Iran's response will be decisive and proper to make Israel regret its actions.

- Senior Iranian Guards Commander said Tehran could review its nuclear doctrine and that nuclear sites are in "total security", while he added "Our hands are on the trigger, Israel's nuclear facilities have been identified". Furthermore, he said they are ready to launch powerful missiles to destroy designated targets in Israel and warned if Israel dares to hit their nuclear sites, they will surely hit back.

- US blocked the Palestinian request for full UN membership, while Israel's Foreign Minister said the 'shameful proposal' was rejected at the UN Security Council and he commended the US for vetoing the proposal. It was also reported that the Palestinian Presidency said it condemns the US veto of full Palestinian membership and Egypt said it regrets the inability of the UN Security Council to pass a resolution enabling Palestine to become a full member of the UN.

Geopolitics: Other

- Ukrainian PM Shmyhal said he welcomes progress on USD 61bln in US aid to Ukraine and is optimistic that the aid bill will soon be supported in the House, while he had important discussions with top US officials about using frozen Russian assets to benefit Ukraine and expect results this year.

- German Chancellor Scholz said NATO partners could deliver a further six patriot systems to Ukraine and Germany at the front.

- FBI Director Wray said Chinese government-linked hackers have burrowed into US critical infrastructure and are waiting for the right moment to deal a devastating blow, according to Reuters.

- North Korea's Deputy Foreign Minister held talks with Belarusian counterparts to improve cooperation, according to KCNA.

US Event Calendar

- Nothing scheduled

Central bank speakers

- 10:30: Fed’s Goolsbee Participates in Q&A

DB's Jim Reid concludes the overnight wrap

Markets are reacting to new developments in the Middle East overnight, as US officials have said that Israel had launched a missile strike against Iran . The news has raised fears that the conflict will escalate further, particularly since Iran had said they would respond to any attack, with the Iranian foreign minister having said they would “give a decisive and proper response” to any further military moves. The full details are still coming through, but Iran’s official news agency IRNA reported that they had activated air defence systems, and that flights in Tehran, Isfahan and Shiraz had been suspended. And the New York Times reported three Iranian officials had said a strike hit a military air base near Isfahan early this morning.

In response, Brent crude oil prices (+2.04%) have spiked up to $88.89/bbl, although they have come down from their peak of $90.75/bbl immediately after the news came through. More broadly, the effects have been clear across global markets, and futures on the S&P 500 are down -0.85% this morning, which would put the index on track for a 6th consecutive decline for the first time since October 2022. In the meantime, investors have moved into safe havens, and the 10yr Treasury yield is down -8.0bps this morning to 4.55%, whilst gold prices are up +0.15%. Asian equities have also seen a decisive move lower overnight, including the Nikkei (-2.37%), the KOSPI (-1.63%), the Hang Seng (-1.23%), the CSI 300 (-0.88%) and the Shanghai Comp (-0.40%).

Before all that, markets followed a familiar pattern yesterday, with an initial stabilisation giving away to further losses once again. That meant the S&P 500 (-0.22%) lost ground for a 5th consecutive session, which hasn’t happened since last October, and the NASDAQ (-0.52%) fell to its lowest level in almost two months. Moreover, the latest declines mean that the S&P 500 is on track to post a third consecutive weekly decline for the first time since September, and the NASDAQ is on track for a fourth consecutive weekly decline for the first time since December 2022. So this marks a big shift from the rapid rally we saw from November up to the end of March, and it now leaves the S&P 500 down -4.63% from its recent peak, even before any moves today that futures are currently indicating.

The selloff wasn’t confined to equities, and before the geopolitical developments overnight, sovereign bonds also fell thanks to strong US data, which led investors to become increasingly sceptical the Fed would cut rates this year. For instance, the weekly initial jobless claims were at 212k (vs. 215k expected) over the week ending April 13, offering further evidence that the labour market was still resilient. Moreover, the Philadelphia Fed’s business outlook moved up to 15.5 in April (vs. 2.0 expected), which is the strongest reading in two years.

That scepticism about rate cuts got added support by comments from New York Fed President Williams, who said “I definitely don’t feel urgency to cut interest rates.” In response to a question, he commented that another rate hike wasn’t his baseline but that “if the data are telling us that we would need higher interest rates to achieve our goals, then we would obviously want to do that”. Meanwhile, Atlanta Fed President Bostic said that “I’m comfortable being patient”, reiterating his view that the Fed “won’t be in a position to reduce our rates until toward the end of the year”. In fact by the close, the amount of cuts priced in by the December meeting fell to 39bps, which is the fewest so far this year, although that’s since risen overnight to 43bps. And in turn, that led to a decent selloff for US Treasuries, with the 10yr yield (+4.6bps) back up to 4.63%, whilst the 2yr yield (+5.4bps) ended the day at 4.99%.

Over at the ECB however, several speakers continued to sound increasingly confident about a June cut. For instance, Finnish central bank governor Rehn said “Provided that we are confident that inflation will continue converging to our 2% target in a sustained way, the time will be ripe in June to start easing the monetary policy stance and to cut rates”. Austria’s Holzmann, one of the most hawkish ECB members, said that “If inflation develops as expected and, above all, the geopolitical problems don’t worsen, there will likely be a majority for an interest rate cut in June”. We also got some hints on what the ECB approach might look like beyond June. Lithuania’s Simkus considered about three rates cut this year as a baseline, while Latvia’s Kazaks saw “no rush in kind of further pace of rate cuts”. By contrast, France’s Villeroy suggested that consecutive rate cuts may be in play, noting that “When we say meeting by meeting, it can be at each following meeting — I don’t think, for example, that we should concentrate our rate cuts at quarterly meetings when we have a new forecast.” All this meant European sovereign bonds saw a smaller rise in yields than US Treasuries, with those on 10yr bunds (+3.1bps), OATs (+2.5bps) and BTPs (+1.4bps) all moving higher.

That backdrop meant that equities had another tough session. Initially they had looked to post a better performance, and the S&P 500 had been up by +0.69% intraday. But that began to reverse around the European close, leaving the index down -0.22%, in its 5th consecutive decline. Tech stocks led the underperformance again, and the Magnificent 7 (-0.49%) lost further ground, led by a -3.55% decline for Tesla . That said, banks (+0.99%) and communication services (+0.66%) outperformed, and over in Europe, which closed earlier in the day, the STOXX 600 advanced +0.24%.

In terms of yesterday’s other data, US existing home sales fell to an annualised rate of 4.19m in March (vs. 4.20m expected). Otherwise, the Conference Board’s Leading Index was down -0.3% in March (vs. -0.1% expected), which took the index down to its lowest level since May 2020. Overnight, we’ve also got the news that Japanese inflation fell to +2.7% in March (vs. +2.8% expected).

To the day ahead now, and central bank speakers include BoE Deputy Governor Ramsden, the BoE’s Mann, the Fed’s Goolsbee, and the ECB’s Nagel. Otherwise, data releases include UK retail sales and German PPI for March.