After yesterday's market reversal, US equity futures are higher but lacking the strength seen in EU markets. As of 7:50am, S&P and Nasdaq futures are 0.2% higher, with Mag7 stocks mixed and Semis are higher despite NVDA down -63bps and MSFT flat with closely watched earnings after the close. The yield curve is twisting steeper and 10Y yield is 1bps. The dollar is flat and commodities are lower across all 3 complexes. The macro data focus is on JOLTS and Consumer Confidence in what shapes up to be a quiet session ahead of a central bank bonanza that features the BOJ and the Fed tomorrow: both could impact the yield curve though no large moves are expected. The bond market is pricing no moves tomorrow for the Fed but is not pricing a small probability of a 50bps cut in Sept.

In premarket trading, CrowdStrike dropped 4% after a CNBC report about Delta Air Lines hiring attorney David Boies to seek potential damages from the cyber security company and Microsoft following the widespread outage earlier this month. JetBlue Airways gains 4% after saying it will cut $3 billion in capital spending through 2029 and planning other measures to boost pre-tax income by as much as $900 million. Here are some of the other most notable US movers before the opening bell:

- Amkor Technology falls 6% after the chip-packaging company provided a disappointing 3Q forecast.

- Beyond Inc. climbs 7% as the household products retailer reported a smaller-than-expected adjusted loss per share for the 2Q.

- F5 jumps 13% after the communications equipment company raised its full-year revenue guidance.

- Howmet Aerospace rises 7% after the company boosted its adjusted earnings per share guidance for the full year.

- Lattice Semiconductor falls 15% after the chipmaker forecast revenue for the 3Q that came in below the average analyst estimate. Analysts note that the weak outlook is a result of a slow recovery in the auto and industrial markets.

- Merck & Co. slips 1% after the drugmaker cut its adjusted profit forecast for the full year.

- Novavax slides 8% after JPMorgan downgraded the vaccine maker, saying share levels “substantially overvalue” the potential economics and revenue to Novavax from its collaboration with Sanofi.

- PayPal rises 4% after boosting its forecast for 2024 profit as the firm remains focused on streamlining operations.

- Pfizer rises 1.5% after raising its profit expectations for the year as it seeks to rebuild credibility with investors after a plunge in Covid-related sales.

- Procter & Gamble slips 3% after reporting quarterly sales that missed analysts’ projections as the maker of Pampers diapers and Tide detergent slows its pace of price increases.

- Rambus slumps 6% after the technology company forecast product revenue for the 3Q below analyst estimates.

- Sprouts Farmers Market jumps 17% after the natural and organic food retailer boosted its full-year projections for comparable sales and profit.

- Symbotic drops 19% after the warehouse robotics and automation firm forecast revenue for the 4Q that came in below the average analyst estimate.

An index tracking the so-called Magnificent Seven technology stocks lost almost 9% in the two weeks through July 26 after investors turned skeptical about the scope for returns from investment in artificial intelligence. The gauge rebounded by 1% on Monday with focus turning again to earnings after downbeat results from Tesla and Google last week. After the close, Microsoft reports earnings which will help determine whether megacaps can turn the tide after an underwhelming start to the reporting season. Apple, Meta and Amazon are due to report later this week.

“For anything AI related, we’ve been in the investment phase but now we want to see how it translates in terms of return on investment,” said Lionel Jardin, equity sales trader at Marex in Paris.

Also in focus are central bank decisions from the Bank of Japan and the Fed on Wednesday, followed by the Bank of England a day later. US policymakers are widely expected to keep rates unchanged at a two-decade high, but will signal a move in September as risks grow of imperiling a solid but moderating job market. Swap traders are currently pricing a full cut for the September-meeting and as much as two further reductions before the end of the year. Further clues about the rate path may come from reports on US consumer confidence and jobs openings due later on Tuesday. In Japan, the yen weakened against all its Group-of-10 peers as the BOJ kicked off a two-day policy meeting on speculation that policy tightening would be too slow to dent the appeal of yen-funded carry trades.

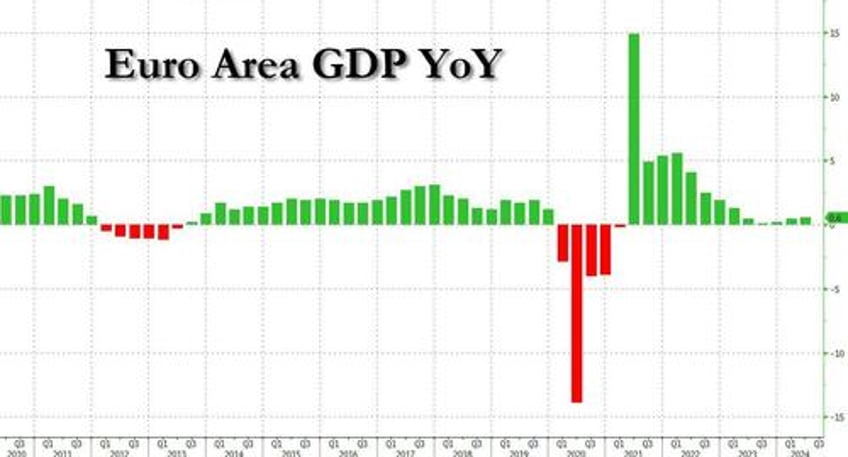

Europe’s Stoxx 600 index advanced 0.5% after the euro-area economy expanded more than expected in the second quarter (even as Germany's economy contracted), easing fears about the pace of an economic recovery.

Technology and retail shares leading gains, while mining and food beverage stocks are the biggest laggards; the FTSE 100 underperforms with a 0.5% fall as material names weigh on the broader market. Here are the biggest movers Tuesday:

- BP shares gain as much as 3.3%, the biggest increase since April, after the UK oil and gas company’s 2Q income beat estimates and it maintained the pace of its share buybacks

- Sika shares rise as much as 4.7%, the most since Feb. 16, with analysts saying that gross margin was the main positive surprise in the Swiss chemical company’s results

- Standard Chartered shares advance as much as 6.4% after the British lender announced a record $1.5 billion buyback that was better than analysts expected

- St James’s Place shares soar as much as 25%, the biggest intraday gain since September 2008, after the UK wealth manager reported first-half net inflows that came ahead of consensus expectations

- Allfunds shares soared as much as 8.4%, best performer on the Stoxx 600 Banks Index, after the fund distribution platform reported soaring 2Q adj. Ebitda

- Greggs shares advance as much as 6.3%, reaching the highest intraday level since January 2022, after the bakery chain reported first-half results which analysts viewed as strong.

- Poste Italiane shares gained as much as 4.3%, the most in almost two years after 2Q results beat estimates and the company raised its full-year guidance

- Diageo’s shares fall as much as 11% to a 2020 low, after the distiller’s results disappointed analysts, with RBC calling the update “grim”

- Glencore shares fall as much as 3.2%, hitting a four-month low, after production figures for some key commodities came in below expectations. Morgan Stanley warns earnings consensus could suffer hefty downgrades based on its first-half performance

- Rexel slumps as much as 8.6%, the most since March 2023, after the electrical-supplies company said it now expects full-year adjusted Ebita margin to be toward the lower end of its guided 6.3% to 6.6% range

- Sage Group shares fall as much as 8.3% as analysts said the software company’s earnings report indicates a slight slowdown in organic sales growth from the past two quarters

Earlier, Asian stocks fell as investors trimmed holdings before a number of key central bank decisions in coming days. Chinese shares extended recent losses amid weak sentiment despite the nation’s top leaders signaling more economic support. The MSCI Asia Pacific Index dropped as much as 0.9% before paring declines, with Tencent and TSMC among the biggest drags on tyhe gauge. Stocks in South Korea also fell, while Japanese benchmarks were mixed. The regional measure was on track for its first monthly decline since April. Investors took some money off the table as they braced for monetary policy decisions from the Bank of Japan and Federal Reserve on Wednesday. While traders are on alert for a potential interest-rate hike in Japan, there’s growing expectation for policy easing in the US.

In FX, the Bloomberg Dollar Spot Index is little changed as traders awaited US employment and consumer confidence data for clues on the Federal Reserve’s policy path. The Japanese yen falls for a second day, weakening 0.5% and briefly going beyond 155 per dollar for the first time in a week as the Bank of Japan kicked off a two-day policy meeting. Overnight-indexed swaps priced in a 35% chance that the BOJ will raise its policy rate by 15 basis points this week. The wide interest-rate spread between the US and Japan “should continue to buoy the USD/JPY exchange rate as long as global macro volatility remains restrained,” Alvin Tan, head of Asia foreign-exchange strategy at Royal Bank of Canada in Singapore, wrote in a research note. “We are forecasting USD/JPY rising to 164 by early next year.” The euro is up 0.1% after showing little reaction to a flurry of data from the bloc. Euro-area GDP rose more than expected in the second-quarter despite a surprise contraction in Germany, where state CPI readings point to a steady national print later today.

In rates, Treasuries held small gains as US trading gets underway Tuesday. Yields are lower by less than 1bp, with the 10Y yield dropping to 4.17%, and with curve spreads little changed; 2s10s, 5s30s reached least-inverted or steepest levels since May 2023 last week amid declines for US stock benchmarks and increased expectations for Fed rate cuts. German 10-year yields rise 1bps to 2.37%. The Stoxx 600 rises 0.3%, led by gains in technology shares. Treasury coupon auctions resume Aug. 6, with Treasury set to unveil August-to-October issuance plans Wednesday at 8:30am; Treasury officials in May said they anticipated steady note and bond auction sizes for “at least the next several quarters,” but strategists say increases are unavoidable thereafter.

In commodities, oil prices decline, with WTI falling 0.2% to trade near $75.70. Spot gold rises 0.2%. Commodities have erased all of their gains this year as a challenging outlook in China, combined with a selloff in US natural gas and losses in foodstuffs, have weighed on raw materials.

Crypto is mixed with Bitcoin under modest pressure after the weekend’s gains continued on Monday following on from Trump’s bullish commentary. Though, the downside thus far is somewhat limited with BTC currently between USD 66-67k.

Looking at today's calendar, US economic data calendar includes May FHFA house price index and S&P CoreLogin home prices (9am), June JOLTS job openings and July Conference Board consumer confidence (10am) and July Dallas Fed services activity (10:30am). Fed officials have no scheduled appearances until after this week’s FOMC meeting ending Wednesday

Market Snapshot

- S&P 500 futures little changed at 5,507.75

- STOXX Europe 600 up 0.1% to 512.49

- MXAP down 0.4% to 179.82

- MXAPJ down 0.4% to 559.71

- Nikkei up 0.1% to 38,525.95

- Topix down 0.2% to 2,754.45

- Hang Seng Index down 1.4% to 17,002.91

- Shanghai Composite down 0.4% to 2,879.30

- Sensex up 0.3% to 81,624.35

- Australia S&P/ASX 200 down 0.5% to 7,953.18

- Kospi down 1.0% to 2,738.19

- German 10Y yield little changed at 2.37%

- Euro up 0.1% to $1.0832

- Brent Futures up 0.2% to $79.91/bbl

- Gold spot up 0.2% to $2,389.79

- US Dollar Index little changed at 104.57

Top Overnight News

- Venezuela’s opposition said it can prove that Edmundo González won Sunday’s election by a wide margin. Leader María Corina Machado called for nationwide “citizen assemblies” in her first public statement since she was accused of plotting to sabotage the election. BBG

- German output unexpectedly shrank last quarter, casting a shadow over resilient growth in the euro region’s next three biggest economies. GDP fell 0.1%, while both France and Spain grew more than predicted and Italy slowed only slightly. Euro-area expansion was 0.3%, a tad more than expected. BBG

- Chinese leaders signaled on Tuesday that the stimulus measures needed to reach this year's economic growth target will be directed at consumers, deviating from their usual playbook of pouring funds into infrastructure projects. RTRS

- Samsung won long-awaited approval from Nvidia for a version of its high-bandwidth HBM3 memory chips, people familiar said, helping narrow the gap with rival SK Hynix. It also expects approval for the next gen version in two to four months. BBG

- Nvidia is accelerating humanoid robotics development by offering new services, including NVIDIA NIM for robot simulation and learning, the OSMO orchestration service for robotics workloads, and a teleoperation workflow for training robots with minimal human demonstration data.

- Amazon’s Prime Video is undercutting rival Netflix on advertising pricing, as it battles for marketers’ attention in an increasingly crowded field of ad-funded streaming services. FT

- Trump says he will “probably” debate Harris, but “can also make a case for not”. ABC

- Banks and other lenders are seizing control of distressed commercial properties at the highest rate in nearly a decade, a sign that the sector’s punishing downturn is entering its next phase and approaching a bottom. In the second quarter, portfolios of foreclosed and seized office buildings, apartments and other commercial property reached $20.5 billion, according to data provider MSCI. That is a 13% increase from the first quarter and the highest quarterly figure since 2015. WSJ

- Apple utilized AI chips designed by Google to train its models instead of ones from Nvidia. RTRS

- Berkshire Hathaway further pared its stake in BofA, bringing this month’s disposal to $3 billion. It still owns $39.5 billion worth at Monday’s closing price. BBG

- Timiraos writes “The NY Fed's measure of inflation persistence (the "multivariate core trend" rate) fell again in June, to 2.1%”, while he added "With meaningful shelter disinflation arriving in June, the declines in inflation are broadening": WSJ

- Former US President Trump said he would probably end up debating VP Harris but added that he could also make a case for not debating.

A more detailed look at global markets courtesy of Newqsuawk

APAC stocks were mostly pressured following the mixed performance stateside and with markets cautious as this week's major risk events drew closer. ASX 200 was dragged lower amid underperformance in mining stocks after several quarterly production updates and with heavy losses in Fortescue after an investor sought to offload as much as AUD 1.9bln of shares, while a much wider-than-expected contraction in building approvals added to the glum mood. Nikkei 225 retreated amid cautiousness as the BoJ kick-started its two-day policy meeting where it will decide on taper plans and is expected to mull lifting its policy rate by 15bps to around 0.25%. Hang Seng and Shanghai Comp. conformed to the broad negative mood in which the former tested the 17,000 level to the downside with notable weakness seen in consumer, energy and tech stocks, while the mainland was subdued with Chinese official PMI data also due tomorrow.

Top Asian News

- China customs official said China faces an increasingly uncertain trade environment and challenges to grow trade in H2.

- Japan reportedly taps brokerages to market JGBs abroad as the BoJ steps back, according to Nikkei.

- China's Politburo has held a meeting to study the current economic situation, according to state media; has set out economic priorities for H2 2024. Domestic effective demand remains insufficient.

A mostly firmer start to the session, Euro Stoxx 50 +0.5%, with sentiment on a better footing than APAC counterparts as earnings take the spotlight ahead of this week's risk events. Sectors have no overarching theme/bias with Autos strong and rebounding from recent pressure, Tech supported by ASML while Basic Resources have been dented by benchmark action. Breakdown dictated by earnings/data; DAX 40 +0.4% firmer but stalling after a soft Flash German GDP print and amid growing pressure in Heidelberg Materials post-earnings. FTSE 100 lags given pressure in mining and most banking names, though BP +2.2% and Standard Chartered +5.5% are strong post-earnings while Diageo -9.0% slips after warning of persisting challenges. Stateside, a modest positive bias remains in play into JOLTS and then earnings; ES +0.2% & NQ +0.2%. Stateside earnings docket has MSFT, AMD, MRK, PFE & PG.

Top European News

- German Surprise GDP Drop Casts Shadow Over Euro-Area Growth

- Indra Drops as Morgan Stanley Notes Strategic Plan Costs

- Deutsche Bank’s DWS Resurrects Corporate Titles to Mollify Staff

- BNY Mellon Cautious Against Excessive Optimism in Turkish Market

- Germany Prelim 2Q GDP Falls 0.1% Q/q, Est. +0.1%

- Diageo Hit By Latin America Slump as Drinkers Spend Less

FX

- DXY is largely contained vs. peers with specifics light into the week’s risk events; DXY is currently within yesterday's 104.13-75 range. Upside sees the 50DMA @ 104.88 and 100DMA @ 104.89. Downside sees 10 and 200DMA both @ 104.32.

- EUR marginally firmer after a slew of data prints which have been headlined by slightly hawkish German regional CPI and a better-than-expected GDP print for the bloc. EUR/USD at the top-end of 1.0815-34 parameters.

- GBP is essentially unchanged with little follow-through from Reeves’ statement, focus remains firmly on Thursday’s BoE. Cable is currently well within yesterday's 1.2807-1.2888 range.

- JPY on the backfoot vs. USD, though has managed to pull away marginally from the USD/JPY 155.21 high for the session. Attention firmly on Wednesday’s BoJ which could potentially be hawkish and is then followed by the FOMC’s gathering.

- NZD outperforms with nothing by way of fresh fundamental catalyst, NZD/USD is in the process of snapping an eight session losing streak; AUD essentially unchanged vs. USD.

Fixed Income

- A relatively contained start before a packed morning of data points. EGBs are under modest pressure after a slightly hawkish set of German regional CPI numbers and a stronger-than-expected EZ Flash Prelim. GDP outing.

- As such, Bunds at the low-end of a 133.09-43 range, the high printed early doors on a cooler Spanish Flash CPI release; Monday’s base at 132.72.

- Gilts steady at the low-end of yesterday’s 98.34-98.93 parameters. Supply saw the first auction for the 4.25% 2034 line post strong results after a record setting syndication in June.

- USTs are essentially flat. Holding a handful of ticks below Monday’s 111-16+ best. Docket headlined by JOLTS.

- UK sells GBP 3.75bln 4.25% 2034 Gilt: b/c 2.93x, average yield 4.082%, tail 0.5bps

- Italy sells EUR 7.75bln vs exp. EUR 6.5-7.75bln 4.10% 2029, 3.35% 2029 & 3.85% 2035 BTP and EUR 1.5bln vs exp. EUR 1.0-1.5bln 2032 CCTeu

Commodities

- Crude benchmarks are flat/choppy following APAC losses which were largely a continuation of the weakness that has plagued the complex recently.

- WTI & Brent in narrow circa. USD 0.50/bbl parameters and are currently around the mid-point of such bands.

- Nat Gas is flat but with a mild upward tilt following another session of gains for Dutch TTF which settled higher by over 4% yesterday amid hotter weather forecasts for Asia.

- Metals are mixed; precious metals are slightly firmer with gold at the top-end of a USD 20/oz band that is entirely contained by Monday’s USD 2369-2403/oz parameter; base metals pressured, but off worst.

- Adnoc announces that the Satah Al Razboot field has attained a 25% increase in production capacity due to advanced technologies, taking it to 140k BPD.

- Japan's Eneos has restarted its 129k BPD Chiba CDU on July 28th following system issues, according to a spokesperson cited by Reuters.

- BP (BP/ LN) CEO says European refining margins are struggling due to weak gasoline and diesel demand, BP expects global fuel inventories to fall during summer driving seasons and lift refining margins.

- Ukraine is ready to resolve oil transit issues with Slovakia if Slovakia activates relevant mechanism in EU association agreement, according to the Ukrainian deputy energy minister.

Geopolitics: Middle East

- US is leading a diplomatic push to deter Israel from targeting Beirut and southern suburbs in response to the Golan strike, according to Reuters citing sources.

- Syrian Observatory said the Israeli army targeted with missiles a military site west of the city of Nawa in the western countryside of Daraa province, according to Sky News Arabia.

Geopolitics: Other

- Russia's Navy started drills involving 20,000 personnel and 300 ships, while drills involve Russia's Northern, Pacific and Baltic fleets and Caspian Sea flotilla, according to Interfax

- Venezuelan opposition leader Machado said the opposition has the ability to prove truth of election results, while a US senior official accused Venezuela's Maduro government of "electoral manipulation". It was also reported that Uruguay's Foreign Minister said the country will never recognise Maduro's win due to a clear victory of the opposition and Peru's Foreign Ministry ordered Venezuelan diplomats to leave the country within 72 hours.

US Event calendar

- 09:00: May S&P CS Composite-20 YoY, est. 6.50%, prior 7.20%

- 09:00: May S&P/CS 20 City MoM SA, est. 0.30%, prior 0.38%

- 10:00: July Conf. Board Consumer Confidenc, est. 99.7, prior 100.4

- July Conf. Board Present Situation, prior 141.5

- July Conf. Board Expectations, prior 73.0

- 10:00: June JOLTs Job Openings, est. 8m, prior 8.14m

- 10:30: July Dallas Fed Services Activity, prior -4.1

DB's Jim Reid concludes the overnight wrap

As we swelter here in London with insect bite marks building up a diversified portfolio on my body, markets are wilting a touch at the moment with Asia lower overnight and with the S&P 500 (+0.08%) just about managing to eke out a marginal gain last night after the last two weeks of declines, while bonds mostly posted modest gains. We did see a reverse rotation back into tech away from small caps as we'll detail below. That all comes as investors face some crucial days ahead, with an array of major earnings announcements, data releases, and central bank decisions all happening that will be critical for the market narrative. That begins in earnest today, as we’ve got Microsoft’s results after the US close, along with the German and Spanish CPI prints for July, and the JOLTS report of job openings from the US. So plenty to keep us occupied as we build up to the BoJ and FOMC decision tomorrow and three additional Mag-7 earnings releases with Meta tomorrow and Amazon and Apple on Thursday.

With much to look forward to, the one event that did happen yesterday was the latest QRA borrowing estimates from the US Treasury. The borrowing estimate for Q3 was revised down from $847bn to $740bn, effectively in line with our US rates strategists’ expectations (here), while the Q4 borrowing estimate ($565bn) was slightly above their expectation. In any case, this did little to move markets unlike the shock of a big increase in supply this time last year. Longer dated yields rallied by a touch over 1bp on the announcement, with 10yr yields falling -2.0bps on the day. By contrast, 2yr yields ended the day +1.7bps higher at 4.40%.

Earlier in Europe, sovereign bond yields had seen more significant declines, driven by mounting anticipation that the ECB would cut rates several times over the year ahead. That was very clear from the front end of the curve, where yields on 2yr German debt were down -1.5bps to 2.58%, their lowest level since February. And here in the UK, the 2yr gilt yield fell -4.1bps to 3.84% after some weaker than expected data, which is the lowest it’s been since May 2023. So there’s a growing expectation that global central banks are increasingly moving towards a synchronised easing pattern, and that was echoed at the long end of the curve, where yields on 10yr bunds (-5.0bps), OATs (-4.5bps) and BTPs (-5.1bps) were also lower.

One trend that’s boosted the rate cut speculation has been ongoing declines in commodity prices, which are proving to be a very helpful tailwind on inflation. Indeed, yesterday saw Bloomberg’s Commodity Spot Index (-0.58%) hit its lowest level since March. That comes as metals prices have seen significant declines, with copper (-1.04%) falling for the 10th time in the last 11 sessions yesterday. Oil prices fell back yesterday as well, despite the fears of growing tensions in the Middle East, and Brent crude was down -1.66% to a 7-week low of $79.78/bbl. This morning in Asia, Brent crude prices are a further -0.51% lower.

As all that was going on, equities had muted days on both sides of the Atlantic, with the S&P 500 (+0.08%) eking out a marginal gain, while Europe’s STOXX 600 (- 0.20%) fell back. The notable theme was a reversal of the recent rotation trade, with the small cap Russell 2000 down -1.09%, while the Magnificent 7 (+1.01%) posted a second consecutive gain thanks to a rebound from Tesla (+5.60%). On the earnings front there wasn’t much happening yesterday (the bulk are coming today through to Thursday), but McDonald’s reported their first year-on-year decline in comparable sales since 2020 during the pandemic, so that offered another sign of potential consumer weakness that’s been showing up in other reports. That said, their share price was up +3.74%, and it was a good day for the restaurants subcomponent in the S&P 500 (+2.80%), with all 6 companies moving higher on the day. Meanwhile, energy stocks (-0.87%) led on the downside amid the decline in oil.

Here in the UK, the new Labour government made several fiscal announcements yesterday, including £5.5bn of savings over 2024-25, and £8.1bn for 2025-26. Some of that total included announcements already made, including the ending of the agreement with Rwanda on migration, but it also included new ones, including that Winter Fuel Payments would no longer be universal for the elderly, and that previous plans for reforms to adult social care charging would no longer go ahead. Looking forward, Chancellor Reeves also confirmed that the governments’ first Budget would take place on October 30. The announcements came as speculation mounted that the BoE might deliver their first rate cut of this cycle at their meeting this week, with investors dialling up the probability to 54%, up from 50% on Friday. That followed a weak batch of data yesterday, with the CBI’s retail sales volume survey falling to -43 (vs. -10 expected), whilst mortgage approvals were at 60.0k in June (vs. 60.3k xpected).

Asian markets are mostly trading lower this morning reversing much of the positive start to the week yesterday. Across the region, Chinese equities are underperforming with the Hang Seng (-1.10%) leading losses while the CSI (- 0.85%) and the Shanghai Composite (-0.59%) are also edging lower. Elsewhere, the KOSPI (-1.03%) and the Nikkei (-0.29%) are also trading in the red. S&P 500 (-0.25%) and NASDAQ 100 (-0.43%) futures are also moving lower.

Early morning data showed that Japan’s jobless rate dropped to 2.5% in June (v/s +2.6% expected) from a level of +2.6% in the previous month. Meanwhile, the jobs-to-applicants ratio slipped to 1.23 in June from 1.24 in May

To the day ahead now, and data highlights include the Euro Area Q2 GDP reading and the German CPI print for July. Meanwhile in the US, we’ll get the JOLTS job openings for June, the Conference Board’s consumer confidence for July, and the FHFA’s house price index for May. Finally, earnings releases include Microsoft, Starbucks, Pfizer and PayPal.