By Michael Msika and Jan-Patrick Barnert, Bloomberg markets live reporters and strategists

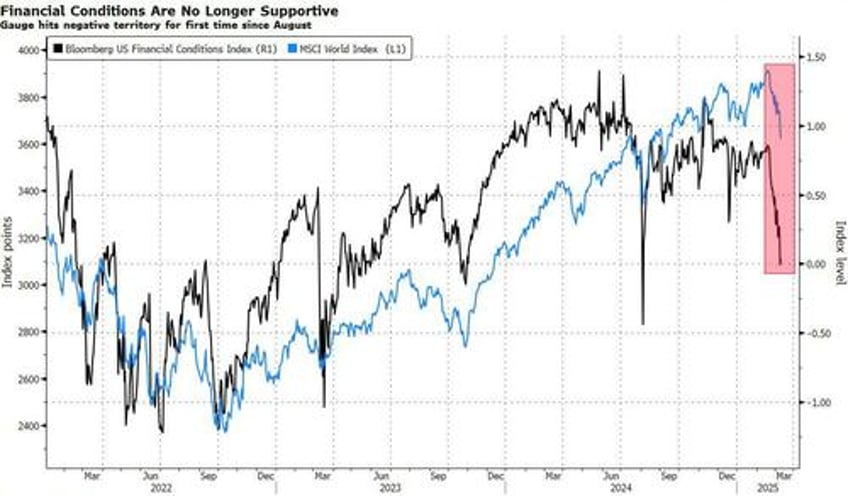

Markets are facing an episode of de-risking that started in the US and is now feeding into Europe. While an improving geopolitical landscape is helping lift sentiment, investors are worried about growth and will be looking for more relief in economic data.

Ukraine accepted a US proposal for a 30-day truce with Russia, but the focus is also still on tariffs. The trade war escalated overnight after President Donald Trump’s 25% tariffs on steel and aluminum imports took effect, prompting a response from the European Union.

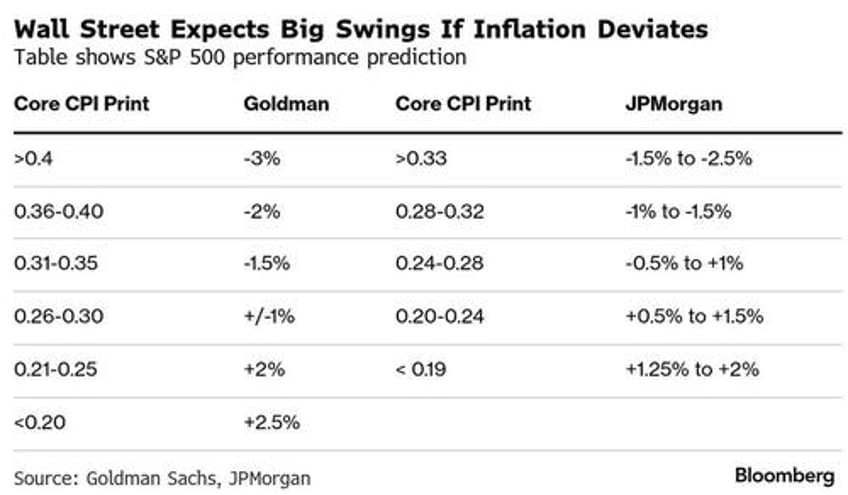

Tariff headlines have been the big market driver, and will end up becoming intertwined with economic figures. The potential impact on growth has already pushed investors to lower risk and diversify portfolios. While Europe is outperforming, the US selloff is dragging on global stocks, and the market is hoping to find comfort in lower US inflation later today. Any respite might be temporary.

“We may see a relief rally this week, especially if the inflation data prints dovishly,” say JPMorgan Market Intelligence analysts led by Andrew Tyler. They see tariffs and trade wars as unambiguously negative for the US, and say the trade uncertainty is already having a negative impact on consumption, capex, sentiment and ultimately economic growth. “We would fade that rally.”

Economists have started to cut their outlook for US economic growth, and this trend may continue until they get a better sense of the impact from trade and fiscal policies. The executive order that President Donald Trump is using to apply tariffs to China, Canada and Mexico has an escalation clause that is designed to kick in automatically in the event a country retaliates.

With US government funding due to run out at the end of the week, a shutdown is another potential negative event for sentiment. Recession fears are now mounting. Job cut plans jumped the most on record outside a recession in February, doubling from last year, in figures that sparked market volatility. While the federal government was responsible for the largest share, it remains to be seen whether the private sector will absorb workers. JOLTs figures out yesterday showed some resilience in the labor market, with openings rising in January and layoffs falling.

The overall narrative change from Trump running the economy hot to Trump stalling it into recession is producing some colorful language on trading desks. Goldman Sachs’s head of Americas execution services John Flood says that with investors on the edge of their seats, “zero offense” is being played and “PnL destruction” over the last few weeks has been real.

Meanwhile Nomura’s Charlie McElligott sees Trump acting as a “Gamma Agent,” a term usually applied to the flows of option desks that can fuel markets in a specific direction. The US administration’s remarks are “effectively the same phenomenon as introducing a sudden volatility catalyst or tail surprise,” he says.

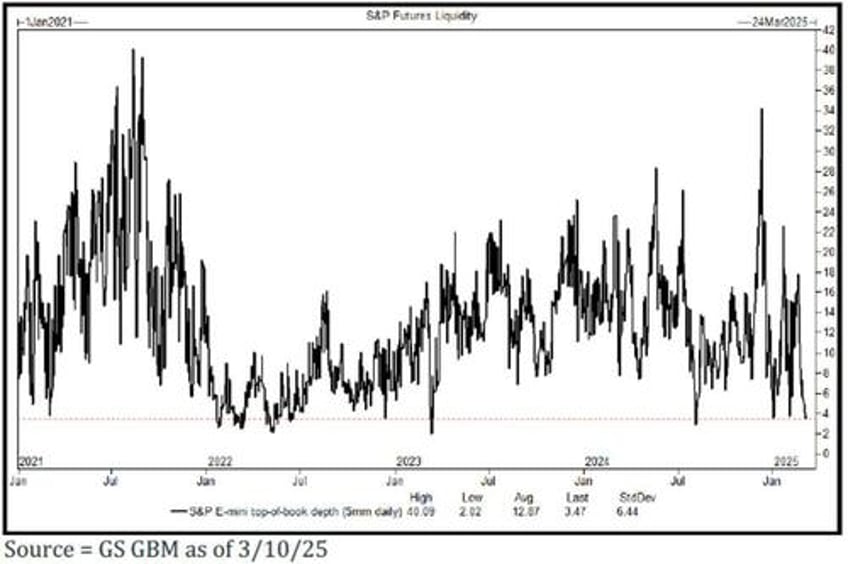

All this is leading to positioning being washed out. Fast money CTAs have been offloading stocks at pace and are likely to continue to do so, according to market specialists at UBS and Goldman Sachs. They are modeling CTAs to be sellers of stocks this week in any scenario. The cleansing of portfolios is also having a bigger impact on stocks as liquidity is suffering a meltdown. Goldman Sachs traders note that S&P 500 top of book liquidity — the aggregated best bid and best offer — ticked below $4 million Monday, only around one-third of the average since 2021.

The next worry will be what asset managers are doing. “Our conversations this week suggest that asset managers are still selling futures as they are concerned about (1) growth impact of tariff discussions, and (2) lack of monetary policy tailwinds,” says Goldman Sachs’s head of derivatives research John Marshall. “We continue to watch this flow carefully as asset allocation shifts within this cohort of investor tend to take time.”