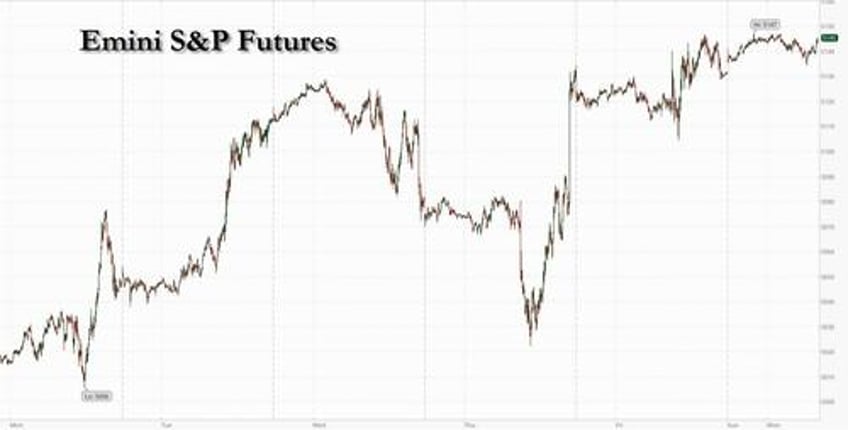

US equity futures swung between gains and losses and traded near session highs as US traders walked to their desks on Monday morning after a rollercoaster day for the Japanese yen, which increasingly looks like some 3rd world banana republic currency instead of belonging to the world's 3rd largest economy, and which first plunged below 160 vs the USD - the lowest level since 1990 amid dismal volumes thanks to the Japanese market holiday on Monday - only to soar more than 500 pips in what is now the first confirmed BOJ intervention since 2022. Futures were buoyed by rising earnings optimism as traders looked ahead to another very busy week for company results, and as of 7:40am, S&P futures gained 0.2% with Nasdaq futures rising 0.3%, boosted by another surge in Tesla shares. 10Y Treasury yields fell four basis points to 4.62% ahead of today's announcement by the Treasury of its funding needs for the coming quarter, while the dollar weakened. Oil retreated, with Brent first trading below $89 a barrel, only to rebound higher amid the endless speculation that a peace deal between Israel and Hamas is coming that would reduce geopolitical tensions in the Middle East (spoiler alert: there will be no deal). Gold rose and bitcoin fell.

In premarket trading, Tesla surged 11%, slamming the recent pile up of shorts (the biggest in two years) as Elon Musk’s quick visit to China paid immediate dividends, with Tesla receiving in-principle approval from government officials to deploy its driver-assistance system in the world’s biggest auto market.

Here are some other premarket movers:

- Here Altimmune drops 4% after Guggenheim downgraded the stock, saying a partnership for the biotech’s lead asset pemvidutide look “increasingly unlikely.”

- Apple climbs 2% after Bernstein upgraded its rating, calling issues in China “more cyclical than structural” and highlighting that the tech giant’s business in the country has tended to be more volatile than the wider company.

- AT&T rises 1% as Barclays upgrades to overweight, noting the wireless carrier’s “steadier execution story.”

- Paramount Global jumps 5% after Bloomberg reported that the Redstone family and Skydance Media CEO David Ellison have both offered concessions to make a possible change in control at the media company more appealing to other investors.

- Shopify advances 3% after Citi raises the e-commerce company to buy, expecting solid first-quarter results following recent industry conferences and channel checks.

- SoFi Technologies gains 2% after the company boosted its adjusted Ebitda guidance for the full year.

- Southwest Airlines declines 1.2% after Jefferies downgraded the carrier to underperform, noting that optimization plans are languishing as delays at Boeing reduce fleets.

- Tandem Diabetes rises 4% after Wells Fargo upgraded the medical device manufacturer, saying a survey indicates stable growth in insulin pumps.

The big overnight market event was the rollercoaster move in the Japanese yen which again took center stage with dramatic moves that fueled speculation over whether the government had intervened to support its beleaguered currency. In holiday-thinned trading, the yen swung wildly, rallying more than 2% on Monday after earlier dropping as much as 1.2% to 160.17 per dollar.

While analysts suggested the size and speed of the jump smacked of intervention, some traders questioned that conclusion and said Japanese banks sold dollars for customers as it rallied. Japan’s top currency official, Masato Kanda, chose to keep investors guessing by declining to comment. Dow Jones reported authorities stepped in to support the yen, citing people familiar with the matter.

It is a busy week: the Fed meeting on Wednesday and US jobs report on Friday will also be critical for markets this week. The last time Fed Chair Jerome Powell spoke, he signaled that policymakers were likely to keep borrowing costs high for longer than previously anticipated, pointing to the lack of further progress on bringing inflation down, and to enduring strength in the labor market. Meanwhile, with Apple and Amazon.scheduled to report in the next few days, investors will be hoping for more evidence that big technology profits can keep propelling stocks.

Morgan Stanley’s in house permabear Michael Wilson said the pressure from higher Treasury yields is taking the shine off an upbeat earnings season; that's even as Bloomberg data showed that 81% of S&P 500 firms have beaten first-quarter profit estimates so far. Still, as we noted over the weekend, the average stock price has barely outperformed the benchmark index on the day of results — the worst scorecard since the fourth quarter of 2020, the figures showed.

European stocks are higher, the Stoxx 600 rising 0.3% to 509.7, with Dutch medtech Philips the biggest stand-out performer, rising the most on record after striking a settlement related to a device recall; Deutsche Bank was the biggest decliner after making €1.3 billion of provisions, with its country peer Porsche falling too, following its latest earnings. Here are the biggest movers Monday:

- Philips gains as much as 37%, the most on record, after the Dutch medical equipment manufacturer agreed to pay $1.1 billion to settle US claims related to the 2021 recall of sleep apnea devices

- Alfen surges as much as 14% after it agreed with Dutch grid operator Liander on a new production method to avoid moisture in its Pacto transformer substations, with KBC raising the firm to buy

- Anglo American shares gain as much as 4.1% after Bloomberg News reported over the weekend that BHP is considering making an improved proposal after its $39b initial offer was rejected

- Unicaja Banco jumped as much as 8% to the highest level since 2018, after the Spanish lender delivered revenue ahead of expectations in the first quarter

- Douglas jumps as much as 5.3% after several brokerages initiated the German perfume retailer at buy, including Citi, which called the stock a “scarce asset” in a growing category

- Bravida rises as much as 6% after an internal investigation which revealed previously reported overinvoicing at the Swedish real estate services firm was very limited

- Atos shares jump as much as 20%, to the highest in almost three weeks, after the IT firm got a non-binding letter of intent from the French state to acquire some parts of the business

- Deutsche Bank declines 5.7%, the sharpest drop since 2023, after the German lender’s announcement that it is setting aside as much as €1.3b in legal provisions in a blow to profitability

- Porsche AG shares fall as much as 4.6% after the German firm saw a “challenging” first quarter, according to analysts, who note the automaker’s headline earnings miss

- Morphosys falls as much as 2.4% after a report flagged a potential issue related to experimental drug pelabresib, an issue which could complicate the planned acquisition by Novartis

- Siltronic shares fall as much as 3.4% after the German wafer maker was downgraded to hold by Hauck & Aufhaeuser following a profit warning issued last week

Meanwhile, Asian equities climbed for a second straight day, as benchmarks for mainland and Hong Kong stocks looked set to enter a bull market. The MSCI Asia Pacific Index climbed as much as 0.3%, with AIA Group and TSMC among the top contributors to the gains. The MSCI China Index and Hong Kong’s Hang Seng Index were both on track to close more than 20% higher than their January lows, helped by a surge in property shares after a major Chinese developer reached a solution with bondholders for its liquidity issues.

“China may continue to outperform especially in a scenario where global risk sentiment remains cautious,” Nomura strategists including Chetan Seth wrote in a note. “Fundamentals remain tepid” and economic data in the next couple of months are important to avoid a reversal of recent gains, they added. Benchmarks in Taiwan, the Philippines and South Korea also advanced on Monday. Markets in Japan and Vietnam were closed for holidays.

In FX, the yen rallied to a 155 handle versus the dollar, having earlier weakened past 160 for the first time since 1990. The abrupt swing prompted speculation authorities may have intervened, although Japan’s top currency official has declined to comment even as Dow confirmed intervention. The Bloomberg Dollar Spot Index is down 0.3% as the greenback loses ground versus all its G-10 rivals.

In rates, treasuries climbed with US 10-year yields falling 4bps to 4.62%, with gains supported by euro-zone bond markets, particularly France’s, outperforming after Moody’s and Fitch affirmed the sovereign’s rating Friday. April inflation numbers from Germany and Spain were taken in stride. US yields richer by 2bp to 4bp across the curve with long-end-led gains flattening 2s10s, 5s30s spreads by 1.5bp and 0.5bp on the day; 10-year remains near session low around 4.625% with bunds outperforming by around 1.5bp in the sector, French 10-year by ~3bp. On Wednesday, Treasury announces quarterly refunding, expected to follow through on its January guidance of holding off on further increases

Oil prices are lower as the US pushes to broker a peace deal between Israel and Hamas. WTI falls 0.2% to trade near $83.70. Spot gold is little changed around $2,338/oz.

Monday’s US session has few calendar events. US economic data slate includes April Dallas Fed manufacturing activity at 10:30am New York time; ahead this week are consumer confidence, ADP employment change, manufacturing PMI, ISM manufacturing, factory orders and April jobs report. Fed members are in self-imposed quiet period ahead of May 1 policy announcement.

Market Snapshot

- S&P 500 futures up 0.2% to 5,142.75

- STOXX Europe 600 up 0.3% to 509.67

- MXAP up 0.9% to 173.90

- MXAPJ up 0.9% to 540.54

- Nikkei up 0.8% to 37,934.76

- Topix up 0.9% to 2,686.48

- Hang Seng Index up 0.5% to 17,746.91

- Shanghai Composite up 0.8% to 3,113.04

- Sensex up 1.2% to 74,584.25

- Australia S&P/ASX 200 up 0.8% to 7,637.38

- Kospi up 1.2% to 2,687.44

- German 10Y yield little changed at 2.55%

- Euro up 0.2% to $1.0719

- Brent Futures down 0.6% to $88.94/bbl

- Gold spot up 0.1% to $2,339.61

- US Dollar Index down 0.31% to 105.61

Top Overnight News

- Tesla CEO Musk made a surprise visit to Beijing with media reports saying he aims to discuss enabling autonomous driving mode on Tesla cars in China. Later, it was reported Tesla is to partner with Baidu for China self-driving approval, according to Bloomberg. (BBC/Bloomberg) Separately, two US Senators say NHTSA should require Tesla to restrict autopilot use to certain roads.

- White House said President Biden approved the Kansas disaster declaration and ordered federal assistance to supplement recovery efforts in areas affected by severe winter storm from January 8th-16th.

- Apple intensified talks with OpenAI for iPhone generative AI features in which they are discussing the terms of a possible agreement and how the OpenAI features would be integrated into Apple’s iOS 18, according to Bloomberg. EU says that Apple's (AAPL) iPad operating system has been designated as a gatekeeper under the EU DMA; apple has six months to comply with EU tech rules.

- Paramount is reportedly preparing to fire CEO Bakish, via FT citing sources; additionally, sources add that the Co. is expected to receive a counterbid from Sony and Apollo this week to the offer from Skydance Media. (FT)

- China's industrial profits fell in March and slowed gains for the quarter compared to the first two months, raising doubts about the strength of a recovery for the world's second-biggest economy. Cumulative profits of China's industrial firms rose 4.3% to 1.5 trillion yuan ($207.0 billion) in the first quarter from a year earlier, NBS data showed, slower than a 10.2% rise in the first two months. RTRS

- China’s banking regulator warns the country’s regional banks to stop piling into long-term government bonds as they could be hit with heavy losses if rates rise. FT

- Japan's currency surged as much as 5 yen against the dollar on Monday, with traders citing heavy dollar-selling intervention by Japanese banks for the first time in 18 months after the yen hit fresh 34-year lows earlier in the day. RTRS

- Russia is expected to launch a new large-scale offensive in May or June (although the influx of American weapons will make Ukraine better positioned to withstand the onslaught). FT

- Ukraine isn’t expected to regain offensive momentum until 2025 at the earliest and has no clear military path to recapturing the ~20% of the country stolen by Russia. WaPo

- BHP is considering an improved bid for Anglo American, people familiar said. The miner may need to find over $9 billion in cost savings from the tie-up to raise the offer, which may be a stretch. BBG

- Apple’s iPad was hit by the EU rules aimed at stopping potential competition abuses before they take hold. Apple now has six months to make sure its tablet ecosystem complies with preemptive measures. BBG

- AAPL has renewed negotiations w/OpenAI and remains in talks w/Google about incorporating AI-linked technology into the next version of iOS (investors expect to hear a lot more about Apple’s plans at the upcoming WWDC). BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks began the week on the front foot after the tech-led surge last Friday on Wall St and amid increased optimism regarding a Gaza truce with negotiators set for talks in Cairo on Monday, although Japan was on holiday and ahead of this week's key risk events. ASX 200 was led higher by real estate, tech and telecoms owing to softer yields. Hang Seng and Shanghai Comp. gained with the former entering into bull market territory after climbing over 20% from its January lows, while participants digested a slew of earnings and the mainland also shrugged off the slowdown in March Industrial Profits.

Top Asian News

- China's MOFCOM said export control measures proposed by Japan on semiconductors will seriously affect the normal trade between Chinese and Japanese enterprises, as well as undermine the stability of the global supply chain. Furthermore, it stated that China urges the Japanese side to rectify its 'erroneous practices' in a timely manner and China will take necessary measures to firmly safeguard the legitimate rights and interests of Chinese enterprises, according to Reuters.

- US and Taiwan are to hold in-person negotiation talks on trade beginning on April 29th, according to Reuters.

- Japanese PM Kishida said they will promote union policies for wage increases, according to Reuters.

- PBoC has reportedly expanded a warning on bond investments to regional banks, via Bloomberg citing sources.

- Agricultural Bank of China (1288 HK) Q1 (CNY): Net Income 70.839bln (exp. 73.578bln), NII 144.535bln (exp. 137.021bln).

- PetroChina (857 HK) Q1 (CNY): Revenue 812.184bln (exp. 833.77bln), Net +5% Y/Y, EPS 0.25 (exp. 0.24).

- Japanese Top Currency Diplomat Kanda offers no comments on whether there was FX intervention; will continue to take appropriate action against excessive FX moves; does not have a specific FX level in mind. Speculative, rapid, abnormal FX moves have bad impact on the economy, so unacceptable. Ready to respond 24 hours, 365 days, when asked whether Japan was ready to take action in FX. Will disclose at the end of May if there way intervention.

European bourses, Stoxx600 (+0.3%) are almost entirely in the green, taking the lead from a positive APAC session overnight. Trade has been rangebound since the open, though has just been coming off best levels in recent trade. Basic Resources is found towards the top of the pile, benefiting from modestly firmer base metal prices and after further takeover reports regarding BHP/Anglo American. Retail marginally underperforms. US Equity Futures (ES +0.2%, NQ +0.3%, RTY +0.3%) are entirely in the green, posting modest gains in tandem with European peers. In terms of pre-market movers; Apple (+1.5%) gains on reports that it has resumed talks with OpenAI. And Tesla (+6.5%) benefits from news that the Co. has received tentative approval for its self-driving service.

Top European News

- ECB's Wunsch (interview from 20th April) said ECB should be cautious regarding a July cut, should be cautious regarding a larger-than-25bps cut in June. Base case it as least two cuts, "but if we only do two or even three cuts, then we shouldn't communicate that we're going to cut at every meeting". Don't think ECB has sufficient data to have confidence on 100bps of cuts throughout the year. On what could get in the way of a June cut, Wunsch said "really bad news", "two bad readings on the inflation front or other major developments."

- Spanish PM says he has decided to stay on as Prime Minister.

- Scotland's First Minister Humza Yousaf is set to step down after coming to the conclusion that is position is no longer tenable, according to The Sunday Times.

- Fitch affirmed France at AA-; Outlook Stable and affirmed Switzerland at AAA; Outlook Stable, while it affirmed Sweden at AAA; Outlook Stable.

FX

- USD is softer vs. peers in the wake of aggressive USD/JPY selling overnight and into the European morning. From a technical perspective, DXY has been as low as 105.46 but is respecting Friday's 105.41 base.

- JPY was volatile overnight and initially surged above 160.00 with no obvious catalysts and with Japanese participants away from the market. The pair later saw a sharper drop and breached 156.00 to the downside in the absence of any obvious drivers; some have speculated potential intervention. Since, USD/JPY has continued to bleed, going as low as 154.54 (currently 155.80).

- EUR is firmer vs. USD (as is the case for all major peers). Focus in the Eurozone today is on the German national CPI at 13:00BST, with regional releases thus far broadly showing increases on a M/M and Y/Y basis, though initial reaction dovish as the core numbers continue to moderate. 1.0733 is the high thus far and yet to approach Friday's best of 1.0753.

- Antipodeans are benefitting from the broadly softer USD. AUD/USD is now up for a 6th consecutive session with focus on a test of 0.66 after printing a session high of 0.6586.

- Japan's Top currency diplomat Kanda said will not comment now, when asked about whether Japan intervened in the currency market.

- PBoC set USD/CNY mid-point at 7.1066 vs exp. 7.2759 (prev. 7.1056).

Fixed Income

- USTs are bid with specifics light so far and direction drawn from EGB action after the regions core inflation numbers from Spain & German. Currently at the top-end of a 107-18+ to 107-27+ range with the 10yr yield below 4.65% but in familiar ranges.

- Bunds are firmer with markets focussing on the continued moderation in core Spanish and German state CPI into the 13:00BST nationwide German number. Bunds peaked at 130.87 having pared knee-jerk pressure of around 20 ticks on the German headline numbers; now off best levels.

- Gilts are a touch firmer but yet to move significantly from the unchanged mark in a narrow circa-20 tick range with specifics light and direction for today and this week broadly likely to come from European and US events. Currently at 96.25 shy of Friday's 96.33 best and then 96.67 from Wednesday thereafter.

- Italy sells EUR 6.75bln vs exp. EUR 5.75-6.75bln 3.35% 2029, 3.85% 2034 BTP and EUR 3.5bln vs exp. EUR 3-3.5bln CCTeu.

- EU sells EUR vs exp. EUR 2.5bln 3.125% 2028 and EUR 2.5bln 2.75% 2033 EU Bond.

Commodities

- A subdued day for the crude complex despite the weaker Dollar, but amid the lack of geopolitical escalation over the weekend and amid more sanguine atmosphere surrounding the latest Israel-Gaza ceasefire talks. Brent counterpart slipped from USD 89.25/bbl to USD 88.43/bbl.

- Mixed trade across precious metals with only spot silver benefiting from the slide in the Dollar, whilst spot gold sees its upside capped by the lack of geopolitical escalation and ahead of FOMC later this week. XAU clambered off its USD 2,319.84/oz intraday low but is yet to reach highs seen on Friday at USD 2,352.64/oz.

- Base metals are mixed with some of the market benefiting from the softer Dollar, albeit modestly; 3M LME copper trades on either side of USD 10,000/t.

- TotalEnergies (TTE FP) CEO said the Co. is expected to complete the first phase of the solar power project in Iraq within the next year, while the Co. is to complete the first stage of utilising the by-produced gas from Iraq’s project during 2025 with a production capacity of 50mln cubic feet, according to Reuters.

- Turkey is in talks with ExxonMobil (XOM) over a multi-billion dollar LNG deal, according to FT.

Geopolitics: Middle East

- "Al-Arabiya sources: An Israeli delegation will head to Cairo tomorrow and the plan is indirect negotiations with Hamas"

- UKMTO said it has receives a report of an incident 54NM Northwest of Yemen's Mokha

- Egypt offered a new proposal for a truce between Israel and Hamas in which some Israeli hostages would be exchanged for Palestinian prisoners and a three-week ceasefire, while Egyptian officials said Israel helped create the proposal and would enter longer-term discussions once Hamas releases the first group of 20 hostages over the truce period, according to WSJ.

- Hamas said it received Israel’s official response to its position over ceasefire talks and will study the proposal before submitting its response. It was later reported that a Hamas official told AFP that there were no major issues in the group’s remarks on the truce proposal, while it was separately reported that a Hamas delegation is to visit Cairo on Monday for ceasefire talks, according to an official cited by Reuters.

- Israel’s Foreign Minister said Israel will suspend the planned operation in Rafah if Hamas agrees to a hostage deal and stated the release of hostages is their top priority. It was also reported that the Israeli military said the amount of aid going into Gaza will scale up in the coming days.

- Palestinian President Abbas said Israel will go into Rafah in the next few days and the US is the only country that can stop Israel from attacking Rafah, while he is worried that Israel will try to push Palestinians out of the West Bank after it is done with Gaza, according to Reuters.

- Medical official said at least 13 Palestinians were killed in Israeli airstrikes on three houses in Rafah in southern Gaza, according to Reuters.

- US President Biden spoke with Israeli PM Netanyahu on Sunday and reaffirmed his ironclad commitment to Israel’s security, as well as stressed the need for progress in aid deliveries to be sustained and enhanced in full coordination with humanitarian organisations. Furthermore, they discussed Rafah and Biden reiterated his clear position, according to the White House cited by Reuters.

- White House national security spokesperson Kirby said Israel assured the US that they won’t go into Rafah until the US has a chance to share its perspectives and concerns, while he added Israelis have started to meet the aid commitments that US President Biden asked them to meet. It was separately reported that US Secretary of State Blinken will travel to Jordan and Israel following Saudi Arabia, according to Reuters.

- France’s Foreign Minister said to make proposals in Lebanon to stabilise the zone and prevent a war between Hezbollah and Israel, according to Reuters.

- UKMTO said it received reports of an incident 177 nautical miles southeast of the Port of Nashtoon located in eastern Yemen on Saturday night which involved a small boat that approached a ship, although there was no harm or damage and the ship carried on its journey, according to IRNA.

OTHER

- US intelligence found that Russian President Putin did not directly order Navalny’s death in February, according to WSJ. US intelligence report does not dispute Putin’s culpability for the death of Navalny but believes he probably did not order it at that moment, while a Kremlin spokesperson called the intelligence report empty speculation.

- Russian Foreign Ministry said there will be a severe response if Russian assets are touched and it is a pity that some in the West do not understand it, while it was also reported that Russia’s Kremlin said there will be endless legal challenges if Russian assets are seized.

- Russia’s Kremlin said there are no grounds to hold any peace talks with Ukraine given Kyiv’s official refusal to conduct such talks with Russia.

- Kyiv’s top general said fighting on the eastern front worsened and Ukrainian troops had fallen back in three places.

- North Korea’s Foreign Ministry said it will make stern and decisive choices in response to the US using human rights for anti-North Korean behaviour, while it added that the US envoy on North Korean human rights is motivated politically and is considered political provocation, according to KCNA.

US Event Calendar

- 10:30: April Dallas Fed Manf. Activity, est. -11.3, prior -14.4

DB's Jim Reid concludes the overnight wrap

I wrote some of this while supervising my three kids doing their homework this weekend. The 6yr old twins had fractions and adverbs, with the latter being pretty challenging. They had a whole story where they had to insert missing adverbs. It was incredibly, astonishingly, extremely, exceedingly, enormously, supremely, difficult. So if you see a few stray adverbs below it's because I've been swimming in them this weekend.

With just two days left of a difficult April for markets, last week actually saw the best week for the S&P 500 (+2.67%) and NASDAQ (+4.23%) since November as earnings generally gave markets a boost even if the US inflation data was net net worrying. You’ll see our full recap of last week towards at the end but looking forward first it's an exceptionally busy week of important events.

The FOMC conclusion on Wednesday is the obvious highlight (full preview below) but we also have payrolls on Friday to look forward to. DB expect a more hawkish-leaning Fed this week. While our economists expect the Committee will maintain an easing bias (preview here), they do expect the statement and press conference to echo Chair Powell’s view that firmer inflation prints suggest it will take longer to gain confidence about disinflation. The press conference will be fascinating to see the nuances in Powell’s responses as he justifies a likely unchanged easing bias, even if the rhetoric is more hawkish, in the face of rising inflation.

In terms of the jobs report on Friday, our US economists see payrolls gaining +240k in April (consensus +250k), down from +303k in March. The consensus expects the unemployment rate and the hourly earnings growth rate to stay at 3.8% and +0.3% MoM, respectively, although DB expects the former to tick up a tenth. Overall the market sees a solid report.

Other key data in the US includes consumer confidence tomorrow, the manufacturing ISM, JOLTS, and ADP on Wednesday, and the services ISM on Friday. We also see the latest US Treasury quarterly refunding announcement on Wednesday, after the borrowing estimate is due today. This was a big pivot point for global markets back in August (negative) and October (positive) but since then a commitment not to increase auction sizes has reduced its importance. Our strategists preview the event and detail their estimates here. Finally in the US, earnings season maintains its peak pace as 174 report in the S&P versus 180 last week with Amazon (Tuesday) and Apple (Thursday) the obvious highlights. Meanwhile, 66 Stoxx 600 companies will report this week.

In Europe, preliminary CPI reports for Germany and Spain today, and the Eurozone tomorrow will have a lot of significance for the June ECB meeting and whether we will see the first cut. Our European economists preview the release here. For the Eurozone, they expect the headline HICP to fall one-tenth to 2.31% yoy, its lowest value since August 2021 and see core inflation slowing further to 2.45% yoy, 0.50pp lower than in March 2024. Staying in Europe the latest GDP data for Germany, France, Italy and the Eurozone are due tomorrow. In Asia, various China PMIs (tomorrow) will be a big focus and in Japan, several key economic indicators are also due, including industrial production and labour market data tomorrow.

The day-by-day calendar at the end as usual gives a more detailed diary of the main events this coming week.

Asian equity markets have started the week on a positive note extending Friday’s rally on Wall Street. Chinese stocks are the best performers across the region with the Hang Seng (+1.93%) leading gains followed by the CSI (+1.63%) and the Shanghai Composite (+0.94%), buoyed by a rally in property stocks after embattled property developer CIFI Holdings reached a solution with bondholders on a plan to restructure its offshore debt. Elsewhere, the KOSPI (+0.91%) is also trading higher while stock markets in Japan are closed for a public holiday, also meaning no cash Treasury trading as yet. S&P 500 (+0.25%) and NASDAQ 100 (+0.34%) futures are edging higher.

In FX, the Japanese yen remained under pressure as it weakened past 160 earlier (from just below 158 at the open), its weakest level since 1990. This was in thin holiday trading and it's subsequently bounced back to below 156. So some astonishing moves this morning!

Over the weekend, China’s industrial profits fell -3.5% in March (YoY) and have now risen + 4.3% y/y in the first quarter, significantly down from a +10.2% expansion in the January-February period, thus still pointing to challenges for China even with a better outlook of late.

Recapping last week now, the US March PCE inflation came in line with expectations on Friday at +0.3% month-on-month, allowing markets to breathe a slight sigh of relief compared to the strong Q1 PCE deflator in the GDP data the day before. In year-on-year terms, the March PCE release came in just above expectations at +2.7% (vs 2.6% expected). The month-on-month core print was also in line with consensus at +0.3%, and at +2.8% year-on-year (vs 2.7% expected). The March data also pointed to a still vibrant US consumer, with real personal spending up +0.5% on the month (vs +0.3% expected).

With the PCE print largely in line with expectations, US equities rallied, with the S&P 500 rising +1.02% on Friday. A strong performance by the tech giants following strong Q1 results from Alphabet (+10.22%) and Microsoft (+1.82%) the previous evening saw the Magnificent Seven post their best day in two months (+3.27%). After three weeks of consecutive losses, both the S&P 500 (+2.67%) and the NASDAQ (+4.23%) saw their largest weekly gains since last November. Even as technology spearheaded the rally, the gains were broad-based, as the Russell 2000 index rose +2.79% (and +1.05% on Friday). European equities also advanced, with the STOXX 600 up +1.74% last week (and +1.11% on Friday). The FTSE 100 hit another record high after gaining +3.09% (and +0.75% on Friday).

Friday’s PCE print did little to reverse expectations for fewer Fed rate cuts this year. The number of cuts anticipated by the December meeting was unchanged on Friday (+0.1bps) but down -4.9bps over the week to 34bps, with the decline coming on Thursday following the inflation data within the Q1 GDP release. US Treasuries did see a moderate rally on Friday, as the 2yr and 10yr yields fell -0.3bps and -4.0bps respectively. However, this was insufficient to erase earlier losses with Treasury yields seeing their highest weekly close year-to-date, up +0.9bps to 4.996% for 2yrs and +4.3bps to 4.665% for 10yrs. The story was similar in Europe, as investors dialled back their expectations of ECB rate cuts by -2.2bps on the week to 72bps. This saw 10yr bund yields rise +7.5bps on the week to 2.57%, despite a sizeable recovery on Friday (-5.5bps).

Meanwhile in Asia, the major story last week was the weakening of the Japanese yen. With the Bank of Japan leaving interest rates on hold, alongside restrained commentary on the exchange rate by policymakers, the yen fell -2.33% (and -1.78% on Friday) to 158.33 per dollar, its weakest level since 1990. Against this backdrop, the Nikkei 225 rose +2.34% (and +0.81% on Friday).

Finally in commodities, copper secured its fifth consecutive week of gains after rising +1.48% (and +1.03% on Friday) on the back of growing demand for clean transition metals and tight supply. On the other hand, gold ended its five-week streak of consecutive gains, falling -2.26% (+0.39% on Friday) amid easing geopolitical fears.