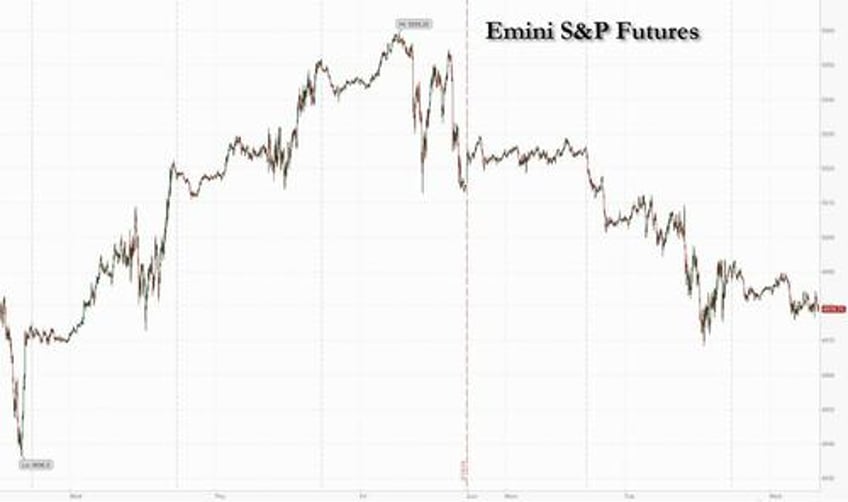

US futures extended their slide, bucking a strong Asian session with European stocks mixed, ahead of what Goldman trader Scott Rubner called “the most important stock on planet earth” - that would be Nvidia for anyone who has been living in a cave the past year - reports after the close facing sky-high expectations, and where another Goldman trader, Peter Callahan, said that the tactical debate is whether this print will be a local top or a ‘break-out’ moment for the stock and for the AI trade (from where he sits, this "feels like consensus is learning more towards the former"). And with options implying the stock may move about 11% in either direction, i.e., a whopping $200BN in market cap may be gained or lost for a company that recently surpassed GOOGL and AMZN in market cap, it's not surprising why the market is on edge. With that preamble out of the way, S&P 500 futures dropped 0.2% as of 7:40am and Nasdaq contracts lost about 0.5%, suggesting Wall Street may be in for a third day of declines. Bond yields are lower, the 10Y dropping 2bps, with steepening across most of the curve; the USD is flat and commodities are weaker. The macro data focus is on Fed Minutes this afternoon; while possible to see a dovish surprise regarding QT this most likely comes at the March 20 Fed meeting where we may see a reduction in the pace of QT.

In premarket trading, Palo Alto Networks plunged more than 20% after the cybersecurity firm cut its forecasts for both revenue and billing and warned of "spending fatigue" among its customers; Piper Sandler downgraded its rating on the stock. Amazon.com rose 1.2% after replacing Walgreens Boots Alliance Inc. in the Dow Jones Industrial Average. Walgreens fell 2.8%. Here are some other notable premarket movers:

- Community Health Systems falls 18% after the hospital owner and operator released a 2024 adjusted Ebitda guidance that was below the average analyst estimate.

- International Flavors & Fragrances shares fall 8.6% after providing a disappointing sales outlook. The company, which provides ingredients, flavors and scents for industries including food and beverage, also cut the dividend.

- Intuitive Machines shares jump 22% after giving an update on its lunar lander, Odysseus. The company, seeking to land a US spacecraft on the moon this week, closed higher by 50% during the regular session on Tuesday, for a third straight gain.

- Manchester United shares slip 2.5% after Jim Ratcliffe completed the acquisition of 25% of Class A shares and 25% of Class B shares for $33 per share.

- Matterport shares drop 13% after giving first-quarter subscription and revenue guidance that came in below the average analyst estimate. Fourth-quarter revenue also missed expectations.

- SolarEdge plunges 16% as the solar equipment maker’s first-quarter revenue forecast missed Wall Street estimates. Fourth-quarter results disappointed as well.

- Teladoc Health shares slide 22% after the healthcare services company reported fourth-quarter revenue that was weaker than expected. Additionally, the company gave first-quarter forecast below consensus expectations.

- Wendy’s shares decline 1.3% after the fast-food chain was downgraded to neutral from overweight at JPMorgan, which sees the stock remaining rangebound.

- RingCentral falls 4% after the provider of cloud-based communications services gave an outlook that analysts said wasn’t strong enough to be compelling.

- Wix.com shares rise 5.9% as the web platform company’s fourth-quarter revenue edged past the average estimate of analysts, who noted revenue growth momentum and expectations for margin expansion in the coming years.

Going back to today's main highlight, Nvidia, the stock fell 1.7% in pre-market trading after sliding 4.4% yesterday. “It feels like these earnings today are a barometer of where we are in the global cycle,” said Justin Onuekwusi, chief investment officer at St James’s Place. “Concentration in the stock market has got to levels where one company’s earnings can have a big macro effect. It’s gone beyond being just a portfolio construction issue; it’s a macro challenge which you can’t get away from.”

Meanwhile, Europe’s stock benchmark retreated from near a record high amid disappointing earnings from some of the region’s biggest companies. The Stoxx Europe 600 gauge edged lower 0.1% for a second day, still about four points from its January 2022 peak. Banks were among the leading decliners as HSBC Holdings Plc tumbled more than 7% after reporting an 80% plunge in fourth-quarter profit. Weak earnings from commodities trader Glencore Plc and Rio Tinto Plc, the world’s biggest iron ore miner, weighed on the basic resources sub-index, which slumped to a four-month low. On the positive side, Carrefour SA gained after the French grocer announced a share buy-back, even as quarterly sales disappointed. Here are all the notable European movers:

- Fresenius SE shares rise as much as 4.7% after the German health-care company reported 4Q Ebit before special items for beat estimates and provided reassuring 2024 guidance

- NKT gains as much as 8.8%, to a record high, after the Copenhagen-listed power cable manufacturer’s 4Q report and guidance both impressed with solid numbers, Carnegie says

- Aedifica rises as much as 3.7% after releasing results described as “excellent” by KBC analysts. A highlight was the Belgian healthcare property operator’s occupancy rates

- Conduit rises as much as 6.2%, the most in about 13 months, after the reinsurer delivers results which Peel Hunt says are strong, and highlight the maturity of the business

- Inditex advances to a fresh record, with Oddo BHF increasing its price target for the Spanish retailer ahead of 4Q earnings that the broker expects will show strong sales growth

- EFG International shares climb as much as 4.2%, to the highest level since 2015, after the Swiss private bank posted solid results according to Vontobel

- HSBC slides as much as 7.6% in London after the bank reported profit that was hit by charges and offered guidance for the year that analysts said was unclear, with Jefferies calling them “messy”

- Glencore shares slump 6.4% after the mining giant posted results showing lower thermal coal prices, which will likely lead to consensus downgrades, according to RBC says

- JDE Peet’s shares drop as much as 6.7%, hitting the lowest level on record, after the Dutch coffee company reported full-year adjusted Ebit that missed estimates

- BAE Systems retreats as much as 3.6% on Wednesday, paring a rally which has fueled the defense and aerospace systems manufacturer to a record high

- Fresenius Medical Care falls as much as 5.5%, adding to Tuesday’s 4.5% drop, following earnings and guidance that failed to turn analysts more bullish on the German dialysis provider

- Nel shares fall as much as 4.2% and to 2019 lows after SEB cut the Norwegian supplier of hydrogen technology’s price target, citing low visibility and forecasts for an Ebitda loss

Positive economic surprises had buoyed European stocks even as traders trimmed bets on interest rate cuts by the European Central Bank. Volatility measures are at historical lows, suggesting some complacency has crept into a market still facing potential headwinds, including rising bond yields, according to Bloomberg Intelligence.

“European stocks could consolidate recent gains in the near term as investor sentiment looks overheated,” BI strategists Laurent Douillet and Tim Craighead wrote in a report. “Rising government bond yields haven’t curbed enthusiasm so far, as highly leveraged companies slightly outperform, and remain a key 2024 risk for equities.”

Earlier in the session, Asian stocks erased an early loss and edged higher as China rallied after authorities rolled out more measures to restore investor confidence, offsetting broader weakness ahead of Nvidia’s earnings. The MSCI Asia Pacific Index rose 0.1% after falling as much as 0.5% earlier, driven by gains in Chinese tech giants including Tencent and Alibaba. Miners dragged on the gauge as iron ore extended declines amid concerns about demand outlook in China, while chip-related stocks declined in Taiwan, South Korea and Japan. Chinese benchmarks jumped, with a gauge of offshore-listed shares surging more than 3% in Hong Kong, as the nation’s two bourses vowed to tighten supervision of quantitative trading after imposing a freeze on a major fund’s accounts. Bloomberg also reported that China has banned major institutional investors from reducing equity holdings at the open and close of each trading day, part of the government’s most forceful attempt yet to prop up the nation’s $8.6 trillion stock market. Banks meanwhile ramped up funding help for the troubled property sector.

- Hang Seng and Shanghai Comp. shrugged off early weakness with outperformance in Hong Kong driven by strength in property and tech, while the mainland also recovered its initial losses and more following recent stability efforts by Chinese authorities.

- ASX 200 was dragged lower by consumer stocks and miners in another busy day of earnings.

- Nikkei 225 continued its gradual pullback from near-record levels but remained above the 38,000 level.

- Indian stocks snapped a six-day rally, dragged by a selloff in information technology companies and as investors likely booked profits. The S&P BSE Sensex Index fell 0.6% to 72,623.09 in Mumbai, while the NSE Nifty 50 Index declined by a similar measure. Both gauges posted their biggest single-day slump since Feb. 12.

In FX, the Bloomberg Dollar Spot Index is little changed after posting a small drop for two straight days; one-year risk reversals in the Bloomberg Dollar Spot Index closed yesterday at the least bullish level in eight months. Markets are close to fully discounting a 25bps cut in June, and see a 33% chance of a cut in May.

- USD/JPY consolidated around 150 while EUR/USD fell back below 1.08 after hitting 1.0839 on Tuesday, its highest since Feb.

- GBP/USD fell 0.1% to 1.2606, in line with recent range

- AUD/USD rose on buying from leveraged accounts in view of solid gains in Chinese stock indexes, according to Asia-based FX traders

In rates, Treasuries are slightly richer across the curve with gains led by front-end, where 2-year yields are lower by ~2bp vs Tuesday’s close. Treasury 10-year yields around 4.26%, richer by around 1.5bp on the day, outperforming bunds and gilts by 2bp and 3bp in the sector. Front-end-led gains in Treasuries steepen 2s10s, 5s30s curves by 0.5bp and 0.7bp, with both spreads off session wides. Bunds lag as the market digests German 10-year auction, while gilts give back a portion of Tuesday’s aggressive rally. US session includes 20-year bond auction, January FOMC minutes and Nvidia Corp. results, scheduled to be reported after the close. Corporate new-issue calendar is said to be under consideration for a large offering. Treasury auctions resume with $16b 20-year bond sale at 1pm; the WI level around 4.535% is above auction stops since November and ~11bp cheaper than January’s, which tailed by 0.8bp.

In commodities, aluminum surged on speculation that a fresh wave of US sanctions against Russia may target the metal, potentially disrupting supplies. Iron ore futures hit the lowest since October after a volatile session in which prices flipped between gains and losses. Oil edged lower with WTI falling 0.7% to trade near $76.50. Spot gold rises 0.2%.

In crypto, Bitcoin (-1.3%) fell back below USD 52k, and Ethereum (-2.2%) dips back under 3k after briefly breaking out above.

US economic data calendar includes only MBA mortgage applications, which declined 10.6% as interest rates rose. Federal Reserve members scheduled to speak include Bostic (8am), Barkin (9:10am) and Collins (5:30pm). FOMC minutes from Jan. 30-31 meeting are due to be released at 2pm

Market Snapshot

- S&P 500 futures down 0.2% to 4,979.75

- STOXX Europe 600 down 0.2% to 490.85

- MXAP little changed at 171.21

- MXAPJ little changed at 523.44

- Nikkei down 0.3% to 38,262.16

- Topix down 0.2% to 2,627.30

- Hang Seng Index up 1.6% to 16,503.10

- Shanghai Composite up 1.0% to 2,950.96

- Sensex down 0.7% to 72,582.18

- Australia S&P/ASX 200 down 0.7% to 7,608.36

- Kospi down 0.2% to 2,653.31

- German 10Y yield little changed at 2.40%

- Euro down 0.1% to $1.0796

- Brent Futures down 0.6% to $81.83/bbl

- Gold spot up 0.2% to $2,027.48

- U.S. Dollar Index little changed at 104.17

Top Overnight News

- Beijing is overhauling how China’s fast-growing quant trading industry is regulated after one of the sector’s largest operators was hit with a trading ban this week for dumping shares. Stock exchanges in Shanghai and Shenzhen announced late on Tuesday that all market activity by computer-driven quant funds, which rely on complex automated trading strategies, would be closely scrutinized under a new monitoring scheme jointly run by both bourses and the China Securities Regulatory Commission. FT

- HSBC slid as its profit plunged 80% after taking unexpected charges on holdings in a Chinese bank. CEO Noel Quinn said it has de-risked its US commercial real-estate exposure and that China’s moves to prop up its property sector will lead to a more lasting recovery. The bank announced a $2 billion buyback. BBG

- Honda and Mazda agree to union wage demands, the latest sign that compensation is rising enough for the BOJ to begin tightening policy. BBG

- Japan’s exports for Jan come in a bit ahead of plan at +11.9% (vs. the Street +9.5%), although the Reuters Tankan survey revealed a deterioration in sentiment while the Japanese gov’t reduced its economic assessment for the first time in 3 months. RTRS

- Boaz Weinstein is building up positions across UK investment trusts that now account for about a quarter of his $5.4 billion bet on closed-end funds trading near historic discounts. His targets include funds managed by JPMorgan, BlackRock, Schroders and Baillie Gifford. BBG

- As Russia’s war in Ukraine enters a third year, President Vladimir Putin’s forces have shifted to the offensive and captured the eastern city of Avdiivka after months of fighting. In a conflict where momentum has ebbed and flowed, the mood is now noticeably darker in Kyiv. BBG

- Private equity firms are increasingly raising money to buy individual companies on a deal-by-deal basis, as they struggle with a downturn in the market and investors look for ways to cut management fees. A record $31bn was deployed by “deal-by-deal” investors last year, according to data provided by private equity advisory firm Triago, defying a broader dealmaking and fundraising slump in the industry. FT

- Donald Trump entered the 2024 election year with about 200,000 fewer donors than in the previous presidential campaign four years ago, raising questions about his fundraising machine just as legal bills eat into his war chest. FT

- Bank reserve balances remain ample, suggesting liquidity levels remain ample despite the drop in reverse repo balances (which means the Fed may not need to slow the pace of QT). BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed with headwinds following the tech-led declines stateside ahead of Nvidia earnings and FOMC Minutes. ASX 200 was dragged lower by consumer stocks and miners in another busy day of earnings. Nikkei 225 continued its gradual pullback from near-record levels but remained above the 38,000 level. Hang Seng and Shanghai Comp. shrugged off early weakness with outperformance in Hong Kong driven by strength in property and tech, while the mainland also recovered its initial losses and more following recent stability efforts by Chinese authorities.

Top Asian News

- China's housing authority said a total of CNY 123.6bln of development loans have been approved and that CNY 29.4bln have been issued under China's "whitelist" mechanism which was launched on January 26th and is aimed at injecting liquidity to the property sector.

- Chinese Foreign Minister Wang met with his French counterpart and said China is ready to strengthen strategic communication with France and forge more consensus, strengthen solidarity and cooperation, as well respond more effectively to global challenges. Wang also stated the two sides had in-depth communication on issues related to peace and security, while they agreed that multi-polarisation is indispensable for peace and stability, and will continue to strengthen strategic coordination. Furthermore, Wang said in a meeting with French President Macron that he hopes France will continue to play a constructive role in the healthy and stable development of Sino-European relations, while China hopes France will also create a fair and just business environment for Chinese enterprises there and provide positive and stable long-term expectations.

- China state asset regulator says state-owned firms should take steps to develop and promote artificial intelligence and should speed up in building smart computer centres.

- China's draft legislation of private economy promotion has commenced, according to state media.

- Japanese government cuts its view on the economy for the first time since November 2023.

- China is said to be tightening its grip on stocks with net sale ban at the open and close, according to Bloomberg sources. Major institutional investors have been banned form reducing equity holdings at the open and close of each session. Firms affected by the ban are not able to offload more shares than they buy during the first and last 30 minutes of the trading day. The order was delivered from China’s securities watchdog to major asset managers and proprietary trading desks of brokerages, sources said. The CSRC (with newly appointed Chairman Qing) also created a task force to monitor short-selling.

European bourses, Stoxx600 (-0.1%) are mixed with a slight positive bias, following on from a similar APAC handover. FTSE 100 (-0.8%) underperforms, hampered by significant losses in index heavyweights. European sectors are on a mixed footing; Autos outperform with broad-based gains within the sector. Basic Resources is at the foot of the pile, weighed on by Glencore (-5.5%) and Rio Tinto (-2.1%) following poorly received earnings. Banks are also lower, after softer HSBC (-7.1%) results. US Equity Futures (ES -0.2%, NQ -0.4%, RTY -0.2%), are modestly in the red, continuing the losses seen in the prior session. Nvidia (-1.7%) is softer in the pre-market, ahead of earnings. In terms of pre-market movers; Amazon (+1.0%) and Uber (+0.6%) are firmer, after S&P Dow Jones Indices said they are set to join the DJIA and DJTA respectively.

Top European News

- UK Chancellor Hunt will have GBP 23bln of headroom for pre-election tax reductions in next month's budget, according to the Resolution Foundation, via Bloomberg.

Earnings

- BAE Systems (BA/ LN) – FY (GBP): Sales 25.2bln (exp. 24.6bln), adj. EBIT 26.82bln (exp. 27.1bln), Board has recommended a final dividend of 18.5p. Q4: EPS 63.2p (prev. 55.5p Y/Y), Adj. EBIT 2.68bln (prev. 2.48bln Y/Y). Order backlog 69.8bln (prev. 58.9bln Y/Y). Guides initial FY24 adj. EPS +6-8%, Revenue +10-12%, adj. EBIT +11-13%. Shares -3.5% in European trade

- Glencore (GLEN LN) - FY23 (USD): Revenue 217.83bln (exp. 216.02bln). adj. EBTIDA 17.10bln (exp. 17.35bln). Net Debt 4.92bln (exp. 4.43bln). Adj. Marketing EBIT 3.5bln (exp. 3.67bln); Recommends to shareholders a USD 0.13/shr base cash distribution. "Although the current macroeconomic environment remains challenging, global economic growth is forecast to bottom out in 2024." "Supply constraints and energy transition demand prevented large inventory increases in most commodities during this cyclical trough, leaving markets well-positioned for a strong recovery as demand conditions improve." "This is particularly the case for copper, where the closure of a major mine and various cuts to production guidance through the second half of 2023 have highlighted the persistent supply challenges facing the industry. These are likely to keep the market tight throughout 2024 against previous expectations of oversupply." Shares -5.5% in European trade

- HSBC (5 HK / HSBA LN) - FY23 (USD): Revenue 66.06bln (exp. 66.69bln). Pretax profit 30.35bln (exp. 34.12bln). Announces up to USD 2bln in share buybacks and a fourth interim dividend of USD 0.31/shr. Co. says the outlook for loan growth remains cautious for H1. OTHER METRICS: CET1 ratio 14.8% (exp. 14.5%). NIM 1.66% (prev. 1.42% Y/Y). Cost efficiency ratio 48.5% (prev. 64.6% Y/Y). OUTLOOK: Sees ROTE in the mid-teens for 2024. Expect banking NII Of At Least USD 41bln For 2024. The dividend payout ratio target remains at 50% for 2024, excluding material notable items and related impacts. Shares -7.1% in European trade

- Rio Tinto (RIO AT / RIO LN) - FY23 (USD): Adj. EPS 7.25 (exp. 7.27). Underlying Profit 11.8bln (exp. 11.7bln). Revenue 54.04bln (exp. 53.94bln). Net Income 10.6bln (exp. 11.15bln). Underlying EBITDA 23.90bln (exp. 23.85bln). Co. said cost pressures and weaker market demand lowered underlying EBITDA by USD 1.0bln. Shares -2.1% in European trade

- Fresenius (FRE GY) - Q4 (EUR): Adj. Net 397mln (exp. 416mln, prev. 445mln Y/Y), EBIT 634mln (exp. 592mln, prev. 559mln Y/Y), Revenue 5.68bln (exp. 5.82bln, prev. 5.67bln Y/Y). Guides FY23 EBIT +4-8%, Organic Revenue growth +3-6%. Shares +4% in European trade

- Carrefour (CA FP) - FY23 (EUR): Adj. Net 1.3bln (prev. 1.2bln Y/Y), Sales 94.13bln (prev. 90.81bln Y/Y). Raises dividend by 55% to 0.87/shr and launches new 700mln share buyback programme. CFO says the retailer plans to keep cutting prices this year in France to be more competitive; the Red Sea crisis has caused delays of one-to-two weeks on products coming from Asia to Europe and increased transport costs. Shares +4.6% in European trade

FX

- Dollar is mixed vs its peers following yesterday's session of losses which sent the DXY down to a low of 103.79 but stopped shy of testing the 200DMA at 103.68.

- EUR is back on a 1.07 handle after pulling back from yesterday's 1.0839 peak and back below its 100DMA at 1.0806. Yesterday's low sits at 1.0761 with not much in the way of notable EZ newsflow to guide price action thus far.

- JPY is relatively steady vs. the USD as the pair continues to pivot around the 150 mark and remains within yesterday's 149.68-150.44 range.

- Antipodeans are both firmer vs. the USD but NZD more so. NZD/USD has mounted yesterday's peak and the 50DMA at 0.6181 with focus now on a potential test of 0.62. AUD/USD currently below yesterday's best of 0.6579 and the 200DMA at 0.6563.

- PBoC set USD/CNY mid-point at 7.1030 vs exp. 7.1877 (prev. 7.1068).

Fixed Income

- USTs are essentially unchanged after Tuesday's light session into the 20yr supply. An outing which hasn't spurred any overt concession just yet, but this could well emerge into the US session. The yield curve is slightly steeper, whilst the benchmark itself is comfortably within Tuesday's 109-19 to 110-05 bounds.

- Bunds started the session on bearish/defensive footing, printing a trough at 132.89; initially unreactive to a strong German outing, but modest upside has emerged since.

- Gilt price action is in-fitting with the above ahead of BoE speak from Dhingra; incremental upside to a strong 2028 outing.

- UK sells GBP 4bln 4.50% 2028 Gilt: b/c 3.34x (prev. 2.86x), average yield 4.095% (prev. 3.946%) & tail 0.4bps (prev. 1.2bps)

- Germany sells EUR 3.712bln vs exp. EUR 4.5bln 2.20% 2034 Bund: b/c 2.1x (prev. 1.77x), average yield 2.38% (prev. 2.23%) and retention 17.53% (prev. 19.78%)

Commodities

- Crude is lower with fresh catalysts light, though focus still remains on the Middle East and China; Brent futures hover off lows and holds around USD 82/bbl.

- Precious metals see upward biases despite the modest gains seen in the Dollar, but as market sentiment is tilting lower and geopolitics largely show signs of expanding; XAU met resistance at its 50 DMA (2,031.04/oz today).

- Mostly firmer trade across base metals. 3M LME copper rose back above the 8,500/t mark and LME aluminium soared over 3% in early trade

Geopolitics: Middle East

- China's envoy to the UN said the objection to a ceasefire in Gaza equals a license to kill and is nothing different from giving the green light to a continued slaughter following the US veto of the Security Council draft resolution on a ceasefire in Gaza, while China expressed its strong disappointment at and dissatisfaction with the US veto, according to Reuters.

- US Central Command said Houthis fired two anti-ship ballistic missiles at a Greek-flagged and US-owned bulk carrier bound for Yemen's Port of Aden, while one of the missiles detonated near the ship and caused minor damage

- UKMTO received a report of heightened uncrewed aerial system activity 40NM west of Yemen's Hodeidah.

- "Israeli sources: progress in hostage talks, Israeli delegation will head to Cairo", according to Sky News Arabia

Geopolitics: Other

- Ukrainian military intelligence chief Budanov said Russia will struggle to keep up the fight and Russians don't have the strength to achieve the goal of seizing two eastern regions this year, according to WSJ.

- Taiwan's Defence Ministry denied increasing military deployments on Taiwan's offshore islands and said there is nothing unusual regarding the military situation around Taiwan, but stated that it is making preparations with the coast guard for possible new scenarios near offshore islands, according to Reuters.

US Event Calendar

- 07:00: Feb. MBA Mortgage Applications, prior -2.3%

- 14:00: Jan. FOMC Meeting Minutes

Central Bank speakers

- 08:00: Fed’s Bostic Gives Welcoming Remarks

- 09:10: Fed’s Barkin Speaks on SiriusXM

- 14:00: Jan. FOMC Meeting Minutes

- 17:30: Fed’s Collins Participates in Fireside Chat

DB's Jim Reid concludes the overnight wrap

One of the proudest moment of my career arrived in the last 24 hours as after 29 years of having a Bloomberg terminal, I found out that I breached their monthly download limit for the first time and was locked out. Before I apply for a pay rise based on my increased productivity, I can only think it's because of the colossal spreadsheets that were involved in the making of the Mag-7 chartbook where Galina in my team and I worked out the profitability of every listed stock in every G20 country and amalgamated them to compare with the Mag-7. A quick call to their help desk and my account was thankfully restored.

Between publishing the above chart book 9 days ago and now, Nvidia has gone from being the 5th largest company in the US to initially the 4th and then the 3rd largest but yesterday it slipped back to the 5th again as it fell -4.35% ahead of a very important earnings release today. This was the worst daily performance since last October. However implied options suggest that that the post results move is priced to be 10.5% in either direction so stand by for potential fireworks across markets in either direction. After having said that they'll probably end up being flat in after-hours trading by tomorrow's EMR!

This move contributed to the S&P 500 (-0.60%) losing ground with the Mag-7 (-1.46%) and the Nasdaq (-0.92%) underperforming. Small caps also lost significant ground, with the Russell 2000 (-1.41%) moving back into the red year-to-date. To be fair, most sectors within the S&P 500 posted pretty modest declines, and the equal-weighted S&P 500 saw a moderate -0.31% decline with 197 advancers. That included a strong performance for Walmart (+3.23%), which was the fifth best performer in the index after their earnings beat estimates. And over in Europe, it was much the same story, with technology stocks helping to drag the broader indices lower, as the STOXX Technology Index fell -1.93%, even though the STOXX 600 (-0.10%) only experienced a marginal decline. Moreover in France, the CAC 40 (+0.34%) hit a new all-time high.

In the meantime, sovereign bonds got support from more dovish news over the last 24 hours, as the Canadian CPI print for January surprised on the downside. That was welcome news for investors, as recent prints from the US and Sweden had seen upside surprises, which added to fears that the path back to target was likely to prove a bumpy one. So with Canadian headline inflation down to +2.9% (vs. +3.3% expected), and core inflation also falling, that led to growing expectations that the Bank of Canada would soon be able to cut rates. Indeed, the chance of a rate cut by June surged from 58% on Monday to 84% by the close yesterday, and yields on 10yr Canadian government bonds fell -7.1bps.

That backdrop helped support a global sovereign bond rally. There were modest declines in Treasury yields, with the 10yr down -0.5bps to 4.28%, and 2yr down -3.0bps. The bond rally was slightly stronger in Europe, where yields on 10yr bunds (-3.8bps), OATs (-3.6bps) and BTPs (-4.2bps) all fell back. And it was UK gilts (-6.9bps) that saw one of the biggest moves after comments from BoE Governor Bailey. He said that they “ don’t need obviously inflation to come back to target before we cut interest rates. I must be very clear on that, that’s not necessary ”. In addition, Bailey also said he was “comfortable with a profile that has cuts in it”, suggesting that the next move was likely to be a rate cut. In turn, investors became more confident in the likelihood of a cut by June, with the chance up to 66% by the close from 52% the day before.

Otherwise on the inflation side, there was better news from the latest commodity declines, with Brent oil prices (-1.46% to $82.34) falling back from their 3-month high the previous day. At the same time, there was a notable decline in iron ore futures (-2.01%), which hit a 3-month low amidst ongoing concern about demand from China. The Bloomberg commodity index declined by -0.44%, although it stayed half a percent above its 2-year lows seen last week.

Chinese stocks are bucking the global trend this morning as actions to boost sentiment are winning out for now. The Hang Seng (+2.40%) is off its highs but with the CSI (+2.30%) and the Shanghai Composite (+2.13%) catching up after the lunch break.

Other Asian markets are lower with the Nikkei (-0.24%), KOSPI (-0.32%) and the S&P/ASX 200 (-0.66%) trading lower alongside S&P 500 (-0.13%) and NASDAQ 100 (-0.27%) futures. 2yr and 10yr US treasuries are -2.3bps and -0.6bps lower respectively.

Early morning data showed that Japan’s exports rose for the second consecutive month advancing +11.9% y/y in January (v/s +9.5% expected and against a +9.7% downwardly revised increase in December) on higher demand for cars and semiconductor-manufacturing equipment. Imports fell -9.6% y/y, versus Bloomberg’s estimate for an -8.7% decrease. As such the trade deficit of -1.758 trillion yen was slightly smaller than the -1.855 trillion yen expected.

There wasn’t too much data yesterday, although the US Conference Board’s Leading Index fell for a 22nd consecutive month in January, with a -0.4% decline (vs. -0.3% expected).

To the day ahead now, and an important highlight will be Nvidia’s earnings after the US close. Otherwise from central banks, we’ll get the FOMC’s minutes from the January meeting, and hear from the Fed’s Bostic and the BoE’s Dhingra. Data releases include Euro Area consumer confidence for February.