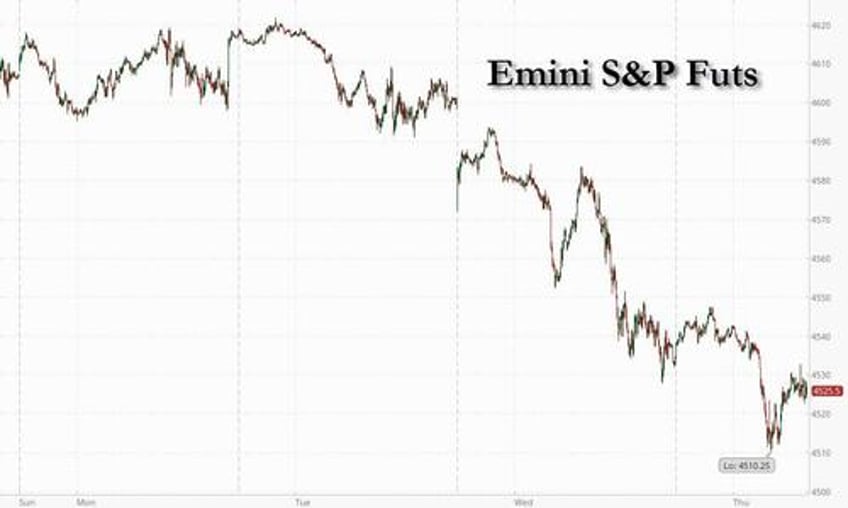

US equity futures are weaker for a second day amid a global stock sell-off sparked by a rout in US Treasuries which accelerated overnight when the BOJ "unexpectedly" stepped in with unlimited bond buying for a second time this week after the benchmark 10-year note yield touched a fresh nine-year high of 0.65%, confusing markets about what it wants to do: keep a cap on yields or strengthen the collapsing yen. European stocks fell 0.6% and Asian markets suffered their worst two-day drop since February as the S&P 500 was set to extend yesterday’s losses. As of 7:45am ET, S&P futures were down 0.3% while Nasdaq futures dropped 0.4% after several very disappointing earnings after the close yesterday. Tech gigacaps were mixed pre-mkt ahead of AAPL (-38bps) and AMZN (+34bps) earnings.

Global bond yields continue to surge higher with 10Y yields now +19.2bps this week. Bill Ackman added to the bearish mood by announcing he’s shorting 30-year Treasuries as a hedge on the impact of higher long-term rates on stocks. Commodities are mixed as the dollar strengthened for a fourth day; nat gas the upside standout with Ags and base metals giving up recent gains, which appear to be more geopolitically related moves. Today’s macro data focus includes ISM-Srvcs, Durable Goods/Cap Goods, Factory Orders, and Jobless Claims. The earnings highlight is after the close when AAPL and AMZN report and while they may not give a strong read-through on the broader economy, certainly every investor will be watching results.

It has been a busy session in premarket trading following an earnings deluge, with PayPal falling as much as 9% after the company’s transaction revenue fell short of estimates and as analysts cut their price targets on the stock, saying that the digital payments company’s transaction margins were disappointing and will weigh on sentiment. Qualcomm shares also fell around 8%, after the chipmaker gave a revenue outlook seen as weak by analysts, underlining headwinds in the handset market. Brokers said the struggling handset business will be slow to recover. Deutsche Bank cut the recommendation on the stock to hold from buy. Here are some other notable premarket movers:

- American Well drops 9% after Morgan Stanley downgrades its rating on the telehealth company to equal-weight and says Wednesday’s second-quarter results were “another setback on growth.”.

- Aravive shares fall 47% in US premarket trading after its Phase 3 AXLerate-OC trial evaluating the safety and efficacy of batiraxcept in platinum-resistant ovarian cancer did not meet its primary endpoint of progression-free survival. .

- DoorDash shares jump 3.6% after the online food ordering and delivery platform reported second-quarter adjusted Ebitda that beat estimates. Analysts said results were good, with William Blair highlighting the strong user engagement and increase in total orders both year-over-year and sequentially.

- DXC Technology shares slide 19% after the information technology servicer reported first-quarter revenue and adjusted earnings per share that missed consensus estimates. The company also reduced its full-year outlook for adjusted earnings per share and revenue. RBC Capital Markets downgraded their recommendation on the stock to sector perform from outperform, labeling the print “disappointing.”

- EVgo shares rise as much as 16% after the electric-car charging company said CEO Cathy Zoi will retire in November and be succeeded by board member Badar Khan. The company also reported $50.6 million of second-quarter revenue Wednesday, more than five times what it generated in the same period last year.

- Etsy shares fell as much as 8.7%, after the online retailer reported its second-quarter results and gave an outlook that Citi said wouldn’t be enough to reassure investors about its growth prospects.

- Procore Technologies’ results on Wednesday were solid, but there are gathering macro headwinds, Loop Capital Markets writes in note downgrading the construction-management software company to hold from buy.

- Robinhood (HOOD US) shares dropped as much as 9%, after the trading platform’s monthly active users missed analyst estimates, overshadowing the company reaching profitability for the first time since its IPO. On a more positive note, some analysts said that the company beating revenue expectations was a good sign.

- Spirit AeroSystems Holdings shares fall 1% after Goldman Sachs cuts its rating on the planemaker’s stock to neutral from buy, saying the company’s medium-term profitability and free cash flow is worse than expected.

- US-listed shares of Shopify fall as much as 2.7% on Thursday as Morgan Stanley notes that investors still lack direction from the company on longer-term growth. The Canadian e-commerce company, however, reported revenue for the second quarter that beat the average analyst estimate.

- Unity Software shares rise as much as 6.6%, after the graphic tools provider reported second- quarter revenue that beat expectations and raised the low end of its full-year revenue forecast.

- Upwork climbs 17% after the online-recruitment company increased its revenue and profit projections for the full year.

All attention remains on the 10-year Treasury yield which increased five basis points to 4.13% this morning. The selling has come on the heels of news that the Treasury will issue $103 billion of securities next week, more than forecast. The decision by Fitch Ratings to strip the US of its AAA credit ranking also put a spotlight on the country’s booming fiscal deficits.

“The US downgrade doesn’t have any direct impact on markets, but what’s happened is there’s been a lot of concurrent news,” Fowler at UBS said. “Treasury supply is going to pick up. And the Bank of Japan’s policy change has also removed the floor on bonds and that’s led to rising yields.”

Long-term debt looks “overbought” from a supply and demand perspective and it’s hard to see how the market will cope with the increased issuance “without materially higher rates,” Ackman said in a tweet.

I have been surprised how low US long-term rates have remained in light of structural changes that are likely to lead to higher levels of long-term inflation including de-globalization, higher defense costs, the energy transition, growing entitlements, and the greater bargaining…

— Bill Ackman (@BillAckman) August 3, 2023

Warren Buffett, on the other hand, told CNBC the Fitch move doesn’t change what Berkshire Hathaway Inc. is doing at the moment. “Berkshire bought $10 billion in US Treasurys last Monday. We bought $10 billion in Treasurys this Monday. And the only question for next Monday is whether we will buy $10 billion in 3-month or 6-month” T-bills, CNBC cited Buffett as saying.

Elsewhere, the Bank of Japan came into the market for the second time this week to slow gains in benchmark sovereign bond yields, underscoring its determination to curb sharp moves in rates even as it makes room for them to rise. The yen strengthened against all its major peers, adding 0.3%.

In European equities, the Stoxx 600 Index headed for the steepest three-day retreat since March. Infineon Technologies AG plunged as much as 12% after disappointing forecasts from the German chipmaker. Deutsche Lufthansa AG dropped amid concerns over debt and higher costs. Here are the most notable European movers:

- Anheuser-Busch InBev shares jump as much as 5.1%, after the brewer reported second-quarter organic adjusted Ebitda that came ahead of estimates. BC Capital Markets said the results were an “impressive demonstration” of the company’s resilience and diversification

- Zalando shares gain as much as 9% after the online fashion retailer reported adjusted Ebit for the second- quarter that topped estimates, with analysts pointing to lower marketing costs among the key drivers

- Merck KGaA gains as much as 4% after the German health-care conglomerate reported its latest earnings and cut its forecast for the full year. Analysts say the reduced forecast is largely accounted

- Beiersdorf shares rise as much as 4.6%, after it reported adjusted Ebit for the first half-year that beat the average analyst estimate Jefferies says the German consumer-goods group’s results came in well ahead in consumer segment

- Adecco shares rise as much as 5.9%, as investors look past below-consensus 2Q earnings and focus on the staffing company’s market share gains, robust organic growth and cost control

- SES shares rise as much as 16%, after the satellite operator reported estimate-beating results, announced buybacks and said it expects to receive a $3b pretax payment in 4Q after clearing C-band airwaves ahead of schedule

- Societe Generale shares gained 3.3%, second best-performer on the Stoxx 600 Banks Index, after the French lender reported net income for the second quarter that beat the average analyst estimate in the first set of results

- Infineon shares fall as much as 12%, the most since March 2020. The chipmaker’s fourth-quarter forecasts for margin and revenue both missed analyst estimates as inventory levels edged higher

- Veolia Environment falls as much as 8% in Paris trading after broadly in-line 1H results, with Citi analysts saying consensus already prices more than average long- term Ebitda growth and margin outlook

- Tenaris’s shares tumbled as much as 8.6% after the Italian steel pipe maker warned that sales and margins will be “significantly lower” in the second half due to an expected decline in sales in the Americas

- Solvay drops as much as 4%, as the Belgian chemicals producer reports weaker 2Q volumes and a drop in adjusted Ebitda. Morgan Stanley highlights the steady guidance as a bright spot, however, given the recent spate of profit warnings across the sector

- BPER Banca shares declined as much as 9.1% after the Italian lender gave what Deutsche Bank called “prudent” guidance that reflects a slowdown in 2H including in net interest income

Earlier in the session, Asian equities fell, taking their two-day drop to the most since February, as investors sold tech and consumer discretionary shares on concerns over higher bond yields. The MSCI Asia Pacific Index extended losses by as much as 0.8% after a 2.1% drop on Wednesday. Alibaba, Sony Group and Samsung Electronics were among the biggest drags as 10-year Treasury yields climbed past 4.1%. Valuations for tech stocks are generally impacted by higher yields as elevated interest rates affect expectations for future earnings growth.

Fitch Ratings’ downgrade of US sovereign rating and increased Treasuries issuance sparked risk-off mood globally, with the recent rally in Asian stocks halting in August, which is seasonally a bad month for equities. The index has slumped as much as 2.7% so far this week amid bouts of profit-taking in North Asian markets as the AI rally peters out.

Benchmarks in Japan led declines in the region Thursday. All sectors were in the red. Australia's ASX 200 was dragged lower by losses in tech after the underperformance of their US counterparts, with sentiment not helped by softer monthly exports and a continued contraction in quarterly retail trade.

Investors are now looking ahead to US non-farm payroll data on Friday for cues on the Federal Reserve’s next policy move after ADP Research Institute data showed that US companies added more-than-expected jobs in July. “I think the selloff was waiting to happen,” said Aninda Mitra, head of Asia macro and investment strategy at BNY Mellon Investment Management. “Overconfidence about the inevitability of a US soft landing and dovish policy pricing, when in reality the regime of high inflation and high rates is very much entrenched.”

In FX, the Bloomberg dollar index gained for a fourth day, rising 0.2%; the pound fell 0.3% against the dollar after the BOE hiked rates by 25bps, disappointing markets which had priced in roughly 33% odds of another 50bps hike. JPY stood as the outperforming currency amid haven flows following overnight weakness sparked by another unscheduled BoJ JGB purchase operation. EUR is softer against the Dollar with the Single Currency digesting the Final PMIs for July while the Sterling gears up the Bank of England policy decision.

In rates, treasuries extend losses and the recent bear steepening move with long-end underperformance, leaving 30-year yields cheaper by around 6bps on the day. US yields cheaper by 2bp to 6bp across the curve with long-end led losses steepening 2s10s, 5s30s spreads by 3.5bp and 2.2bp on the day; 10-year yields around 4.13%, cheaper by 5bp on the session with gilts outperforming by 5bp in the sector. Gilts outperformed after the Bank of England raised rates 25bps, in line with estimates. The US session focuses on the flood of US economic data due, including initial jobless claims and ISM services. On the day UK 2-year yields richer by 7bp following Bank of England 25bp hike in a three-way vote split. The Dollar IG issuance slate empty so far; three deals priced $12.2b Wednesday, where issuers paid ~6bps in concessions on order books that were 4.4 times oversubscribed.

In commodities, iron ore slipped back below $100 a ton as investors questioned China’s resolve to revive growth with steel-intensive stimulus and the nation’s biggest group of mills called for curbs on trading. Futures in Singapore lost as much as 4.3%, to head for the sixth weekly drop in the past seven.

Looking ahead, US economic data slate includes July Challenger job cuts (7:30am), 2Q nonfarm productivity, unit labor costs, initial jobless claims (8:30am), S&P services PMI (9:45am), June factory orders, durable goods orders, July ISM services index (10am). We also have the UK July official reserves changes, Italian July services PMI, June retail sales, German June trade balance, the French budget balance for June and the Eurozone PPI result for June. In terms of central banks, we have the BoE decision, the Decision Maker Panel survey and we will also hear from the Fed’s Barkin. Finally, company earnings include Apple, Amazon, ConocoPhillips, Amgen, Booking Holdings, Stryker, Airbnb, Gilead Sciences, Cigna, Regeneron, Monster Beverage, EOG Resources, Block, Moderna, Cheniere, Warner Bros Discovery, Expedia and Draft Kings.

Market Snapshot

- S&P 500 futures down 0.5% to 4,516.25

- MXAP down 0.8% to 165.41

- MXAPJ down 0.5% to 524.45

- Nikkei down 1.7% to 32,159.28

- Topix down 1.5% to 2,268.35

- Hang Seng Index down 0.5% to 19,420.87

- Shanghai Composite up 0.6% to 3,280.46

- Sensex down 1.1% to 65,036.75

- Australia S&P/ASX 200 down 0.6% to 7,311.68

- Kospi down 0.4% to 2,605.39

- STOXX Europe 600 down 0.9% to 456.84

- German 10Y yield little changed at 2.57%

- Euro down 0.2% to $1.0914

- Brent Futures down 0.5% to $82.76/bbl

- Gold spot up 0.1% to $1,935.90

- U.S. Dollar Index up 0.19% to 102.79

Top Overnight News from Bloomberg

- China will be sending a representative to a major Saudi Arabia summit focused on achieving peace in Ukraine, suggesting Beijing is eager to see the conflict conclude. WSJ

- China’s services PMI comes in ahead of the Street at 54.1 (up from 53.9 in June and ahead of the consensus forecast of 52.4). RTRS

- The BOJ intervened for a second time this week after the benchmark 10-year yield touched a fresh nine-year high of 0.65%. The unscheduled move pushed the rate fractionally below this level but still well above where it traded before last week's policy tweak. BBG

- Brazil cut its policy rate by 50bp, more than the 25bp anticipated by investors, and said there would be further reductions in the months ahead. WSJ

- Another BOE rate hike is in the cards today, the size of which is uncertain given the recent slowdown in inflation. Economists expect at least a 25-bp move to 5.25%, with a strong chance that policymakers may repeat June's 50-bp jump. Traders see rates peaking around 5.75% by year end, almost a full point below expectations just a month ago. BBG

- SALT is causing another fiscal battle in Washington – certain Republicans in the House are threatening to block spending bills unless the $10K cap is increased. WSJ

- The SEC is preparing to adopt a rule package as soon as this month aiming to bring greater transparency and competition to the multitrillion- dollar private-funds industry, people familiar with the matter said. SEC Chair Gary Gensler has said he hopes to bring down fees and expenses that cost hundreds of billions of dollars a year. WSJ

- Fitch’s downgrade of its U.S. government debt rating Tuesday only fueled more of the partisan bickering that the firm said was raising concerns about America’s ability to tackle its swelling budget deficits. And as Congress prepares to hash out spending for next fiscal year, the two parties aren’t considering the policies that could meaningfully address the problem: raising taxes or cutting spending on major programs such as Medicare or Social Security. WSJ

- Bill Ackman is making sizable bets on declines for 30-year US Treasuries as a hedge on the impact of higher long-term rates on stocks. Ackman also sees the short as a “high probability” standalone play, the Pershing Square Capital Management founder said in a post on X, the platform formerly known as Twitter. An increasing supply of Treasuries will be needed to fund the current budget deficit, future spending plans and higher refinancing rates, Ackman said. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks mostly followed suit to the weakness in global peers including on Wall St where stocks and bonds were pressured by the US rating downgrade, AMD earnings and hot ADP data, albeit with some of the losses were stemmed in Asia as participants digested Chinese Caixin Services and Composite PMI figures. ASX 200 was dragged lower by losses in tech after the underperformance of their US counterparts, with sentiment not helped by softer monthly exports and a continued contraction in quarterly retail trade. Nikkei 225 underperformed as yields edged higher and with newsflow dominated by earnings. Hang Seng and Shanghai Comp were choppy and briefly clawed back opening losses in the aftermath of somewhat mixed Chinese Caixin Services and Composite PMI data.

Top Asian News

- China's Foreign Ministry said China is willing to maintain communications regarding the US inviting Chinese Foreign Minister Wang Yi for a visit, according to Reuters.

- US House Committee opened an investigation into the suspected Chinese hacking of State Department and Commerce Department emails.

- Japanese Chief Cabinet Secretary Matsuno said he hopes the BoJ works closely with the government and guides policy appropriately to stably and sustainably hit the 2% price target, while he added the government is closely watching FX moves and their impact on Japan's economy and prices, according to Reuters.

European bourses and US futures continue to slump in an extension of Wednesday's price action as yields continue to rise; Euro Stoxx 50 -0.8% & ES -0.3% Sectors in Europe are lower across the board with marked underperformance in Tech as Infineon -7.7% slumps post-earnings given two-way commentary and below-forecast Q4 guidance. Autos also stalling on BMW while Travel & Leisure is affected by Lufthansa. Stateside, given the marked yield action the NQ -0.4% is the incremental underperformer with attention on data points before numerous blockbuster earnings, incl. Apple and Amazon after-hours.

Top European News

- ECB's Panetta says monetary policy may operate not just by increasing rates but also by keeping the prevailing level of policy rate for longer. With policy rates now firmly in restrictive territory, setting and communicating the direction of monetary policy has become more complex. The risks to inflation are becoming balanced. Supply chain pressures have substantially abated compared with last year. It is possible that the transmission of our monetary policy might be even stronger than the staff projections indicate.. Adds, will decide in September whether we should pause or not.

FX

- Another session of gains thus far the Buck, driven by an upside in bond yields as debt futures continue to trundle lower in a continuation of recent price action. DXY found overnight support around 102.50 before edging higher in early European trade to a 102.84 high at the time of writing.

- JPY now stands as the outperforming currency amid haven flows following overnight weakness sparked by another unscheduled BoJ JGB purchase operation.

- EUR and GBP are both softer against the Dollar with the Single Currency digesting the Final PMIs for July while the Sterling gears up the Bank of England policy decision.

- Antipodeans are all modestly softer on the day amid the firmer Dollar and broader risk aversion, but losses are stemmed by the overnight Chinese Caixin Services PMI which topped forecasts, whilst Australian Trade Balance printed at a slightly wider surplus than expected, although Imports and Exports both contracted.

- PBoC set USD/CNY mid-point at 7.1495 vs exp. 7.1933 (prev. 7.1368)

- Brazil Central Bank cut the Selic rate by 50bps to 13.25% (exp. 25bps cut) with the decision not unanimous. BCB stated the current scenario demands serenity and moderation in the conduct of monetary policy and if the expected scenario is confirmed, the committee unanimously expects rate cuts of the same magnitude in coming meetings, while it considered a 25bps cut but concluded a 50bps cut was appropriate due to the improvement in inflation dynamics.

Fixed Income

- In short, a continuation of Wednesday’s post-Fitch/Refunding price action with catalysts since somewhat light as we count down to the BoE.

- EGBs and USTs are lower across the board and have dropped markedly below the prior sessions’ troughs.

- JGBs buck the trend and are modestly firmer after another unscheduled BoJ purchase overnight, which came much later in the session than normal and is the second such operation since the YCC tweak.

- BoJ offered to buy JPY 100bln in 1yr-3yr JGBs and offers to buy JPY 300bln in 5yr-10yr JGBs in an unscheduled operation.

Commodities

- WTI and Brent futures are subdued as risk sentiment remains on the backfoot whilst the Dollar is underpinned.

- Spot gold remains heavy amid the recent gains in the Dollar, with the yellow metal extending losses under USD 1,950/oz following yesterday’s fall below the psychological level.

- Base metals are subdued but not to a great extent following the recent selloff in the complex, with the downside possibly cushioned by the rosier Chinese Caixin Services PMI overnight.

- Saudi Arabia and Kuwait reaffirmed they jointly own rights to natural resources in the Durra Gas field and renewed calls for Iran to negotiate over the demarcation of borders, according to Saudi's Foreign Ministry.

- Chile Codelco copper production fell 7.39% Y/Y in June to 120.3k tonnes, while Escondida copper mine production rose 8.7% Y/Y to 111.4k tonnes in June.

- Ukraine's PM says Ukraine is considering the possibility of insuring ships and companies going via a "grain corridor", according to Interfax-Ukraine.

Geopolitics

- Ukrainian military warned of drone attacks around Kyiv and said anti-aircraft units were in operation, while explosions were also reported, according to Reuters.

- Russian Defence Ministry said navigation is restricted in Kerch Strait and that movement in the Kerch Strait is also limited for aircraft, according to TASS.

- Polish PM says Wagner's forces are moving towards NATO's eastern flank to destabilize, according to Al Arabiya.

US Event Calendar

- 07:30: July Challenger Job Cuts -8.2% YoY, prior 25.2%

- 08:30: July Initial Jobless Claims, est. 225,000, prior 221,000

- July Continuing Claims, est. 1.71m, prior 1.69m

- 08:30: 2Q Unit Labor Costs, est. 2.5%, prior 4.2%

- Nonfarm Productivity, est. 2.3%, prior -2.1%

- 09:45: July S&P Global US Services PMI, est. 52.4, prior 52.4

- 10:00: June Durable Goods Orders, est. 4.7%, prior 4.7%

- June Durables -Less Transportation, est. 0.6%, prior 0.6%

- 10:00: June Factory Orders, est. 2.3%, prior 0.3%

- June Factory Orders Ex Trans, est. 0.1%, prior -0.5%

- 10:00: June Cap Goods Ship Nondef Ex Air, prior 0%

- June Cap Goods Orders Nondef Ex Air, prior 0.2%

- 10:00: July ISM Services Index, est. 53.0, prior 53.9

- July ISM Services Prices Paid, prior 54.1

- July ISM Services New Orders, prior 55.5

- July ISM Services Employment, prior 53.1

DB's Jim Reid concludes the overnight wrap

August is often a month where everyone thinks it will be quiet but also one that throws up a disproportionate amount of surprises in what are thin liquidity conditions. Clearly by the time the real dog days of the month are amongst us in a couple of weeks we may have forgotten about the Fitch US debt downgrade but its certainly given the start of the month a big dose of volatility with the S&P 500 (-1.38%) seeing its worst day since April. However the increased treasury issuance will live on so that's something we won't be able to forget in the weeks and months ahead. All this excitement has occurred ahead of a big day today including the BoE rate decision (we think 25bps over 50bps), US services ISM, jobless claims, unit labour costs and productivity, with Apple and Amazon then reporting after the bell.

The straw that probably broke the back for the Fitch downgrade was the surprise announcement on Monday of the Treasury’s near-term borrowing needs which were formalised yesterday in the refunding announcement. At the margin it seems slightly bigger than the very recently revised expectations but within the range of likely outcomes. Indeed rising borrowing needs are what Fitch cited as a key factor driving its decision to lower its rating for US sovereign debt. The increase in issuance announced yesterday is unlikely to be the last, as the Treasury concurrently announced that it expects “further gradual increases will likely be necessary in future quarters” into 2024. In the subsequent press conference, the Treasury also emphasised it was too early to speculate whether this would lead to future actions by Congress to reduce the deficit. Much too early for that discussion I would imagine but it’s a small shot across the bows nevertheless.

The culmination of this week’s news led to a decent steepening of the curve with 2yr and 10yr USTs -2.4bps and +5.6bps respectively with the latter up to 4.08% (peak at 4.12% for the day), their highest closing level since November last year. The 2s10s slope, while still deeply inverted at -80.5bp, rose to its highest level since early June. 30yr yields also continued to rise, gaining +8.3bps to 4.17%, also the highest since last November. This morning in Asia, US Treasuries are up another couple of basis points to 4.10% as I type.

A strong ADP (more later) contributed to an initial sell off at the front end (with 2yr trading +3.5bp higher at one point). But rates then rallied, especially at the short end, with Fed funds pricing for end-24 down -6.0bps on the day to 4.14%. So longer end yield moves were more of an issuance story than a response to the ADP given the Fed repricing. A reminder that DB thinks that US term premium should be going up for structural issues but the trade has certainly got a kicker from the BoJ last week and now the refunding announcement and Fitch this week.

In contrast, European bonds saw a bull steepening as the equity risk-off story and a flight to quality away from US debt was the dominant theme. 10yr German bund yields fell -2.4bps, with 2yr yields falling -6.0bps.

Equities were in the red across the board, with the S&P 500 slipping -1.38% in its largest down move since April, with only the consumer staples (+0.25%) and healthcare (+0.06%) sectors remaining in the green. 73% of the constituent members of the S&P 500 were negative on the day. Technology led the decline, with the NASDAQ falling -2.17%. The FANG+ index fell -3.45%, with all 10 constituents down. Accompanying the equity decline was a rise in implied volatility, with the VIX seeing its sharpest daily increase since the March banking stress, and up to its highest level since the end of May at 16.09. European equities also slipped with the STOXX 600 falling -1.35%. The retreat was even broader than in the US, with 88% of constituents down on the day.

The credit market was not left unscathed. US high-yield credit default swaps rose +11.3bps, with European Crossover rising +11.5bps. The indices for US and European investment grade credit default swaps also increased, +2.1bps and +2.5bps respectively.

In terms of data, we had the US July ADP report, which upwardly surprised at +324k (vs 190k expected), even if that marked a slowdown from +455k in June. Although typically not the most reliable monthly print, the annual wage growth component of the survey did prove consistent with the softening inflation narrative, falling from 6.4% to 6.2%. Overall, the market paid little attention to the report, with the US debt issuance surprise proving the lead story.

Turning to the UK, Prime Minister Rishi Sunak was reported stating that he felt inflation was not falling as fast as he would like. This came ahead of the BoE monetary policy decision later today. Our economists are expecting a 25bps hike to bring the policy rate to 5.25% and looking ahead, we see two further quarter point rate hikes, with the terminal rate at 5.75%. Read their preview here. 2yr gilt yields traded down -6.2bps yesterday ahead of the meeting, following the broader short-end rally in Europe. Money markets moved to price a 27% chance of a 50bp hike, down from 32% the day before. This had been at over 70% prior to the weaker UK inflation print on 19 July.

Risk-off sentiment has continued in Asia overnight. As I check my screens, the Nikkei (-1.42%) is sharply lower with the KOSPI (-0.64%), the Hang Seng (-0.15%), the Shanghai Composite (-0.18%) and the CSI (-0.02%) also edging lower. S&P 500 (+0.07%) and NASDAQ 100 (-0.03%) futures are fairly flat. 10yr JGB yields earlier rose +4bps to 0.66%, the highest since April 2014, but the second unscheduled bond buying program of the week has led to a 2bps rally from the yield highs.

Early morning data showed that China services activity expanded at a faster place in July as the Caixin services PMI edged up to 54.1 v/s (52.4 expected) from a level of 53.9, thus partly offsetting the drag from the weak manufacturing sector. Elsewhere, Australia’s services sector activity contracted in July as the Judo Bank services PMI fell to 47.9 (the lowest since December) from 50.3. Separately, the country’s trade surplus unexpectedly swelled to A$11.3 bn in June (v/s A$10.75 bn expected) compared to a downwardly revised surplus of A$10.5 bn in May.

In the geopolitics sphere, it was reported yesterday morning that Russia conducted a drone strike on the key Danube port in the Odesa region, Ukraine, hitting grain storage facilities. In response, the price of Chicago wheat futures jumped +4.87% above its previous day close before slipping to finish the day down -1.88%. Corn futures also spiked, before falling -1.76% on the day. US corn prices have in fact declined to their lowest since the end of 2020 amid a more encouraging weather outlook.

Looking ahead, we have the US July ISM services index, the Q2 unit labour costs, nonfarm productivity, June factory orders and initial jobless claims from the US. We also have the UK July official reserves changes, Italian July services PMI, June retail sales, German June trade balance, the French budget balance for June and the Eurozone PPI result for June. In terms of central banks, we have the BoE decision, the Decision Maker Panel survey and we will also hear from the Fed’s Barkin. Finally, company earnings include Apple, Amazon, ConocoPhillips, Amgen, Booking Holdings, Stryker, Airbnb, Gilead Sciences, Cigna, Regeneron, Monster Beverage, EOG Resources, Block, Moderna, Cheniere, Warner Bros Discovery, Expedia and Draft Kings.