In a major, first-of-its-kind milestone along ESG's relentless march to its grave, a federal court has ruled that American Airlines breached its duty to employees by tapping ESG-addled BlackRock to manage part of its 401(k) plan.

"The facts here compellingly established fiduciary misconduct in the form of conflicts of interest and the failure to loyally act solely in the Plan’s best financial interests," wrote US District Judge Reed O'Connor in a ruling that followed a four-day bench trial in June 2024. That duty of loyalty is imposed by the Employee Retirement Income Security Act (ERISA).

The ruling is certain to set off alarms in general counsel offices and boardrooms across America. For starters, 401(k) plans at 60% of Fortune 100 employers contain BlackRock investments, and BlackRock manages a huge chunk of the federal government's Thrift Savings Plan. Of course, BlackRock isn't the only asset manager whose ESG problem could become an employer's problem.

Notably, the American Airlines plan didn't offer any explicitly-ESG investment options. The issue was BlackRock's intrinsically ESG-oriented management of all its funds. “This is not about ESG funds at all,” Josh Lichtenstein of law firm Ropes & Gray told the Financial Times. “This, to me, looks like the same claim could be brought against literally any 401k plan in America.”

With former pilot Bryan Spence as lead plaintiff of upwards of 100,000 participants, the class action suit accused American Airlines and its employee benefits committee of choosing investment managers that "pursue leftist political agendas" -- sacrificing investment returns in favor of woke environmental, social and governance (ESG) goals like promoting workplace diversity or decreasing the use of fossil fuels.

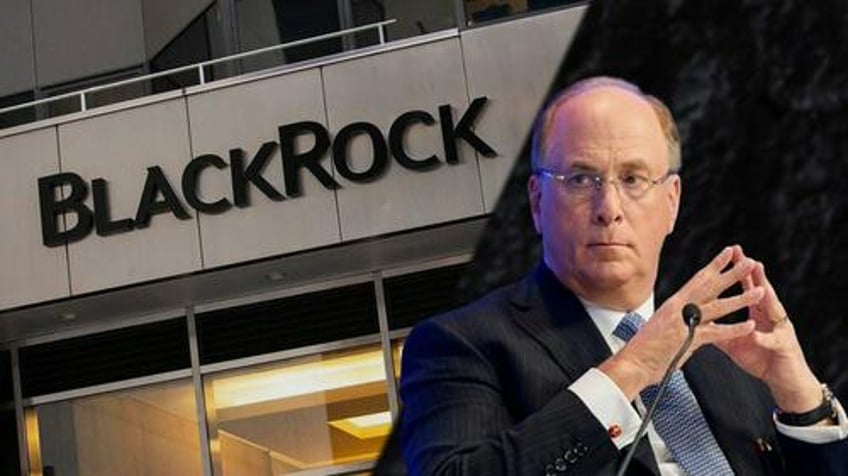

While BlackRock wasn't a defendant, the $11.5 trillion behemoth was nonetheless front and center in the case. To make the case that BlackRock's priorities were warped, O'Connor quoted liberally from CEO Larry Fink himself, including his 2018 threat that companies must "contribute to society . . . or risk losing the support of the world’s largest asset manager."

"BlackRock’s ESG influence is evident throughout administration of the Plan," wrote O'Connor, a George W. Bush appointee, who credited claims that ESG takes a steep toll on returns: "By focusing on non-pecuniary interests, ESG investments often underperform traditional investments by approximately 10%."

Given its enormous size, BlackRock also has the power to reduce the profitability of the companies it holds shares in -- by voting its shares in ways that are detrimental to the bottom line. Among several examples, the plaintiffs pointed to Blackrock's infamous 2021 ExxonMobil proxy vote -- in which the firm helped secure two board seats for activist investor "Engine No. 1," with the goal of pressuring the fossil fuel company to reduce its emphasis on fossil fuels and to commit to fighting "climate change." At the time, BlackRock was ExxonMobil's second-largest shareholder.

Characterizing American's relationship with BlackRock as "incestuous," O'Connor noted that BlackRock is simultaneously the largest investment manager of American's 401(k) plan, one of American's largest shareholders, and financier of $400 million of the company's debt: "It is no wonder Defendants repeatedly attempted to signal alignment with BlackRock." Further making the case that American's disloyalty to its employees may have been driven by BlackRock's "outsized influence," he wrote, "As a large company [that] consumes copious amount of fossil fuels, American was potentially susceptible to a proxy fight of its own by failing to comply with BlackRock’s climate-related demands."

From O'Connor's 70-page ruling, here's are a few more of his pointed rebukes of American Airlines and ESG investing generally:

- "A pursuit of non-pecuniary interests, in whole or in part, was an end itself rather than as a means to some financial end...The evidence made clear that BlackRock wanted to play its part in combating perceived social ills by bolstering DEI and climate change initiatives."

- "The belief that ESG considerations confer a license to ignore pecuniary benefits is mistaken. ERISA does not permit a fiduciary to pursue a non-pecuniary interest no matter how noble it might view the aim."

- Despite widespread coverage of the ESG controversy, “Defendants utterly failed to loyally investigate BlackRock’s ESG investment activities."

- “Plaintiff proved by a preponderance of the evidence that American disloyally acted with an intent to benefit a party other than Plan participants and in a manner that was not wholly focused on the best financial benefit to the Plan.”

A ruling on damages or another form of relief will come later. Though he ruled that American breached its duty of loyalty to plan participants, O'Connor concluded American did not breach the duty of prudence -- because prudence is judged by prevailing industry standards, and the asset management industry is, for now, regrettably dominated by ESG-minded firms.

In December, O'Connor fired a shot at a different strain of wokeness. He tossed out a plea deal between the Justice Department and Boeing -- because the Biden administration included a requirement that diversity should be a consideration in selecting a compliance monitor. "In a case of this magnitude, it is in the utmost interest of justice that the public is confident this monitor selection is done based solely on competency," wrote O'Connor, whose court is in Fort Worth.

As evidence by some recent ZeroHedge headlines, the welcome ruling against ESG's malign influence on workers' wealth-building is just the latest in a string of victories over woke ideology in general:

- Meta Nukes DEI Program; "Morale For Queer Staff In Shitter"; Zuckerberg Joins Joe Rogan Podcast

- Another DEI-mino Falls: McDonald's Latest To Bail On Diversity Goals

- 'Fact-Checkers Too Politically-Biased' - Zuckerberg Abandons Facebook Censorship For X-Like Community Notes

- Walmart Nukes DEI As Anti-Woke Crusader Robby Starbuck Sends "Shockwaves Across Corporate America"

- Celebrating The Death Of Woke And The Resurrection Of Common Sense