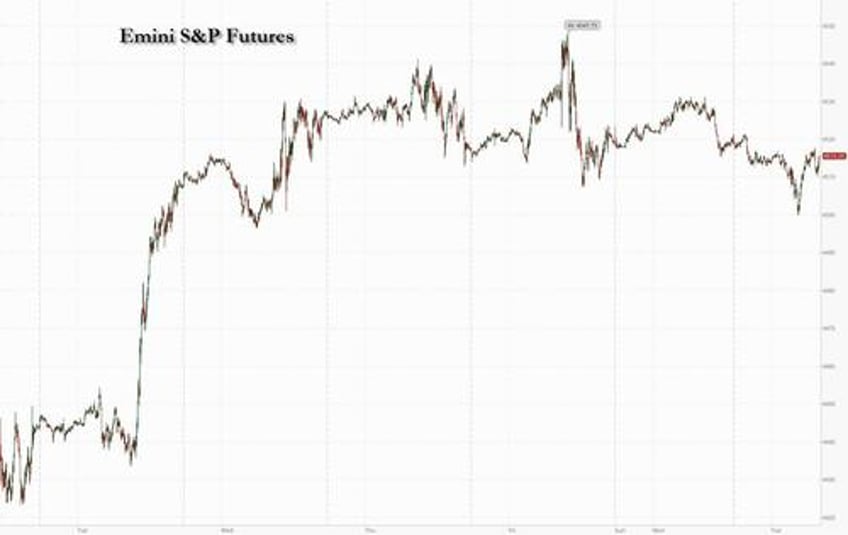

Futures are lower, tracking European bourses and Asian markets, but well off session lows as a brief burst of China-linked optimism promptly following a Monday surge in property stocks and hopes of a Chine recovery turned to bust, as China reported the slowest service sector monthly growth so far this according to the August PMI survey, adding to a series of disappointing data. As of 7:50am ET, S&P futures were down 0.1% to 4,517 reversing the 0.2% gain during the Monday Labor Day holiday session; Nasdaq 100 futures dropped 0.4%. The US currency gained as much as 0.5% against its Group-of-10 peers, touching the highest level since March, sending commodities, gold and bitcoin lower. 10Y Yields are up to 4.22% and once again approaching the key resistance level of 4.25%, pressured not just by oil trading near 2023 highs but also in anticipation of a surge in corporate bond sales this week. Also, UK and euro-zone yields rose Monday and are extending that move. Today’s macro data focus is Durable Goods/Cap Goods plus Factory Orders. Later in the week we receive ISM-Srvcs and Jobless Claims.

In premarket trading, NextGen Healthcare jumped 8% after Bloomberg News reported that Thoma Bravo is in advanced talks to buy the health-records software company. US-listed Chinese stocks dropped following their best weekly performance since July, as August data pointed to a slowdown in China’s services sector. Alibaba -1%, Baidu -1.7%. Blackstone and Airbnb rose after the S&P Dow Jones Indices said the stocks will join the S&P 500 index prior to the opening of trading on Sept. 18. Manchester United fell as much as 9.2% amid ongoing speculation over a possible deal for the Premier League team. Here are some other notable premarket movers:

- Associated Banc-Corp (ASB US) shares rise as much as 0.6% after Baird upgraded the Midwest bank to outperform from neutral, saying that the shares offer attractive risk-reward following recent underperformance.

- Oracle (ORCL US) gains 1.5% after Barclays upgrades to overweight from equal-weight in note, calling the infrastructure software company a “multi-year growth story.”

- General Mills Inc. (GIS) slips 0.4% after BNP Paribas Exane analyst Max Gumport cut the recommendation on the packaged-foods company to neutral from outperform, citing a slowdown in premium dog-food demand.

- Lowe’s (LOW) recommendation was raised to outperform from market perform at Bernstein, with the broker noting that there are multiple positive catalysts including: margin expansion and improving return on invested capital. Stock edges higher, up 1%.

- NetApp Inc. shares are up 1.8% after Susquehanna Financial upgraded the data storage company to positive from neutral.

- Olin Corp is upgraded to overweight from sector weight at KeyBanc Capital Markets, which says the stock’s valuation appears attractive after shares tumbled following news that CEO Scott Sutton will step down. Shares in the manufacturer of chemical products and ammunition rise 2%.

- Oracle gains 1.7% after Barclays upgrades to overweight from equal-weight in note, calling the infrastructure software company a “multi-year growth story.”

- Viatris gains 2% after the firm said the US FDA has tentatively approved a drug cocktail for children with HIV-1.

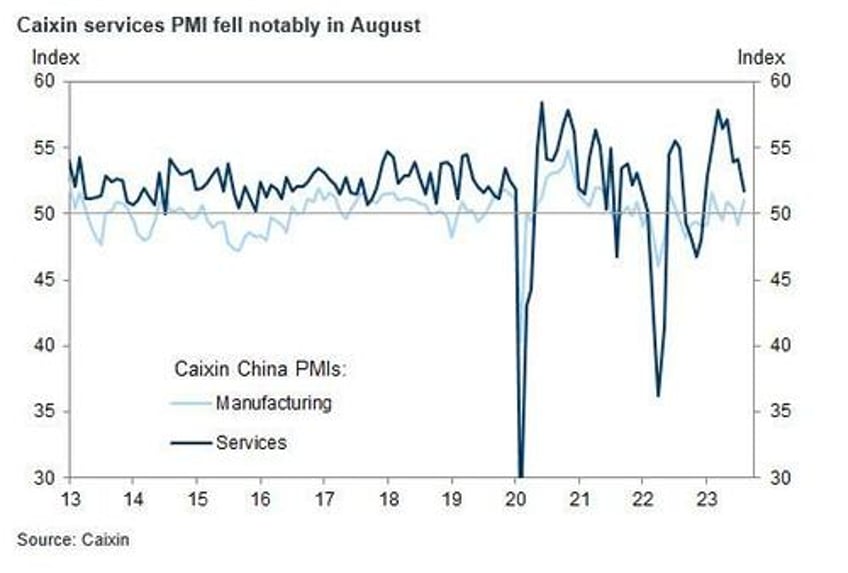

Overnight, China’s services sector saw the slowest growth this year in August, an industry survey showed, adding to evidence the economic recovery is losing traction and damping earlier optimism over government stimulus.

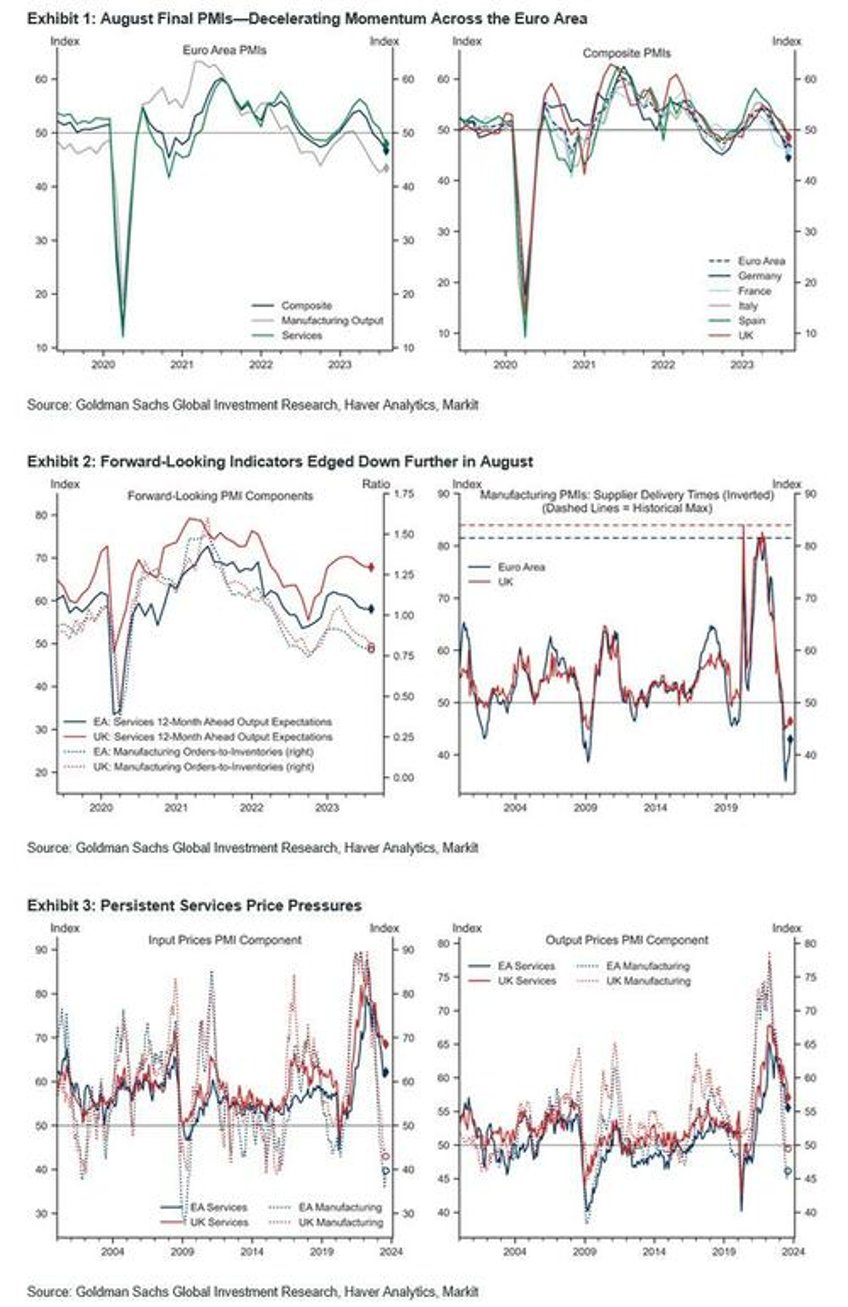

Similarly in Europe, the composite purchasing managers’ index undershot expectations, posting a contraction for a third straight month.

As we enter Sept, JPM's market intel team writes that there is much discussion on seasonality; while Sept’s average return is negative, its median return is ~0%. When SPX is update double-digits into Sept, then Sept tends to be positive, too. We may also see a surge of capital markets activity over the next couple weeks.

The European Central Bank, which meets next week, faces a quandary over interest rates, given recession fears and above-target inflation. "There is real concern for the euro-area picture, with survey data suggesting the economy is sliding into recession," said Sarah Hewin, head of Europe and Americas research at Standard Chartered. “It raises questions over how aggressive the ECB can be going forward.”

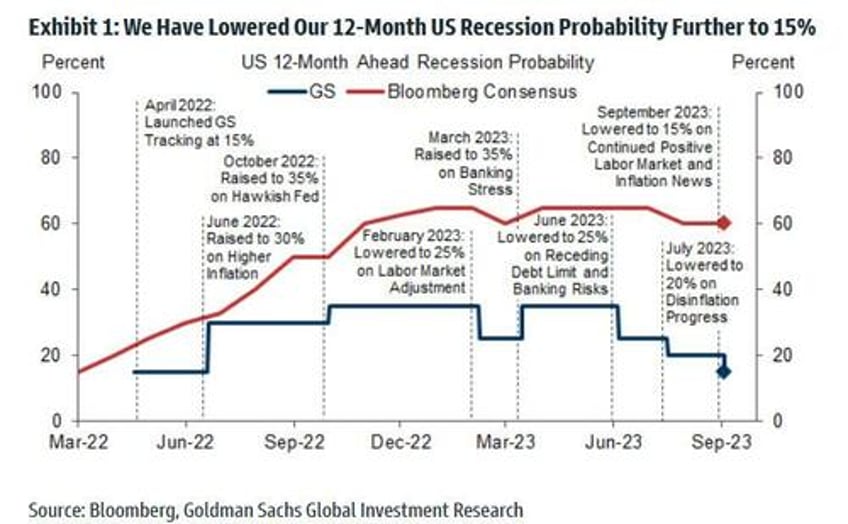

By contrast, recent data shows the US economy is holding up well and rate cuts may not come any time soon, even though many economists say the Federal Reserve has come to the end of its 18-month long policy-tightening campaign. Goldman Sachs now sees just a 15% probability of a US recession in the coming year, down five percentage points from their previous estimate.

Europe’s Stoxx 600 traded flat, after paring a drop of as much as 0.8% with luxury goods among the worst performers. Here are the most notable European movers:

- Partners Group rises as much as 8.4% and is the biggest gainer in the Stoxx 600 after the Swiss investment manager delivered performance fees that analysts describe as a material beat

- BKW climbs as much as 4.4% after the Swiss energy company reported operating profit for the first half-year that beat estimates, with analysts highlighting positive momentum in the energy division

- Johnson Service Group rises as much as 5.5% in 7th straight day of gains, hitting highest since March 22, as RBC highlights good first-half momentum for the UK textile rental and laundry firm

- Alten rises as much as 2.8% after Stifel initiates coverage with a buy rating, saying the engineering and technology consulting firm is set for long-term earnings growth

- European food retail stocks fall after JPMorgan downgrades the sector, citing an “unattractive risk reward” given the current sentiment as well as valuations

- Commerzbank drops as much as 5.2%, the most in a month, after Barclays downgrades to underweight from equal-weight based on “significant” downside risk to estimates

- Roche falls as much as 2.2%, slipping to its lowest since January 2019, after Berenberg cut its recommendation for the Swiss pharma giant to hold on a lack of share-price catalysts

- Credit Agricole falls as much as 3.8% after Goldman Sachs downgraded the stock to sell from neutral as it turned “more cautious” on the French lender’s earnings expectations

- Sectra falls as much as 14% after the Swedish medical imaging and cybersecurity firm reported first-quarter earnings which included a year-on-year fall for operating margins and profit

- EnQuest shares drop as much as 17% in their worst day since April 2020, after the oil producer swung to a 1H loss from a profit a year earlier due to the impact of the UK energy windfall tax

Earlier in the session, Asian stocks fell, with the key regional benchmark on track to snap a six-day winning streak, as a property-led rally in Chinese equities fizzled amid disappointing economic data. The MSCI Asia Pacific Index fell as much as 0.8%, dragged by weakness in the financial sector. China equities declined, retreating after Monday’s strong gains as a gauge of services activity printed well below estimates. China led the rally in Asian stocks on Monday after authorities rolled out more stimulus for the embattled property sector. The decline on Tuesday shows investor sentiment toward Chinese shares remains fragile, casting a pall on the outlook for regional equities. Even after its latest rally, the Asian benchmark is trailing key gauges of peers in the US and Europe this year.

- Hang Seng and Shanghai Comp were pressured after Chinese Caixin Services PMI data missed forecasts and with the property sector dampened by default fears with about a third of 50 major private builders said to face around $1.5bln dollars of payments this month, while Country Garden narrowly averted a default and paid USD-denominated coupons hours before the end of the grace period.

- South Korea stocks traded lower, where inflation accelerated much faster than estimated in August, keeping the door open to a rate hike. Shares also dropped in Australia, where the central bank is expected to keep rates unchanged for a third-straight month in a meeting later Tuesday. Vietnamese equities were the only notable gainers following a national holiday.

- Australia's ASX 200 was lower amid underperformance in the commodity-related sectors and as participants braced for the conclusion of RBA Governor Lowe’s final policy meeting in which the central bank kept rates unchanged as expected.

- Nikkei 225 stalled on its approach to the 33,000 level and with headwinds from disappointing household spending data which suffered its worst drop since February 2021.

“It’s the typical post-party reality check that’s cooling down China’s rally today, as the services PMI notably missed expectations, suggesting further economic downtrend ahead,” said Hebe Chen, an analyst at IG Markets Ltd. “Meanwhile, investors are cautiously awaiting the RBA’s meeting decision, which is poised to raise the curtain for a new round of central bank talks.”

In FX, the US dollar rose to the strongest since July against the euro and the pound. Against the yen, it’s approaching the highest since November, and BOJ intervention is looking increasingly inevitable. The Bloomberg Dollar Index jumped 0.4% to 1250.81, its highest since mid-March as China data pointed to sputtering economic recovery. The US currency posted the biggest gains against the Australian dollar, down 1.3%. Australia’s central bank kept its key interest rate unchanged and maintained a tightening bias. “With RBA already acknowledging that the economy is already experiencing below-trend growth, surely any further tightening should crimp on growth momentum further down the road,” said Fiona Lim, senior FX strategist at Malayan Banking Bhd. in Singapore. “AUD could still remain under pressure." EUR/USD fell 0.5% to $1.0747 as data showed consumer inflation expectations rose in July even as demand for services cooled

In rates, treasuries were lower with US 10-year yields rising 4bps to 4.22%. US yields are higher by 3bp-54bp across the curve led by intermediate tenors, leaving curve spreads narrowly mixed, and extending a slide that began Friday in anticipation of a surge in corporate bond sales this week. At least six US high-grade corporate bond issuers have slated offerings for Tuesday; sales are expected to total about $120b this month, a seasonally heavy month that normally sees issuance concentrated in the week or so after US Labor Day. Treasury coupon supply is on hiatus until Sept. 11, when cycle including new 3-year and 10- and 30-year reopenings is slated to begin. Also, UK and euro-zone yields rose Monday and are extending that move. Bunds are also in the red with little reaction shown to a downward revision to euro-area service PMI.

In commodities, crude futures decline, with WTI falling 0.2%. Spot gold drops 0.6%.

Bitcoin is under modest pressure, -0.2%, as the USD continues to climb higher and the overall tone remains a subdued one after the APAC handover. Currently, BTC resides at the mid-point of USD 25.55-25.83k parameters.

To the day ahead now, and data releases include the global services and composite PMIs for August, along with Euro Area PPI for July and US factory orders for July. From central banks, we’ll get the ECB’s Consumer Expectations Survey, and hear from the ECB’s Schnabel and Visco.

Market Snapshot

- S&P 500 futures down 0.1% to 4,515

- MXAP down 0.8% to 163.12

- MXAPJ down 1.1% to 509.51

- Nikkei up 0.3% to 33,036.76

- Topix up 0.2% to 2,377.85

- Hang Seng Index down 2.1% to 18,456.91

- Shanghai Composite down 0.7% to 3,154.37

- Sensex little changed at 65,687.26

- Australia S&P/ASX 200 little changed at 7,314.28

- Kospi little changed at 2,582.18

- STOXX Europe 600 down 0.6% to 455.24

- German 10Y yield little changed at 2.59%

- Euro down 0.5% to $1.0746

- Brent Futures down 0.8% to $88.30/bbl

- Gold spot down 0.5% to $1,933.17

- U.S. Dollar Index up 0.35% to 104.61

Top overnight news from Bloomberg

- Home sales in two of China’s biggest cities soared in the past two days following mortgage relaxations, an early sign that government efforts to cushion a record housing slowdown are helping. Existing-home sales for Beijing and Shanghai doubled over the weekend from the previous one, according to CGS-CIMB Securities. “We were surprised by the strong pick up in Beijing and Shanghai, despite the challenging economy,” said Raymond Cheng, head of China property at CIMB. BBG

- Chinese property developer Country Garden made payments on two dollar bonds within their grace periods on Tuesday, ending a month-long saga that had become the focal point of global investors’ concerns about China’s struggling property sector. FT

- China’s Caixin services PMI for Aug was very soft, coming in at 51.8, down from 54.1 in Jul and below the Street’s 53.5 forecast. RTRS

- North Korean leader Kim Jong-un plans to travel to Russia this month for a meeting with Putin at which the two will discuss Pyongyang ramping its weapons supplies to Moscow. NYT

- Ukraine president Zelensky said he was replacing the minister of defense, confirming recent media speculation, in what is the biggest shakeup since Russia launched its invasion. NYT

- The world’s most powerful financial watchdog has warned of “further challenges and shocks” in the months ahead, as high interest rates undermine economic recoveries and threaten key sectors including real estate. In his regular update to G20 leaders ahead of their summit in New Delhi this week, Klaas Knot, chair of the Basel-based Financial Stability Board, said: “The global economic recovery is losing momentum and the effects of the rise in interest rates in major economies are increasingly being felt.” FT

- The US deficit is climbing, but not for reasons that are inflationary - things like higher interest expense, reduced Fed earnings, and lower non-withheld tax revenue (due to smaller capital gains) are pushing deficits higher. WSJ

- Trump’s lead grows more dominant – he’s now the choice of ~60% of GOP primary voters, up 11 points from the prior survey in April. Biden’s age a growing political liability – 73% of voters think Biden is too old for a second term vs. 47% who feel the same about Trump (and Trump has an 11-point advantage on record of accomplishments as president) WSJ

- Private equity giant Blackstone Inc. is the latest addition to the S&P 500 Index, the first alternative asset manager to join the equity gauge. Airbnb Inc. is added as well. The New York-based Blackstone and Airbnb will replace Lincoln National Corp. and Newell Brands Inc. prior to the start of trading on Sept. 18, S&P Dow Jones Indices said. BBG

- The continued positive inflation and labor market news has led GIR to cut our estimated 12-month US recession probability further to 15%, down 5pp from our prior estimate and equal to the unconditional average recession probability of 15% calculated from the fact that a recession has occurred roughly once every seven years since WW2

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly subdued after the holiday lull stateside and as the region digested disappointing data releases including the weaker-than-expected Chinese Caixin Services PMI. ASX 200 was lower amid underperformance in the commodity-related sectors and as participants braced for the conclusion of RBA Governor Lowe’s final policy meeting in which the central bank kept rates unchanged as expected. Nikkei 225 stalled on its approach to the 33,000 level and with headwinds from disappointing household spending data which suffered its worst drop since February 2021. Hang Seng and Shanghai Comp were pressured after Chinese Caixin Services PMI data missed forecasts and with the property sector dampened by default fears with about a third of 50 major private builders said to face around USD 1.5bln dollars of payments this month, while Country Garden narrowly averted a default and paid USD-denominated coupons hours before the end of the grace period.

Top Asian News

- China's MIIT released a plan to develop the electronics industry and will guide capital to the industry, while it will support qualified enterprises to make good use of financing tools such as domestic and overseas listings and bond issuances, according to Bloomberg and Reuters.

- China's Foreign Minister Wang said following the recent meeting with his Italian counterpart that China and Italy should adhere to the right way of getting along in terms of mutual respect, trust, openness and cooperation, while he added that both countries should strive for bilateral relations to be at the forefront of China-EU relations. Furthermore, Wang said they should jointly safeguard a free and open multilateral trading system, maintain a stable global supply chain and provide a fair business environment for each other's enterprises.

- A debt crisis reportedly threatens to engulf Chinese developers with about two-thirds of 50 major private builders defaulters and with the 16 survivors facing USD 1.5bln of bond payments this month, according to Bloomberg.

- Country Garden Holdings (2007 HK) paid USD-denominated coupons that were due last month before the end of the grace period which was set to expire by September 6th, according to Bloomberg and Reuters.

- RBA kept the Cash Rate Target unchanged at 4.10%, as expected, while it reiterated that some further tightening of monetary policy may be required and the Board remains resolute in its determination to return inflation to the target.. RBA higher interest rates are working to establish a more sustainable balance between supply and demand in the economy and will continue to do so but noted inflation is still too high and will remain so for some time yet. Furthermore, the RBA said the pause will provide further time to assess the impact of the increase in interest rates to date and the economic outlook but noted increased uncertainty around the outlook for the Chinese economy due to ongoing stresses in the property market and that the outlook for household consumption also remains uncertain

- China is reportedly to launch a new state-backed fund that aims to raise USD 40bln in order to boost the chip industry, via Reuters citing sources. The new fund will focus on areas incl. equipment for chip manufacturing. Fund has received approval from Chinese authorities in recent months. Finance Ministry intends to contribute CNY 60bln to it.

European bourses are in the red, Euro Stoxx 50 -0.2%, but have been gradually making their way higher after a subdued open given the downbeat APAC handover. A handover that was negatively affected by soft Chinese Caixin PMI data. Since action has been influenced by Final PMIs though the metrics provided little to lift the overall tone with the recovery off lows occurring gradually and without a specific fundamental driver. Sectors are mixed after beginning the morning firmly in the red. Personal Care, Drug & Household names alongside Consumer Products/Services continue to lag given broker activity and data while Financial Services, Energy, Insurance and Banking are now modestly firmer on the session; the latter components perhaps benefitting from yield support. Stateside, futures have been directionally in-fitting with the above though magnitudes have been more contained thus far. ES -0.2% has lifted off of lows with the NQ -0.3% following suit but to a slightly lesser extend given yield upside. Action which comes ahead of Final PMIs and a handful of other data points.

Top European News

- ECB's Lane (conducted on August 31st): I would underline the fact that there has been some easing in goods inflation and services inflation, which is a welcome development. "expect to see this famous core inflation come down throughout the autumn."; "... it would be a mistake to extrapolate the high inflation we’ve seen into a longer-term projection.". Click here for the full release.

- Spanish Catalan Leader Puigdemont says all judicial cases that are targeting Catalan separatism must be dropped as a condition for discussions on the PMs investiture

FX

- A firm start to the session for the Dollar index, fuelled by risk aversion and an overnight uptick in yields, and with US cash yields back online following its long Labor Day weekend.

- The Yen is one of the focal points in today’s session as it approaches YTD lows against the Dollar, while the overnight session saw a particularly weak 10-year JGB auction.

- The Antipodeans sit as G10 underperformers as the fallout from the softer Chinese Services PMI takes its toll, while the RBA’s policy decision saw no fireworks.

- The European majors succumb to the Dollar but to a lesser extent than their Antipodean counterparts. The morning saw the final PMIs in the EZ downgraded, with the broader theme being slower growth and rising input prices.

- PBoC set USD/CNY mid-point at 7.1783 vs exp. 7.2703 (prev. 7.1786)

- World Bank is reportedly in talks to double its Turkey exposure to USD 35bln, according to Bloomberg sources; the World Bank is reportedly working on USD 18bln in new funding over the next three years which will focus mostly on the private sector.

Fixed Income

- Core benchmarks are under modest pressure with action occurring around the EZ/regional and UK PMIs but for the most part this has been shortlived as we await the return of US players from the long weekend.

- Bunds are softer to the tune of 15 ticks and reside towards the mid-point of 131.61-131.98 boundaries. A high which printed in proximity to the morning’s Spanish Services PMI while the low was re-tested on the Final EZ figure.

- Gilts have been slightly more contained given their more outsized action on Monday while USTs are broadly in-line with EGBs ahead of data points. As it stands, yields are firmer across the curve with action slightly more pronounced at the long end and the curve incrementally bear-steepening as a result.

Commodities

- WTI and Brent front-month futures are softer intraday amid the broader risk aversion emanating from the Chinese Services PMIs overnight.

- Dutch TTF kicked off the session firmer but then fell into losses, with news overnight suggesting Offshore Alliance members at Chevron’s Gorgon Facility, Wheatstone Platform and Wheatstone Downstream gas processing facilities in northwest Western Australia have notified the company that they intend to stop work for 2 weeks commencing September 14.

- Metals are seeing broader pressure from the firmer Dollar whilst industrial metals see deeper losses vs precious metals amid the demand dent emanating from China.

- Australia's Offshore Alliance served Chevron (CVX) with further notice of protected industrial action which will commence after the first 7 days of the protected industrial action kicks off on September 7th, while the Australian union said it plans a full strike at Chevron's Wheatstone and Gorgon LNG facilities in Australia for two weeks from September 14th if its demands are not met, according to Reuters.

- Goldman Sachs said it still sees a potentially more aggressive OPEC+ price target as a key moderately bullish risk to its 12-month ahead Brent crude forecast of USD 93/bbl and it no longer expects Saudi to announce a partial unwind of its 1mln bpd production cut, according to Reuters.

- Ukraine does not expect its grain export situation to change after the talks between Russian President Putin and Turkish President Erdogan, according to Reuters sources.

- Chevron (CVX), on industrial action, says it has continuity plans and plans to be a reliable supplier. Elsewhere, says if the winter is a normal one, then it could be a difficult time for some European nations.

Geopolitics

- The Russian Defence Ministry said it shot down a drone over Russia's Kaluga region,** according to Reuters.

- North Korean leader Kim plans to travel to Russia this month and meet Russian President Putin to discuss the possibility of supplying weapons for the war in Ukraine, according to NYT citing US and allied sources. In response, the Russian Kremlin says it has "nothing to say".

US Event Calendar

- 10:00: July Factory Orders, est. -2.5%, prior 2.3%

- July Factory Orders Ex Trans, est. 0.1%, prior 0.2%

- 10:00: July Durable Goods Orders, prior -5.2%

- Durables-Less Transportation, prior 0.5%

- Cap Goods Orders Nondef Ex Air, prior 0.1%

- Cap Goods Ship Nondef Ex Air, prior -0.2%

DB's Jim Reid concludes the overnight wrap

The last 24 hours have been fairly quiet for markets given the US holiday, but the overall tone was slightly negative after what was earlier a very good handover from a strong China market on Monday. However this faded as the day progressed with losses for bonds and equities in Europe, just as oil prices hit a new high for 2023. The recent run-up in oil prices is already setting us up for some hotter August CPI prints, so any further gains there are going to be a fresh hurdle for central banks in their quest to get inflation back to target.

That concern was evident among sovereign bonds, which sold off mainly thanks to higher inflation expectations. For instance, the 10yr bund yield was up +3.1bps on the day to 2.57%, of which +2.5bps was a result of higher inflation expectations. Yields moved higher in other countries as well, with those on 10yr OATs (+2.8bps), BTPs (+5.4bps) and gilts (+3.5bps) all rising.

Unsurprisingly, that rise in inflation expectations led to a bit more speculation about whether the ECB might deliver another hike next week. Currently, overnight index swaps still consider that an unlikely prospect and are pricing in a 25.7% chance, but that’s up from 23% the previous day, so clearly investors aren’t entirely discounting the prospects of another move.

When it comes to that meeting, ECB President Lagarde provided no clues on what the ECB might do in a speech yesterday. That focused on communication and monetary policy, although Lagarde did say “actions speak louder than words” and referenced the 425bps of hikes that the ECB had already delivered. If they were to pause, that would end a run of 9 consecutive rate hikes, so it could be a big moment. However, markets think there’s also a decent probability they might do a “skip” like the Fed did in June, since they’re also pricing in a 50% chance of a hike by the time of the December meeting.

This backdrop saw European equities lose ground throughout the session, despite a fairly strong performance at the open. Indeed, the STOXX 600 was initially up +0.88%, with China related stocks in the ascendency. These gains were pared back with the index ending the day -0.04% lower. It was a similar story across the continent, with modest losses for the FTSE 100 (-0.16%), the CAC 40 (-0.24%) and the DAX (-0.10%) as well. US markets were closed yesterday, but S&P 500 (-0.17%) and NASDAQ 100 (-0.11%) futures have edged lower overnight. 10yr USTs yields (+3.15bps) have edged up trading at 4.21% as trading has resumed.

The other big development yesterday came from oil prices, which hit a new closing high for 2023. The latest moves saw Brent crude up +0.51% yesterday to $89.0/bbl, whilst WTI is up +0.47% this morning trading at $85.95/bbl as we go to press. The last time Brent traded above $90/bbl was last November, and even a temporary uplift could prove challenging for policymakers and markets, since inflation is still running above target. So any pivot away from restrictive policy is going to be hard so long as it remains there, and it's going to heighten the dilemmas they might face if we do end up with a noticeable downturn in growth.

Asian equity markets are lower this morning reversing some of yesterday's gains. Chinese equities are leading losses with the Hang Seng (-1.55%) the biggest underperformer followed by the Shanghai composite (-0.63%) and the CSI (-0.57%). The Nikkei (-0.21%) and the KOSPI (-0.12%) are also slightly lower as I type.

Coming back to China, services sector activity expanded at the slowest pace in eight months as the Caixin/S&P Global services PMI dropped to 51.8 in August (v/s 53.5 expected) from 54.1 in July, bringing it more in line with the official services PMI.

In company news, China’s former largest builder Country Garden managed to avoid default by paying $22.5 million of US bond interest due on August 07, just within a 30-day grace period ending. It's also looking to extend the principal of 8 Yuan bonds by 3 years. So they are obviously doing what they can to avoid default.

In monetary policy action, the Reserve Bank of Australia (RBA) decided to keep its benchmark policy rate unchanged at 4.1% for the third straight month with the statement seemingly very similar to last month. It is the last meeting chaired by RBA governor Philip Lowe, whose seven-year term ends next week.

Elsewhere, household spending in Japan (-5.0% y/y) posted its biggest decline in nearly 2.5 years in July, sliding for the fifth consecutive month and worse than market expectations of -2.5% and against the prior month’s -4.2%. South Korea CPI reaccelerated in August after six months of cooling, coming in at +3.4% y/y in August (v/s +2.9% expected; +2.3% in July) on the back of upside surprises coming from fresh food and energy.

To the day ahead now, and data releases include the global services and composite PMIs for August, along with Euro Area PPI for July and US factory orders for July. From central banks, we’ll get the ECB’s Consumer Expectations Survey, and hear from the ECB’s Schnabel and Visco.