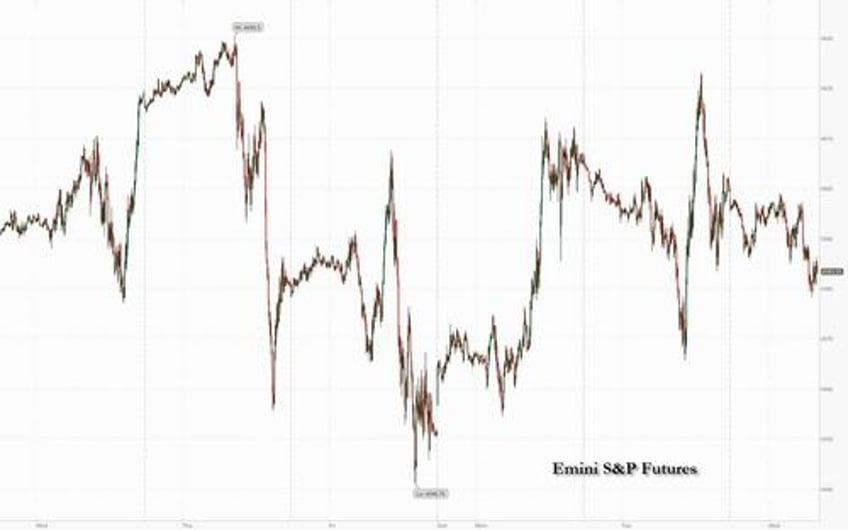

US equity futures and global markets dropped, while gold surged and crude oil futures spiked as much as 3% to fresh weekly highs as the conflict in the Middle East escalated sharply despite Biden's visit to Israel seeking a normalization in tensions, as Arab leaders canceled a summit with the US President and as Iran intensified its war of words against Israel. As of 7:45am, S&P 500 and Nasdaq 100 futures lost more than 0.4%, after yesterday's flat close. Crude’s surged after the foreign minister of Iran, a major oil exporter albeit embargoed, called for an embargo against Israel. Gold prices rose as investors snapped up haven assets.

Amid the geopolitical concerns, traders are also tracking the latest earnings. Morgan Stanley dropped 2.9% in premarket after third-quarter wealth management revenue missed estimates. Elsewhere in the premarket, Nvidia shares are on track for a second day of declines, down 1.6% and extending its 4.7% slump in the previous session, after a Morgan Stanley downgrade (note available to pro subscribers) as the US steps up efforts to keep advanced chips out of China; Procter & Gamble gained after organic sales topped expectations. In other individual stock moves, United Airlines fell 6%, leading declines for other carriers, after the company warned of a potential sharp profit impact from suspended flights to Tel Aviv. Here are some other notable premarket movers:

- Editas Medicine shares jump 3.2% after JPMorgan upgraded the clinical-stage biotechnology company to neutral from underweight, saying the valuation should remain range bound.

- Interactive Brokers shares fell 3.2% after the company tempered its guidance for accounts growth.

- Terawulf shares jump 4.0% after Stifel Canada initiates coverage on the Bitcoin miner with a buy recommendation, noting the company has one of the highest breakeven costs of power.

- Viking Therapeutics shares rose 8.9% after the company said its GLP-1/GIP receptor agonist VK2735 significantly reduced liver fat and plasma lipid following 28 days of treatment in a Phase 1 trial.

US President Joe Biden met Prime Minister Benjamin Netanyahu in Israel on Wednesday, hours after the hospital blast killed hundreds and threatened to plunge the region into chaos. Leaders of Jordan, Egypt and the Palestinian Authority canceled a summit with Biden, who planned to use the trip to reinforce the US commitment to Israel.

"The risks of an escalation have risen on the back of the latest news reports regarding the hospital bombing,” said Jane Foley, head of foreign-exchange strategy at Rabobank. While there have been few signs of panic, “on any clear escalation, we can expect to see a ratcheting up of risk aversion,” she said.

European stocks are also in the red, although off their worst levels, with the Stoxx 600 down 0.2%. Among other individual movers, ASML Holding NV, Europe’s most valuable technology company, slumped 1.7% after the company reported the lowest quarterly order intake since 2020 and revenue that missed estimates for the first time in seven quarters. Adidas AG advanced 5.3% after the sportswear maker boosted its guidance, helped by sales of more Yeezy sneakers from its canceled partnership with the rapper Ye. Nexi SpA jumped as much as 19% after people with knowledge of the matter said CVC Capital Partners is in the early stages of considering a potential bid for European payments firm. Here are the most notable European movers:

- Handelsbanken gains as much as 6.3%, most in a year, after the Swedish lender reported net interest income for the third quarter that beat the average analyst estimate

- Nexi soars as much as 19% after Bloomberg News reports CVC Capital Partners is in the early stages of considering a potential bid for the Italian payments firm

- Volvo shares erase early declines, rising as much as 4.1% after the truckmaker reported third quarter earnings that beat estimates on the back of pent-up demand, though the Swedish company said it expects markets to weaken next year

- Adidas shares jump as much as 5.3% in Frankfurt after the sportswear company improved its annual financial projections and posted stronger-than-anticipated preliminary third-quarter revenue and gross margin

- Ultimovacs gains as much as 60%, the most since its June 2019 IPO, after the Norwegian biotech said a Phase II trial of its UV1 cancer vaccine for malignant mesothelioma showed “clinically meaningful” improvement in overall survival

- Just Eat Takeaway shares rise as much as 9.3% after the food delivery company forecast positive free cash flow from start of next year, a timeline earlier than previously communicated

- Genmab drops as much as 7.3% to the lowest since 2022 as partial results for the Mariposa lung cancer study with partner J&J underwhelm analysts after they were released early

- ABB shares fall as much as 6.6%, most since 2021, after its orders came in slightly soft as the Swiss industrial conglomerate’s robotics segment was weak

- Kinnevik falls as much as 7.9%, the most since March, after the Swedish investment group reported a year-on-year drop in net asset value per share

- Barco plunges as much as 19%, the most in nearly three years, after the Belgian technology company said the headwinds from the second quarter have intensified

- Pendragon shares fall as much as 8.7% after AutoNation said it would not be making a formal offer for the motor retailer after submitting a preliminary proposal in September

Traders also sifted through data showing UK inflation exceeded forecasts, leaving open the possibility of a further rate hike from the Bank of England. Ten-year gilt yields rose for a third day, adding six basis points to 4.58%. The pound added 0.2% to $1.22, before paring its gains.

Earlier in the session, Asian equities declined as strong economic data in China failed to lift investors’ cautious mood amid fears of an escalation in the Middle East geopolitical crisis. The MSCI Asia Pacific Index fell as much as 0.5%, with TSMC and Tencent Holdings among the biggest drags.

- Chinese stocks dropped while Hong Kong gauges were little changed despite better-than-expected Chinese GDP, Industrial Production and Retail Sales with several tech stocks hit after the US expanded chip restrictions and amid property sector woes as Country Garden is seen to likely have defaulted and with China property stocks gauge on course for its lowest since 2009.

- Australia's ASX 200 was positive as strength in healthcare, financials and the commodity-related sectors atoned for the losses in tech and utilities but with gains limited amid a higher yield environment.

- Japan's Nikkei 225 was indecisive after a recent source report noted potential hawkish revisions to the BoJ’s Core CPI forecasts, while the rise in yields prompted an unscheduled purchase operation by the BoJ.

- Indian stocks suffered their biggest drop in October tracking most of their Asian peers, weighed by a slump in lenders including HDFC Bank and ICICI Bank. The S&P BSE Sensex fell 0.8% to 65,877.02 in Mumbai, the sharpest decline since Sept. 28, while the NSE Nifty 50 Index slid by 0.7%.

In FX, The Bloomberg Dollar Spot Index falls 0.1%. The Aussie is the best performer among the G-10’s, rising 0.3% after Chinese data topped estimates. GBP/USD climbed as much as 0.23% to 1.2211 after data indicated inflation failed to slow in September as oil prices rose; gilts fell as money markets raised BOE policy tightening wages.

In rates, the treasuries curve twist-steepened with yields on the two-year down 2bps to 5.19% and 10-year yields up 2bps to 4.85%. US yields are cheaper by up to 2bp across long-end of the curve while 2-year yields are richer by 3.5bp on the day; steepening move pushes 2s10s, 5s30s spreads wider by 2.5bp and 5bp; 10-year yields shed around 1bp to 4.82%, outperforming gilts by 6.5bp in the sector. Gilts underperform across core European rates, as money markets raise BOE policy-tightening premium after UK inflation exceeded median estimates. UK 10-year yields rise 7bps to 4.58%. US session focus includes 20-year bond auction and six scheduled Fed speakers. Treasury auction slate includes $13b 20-year bond reopening at 1pm New York time; WI yield at around 5.16% is ~57bp cheaper than last month’s, which stopped 0.3bp through.

In commodities, US crude futures rise 3.4% to trade near $89.70. Spot gold gains 1.1% to around $1,945.

Bitcoin is marginally firmer on the session, currently residing around the mid-point of USD 28.33-28.98k parameters with specific newsflow somewhat light amid numerous broader macro/geopolitical developments.

To the day ahead, and data releases include UK CPI for September, along with US housing starts and building permits for September. From central banks, we’ll hear from the Fed’s Waller, Williams, Bowman, Barkin, Harker and Cook, whilst the Fed will also release their Beige Book. Finally, earnings releases include Netflix, Tesla, Morgan Stanley and Procter & Gamble.

Market Snapshot

- S&P 500 futures down 0.2% to 4,392.50

- MXAP down 0.2% to 156.26

- MXAPJ down 0.4% to 489.87

- Nikkei little changed at 32,042.25

- Topix up 0.1% to 2,295.34

- Hang Seng Index down 0.2% to 17,732.52

- Shanghai Composite down 0.8% to 3,058.71

- Sensex down 0.6% to 66,054.04

- Australia S&P/ASX 200 up 0.3% to 7,077.61

- Kospi little changed at 2,462.60

- STOXX Europe 600 down 0.2% to 448.98

- German 10Y yield little changed at 2.91%

- Euro little changed at $1.0577

- Brent Futures up 2.1% to $91.81/bbl

- Gold spot up 0.8% to $1,939.01

- U.S. Dollar Index little changed at 106.17

Top Overnight News

- China posts bullish economic numbers, including Q3 GDP +4.9% Y/Y (vs. the Street’s +4.5% forecast), Sept industrial production +4.5% (vs. the Street +4.4% and flat vs. +4.5% in Aug), and Sept retail sales +5.5% (vs. the Street’s +4.9% forecast and up from +4.6% in Aug). RTRS

- Country Garden Holdings, a private real estate developer at the center of China's property sector crisis, said Wednesday that it is unable to fulfill all of its offshore debt obligations. The distressed Chinese developer issued a statement saying, "The company is incapable of meeting all the repayment obligations of its external debt items in time." Country Garden was facing a deadline to make an interest payment of $15 million on Tuesday, which was under a 30-day grace period after it missed the payment date on Sept 18. Nikkei

- China’s financial regulators told its policy banks and biggest lenders to issue new loans to cover offshore debt issued by local governments maturing this year and in 2024, ramping up efforts to ease a credit crunch for highly indebted municipalities. BBG

- The BOJ announced an unscheduled bond-purchase operation on Wednesday, reminding the market of its determination to slow the pace of increases in sovereign yields. BBG

- At least five companies are scheduled to provide updates on Italy’s credit ratings in coming weeks. The potential Nov. 17 announcement by Moody’s Investors Service may be the most sensitive pressure point, given that it assesses the country at Baa3, just one notch above junk, with a negative outlook. BBG

- UK CPI holds relatively steady in Sept vs. Aug and overshoots the Street, with headline +6.7% (vs. +6.7% in Aug and vs. the Street +6.6%) and core +6.1% (vs. +6.2% in Aug and vs. the Street +6%). RTRS

- President Joe Biden is considering a supplemental request of approximately $100 billion that would include defense assistance for Israel and Ukraine alongside border security funding and aid to nations in the Indo-Pacific, including Taiwan, according to people familiar with the matter. BBG

- President Biden, arriving in Israel on Wednesday to reaffirm U.S. support for its longtime ally in the war with Hamas, appeared to absolve Israel of responsibility for a deadly blast at a hospital in Gaza that has demonstrated the volatility of the conflict and heightened fears of escalation. WSJ

- The US House will vote again at 11 a.m. for a new speaker after Jim Jordan failed on the first ballot. A group of 20 fellow Republicans withheld support for the Donald Trump-backed conservative hardliner, as did the Democrats. BBG

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks traded mixed following a similar performance on Wall St where the focus was on retail sales data, earnings releases and geopolitical headlines including a deadly strike at a Gaza hospital which both sides blamed each other for, while the region also digested the latest Chinese GDP and activity data which topped forecasts. ASX 200 was positive as strength in healthcare, financials and the commodity-related sectors atoned for the losses in tech and utilities but with gains limited amid a higher yield environment. Nikkei 225 was indecisive after a recent source report noted potential hawkish revisions to the BoJ’s Core CPI forecasts, while the rise in yields prompted an unscheduled purchase operation by the BoJ. Hang Seng and Shanghai Comp. were varied despite better-than-expected Chinese GDP, Industrial Production and Retail Sales with several tech stocks hit after the US expanded chip restrictions and amid property sector woes as Country Garden is seen to likely have defaulted and with China property stocks gauge on course for its lowest since 2009.

Top Asian News

- Chinese President Xi said at the Belt and Road Forum that cooperation has progressed from sketching the outline to filling the details and blueprints have turned to real projects. Xi also stated that China will build a new logistics corridor across the European continent linked by railway transportation and will enter into free trade agreements with more countries, as well as remove all restrictions on foreign investment access in the manufacturing sector. China will also deepen reform in state-owned enterprises, digital economy, intellectual property and government procurement.

- China's stats bureau said the positive momentum of China's economic recovery was more obvious in Q3 and that domestic economic growth has stabilised and picked up. Furthermore, it stated the foundation of the economic recovery and improvement needs to be further consolidated, while it also noted that if China's Q4 GDP Y/Y growth could hit above 4.4%, then the full-year target of around 5% could be achieved, according to Reuters.

- China said it firmly opposes export restrictions imposed by the US on advanced AI chips, according to the Chinese embassy in Washington.

- BoJ is reportedly considering using the returns from its ETF purchases to shore up finances prior to an eventual exit from monetary easing, via Nikkei.

- Former BoJ member Sakurai says BoJ could end negative rates by year-end; BoJ's negative rates may be scrapped before YCC tweak.

European bourses have been relatively steady amid a ramp-up in earnings, Euro Stoxx 50 -0.5%, but with an underlying negative bias increasing in magnitude as geopolitical tensions overshadow stronger than expected Chinese activity data. Sectors are mixed, Telecom names outperform following Tele2 while Retail derives support from Adidas. On the flip side, Real Estate lags after Barratt Developments commentary. More broadly, European heavyweight ASML is lowered after a miss on revenue and bookings alongside cautious commentary for FY23. Stateside, futures are in-fitting with European performance and as such reside in the red, ES -0.4%; focus remains on the yield environment, though action is steady at present ahead of numerous Fed officials, data points and key earnings including NFLX, TSLA & MS. ASML Q3 (EUR): Revenue 6.67bln (exp. 6.71bln), Bookings 2.6bln (exp. 4.5bln), Net Income 1.9bln (exp. 1.8bln), Gross Profit 3.46bln, Margin 51.9%. Click here for more.

Top European News

- ECB's Stournaras said the Middle East crisis casts a shadow over the ECB meeting and the Israel-Hamas war supports the case for keeping rates on hold, according to FT.

- ECB's Visco says inflation is not yet consistent with underlying price stability.

- France's Lille, Lyon, Toulouse and Nice airports evacuated after a security risk alert, according to Sky News Arabia.. Subsequently, it has been reported that six airports across France have been evacuated after emailed 'threats of attack', according to AFP citing police source

FX

- Aussie aloft after a run of better-than-expected Chinese data and hawkish remarks from RBA Governor Bullock, AUD/USD eyes 0.6400 and AUD/NZD tops 1.0800.

- Yuan unable to benefit from GDP, IP and Retail Sales beats as Country Garden misses coupon grace payment deadline, USD/CNY and USD/CNH up to 7.3125 and 7.3275 peaks respectively.

- DXY comfortably above the 106.000 handle and towards the top-end of 106.010-320 range as Franc reclaims 0.9000+ status, Pound probes 1.2200 post-firmer than forecast UK CPI and Loonie gets fillip from resurgent crude prices; USD/CAD and EUR/USD closing in on option expiries between 1.3610-00 and 1.0595-1.0600 respectively.

- PBoC set USD/CNY mid-point at 7.1795 vs exp. 7.3079 (prev. 7.1796).

Fixed Income

- Debt futures are pressured after above forecast Chinese and UK data in the form of GDP, IP, Retail Sales and CPI.

- Bunds down to 127.69 before bouncing in the wake of a solid German 10 year auction; further upside seen as US players enter the fray and potentially alongside security alerts, with Bunds attempting to move back into positive territory.

- Gilts arrest slide at 92.50 and close to support zone.

- T-note holding above 106-00 ahead of US housing data, 20 year supply and more Fed rhetoric.

Commodities

- Commodities are deriving support from a combination of geopolitical tensions and upbeat Chinese data.

- WTI and Brent Dec futures experienced an additional tailwind from the Iranian Foreign Minister calling on Islamic countries to impose an oil embargo "on the Zionist regime"; commentary which, over the course of several minutes, lifted the benchmarks to respective USD 88.57/bbl and USD 93.00/bbl session peaks.

- Spot gold is at highs of USD 1946/oz given escalating geopolitical tensions while base metals glean after stronger than expected Chinese activity data and the sessions USD weakness.

- US Energy Inventory Data (bbls): Crude -4.4mln (exp. -0.3mln), Gasoline -1.6mln (exp. -1.1mln), Distillates -0.6mln (exp. -1.4mln), Cushing -1mln

- Australia's Offshore Alliance stated regarding the Chevron (CVX) deal that members voted 94% in support of an in-principle agreement to suspend protected industrial action.

- India extends sugar export curbs for raw sugar, white sugar, refined sugar and organic sugar under some codes beyond 31st October till further orders.

- Chevron (CVX) Australia welcomes the in-principle agreement with the Australian workers' union on the proposed agreement for workers at the Gorgon and Wheatstone facilities; will now progress to an employee vote.

- Iranian Foreign Minister says "We call on Islamic countries to impose an oil embargo on the Zionist regime", according to Al Jazeera.

Geopolitics

- Israeli military spokesperson said that rockets fired by Palestinian Islamic Jihad passed by the hospital at the time of the strike and another spokesman said they intercepted a conversation in which militants acknowledged a misfire, according to Reuters.

- Palestinian Islamic Jihad spokesman denied Israeli allegations that the militant group is responsible for the strike

- US President Biden said he is outraged and deeply saddened about the Gaza hospital attack, while he spoke with Jordan's King and Israeli PM Netanyahu and directed the national security team to continue gathering information about what happened, according to Reuters. Furthermore, President Biden reportedly plans to ask Congress for roughly USD 100bln in Ukraine, Israel, and border supplemental aid, according to Bloomberg.

- White House's Kirby said US President Biden will meet with families of victims and hostages of the Hamas attack and will be asking the Israelis some tough questions. Kirby added that President Biden will ask Israel about its plans going forward and will make it clear he doesn't want the conflict to expand, while Kirby added that there are no plans to put US boots on the ground in combat in Israel.

- Jordan cancelled the summit with US President Biden and the Egyptian and Palestinian leaders in Amman on Wednesday and said there is no use in talking about anything else now except stopping the war.

- Palestinian President Mahmoud Abbas said targeting Gaza hospital is a hideous war massacre that cannot be tolerated and Israel has crossed all red lines. Furthermore, the Palestinian UN envoy, standing with Arab envoys, said they are outraged by the massacre at the Gaza hospital and blamed Israeli forces, while the envoy added that Arab envoys demand an immediate ceasefire.

- Egyptian President Sisi said he condemns in the strongest terms Israel's bombardment of the Gaza hospital and it is a clear violation of international law, while the UAE also condemned Israeli attack on the hospital in Gaza.

- Lebanon's Hezbollah announced Wednesday as "a day of unprecedented anger" against Israel and President Biden's visit to Israel. It was separately reported that Hezbollah is intensifying military preparations including an escalation in rocket fire and a pending decision from Tehran will determine whether the group will proceed with full-scale military actions, according to an i24 news journalist citing sources.

- Egyptian President says "the idea of displacing Palestinians to Sinai means dragging Egypt into a war against Israel", reported via Al Arabiya.

- US President Biden says the US will ensure that Israel has what it requires to defend itself. Hospital explosion was caused by the "other side", based on what he has seen.

- Iranian Foreign Minister says "We call on Islamic countries to impose an oil embargo on the Zionist regime", according to Al Jazeera.

Central Bank Speakers

- 12:00: Fed’s Waller Speaks About Economic Outlook in London

- 12:30: Fed’s Williams Participates in Moderated Discussion

- 13:00: Fed’s Bowman Delivers Opening Remarks at Fed Listens Event

- 13:00: Fed’s Barkin Speaks at Fed Listens Event

- 14:00: Federal Reserve Releases Beige Book

- 15:15: Fed’s Harker Speaks on Workforce Challenges

- 18:55: Fed’s Cook Speaks About the Fed’s Mandate

US Event Calendar

- 07:00: Oct. MBA Mortgage Applications -6.9%, prior 0.6%

- 08:30: Sept. Housing Starts MoM, est. 7.8%, prior -11.3%

- Sept. Building Permits MoM, est. -5.7%, prior 6.9%, revised 6.8%

- Sept. Housing Starts, est. 1.38m, prior 1.28m

- Sept. Building Permits, est. 1.45m, prior 1.54m, revised 1.54m

- 14:00: Federal Reserve Releases Beige Book

- 16:00: Aug. Total Net TIC Flows, prior $140.6b

DB's Jim Reid concludes the overnight wrap

Macro data was the main market driver yesterday, as very strong US data led investors to dial up the chances of another rate hike from the Fed. In turn, that sent global yields sharply higher, and there were several new milestones across the Treasury curve. For instance, the 10yr yield closed at a new high for the cycle of 4.84%, and the 2yr yield also hit a new cycle high of 5.21%. So that marks a big turnaround relative to last week, since it was only last Thursday that the 10yr yield hit an intraday low of 4.52%, when concerns about geopolitical risk saw a big rally for haven assets like sovereign bonds. That said, overnight we’ve seen a fresh risk-off tone because of the geopolitical situation, and a summit has been cancelled between President Biden and Arab leaders in Jordan following an explosion at a hospital in Gaza. That has led to a clear reaction in markets, with Brent Crude oil prices up +2.22% overnight to $91.90/bbl, whilst gold prices (+0.79%) are up at a one-month high of $1938/oz .

We’ll start with the bond selloff, which was mainly driven by a very strong retail sales print for September. The headline measure was up by +0.7% (vs. +0.3% expected), and there was an upward revision to the August number as well. Furthermore, it marked the 6th consecutive month that retail sales had risen, whilst the measure excluding autos and gas stations was up by +0.6% (vs. +0.1% expected). In the meantime, industrial production was stronger than expected too, with a +0.3% gain in September (vs. unch. expected), albeit with a downward revision to the August figure. So the releases add to the run of positive data out of the US recently, including the September jobs report, which showed nonfarm payrolls up by +336k.

Those positive signs on the economy meant that investors priced in a growing chance of another rate hike from the Fed. In fact, futures were pricing in a 59.5% chance of another hike by the close yesterday, which is the first time that’s been above 50% since October 3. In addition, they moved to price out the chances of cuts in 2024, with the rate priced in by the December 2024 meeting up +11.9bps on the day to a new cycle high of 4.78% .

With markets pricing in higher rates for longer again, that led to a major selloff among sovereign bonds. Most notably, the 10yr Treasury yield ended the day up +12.9bps at 4.84%, which is its highest closing level since 2007. Those increases were evident across the curve as well, with the 2yr yield up +11.1bps to a post-2006 high of 5.21%, and the 5yr yield rose +15.2bps to a post-2007 high of 4.87%. Real yields led the moves higher, but they didn’t quite hit their recent highs, with the 10yr real yield (+10.1bps) closing at 2.42%, which is beneath its closing high of 2.48% on October 6 after the jobs report .

Over in Europe, there was a similar shift in long-term borrowing costs, with yields on 10yr bunds (+9.8bps), OATs (+9.8bps) and BTPs (+12.5bps) all moving higher. UK gilts were the main outperformer, with 10yr yields only up +3.1bps after the employment data out yesterday was a bit weaker than expected. For instance, the number of payrolled employees fell -11k in September (vs. +3k expected), vacancies fell to a two-year low over the July-September period, and wage growth was also beneath expectations. That led investors to lower the chances of a hike at the BoE’s next meeting, which dropped from 31% to 25%, and the focus will now turn to the CPI release this morning, which is out shortly after we go to press.

Equities were largely flat yesterday despite sizeable intra-day moves. There was initially a sharp selloff as markets priced in a more hawkish path for the Fed, but that reversed as the session went on. For instance, the S&P 500 was down -0.83% within the first half hour, before recovering to trade nearly half a percent higher on the day but then ending the session flat at -0.01%. It was a similar story in Europe, where the STOXX 600 pared back most of its afternoon losses to close -0.10% lower. The small-cap Russell 2000 outperformed, advancing +1.09%, bringing its gains to +2.69% over the last two sessions. By contrast, megacap tech stocks were an underperformer, and the FANG+ index shed -0.64%. The was led by a -4.68% decline for chipmaker Nvidia as the US announced new restrictions on chip exports to China.

Overnight, we’ve seen more of a risk-off tone return in light of the latest geopolitical developments, with a summit cancelled between President Biden and Arab leaders in Jordan following an explosion at a hospital in Gaza.. That’s led to growing market concern, which has been evident in the sharp rise in oil prices overnight, with Brent crude up +2.22% to $91.90/bbl. In the meantime, investors have moved into haven assets, with gold up +0.79% to $1938/oz.

The other main story overnight has been the Q3 GDP release from China, which showed year-on-year growth running at +4.9% (vs. +4.5% expected). Furthermore, the monthly data for September also looked better than expected, with industrial production up +4.5% year-on-year (vs. +4.4% expected), and retail sales up +5.5% year-on-year (vs. +4.9% expected). The jobless rate was also down to a 22-month low of 5.0% (vs. 5.2% expected). But in spite of the positive data, the global risk-off tone has prevailed and several equity indices have seen losses in Asia. That includes the Shanghai Comp (-0.61%), the CSI 300 (-0.57%), the Nikkei (-0.12%) and the Hang Seng (-0.10%). The exception to that is the KOSPI, which has advanced +0.09%.

Separately, t he Bank of Japan announced another unscheduled bond buying operation overnight, which comes as yields on 10yr JGBs hit their highest level in over a decade, with an intraday peak of 0.815%. They’re currently a bit lower again at 0.808%.

When it comes to US politics, there was no sign of a new Speaker in the House of Representatives yesterday, as Republican nominee Jim Jordan failed to win a majority on an initial vote. 20 Republicans voted against Jordan, and no further votes were held yesterday.

Looking at yesterday’s other data, in the US there was the NAHB’s housing market index for October, which fell to 40 (vs. 44 expected). That marks a third consecutive monthly decline for the index, and takes it down to its lowest level since January. Meanwhile in Canada, CPI fell to +3.8% in September (vs. +4.0% expected), which led investors to lower the chance of a hike at the Bank of Canada’s next meeting from 43% to 16%. Finally in Germany, the ZEW survey for October saw the expectations component rise to a 6-month high of -1.1 (vs. -9.0 expected).

To the day ahead, and data releases include UK CPI for September, along with US housing starts and building permits for September. From central banks, we’ll hear from the Fed’s Waller, Williams, Bowman, Barkin, Harker and Cook, whilst the Fed will also release their Beige Book. Finally, earnings releases include Netflix, Tesla, Morgan Stanley and Procter & Gamble.