Morgan Stanley reported Q3 earnings of $1.38 per share on net revenue of $13.3 bn (better than the $1.22 and $13.2 bn that were expected).

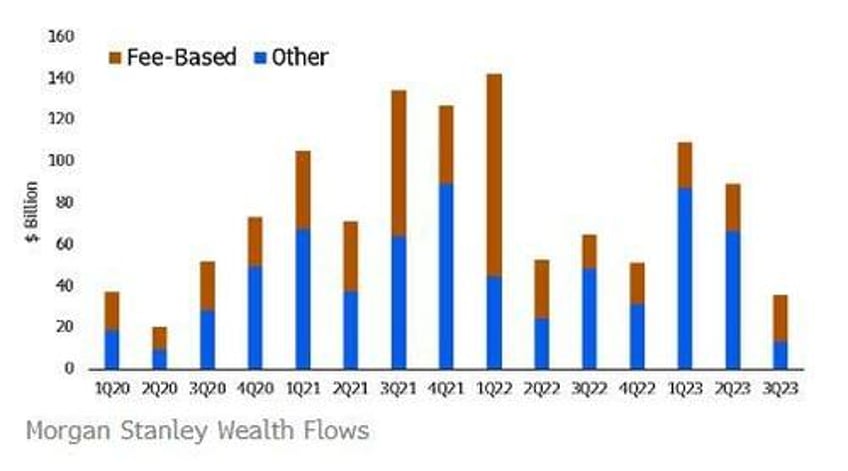

However, while the numbers beat on the top and bottom lines, wealth management revenue disappointed at $6.40 bn versus $6.58 bn expected

Investment banking was hurting, but trading beat on all fronts.

Equities sales & trading revenue $2.51 billion, estimate $2.41 billion

FICC sales & trading revenue $1.95 billion, estimate $1.83 billion

Institutional Investment Banking revenue $938 million, estimate $1.04 billion

Advisory revenue $449 million, estimate $424.9 million

Equity underwriting rev. $237 million, estimate $239.1 million

Fixed Income Underwriting revenue $252 million, estimate $373.4 million

For context on the trading side, Morgan Stanley's $2.51 billion of revenue compares with $2.96 billion at Goldman and $2.07 billion at JPMorgan.

CEO James Gorman says in the release:

“While the market environment remained mixed this quarter, the Firm delivered solid results with an ROTCE of 13.5%. Our Equity and Fixed Income businesses navigated markets well, and both Wealth and Investment Management produced higher revenues and profits year-over-year.”

Despite the disappointment, there was plenty of spin:

“This is solid performance in a mixed environment,” Morgan Stanley Chief Financial Officer Sharon Yeshaya said in an interview.

“Our announcements in terms of M&A this quarter were up 50% on year-over-year basis. We see backlog continuing to grow.”

But investors were not buying it as MS shares are down around 3% in the pre-market:

Additionally, we note comments from UBS' Brennan Hawken, who pre-warned:

“Morgan Stanley's wealth management client base skews more to high net worth investors, which leads to higher demand for yield (and sorting),” Brennan wrote.

"This should support upward pressure on deposit costs, limiting NII expansion (which tends to be high margin)."

And sure enough, despite the soaring rates and curves, Morgan Stanley's net interest income was $1.98 bn, notably below the $2.06 bn expected.

Finally, Morgan Stanley upped its credit loss provisions to $134 million (higher than the $126 million expected). pointing to “deteriorating conditions in the commercial real estate sector” as one reason for the increase.