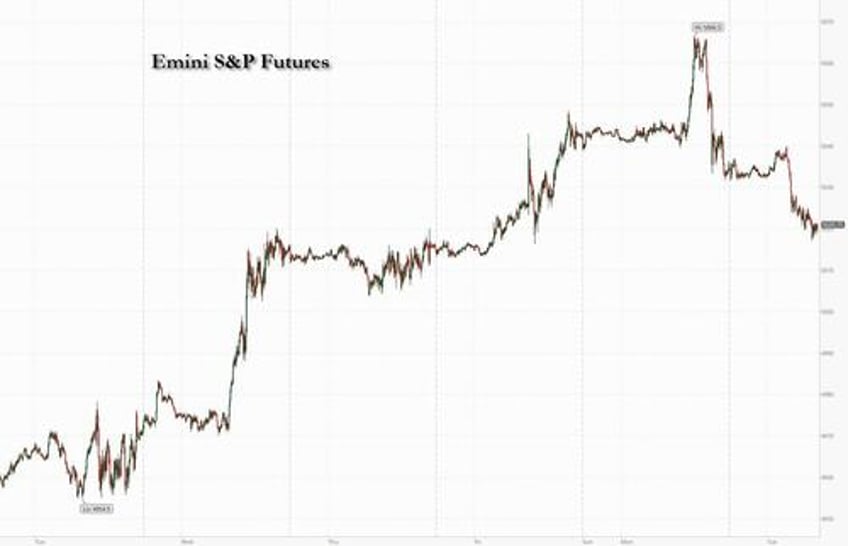

US equity futures and European bourses slumped before the release of closely watched CPI data that could set the stage for the timing of the Federal Reserve move to interest-rate cuts. Contracts on the Nasdaq 100 slid 0.6% while those on the S&P 500 fell 0.4%, extending Monday’s decline in the main US stock gauge from a high of near 5,050. Nvidia dropped 1% in premarket trading with all Mag 7 stocks down. Bond yields are down 3bps, the dollar fell and bitcoin traded around $50,000, the highest in over two years. Commodities are higher pre-mkt led by both Energy and Metals. CPI is the key macro focus for today but we also receive Small Business Optimism; full CPI preview and scenario analysis is below.

In premarket trading, all Mag7 names were lower pre-mkt as it is becoming increasingly clear that someone has been gaming a gamma squeeze (most likely SoftBank in names like Arm Holdings).

Holy shit, that sociopath really did it again. https://t.co/OsWXOxOl5e pic.twitter.com/uHC6X8If5Y

— zerohedge (@zerohedge) February 13, 2024

Here are some other notable premarket movers:

- Arista Networks shares fell 7.1% after the cloud networking company’s first-quarter results and outlook were seen by some as underwhelming, given AI-related expectations.

- Beamr Imaging rose 16%, on track to extend gains after rallying more than 370% on Monday after the video optimization technology and solutions company announced that it teamed up with Nvidia on a joint research.

- Cadence Design System shares fell 6.7% on Tuesday, after the application software company gave a first-quarter forecast that was weaker than expected.

- G1 Therapeutics shares slumped 38% after the biopharmaceutical company announced plans to continue its phase 3 trial of Trilaciclib in metastatic triple negative breast cancer after analysis from an independent data monitoring committee.

- JetBlue shares jumped 14% after activist investor Carl Icahn disclosed a 9.91% stake in the airline and said he had held talks with management about the possibility of representation on the board.

- Lattice Semiconductor fell 7.8% after the chipmaker’s fourth-quarter revenue as well as 1Q forecast fell short of average estimates.

- Teradata shares slid 14% after the infrastructure-software company issued guidance for full-year adjusted earnings per share that missed estimates. TD Cowen said this was a setback in Teradata’s cloud migration momentum.

- TripAdvisor shares climbed 12% after announcing the formation of a special committee to evaluate any proposals that may be brought forward for a potential deal, following Liberty TripAdvisor’s board authorizing talks on a possible acquisition of the travel-services platform.

- ZoomInfo Technologies shares soared 21% after the infrastructure software company reported fourth-quarter revenue that beat consensus estimates. Analysts said the results were solid overall, particularly due to the low expectations going into the report.

- 2U fell 24% after the online educational services company flagged “substantial doubt” about its ability to continue as a going concern, citing debt as a concern. Its 2024 revenue forecasts also missed estimates. Morgan Stanley halves its share price target on the stock.

Investors are taking a breather from the torrid meltup after optimism about corporate earnings - driven by what Bloomberg calls a combination of resilient US growth and expected interest-rate cuts - helped push the market to extremely overbought territory. The latest BofA Fund Managers Survey found that allocation to US equities has risen, with exposure to the tech industry at the highest since August 2020.

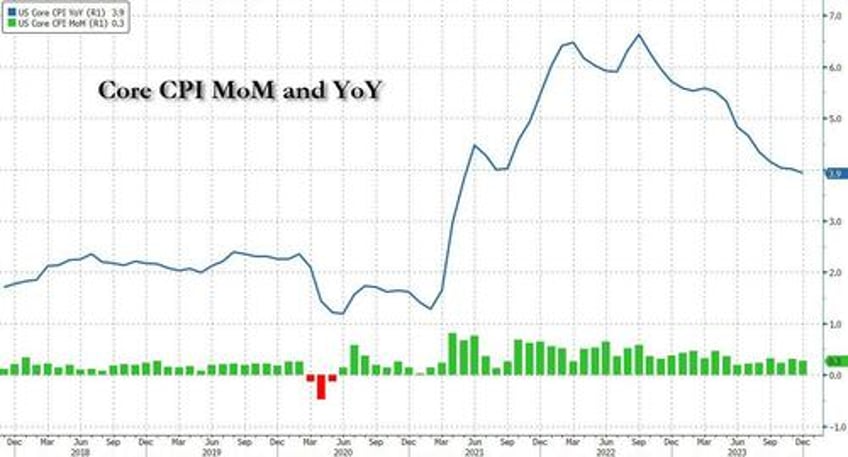

Today's inflation report (which we previewed in depth here), which is expected to show the first reading below 3% on year-over-year headline inflation since March 2021, may not be enough to justify a more rapid shift to monetary easing. Employment (as much as that number is not completely made up), manufacturing and economic growth in the US have surprised on the upside, proving resilient to the fastest rate increases in a generation.

“Despite expecting CPI to print below 3% later, we still think the market is over-exuberant when it comes to when that first cut comes in,” Grace Peters, head of global investment strategy at JPMorgan Private Bank, said in an interview with Bloomberg TV.

Policy makers, meanwhile, are driving home the message that rate-cut bets have become overblown. Federal Reserve Bank of Richmond President Thomas Barkin Monday warned US businesses accustomed to raising prices in recent years may continue to fan inflation. The market is overlooking the risk of rate increases following the easing cycle, strategists at Citigroup Inc. warned Monday.

Derivatives markets point to the first fully-priced quarter-point rate cut in June, with three more to follow in 2024, taking the Fed Funds Rate lower by 1 percentage point by December, according to data compiled by Bloomberg.

European stocks and US futures are on the back foot as investors look ahead to the release of US consumer price data. The Stoxx 600 fell 0.3% led lower by technology names which fell from Monday’s highest close since December 2000, as chip stocks pulled back after wafer maker Siltronic gave full-year guidance that was much weaker than expected; healthcare and auto stocks advanced. ASML lost over 7% at the open before recovering, with some traders blaming a “fat finger.” Here are the key European movers:

- Michelin shares rise as much as 4.1% as analysts welcomed the French tire-maker’s results and a buyback announcement, though several noted the company’s cautious guidance.

- Neste shares gain as much as 1.6% after Redburn raises rating to neutral from sell, saying the Finland-based refiner’s disappointing 2024 margin guidance has put a floor under expectations.

- Lundbeck shares rise as much as 3.5% after the Danish pharmaceutical group was upgraded to buy at Deutsche Bank, which says it’s at a “good entry point” following recent weakness.

- TUI shares rise as much as 8.2% in Frankfurt after the tour operator surprised markets by posting a 1Q underlying Ebit for the first time, bolstering confidence in full-year guidance.

- ThyssenKrupp Nucera shares gain as much as 5.1% after the German firm’s orders beat estimates. Deutsche Bank said the release showed a good start to the year.

- Believe shares gain as much as 19% after investment firms in partnership with its founder Denis Ladegaillerie offered to take the French record label private Monday at €15 per share.

- Tokmanni shares gain as much as 6.1% after raising its revenue target and announcing it targets a store network of 360+ Tokmanni, Dollarstore and Bigdollar stores in Nordics by end 2025.

- Basilea shares gain as much as 15%, the most since August, after the Swiss pharmaceutical company boosted its guidance for 2024, offsettinga revenue miss.

- ASML shares fall as much as 7.1% early on Tuesday before quickly trimming the decline, with several traders citing an erroneous trade known as a ‘fat finger.’

- Genmab shares drop as much as 4.4% after Carnegie decreased its price target on the Danish biotechnology company, scheduled to report full-year earnings on Wednesday.

- Kemira shares fall as much as 5.3% after a share sale by holder Solidium priced at €16 apiece, representing a roughly 5.9% discount to the last close.

- Siltronic shares falls as much as 10% after the wafer maker gave full-year guidance that was much weaker than expected, driven by elevated inventories at chipmaker clients. Peers drop.

Earlier in the session, Asian stocks advanced, boosted by a rally in semiconductor and technology stocks that lifted markets like Korea and Japan. The MSCI Asia Pacific Index rose as much as 0.8%, with Tokyo Electron, Toyota Motor and Tokio Marine contributing the most. Japanese stocks surged the most in a month after trading resumed following Monday’s holiday, driven by gains in chipmakers, exporters and ARM-rigging Softbank. Stocks in China, Vietnam, Taiwan and Hong Kong remained closed on account of Lunar New Year holidays. A Bloomberg gauge of semiconductor stocks in Asia was on pace for its highest close in nearly two years, propelled by Tokyo Electron’s strong earnings forecast and a rally in Nvidia shares overnight. The gains also helped Korea, which was on verge of erasing its year-to-date losses. Australia's ASX 200 was choppy as gains in mining, utilities and financials were offset by weakness in healthcare, telecoms and tech, while data showed an improvement in Westpac Consumer Sentiment but NAB Business Confidence and Conditions were mixed.

In FX, the Bloomberg Dollar Spot Index is also little changed. Gilts are in the red after UK wage growth slowed less than expected in the fourth quarter. The data also pushed the pound to the top of the G-10 FX pile - cable is up 0.3%.

In rates, treasuries were slightly richer across the curve amid outperformance by bunds during European morning. US 10-year at 4.165% trails bunds in the sector by 0.5bp. US intermediate to long-end yields richer by as much as 1.5bp; front-end lags, flattening 2s10s spread by less than 1bp toward middle of Monday’s range. Gilts lag by 2.5bps, with 10-year yields reaching highest level since Dec. 5 after UK December earnings data. Ahead of US CPI data, Fed-dated swaps price in around 3bp of easing for the March policy meeting and 16bp for May; further out, around 112bp of cuts are priced in for the year. Dollar issuance slate includes EBRD 4Y FRN; seven companies combined to price $11.3b on Monday as issuers paid about 6bps in new-issue concessions, driven by order books that were just under three times covered. US economic data calendar includes only January CPI at 8:30am.

In commodities, oil prices advanced again, with WTI rising 1.2%, to trade near $77.80 while Brent briefly topped $83. Spot gold adds 0.3%.

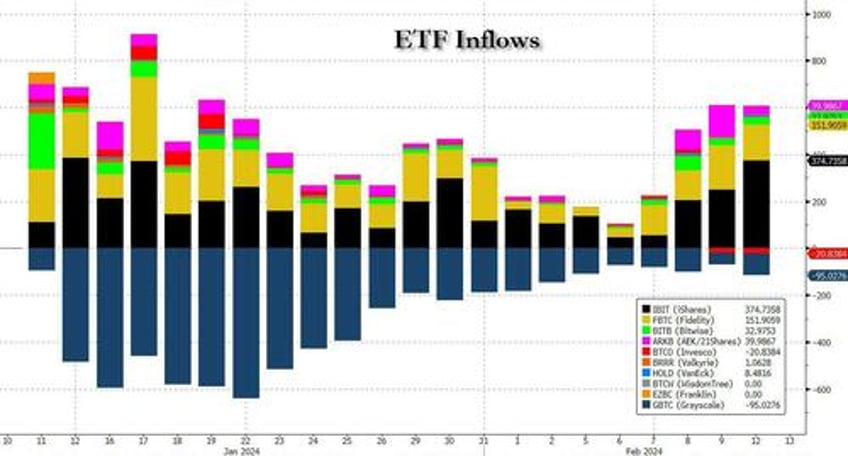

Bitcoin continues to hold above the USD 50k mark and Ethereum (+1.2%) plays catch-up. The aggressive flood of retail flows into bitcoin ETFs continues.

Looking to the day ahead now, data releases include the US January CPI, NFIB small business optimism, UK January jobless claims, December average weekly earnings, Germany and Eurozone February Zew survey, Germany December current account balance and the French Q4 ilo unemployment rate. Finally, we will have earnings releases from Coca-Cola, Shopify, Airbnb, Zoetis, Marriott, Biogen, and Restaurant Brands.

Market Snapshot

- S&P 500 futures down 0.3% to 5,024.00

- STOXX Europe 600 down 0.3% to 486.03

- MXAP up 0.9% to 168.66

- MXAPJ up 0.1% to 512.04

- Nikkei up 2.9% to 37,963.97

- Topix up 2.1% to 2,612.03

- Hang Seng Index down 0.8% to 15,746.58

- Shanghai Composite up 1.3% to 2,865.90

- Sensex up 0.7% to 71,545.85

- Australia S&P/ASX 200 down 0.1% to 7,603.58

- Kospi up 1.1% to 2,649.64

- German 10Y yield little changed at 2.35%

- Euro down 0.1% to $1.0761

- Brent Futures up 0.8% to $82.65/bbl

- Brent Futures up 0.8% to $82.66/bbl

- Gold spot up 0.3% to $2,026.07

- U.S. Dollar Index little changed at 104.24

Top Overnight News

- MSCI Inc. is cutting dozens of Chinese companies from its global benchmarks following a market rout that’s erased trillions of dollars in value from the nation’s stocks. BBG

- Japanese Prime Minister Fumio Kishida is intensifying efforts to meet North Korea’s Kim Jong Un, as he pushes for a diplomatic breakthrough with the dictator in a bid to save his faltering premiership. FT

- Russia intends to double the number of its troops stationed along its border with the Baltic states and Finland as it prepares for a potential military conflict with Nato within the next decade, according to Estonia’s foreign intelligence service. FT

- UK wage growth in Dec cools by less than expected vs. Nov, with core +6.2% Y/Y (down from +6.7% in Nov, but higher than the consensus forecast of +6%). WSJ

- Swiss CPI for Jan tumbles by much more than anticipated, coming in at +1.3% Y/Y headline (vs. the Street +1.7% and vs. +1.7% in Dec) and +1.2% core (vs. the Street +1.6% and vs. +1.5% in Dec). BBG

- CPI GIR estimates a 0.38% increase in January core MoM CPI (vs consensus +.3% and last +.3%). Our forecast reflects a temporary boost from above-normal start-of-year price increases, including for prescription drugs, car insurance, tobacco, and medical services. US equities rally should continue on anything sub 30bps here....north of 40bps will hit stocks...everything else in-between will be noisy which is likely where we land. GS GBM

- Nearly 20% of outstanding debt on US commercial and multifamily real estate — $929 billion — will mature this year, requiring refinancing or property sales. The volume of loans coming due swelled 40% from an earlier estimate by the Mortgage Bankers Association of $659 billion, a surge attributed to loan extensions and other delays rather than new transactions. BBG

- The Senate passed a $95 billion national security package to aid Israel, Ukraine and other U.S. allies early Tuesday morning after a monthslong debate that has deeply divided congressional Republicans. The bill passed 70 to 29, after 22 Republicans joined Democrats in approving the aid. WaPo

- Asset managers from BlackRock to Grayscale have launched an online advertising blitz for their bitcoin exchange traded funds, taking advantage of a change to Google’s marketing rules on promoting cryptocurrency instruments. Google’s new marketing rules allow ads touting “cryptocurrency coin trusts” to appear alongside search results for queries such as “bitcoin ETF”. They took effect on January 29, weeks after 10 asset managers launched bitcoin ETFs on January 11. FT

- 2024 YTD buyback authorizations are on pace for the second largest on record, with $166B authorizations with a tilt towards large cap tech. If you remove CVX, $75B authorization from 2023, authorizations would be +26% y/y. (166b v 132b), a new record

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed albeit with a positive bias as several markets reopened from the extended weekend. ASX 200 was choppy as gains in mining, utilities and financials were offset by weakness in healthcare, telecoms and tech, while data showed an improvement in Westpac Consumer Sentiment but NAB Business Confidence and Conditions were mixed. Nikkei 225 outperformed and extended on its highest levels since February 1990 as the earnings deluge resumed.

Top Asian News

- RBA's Head of Economic Analysis Kohler said inflation is coming down but is still too high and it will take some time for inflation to get back within the 2%-3% target range and based on their central forecast, inflation is expected to return to the target range in 2025 and to the midpoint in 2026. Furthermore, Kohler said services price inflation remains high and broadly based, while she also noted that high inflation, higher tax payments and higher interest rates have significantly reduced household incomes.

- Brussels is now reportedly preparing to sanction four Chinese entities which it believes are helping the Kremlin buy European dual-use goods, according to a draft of the proposal cited by Politico

European bourses, Stoxx600 (-0.3%), initially opened on a mixed footing before dipping into the red as sentiment waned throughout the early hours. The Eurostoxx50 (-0.7%) is dragged down by Tech names Infineon (-2.3%), SAP (-2.3%) and ASML (-3.8%), after Siltronic (-8.1%) issued a profit warning. European sectors are generally lower, though the overall breadth of the market is fairly narrow (ex-Tech). Tech is the clear laggard, after Siltronic announced poor guidance. Healthcare marginally outperforms after GSK (+1.1%) received a broker upgrade at Citi. US Equity Futures (ES -0.3%, NQ -0.6%, RTY -0.4%) are softer across the board, with price action generally following that seen in European trade. The docket for today sees US CPI where expectations are for the headline to cool to 0.2% (prev. revised 0.3%).

Top European News

- BoE reportedly plans to stress test insurers on exposure to reinsurance firms, according to FT.

- Riksbank's Jansson says hard to believe that rates could be cut at each meeting when the time comes for rate cuts to be lowered. There is not a zero chance that the first rate cut could come after this summer. Can not exclude that we could cut rates before Fed and ECB.

FX

- USD firmer vs. most peers but gains tentative as US CPI looms large. DXY incrementally took out yesterday's best of 104.27 with the next upside target the 8th Feb high at 104.43.

- EUR is contained within Monday's 1.0756-1.0805 range with that session's venture above 1.08 unconvincing. However, a soft US CPI print could change that and prompt a test of the 200DMA at 1.0829.

- GBP is the best performer vs. the USD and EUR/GBP is at its lowest level since August post-jobs data. Cable shot to a high of 1.2655, matching yesterday's best but stopped ahead of its 21DMA at 1.2665.

- Antipodeans are both softer vs. the USD but to varying degrees with NZD more so, following soft inflation expectation survey data. NZD/USD has now pared all of Friday's upside. AUD remains rangebound since printing a YTD low last week with AUD/USD chopping and changing around the 0.65 mark.

- CHF is the worst performer across the majors following soft Swiss CPI metrics which have boosted the odds of a March SNB cut to over 50% from 28%. EUR/CHF advanced to a high of 0.9493 (highest since Dec 18th) with all eyes on a potential test of 0.95.

Fixed Income

- Bunds were initially bearish as the complex reacted to hawkish UK wage data, resulting in the 133.28 session trough. This move has now entirely pared and back towards session highs of 133.65, after an additional boost on a well-received German outing.

- USTs moved in tandem with Bunds post-UK data, but magnitudes more limited as we await US CPI where downward inflation trends are expected to be evident once again, headline & core seen easing further.

- Gilts opened lower by 20 ticks from Monday's 97.68 close and thereafter slipped incrementally further to a 97.42 trough as the benchmark reacted to the earlier UK data. However, the move has since pared with Gilts now back towards the mentioned close as focus turns to upcoming events today before UK inflation & GDP later in the week.

- Germany sells EUR 3.292bln vs exp. EUR 4.0bln 2.10% 2029 Bobl: b/c 2.30x, average yield 2.30%, and retention 17.68%.

- UK sells GBP 1.5bln 0.75% 2033 I/L: b/c 2.97x (prev. 2.68x) and real yield 0.634% (prev. 0.724%).

- Italy sells EUR 8.5bln vs exp. EUR 7-8.5bln 2.95% 2027, 3.70% 2030, 4.00% 2030, and 4.45% 2043 BTP.

Commodities

- Crude complex trades with gains after settling relatively flat yesterday, although off Monday's intraday troughs amid heightened geopolitics and Saudi jawboning. Trade is within a tight range as markets look ahead to the OPEC Monthly Oil Report followed by US CPI. Upside in crude prices coincided with commentary from the OPEC Sec Gen with Brent near peaks of USD 82.50/bbl.

- Precious metals hold an underlying bid despite the somewhat resilient pre-CPI Dollar and steady USTs, potentially propped up by the ongoing geopolitical developments which are showing no signs of cooling; XAU found support at USD 2,016.67/oz as it eyes its 21 DMA (USD 2,027.66/oz) to the upside.

- Base metals are modestly firmer despite the resilient Dollar and subdued risk tone, with no obvious catalyst to explain broader base metals' price action, whilst Chinese markets remain on holiday.

- Morgan Stanley raises oil demand growth forecast to 1.5mln BPD (prev. 1.3mln BPD) and reduces non-OPEC growth forecast to 1.5mln BPD (prev. 1.7mln BPD); bringing the two in-line.

- IEA sees 2024 global oil demand growth between 1.2-1.3mln BPD (vs 1.24mln BPD in Jan OMR), according to IEA Executive Director Birol cited by BBG TV. IEA expects more comfortable oil markets and moderate prices this year. Oil supply growth will more than satisfy demand this year. OPEC+ is largely showing good discipline with cuts. Warns against moves that push oil prices up.

- OPEC Secretary General Al Ghais stands by long-term demand outlook; says Saudi decision to postpone capacity expansion should not be misconstrued as a view demand is falling; voluntary cuts show OPEC+ flexibility. Sees strong global economy this year with positive implications. Market is in a good state and rather stable.

- EIA said US oil output from top shale-producing regions in March is due to climb to its highest since December 2023.

- American Petroleum Institute sues the Biden administration over offshore drilling curbs, according to FT

Geopolitics: Middle East

- Israeli warplanes reportedly bombed areas in northern Rafah, according to Al Arabiya via social media platform X.

- The heads of the CIA and Israel’s Mossad spy agency are expected to hold talks with senior Egyptian and Qatari officials on Tuesday in a bid to revive negotiations on a deal to stop the war and release hostages, according to FT sources.

- France's proposal for a truce on the Lebanon-Israeli border was delivered to Lebanon by France which called for fighters including Hezbollah elite forces to withdraw 10km away from the Israel border and aims to enforce a potential ceasefire when the conditions are right, while the proposal also called for the resumption of talks to demarcate the border. Hezbollah official Fadlallah said the group won't discuss the matter relating to south Lebanon before the Israeli offensive in Gaza stops and that Israel is not in a position to impose conditions.

- Russia's Kremlin said they invited Palestinian President Abbas and hope that he will visit Russia, according to RIA.

- US military said Houthi militants fired two missiles from Yemen towards the ship Star Iris in the Bab Al-Mandeb, while the ship reported being seaworthy with minor damage and no injuries to the crew, according to Reuters.

- "Israeli newspaper Haaretz: Some progress has been made in detainee deal negotiations in recent days", according to Sky News Arabia

- Iranian Revolutionary Guards says "if the enemy hits our ships, we will hit the same number or more", according to Sky News Arabia citing Tasnim

Geopolitics: Other

- White House said the US sees no indication there are about to be hostilities at the Venezuela-Guyana border.

- Japanese PM Kishida is seeking a summit with North Korean leader Kim, according to FT.

US Event Calendar

- 06:00: Jan. SMALL BUSINESS OPTIMISM 89.9, est. 92.3, prior 91.9

- 08:30: Jan. CPI MoM, est. 0.2%, prior 0.3%, revised 0.2%

- Jan. CPI Ex Food and Energy MoM, est. 0.3%, prior 0.3%

- Jan. CPI YoY, est. 2.9%, prior 3.4%

- Jan. CPI Ex Food and Energy YoY, est. 3.7%, prior 3.9%

- 08:30: Jan. Real Avg Weekly Earnings YoY, prior 0.5%, revised 0.7%

- Jan. Real Avg Hourly Earning YoY, prior 0.8%, revised 1.0%

DB's Jim Reid concludes the overnight wrap

Welcome to inflation Tuesday as US CPI today will be a very important staging post for any Fed cuts this year. Before we preview this, this morning I’ve just published a new chart book with my colleague Galina Pozdnyakova for macro generalists on the Magnificent Seven. This group has become so big that they are effectively countries and not just companies now in scale. They have already impacted global risk sentiment in recent years and especially in recent months and no market participant can ignore them in whatever asset they look at. Their size has left the S&P 500 at its most concentrated since the 1929 bubble but in the pack we show how these companies are already as profitable as the entire stock market in many countries. We show a number of long term charts that explain how they arrived at this level of dominance and also highlight what happened to all the top 5 S&P 500 stocks over the last 60 years. It was a fun and fascinating pack to put together so hopefully you’ll find it useful in framing the discussion of their future. You can see it here.

Yesterday was one of the rarer sessions where the Magnificent Seven (-0.83%) clearly underperformed, with the pullback in tech sentiment leading the S&P 500 to a marginal decline (-0.09%). But it was also a day when a more prevalent theme this year of differentiation within the mega caps was evident. The reversal was led by a -2.81% decline for Tesla, which is now the second worst performer in the S&P 500 so far in 2024 (-24.3%). By contrast, Nvidia, which eked out a new all-time high yesterday (+0.16%), has been the best performing S&P 500 stock year-to-date, having already risen by +45.9%, adding $561bn in market cap. Just to hammer home the message from the chart book that you can’t ignore these stocks, this six-week gain for Nvidia is larger than the entire market cap of the largest company in Europe (Novo Nordisk at $540bn). Indeed, Nvidia briefly surpassed Amazon to be the 4th largest fully listed company in the world yesterday, rising more than 3% earlier in the session as chipmaker sentiment benefited from dramatic gains for ARM Holdings (+29.3% yesterday and +93.4% over the past three sessions) after its results last week. SoftBank is +6.3% higher overnight given its large stake in the chipmaker.

Elsewhere, small-caps out-performed, with a +1.75% gain for the Russell 2000 yesterday moving the index back into the black year-to-date (+0.90%). Banks also gained, with the S&P 500 banks group (+1.06%) seeing its strongest day since the New York Community Bancorp results two weeks ago, while the KBW index of regional banks was up +1.83%. This easing of banking sector concerns came even as NYCB itself ended the day near flat despite trading up by more than +12% early on. On this, Luke Templeman and Galina Pozdnyakova (she was busy yesterday) published their latest private capital monitor (link here) with a special look at the CRE market. In short private investors don’t seem to be too concerned. Over in Europe equities saw a solid rally, with the STOXX 600 +0.54%, DAX (+0.65%) and CAC (+0.55%) all higher – a similar gain to the equal-weighted version of the S&P 500 (+0.63%).

Supporting the risk on mood outside of tech was the NY Fed inflation expectation report, which showed that 3-year inflation expectations fell to 2.35% (from 2.62%), its lowest level since 2013. 1-year inflation expectations were largely unchanged at 3.00% (previously 3.01%). With today’s US CPI report, given that seasonally adjusted gas prices were down almost 2.5% in January from December, our US economists expect headline CPI to come in at +0.15% (vs. +0.23% previously, consensus +0.2%), with core more elevated at +0.27% (vs. +0.28% previously, consensus +0.3%). This would see core YoY CPI falling two-tenths to 3.7%, and headline down by four-tenths to 2.9%, both in line with consensus. Chair Powell shifted his attention in the January Fed press conference from the three- and six-month annualised rates to year-on-year rates so we expect the market to refocus on these numbers. See our economists preview here.

Talking of the Fed, the speakers yesterday continued to caution regarding Fed cuts, albeit largely reiterating their recent comments. A known hawk, Fed Governor Bowman stated it is still “too soon to project when, how much the Fed will cut rates”, as “many risks remain for the Fed’s inflation fight”. Richmond Fed President Barkin noted that while the Fed was closing in on its inflation target, it was not there yet as there was “a real risk that there will be continued inflationary pressure”.

Against this backdrop, market expectations of Fed rate cuts saw little change, with a slightly less than one in five chance priced in that the Fed cuts by 25bps at the March meeting and an unchanged 112bps of cuts priced by December. Treasury yields were flat on the day, with the 10yr up +0.4bps while 2yr yields fell -0.6bps.

On the other hand, in Europe, the ECB’s Wunsch commented that there was “no big risk in waiting or not for data” in terms of deciding when to cut, as markets have already priced in future rate cuts which provide some easing for financial conditions even before a cutting cycle begins. Expanding, he suggested there was not a “huge difference” whether to start rates cuts earlier and proceed gradually or “wait a bit more and then go faster”. Market expectations of ECB rate cuts saw a moderate rise, with chances of a cut by April up to 60% from a three-month low of 52% on Friday. And the amount of cuts expected by the December meeting rose by +6.2bps on the day to 120bps. 10yr bund yields fell -2.0bps, with a stronger rally in OATs (-2.9bps) and BTPs (-5.7bps).

Talking of Europe and in light of the weekend NATO comments on the US election campaign trail, our German economists yesterday put out a note on potential catalysts for a fiscal regime change in Germany (including uncertainty around NATO post the US election) and then present three potential scenarios for the 2025 budget. See it here.

Asian equity markets are higher but with many still on holiday. As I check my screens, the Nikkei (+2.57%) is sharply higher sustaining its previous gains and making fresh 34-year highs with the KOSPI (+1.01%) also starting the day on a positive note. Chinese markets will remain closed for the week but the Hang Seng will resume trading tomorrow. S&P 500 (-0.17%) and NASDAQ 100 (-0.20%) futures are ticking lower. Treasury yields are flat.

In other notable market moves yesterday, Bitcoin (+3.23%) broke through the $50,000 level for the first time since December 2021, supported by the recent spot Bitcoin ETF by the SEC (more on that here), though it retreated to a touch below this level at the close and as I type.

To the day ahead now, data releases include the US January CPI, NFIB small business optimism, UK January jobless claims, December average weekly earnings, Germany and Eurozone February Zew survey, Germany December current account balance and the French Q4 ilo unemployment rate. Finally, we will have earnings releases from Coca-Cola, Shopify, Airbnb, Zoetis, Marriott, Biogen, and Restaurant Brands.