Having plunged by the most since COVID lockdowns in January, analysts expected a small rebound in February data released this morning. Analysts were right as headline factory orders rose 1.4% MoM (vs +1.0% exp) but this was from a downwardly revised 3.8% MoM loss in January (from -3.6%). That lifted the YoY rise in factory orders to +1.0%...

Source: Bloomberg

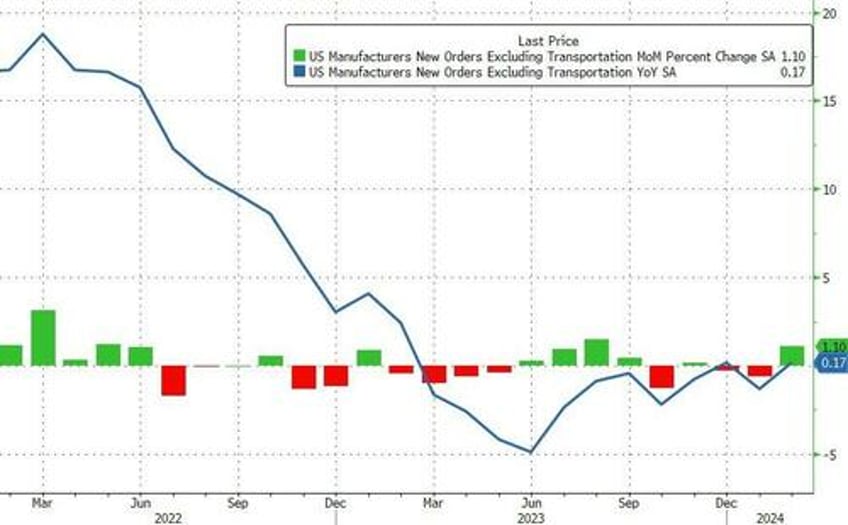

On a core (ex-transports) basis, orders also beat expectations, rising 1.1% MoM (vs +0.5% MoM exp) from an upwardly revised 0.6% MoM loss in January. That MoM gain inched the YoY orders back into the green (+0.17%)...

Source: Bloomberg

The Military-Industrial complex struggled in February (poor things) as Defense spending dropped 12.7% MoM (while non-defense rebounded from its biggest MoM drop since COVID lockdowns)...

Source: Bloomberg

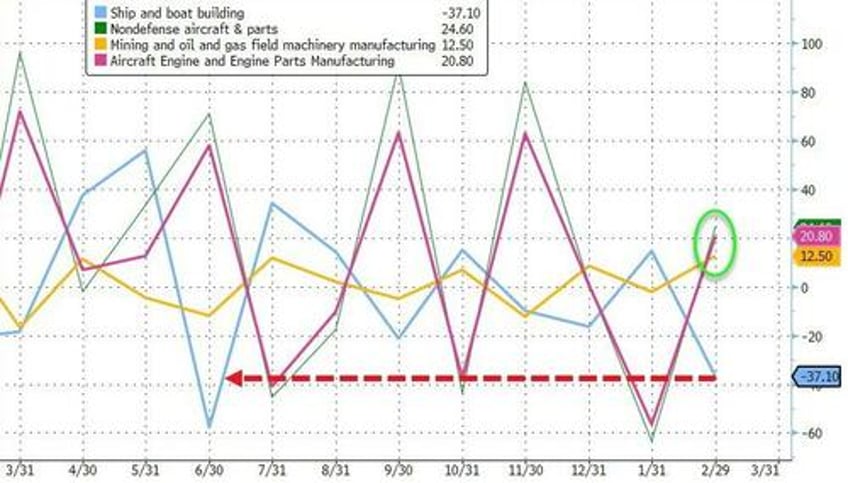

Mining and Refining orders rose notably in February while shipbuilding orders tumbled most since June 2023...

Source: Bloomberg

Final factory orders were revised slightly lower over the month with capital goods shipments ex-air - a key input for the government’s GDP calculation - tumbled 0.6% MoM (the worst since Feb 2021)...

Source: Bloomberg

That’s a troubling signal for future production and and limits the scope for a persistent upswing in capex.

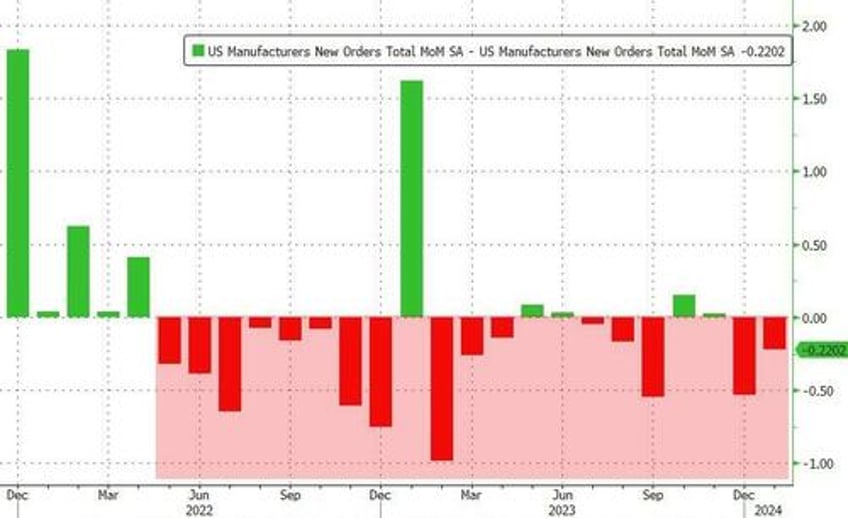

Finally, it's that same old issue again... downward revisions!! In the last 21 months, US factory orders have been downwardly revised 17 times...

Source: Bloomberg

Bidenomics - make it up as you go along - continues.