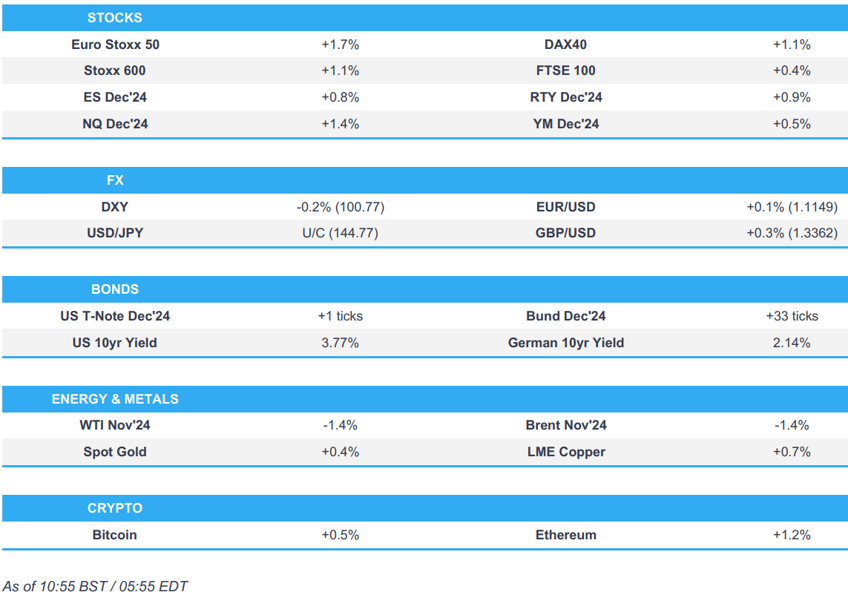

- Equities are entirely in the green, with optimism lifted amid Chinese stimulus efforts; MU +15% pre-market after strong earnings and solid guidance

- Dollar is softer, Antipodeans benefit from the risk-tone but weighs on the JPY

- USTs are flat, EGBs benefit on reports that ECB doves are pushing for an October cut and amid reports surrounding France’s fiscal situation

- Crude tumbles on constructive geopolitical updates, XAU and base metals benefit from the softer Dollar and positive risk tone

- "Senior US officials have said that they expect a ceasefire deal to be implemented "in the coming hours" along Israel-Lebanon border", according to Walla News' Elster

- Looking ahead, US Durable Goods, GDP Final (Q2), Core PCE (Q2), IJC, Banxico Policy Announcement, Speakers including ECB’s Lagarde, de Guindos & Schnabel, Fed’s Powell, Williams, Collins, Kugler, Bowman, Barr, Kashkari & Cook, Supply from the US

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx600 (+1.2%) are entirely in the green, with sentiment lifted from further Chinese stimulus efforts. Price action today has only really moved upwards, initially opening on a strong footing and gradually edging higher as the morning progressed.

- European sectors hold a strong positive bias; Consumer Products tops the pile, benefiting from significant strength in the Luxury sector amid further Chinese stimulus efforts; Basic Resources and Tech also gain. Energy is by far the clear underperformer, dragged down by losses in the crude complex.

- US Equity Futures (ES +0.8%, NQ +1.4%, RTY +0.9%) are entirely in the green, taking impetus from a strong European session, with sentiment lifted by further Chinese stimulus efforts; the tech-heavy NQ outperforms, owing to very strong Micron (+15% pre-market) results where it beat on top- and bottom-lines and provided solid guidance.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is broadly negative vs. peers (ex-JPY) in today's risk-on environment. DXY is currently towards the top end of yesterday's 100.22-99 range.

- EUR/USD is hovering just above yesterday's 1.1121 low that was printed alongside a resurgence in the USD which dragged the pair back from its 1.1214 YTD high. EUR/USD saw a very modest dovish reaction to Reuters reporting that ECB's October rate decision is now "wide-open" on account of recent soft data, which stands in contrast to sources after the Sept.

- Cable is attempting to claw back some of yesterday's lost ground which saw the pair dragged lower from its multi-year peak at 1.3429.

- JPY struggling vs. the USD once again with the pair rising as high as 145.20 during today's session. The next upside target comes via the 4th September high at 145.55.

- Both antipodes are at the top of the G10 leaderboard and enjoying the current risk-on environment. AUD/USD remains supported by the general positivity surrounding China after this week's stimulus efforts by officials.

- EUR/CHF immediately fell from 0.9492 to 0.9436 following the SNB's decision to cut rates by 25bps to 1.00%. A move which partially pared as the statement made clear that they are willing to intervene in the FX market as necessary and pointed to additional cuts being possible.

- PBoC set USD/CNY mid-point at 7.0354 vs exp. 7.0367 (prev. 7.0202).

- Click for a detailed summary

FIXED INCOME

- USTs are contained with no follow through to the European-related updates. A particularly packed US agenda with 7yr supply (follows mixed 2yr & 5yr thus far) and numerous data points (quarterly PCE/GDP & weekly Claims) but the focal point is the speaker schedule with Fed’s Powell and Williams. USTs are holding within narrow 114-15+ to 114-19 bounds.

- Bunds spent the first part of the session in proximity to the unchanged mark and generally unreactive to today's geopolitical updates. Bunds saw some very modest upside to reports that ECB doves were pushing for an October cut, taking it to an initial 134.71 peak. Thereafter, further impetus was driven by reports around France’s fiscal situation, which contributed to the bid in Bunds to a 134.78 peak.

- OATs were lifted out of modest losses following the aforementioned ECB sources and then once again on reports that France will be requesting the EU for a two-year extension. OAT-Bund 10yr yield spread has widened above 80bps to its highest since early August

- Gilts are slightly softer with no real follow through to the above ECB sources and UK specifics somewhat light. Holding around the 98.55 opening mark, briefly dipped to a fresh WTD base of 98.41.

- Click for a detailed summary

COMMODITIES

- Hefty losses in the crude complex this morning emanated from an unwind of risk premium from constructive geopolitical updates, in which reports suggested that senior US officials anticipate a ceasefire deal along the Israel-Lebanon border "in the coming hours". Benchmarks as low as USD 67.16/bbl and USD 70.72/bbl for WTI and Brent respectively.

- Precious metals are buoyed by the softer Dollar but spot gold sees the shallowest gains (+0.5%) vs silver (+1.0%) and palladium (+2.4%), potentially amid the constructive geopoltical updates.

- Base metals are firmer across the board amid the softer Dollar and risk-on mood across the market, with sentiment also seeing continued tailwinds from China's stimulus bazooka. 3M LME copper trades towards the top of a 9,781.00-9,922.50/t range.

- Saudi Arabia is reportedly prepared to abandon its unofficial USD 100 crude target in order to regain market share, via FT citing sources; add, in a sign that Saudi is resigned to a period of lower oil prices. Sources add that Saudi is committed to bringing back production as planned on 1st December. Reportedly unwilling to continue surrendering market share to other producers.

- Russia's Deputy Energy Minister Sorokin says Russia see oil production costs increasing as "Oil will be harder to extract".

- BP (BP/ LN) said it secured offshore facilities and removed some non-essential personnel from Argos, Atlantis, Mad Dog, Na Kika, and Thunder Horse platforms, while it is working toward safely ramping up production across its Gulf of Mexico portfolio.

- Citi forecasts Brent at USD 74/bbl in Q4-2024; sees overall fundamental supply and demand bearishness winning out over time, with a forecast for USD 60/bbl for 2025.

- Iraq's August total oil exports at 105.8mln barrels. according to the oil ministry cited by Reuters

- Click for a detailed summary

NOTABLE DATA RECAP

- Swedish Overall Sentiment (Sep) 94.9 (Prev. 94.7); Manufacturing Confidence (Sep) 94.2 (Prev. 97.1); Total Industry Sentiment (Sep) 96.5 (Prev. 95.0); Consumer Confidence SA (Sep) 99.5 (Prev. 96.3)

- Spanish Retail Sales YY (Aug) 2.3% (Prev. 1.0%, Rev. 1.1%)

- Italian Consumer Confidence (Sep) 98.3 vs. Exp. 97.0 (Prev. 96.1); Mfg Business Confidence (Sep) 86.7 vs. Exp. 87.1 (Prev. 87.1, Rev. 87.0)

- EU Money-M3 Annual Grwth (Aug) 2.9% vs. Exp. 2.6% (Prev. 2.3%); Loans to Non-Fin (Aug) 0.8% (Prev. 0.6%); Loans to Households (Aug) 0.6% (Prev. 0.5%)

NOTABLE EUROPEAN HEADLINES

- SNB cuts its Policy Rate by 25bps as expected to 1.00%; prepared to intervene in the FX market as necessary; Further cuts in the SNB policy rate may become necessary in the coming quarters to ensure price stability over the medium term.; Click for more details.

- SNB outgoing Chairman Jordan says inflationary pressure has decrease significantly in Switzerland; strong CHF, lower oil, and electricity prices contributed to lower inflation forecasts; downside risk to inflation higher than upside risk. Further rate cuts may be necessary int in the coming quarters. Swiss economic growth will be "rather modest" in coming quarters. Says he sees no risk of deflation; further rate cuts "might" be necessary to ensure price stability (post-meeting press conference).

- SNB Vice-Chair Schlegel says measures to expand provision of liquidity for Swiss banks will further strengthen the sector. Comments on possible further rate cuts not unconditional, bank will examine the situation in December

- German Economic Institutes forecast inflation to go down to 2.2% this year from 5.9% last year; cuts 2024 forecast, sees economy shrinking by 0.1% in 2024 (prev. forecast +0.1%).

- "Hearing France will ask Brussels for a two year delay in reaching its 3% of GDP deficit target i.e. 2029 instead of 2027. Speculation rife in French press today", Eurasia Group's Rahman

- UK car manufacturing output fell 8.4% Y/Y to 41,271 units in August, according to SMMT.

- Swedish NIER think tank forecasts 2024 Swedish GDP +0.7% (vs +0.7% in August forecast).

- ECB rate decision is "wide-open", according to Reuters sources; fight for a cut following weak data. Doves are pointing towards recent soft business survey data and weak German sentiment metrics. Hawks are arguing for a pause.

NOTABLE US HEADLINES

- Fed's Kugler (2024 voter) said she strongly supported the Fed's 50bps interest rate cut and will support additional rate cuts going forward if progress on inflation continues as she expects. Kugler added they are at a place where they do not want the labour market to weaken further and it makes sense to shift attention to the employment mandate, as well as noted that they are making very good progress towards inflation goals but they are not at 2% yet. Furthermore, she said with disinflation, they need to cut even just to keep where they are in terms of restrictiveness and it makes sense to cut rates to remove some restrictiveness.

- US House voted 341-82 to pass a stopgap government funding bill and the US Senate also voted 78-18 to pass the bill that would fund the government until December 20th.

- New York City Mayor Adams was indicted following a federal corruption probe and believes he will be charged by the federal government with crimes but added that if charges are filed, they will be entirely false and based on lies, while he won't resign if he has to face charges.

GEOPOLITICS

MIDDLE EAST - EU SESSION UPDATES

- "Senior US officials have said that they expect a ceasefire deal to be implemented "in the coming hours" along Israel-Lebanon border", according to Walla News' Elster.

- "US official says Israel and Lebanon expected to decide "within hours" whether to support the truce", via Sky News Arabia; echoed by Cairo sources thereafter.

- Kann's Stein reports a statement from Israeli PM Netanyahu's coalition members, Smotrich, Ben Gvir and ministers from the Likud party, saying that they "oppose the ceasefire". Furthermore, opposition leader Lapid says the ceasefire should be accepted for only seven days. Lapid adds that even a minor violation of the ceasefire would result in the return of Israel to the attack "with all its strength and throughout Lebanon".

- Source in Israeli PM Netanyahu's says "There is a green light for a ceasefire in order to start negotiations", via Al Jazeera.

- "There are ideas and discussions, but there is no result so far", "The discussions are not only related to Lebanon, but include Gaza", according to Sky News Arabia sources.

- "Israel's Channel 12: Netanyahu ordered the Israeli army to ease attacks in Lebanon against the backdrop of ceasefire talks", according to Al Jazeera.

- "Israel's Channel 12 quoting government sources: Israel sets terms for truce and estimates that Nasrallah [Secretary-general of Hezbollah] will not agree to them", according to Al Jazeera.

- Qatar foreign ministry spokesperson says not aware of direct link between 21-day Lebanon ceasefire proposal and the Gaza ceasefire proposal; there is not yet a formal mediation track working towards a ceasefire in Lebanon.

- Israeli Prime Minister's Office says "the news about a ceasefire are incorrect. This is an American-French proposal, to which the prime minister did not even respond.", via Amichai Stein on X.

- Israeli PM Netanyahu says he has instructed military to keep "fighting at full power".

- "Israeli Foreign Minister: There will be no ceasefire in the north", according to Sky News Arabia.

- "Lebanese PM denies signing ceasefire agreement after meeting with Blinken and Hochstein", according to Al Arabiya.

MIDDLE EAST - APAC UPDATES

- US, France and partners proposed an immediate 21-day ceasefire across the Lebanon-Israel border and called for a ceasefire in Gaza. US President Biden and French President Macron said it is time for a settlement on the Israel-Lebanon border that ensures safety and security to enable civilians to return to their homes and they have worked together in recent days on a joint call for a temporary ceasefire to give diplomacy a chance to succeed. Furthermore, they called for broad endorsement and immediate support from the governments of Israel and Lebanon, while the statement was endorsed by the US, Australia, Canada, EU, France, Germany, Italy, Japan, Saudi Arabia, UAE, and Qatar.

- Israel and Hezbollah communicated details of the US-France proposal and will announce their response soon, while The Washington Post cited US officials stating that Hezbollah will not directly sign the ceasefire agreement.

- US President Biden said an all-out war is possible in the Middle East, but there is also a possibility of a settlement and said there needs to be a two-state solution, according to an ABC interview.

- French Foreign Minister told the Security Council that the situation in Lebanon may reach the point of no return and that Lebanon which is already considerably weakened, will not be able to be restored after a war between Israel and Hezbollah. Furthermore, he said war is not inevitable and there is no alternative to diplomacy. The Foreign Minister also noted that important progress was recently made on a temporary ceasefire in Lebanon and efforts will continue.

- Israeli source said they are approaching a crossroads to make decisive decisions that will determine where the war is heading and noted that talks on the north aim to provide an opportunity for a settlement that prevents a major war, according to Israeli press.

- Israeli press Hayom cited an Israeli source stating there is no prospect of reaching a ceasefire at least in the next few days.

- Israeli UN envoy said Israel would prefer a diplomatic solution in Lebanon and if diplomacy fails, then Israel will use all means at its disposal. The envoy added that diplomacy will be better for Israel and Lebanese people, as well as noted that Israeli PM Netanyahu will arrive on Thursday and address the UN General Assembly on Friday while Israel's UN envoy also commented that Iran is the spider at the centre of the web of violence and there can be no peace in the region until we dismantle this threat.

- Iran's Foreign Minister said the region is on the brink of a full-scale catastrophe and Israel has crossed all red lines, while he added that the UN Security Council must intervene to restore peace and security. Furthermore, he said that Israeli leaders must understand their crimes won't go unpunished and Iran will not remain indifferent in case of a full-scale war in Lebanon.

- UN Secretary-General Guterres told the Security Council that 'hell is breaking loose' in Lebanon and diplomatic efforts have intensified to achieve a temporary ceasefire to allow for aid deliveries and pave the way for more durable peace. Guterres stated all parties must immediately return to a cessation of hostilities, while an all-out war must be avoided at all costs and that Lebanon cannot become another Gaza.

- Lebanon's PM told the Security Council that Israel is violating their sovereignty, while Lebanon's PM responded 'hopefully yes' when asked if a ceasefire can be reached soon, according to Reuters.

OTHER

- US is reportedly preparing USD 8bln in arms aid packages for Ukrainian President Zelensky's visit, according to sources via Reuters. It was later reported that President Biden's administration announced USD 375mln for Ukraine defence aid which includes HIMARS, Javelin missiles and TOW missiles, according to the White House and State Department.

- Russian President Putin proposed to update Russia's nuclear strategy and said that a number of clarifications have been proposed with regard to the definition of conditions for the use of nuclear weapons. The proposal stated that aggression against Russia by any non-nuclear state, but with participation or support of a nuclear state, is proposed to be considered as their joint attack on the Russian federation, while Russia reserves the right to use nuclear weapons in case of aggression against Russia and Belarus.

- China's Foreign Minister said in meeting with EU's top official that China is committed to de-escalating the situation in Ukraine and China will not give up efforts to strive for peace in Ukraine.

- South Korea's National Intelligence Service said North Korea possesses enough plutonium and uranium to make at least double-digit nuclear weapons, while it added that North Korea could possibly conduct a 7th nuclear test, according to Yonhap.

- Russia's Kremlin says changes to Russian nuclear policy in the document on state nuclear deterrence have now been formulated; changes should be considered a signal to "unfriendly" countries. Will subsequently make a decision on whether or not to publish nuclear documents. There are two documents on nuclear policy. Signal to the west is that there are consequences if Western countries participate in an attack on Russia with various means.

CRYPTO

- Bitcoin is slightly firmer and holds around 63.5k whilst Ethereum gains to a larger magnitude, climbing above USD 2.6k.

APAC TRADE

- APAC stocks shrugged off the subdued handover from Wall St and the recent geopolitical escalation, as some 'progress' was said to be made regarding a temporary ceasefire proposal and a 21-day ceasefire was proposed by US and France, while China benefitted again from stimulus.

- ASX 200 saw gains across all sectors, while the RBA's FSR noted Australia's financial system is resilient and risks are contained.

- Nikkei 225 outperformed as exporters benefitted from recent currency weakness, while stale BoJ minutes did little to shift the dial.

- Hang Seng and Shanghai Comp extended on the recent rally owing to policy support after China's State Council issued guidelines for promoting high-quality employment and with China to give rare one-off cash handouts to people in extreme poverty ahead of the National Day holiday, while it was also reported that China was weighing injecting USD 142bln of capital into top banks.

NOTABLE ASIA-PAC HEADLINES

- China's Politburo held meeting on Sept 26, and said they will lower the reserve requirement ratio and implement forceful interest rate cuts, according to Reuters. China's Politburo said it will ensure necessary fiscal spending, will make efforts to stop the falls in the property market and stabilize it.

- China weighs injecting USD 142bln of capital into top banks, according to Bloomberg.

- China's MOFCOM launched an anti-discriminatory investigation against Canada's restrictive measures including additional tariffs on China's EVs, steel and aluminium products, according to Reuters.

- BoJ July Minutes from the July 30th-31st meeting noted that members shared the view over a need for vigilance to risk of an inflation overshoot, while many said it was appropriate to raise rates to 0.25% and adjust the degree of monetary support. A few members also said it was appropriate to gradually adjust very low rates now to avoid being forced to hike rates rapidly later.

- RBA Financial Stability Review stated the Australian Financial System is resilient and risks are contained, while it noted that risks include stress in China's financial sector and the lack of significant response from Beijing.

- China to issue USD 284bln of sovereign debt as part of fresh fiscal stimulus, according to Reuters sources; some of the fiscal support measures could be unveiled as early as this week.