- APAC stocks shrugged off the subdued handover from Wall St and the recent geopolitical escalation, as some 'progress' was said to be made regarding a temporary ceasefire proposal and a 21-day ceasefire was proposed by US and France, while China benefitted again from stimulus.

- "Senior US officials have said that they expect a ceasefire deal to be implemented "in the coming hours" along Israel-Lebanon border", according to Walla News' Elster.

- China Politburo held meeting on Sept 26, and said they will lower the reserve requirement ratio and implement forceful interest rate cuts, according to Reuters.

- Fed's Kugler (2024 voter) said she strongly supported the Fed's 50bps interest rate cut and will support additional rate cuts going forward if progress on inflation continues as she expects.

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.7% after the cash market closed lower by 0.5% on Wednesday.

- Looking ahead, highlights include German GfK Consumer Sentiment, US Durable Goods, GDP Final (Q2), Core PCE (Q2), IJC, SNB & Banxico Policy Announcements, Speakers including SNB's Jordan, ECB’s Elderson, Lagarde, de Guindos & Schnabel, Fed’s Powell, Williams, Collins, Kugler, Bowman, Barr, Kashkari & Cook, Supply from the US, Earnings from JD Sports, H&M, Costco & Jabil.

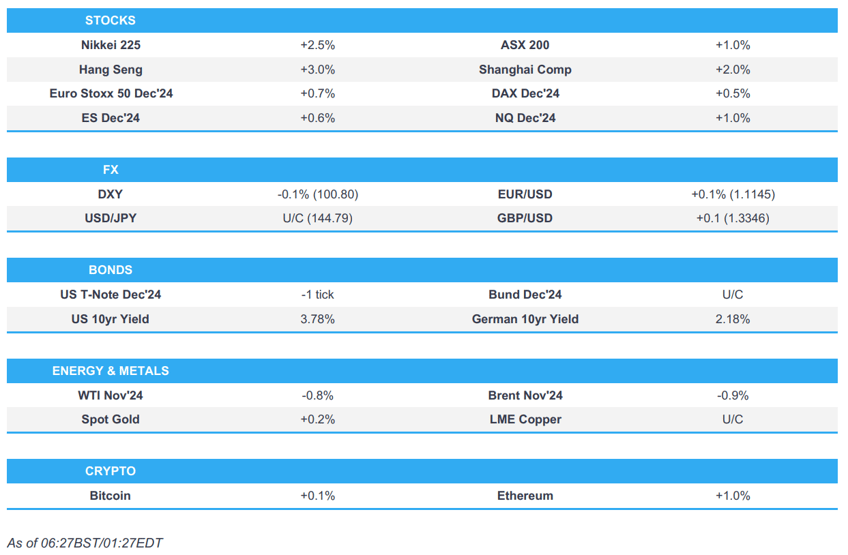

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

LOOKING AHEAD

- Highlights include German GfK Consumer Sentiment, US Durable Goods, GDP Final (Q2), Core PCE (Q2), IJC, SNB & Banxico Policy Announcements, Speakers including SNB's Jordan, ECB’s Elderson, Lagarde, de Guindos & Schnabel, Fed’s Powell, Williams, Collins, Kugler, Bowman, Barr, Kashkari & Cook, Supply from the US, Earnings from JD Sports, H&M, Costco & Jabil.

- Click for the Newsquawk Week Ahead.

US TRADE

EQUITIES

- US stocks ultimately closed mixed but with a negative bias and sectors were predominantly in the red with Energy, Health Care and Materials the underperformers while Utilities and Tech were the only sectors in the green on a day dominated by geopolitical-related headlines. After-hours, Micron (MU) shares soared 14.8% post-earnings.

- There were heightened concerns regarding a potential ground invasion of Lebanon after an Israeli army chief told troops that Israel had been striking all day to prepare the ground for possible entry. Nonetheless, it was also reported that the US was leading a new effort to end hostilities and Israeli PM Netanyahu gave the green light to discuss with the US side the cessation of attacks with Lebanon to give a chance for negotiations, although Netanyahu also said that any truce negotiations will be under fire and they will continue to strike Hezbollah, while a US official noted that it is still uncertain whether Israeli PM Netanyahu and Hezbollah's Nasrallah are willing to agree to a cessation of fighting.

- SPX -0.19% at 5,722, NDX +0.14% at 19,973, DJIA -0.70% at 41,915, RUT -1.19% at 2,197.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Kugler (2024 voter) said she strongly supported the Fed's 50bps interest rate cut and will support additional rate cuts going forward if progress on inflation continues as she expects. Kugler added they are at a place where they do not want the labour market to weaken further and it makes sense to shift attention to the employment mandate, as well as noted that they are making very good progress towards inflation goals but they are not at 2% yet. Furthermore, she said with disinflation, they need to cut even just to keep where they are in terms of restrictiveness and it makes sense to cut rates to remove some restrictiveness.

- US House voted 341-82 to pass a stopgap government funding bill and the US Senate also voted 78-18 to pass the bill that would fund the government until December 20th.

- Agriculture and food groups urged the White House to intervene to block a potential US East Coast and Gulf Coast ports labour disruption.

- New York City Mayor Adams was indicted following a federal corruption probe and believes he will be charged by the federal government with crimes but added that if charges are filed, they will be entirely false and based on lies, while he won't resign if he has to face charges.

APAC TRADE

EQUITIES

- APAC stocks shrugged off the subdued handover from Wall St and the recent geopolitical escalation, as some 'progress' was said to be made regarding a temporary ceasefire proposal and a 21-day ceasefire was proposed by US and France, while China benefitted again from stimulus.

- ASX 200 saw gains across all sectors, while the RBA's FSR noted Australia's financial system is resilient and risks are contained.

- Nikkei 225 outperformed as exporters benefitted from recent currency weakness, while stale BoJ minutes did little to shift the dial.

- Hang Seng and Shanghai Comp extended on the recent rally owing to policy support after China's State Council issued guidelines for promoting high-quality employment and with China to give rare one-off cash handouts to people in extreme poverty ahead of the National Day holiday, while it was also reported that China was weighing injecting USD 142bln of capital into top banks.

- US equity futures were supported alongside the gains in Asia but with the upside capped ahead of an abundance of Fed rhetoric.

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.7% after the cash market closed lower by 0.5% on Wednesday.

FX

- DXY took a breather after yesterday's resurgence whereby it reverted to just shy of the 101.00 level as geopolitical concerns spurred haven appeal, while participants now await a myriad of speakers culminating with Fed Chair Powell and NY Fed President Williams.

- EUR/USD saw some slight reprieve following its slip from resistance at the 1.1200 territory, although the rebound was only marginal with comments from ECB officials also scheduled today including Lagarde, de Guindos, Elderson & Schnabel.

- GBP/USD attempted to nurse some of the prior day's losses after it found support just north of the 1.3300 level.

- USD/JPY marginally edged higher and retained a firm footing in the 144.00 territory after ascending on the recent dollar strength.

- Antipodeans recouped some lost ground with the help of the positive risk environment and ongoing China optimism.

- PBoC set USD/CNY mid-point at 7.0354 vs exp. 7.0367 (prev. 7.0202).

FIXED INCOME

- 10yr UST futures remained subdued after trickling lower yesterday amid corporate supply and a mixed 5yr auction, while demand was restrained ahead of a slew of central bank commentary and data releases, as well as a 7yr auction.

- Bund futures price action was lacklustre after recently pulling back from resistance at the 135.00 level.

- 10yr JGB futures tracked recent losses in global peers and failed to benefit from improved results of the 40yr JGB auction, while outdated BoJ minutes from the July meeting had little effect on prices.

COMMODITIES

- Crude futures languished near the prior day's lows after retreating despite bullish crude inventories and geopolitical escalation in the Middle East, while desks attributed the selling to Libyan tensions easing.

- BSEE said 29% of oil production and 17% of nat gas production at the Gulf of Mexico is shut in due to Hurricane Helene.

- BP (BP/ LN) said it secured offshore facilities and removed some non-essential personnel from Argos, Atlantis, Mad Dog, Na Kika, and Thunder Horse platforms, while it is working toward safely ramping up production across its Gulf of Mexico portfolio.

- Representatives from Libya’s eastern and western administrations are said to have agreed to nominate Naji Issa as interim central bank governor, while it was also reported that Libya’s legislative bodies signed an agreement on procedures, criteria and timelines for appointing the central bank governor, deputy and board of directors.

- Spot gold traded rangebound ahead of a busy schedule of Fed speakers and data releases.

- Copper futures were indecisive despite the predominantly constructive mood and ongoing China stimulus optimism.

CRYPTO

- Bitcoin marginally strengthened overnight after rebounding from an initial dip beneath the USD 63,000 level.

NOTABLE ASIA-PAC HEADLINES

- China's Politburo held meeting on Sept 26, and said they will lower the reserve requirement ratio and implement forceful interest rate cuts, according to Reuters. China's Politburo said it will ensure necessary fiscal spending, will make efforts to stop the falls in the property market and stabilize it.

- China weighs injecting USD 142bln of capital into top banks, according to Bloomberg.

- China's MOFCOM launched an anti-discriminatory investigation against Canada's restrictive measures including additional tariffs on China's EVs, steel and aluminium products, according to Reuters.

- BoJ July Minutes from the July 30th-31st meeting noted that members shared the view over a need for vigilance to risk of an inflation overshoot, while many said it was appropriate to raise rates to 0.25% and adjust the degree of monetary support. A few members also said it was appropriate to gradually adjust very low rates now to avoid being forced to hike rates rapidly later.

- RBA Financial Stability Review stated the Australian Financial System is resilient and risks are contained, while it noted that risks include stress in China's financial sector and the lack of significant response from Beijing.

GEOPOLITICS

MIDDLE EAST

- US, France and partners proposed an immediate 21-day ceasefire across the Lebanon-Israel border and called for a ceasefire in Gaza. US President Biden and French President Macron said it is time for a settlement on the Israel-Lebanon border that ensures safety and security to enable civilians to return to their homes and they have worked together in recent days on a joint call for a temporary ceasefire to give diplomacy a chance to succeed. Furthermore, they called for broad endorsement and immediate support from the governments of Israel and Lebanon, while the statement was endorsed by the US, Australia, Canada, EU, France, Germany, Italy, Japan, Saudi Arabia, UAE, and Qatar.

- "Senior US officials have said that they expect a ceasefire deal to be implemented "in the coming hours" along Israel-Lebanon border", according to Walla News' Elster.

- Israel and Hezbollah communicated details of the US-France proposal and will announce their response soon, while The Washington Post cited US officials stating that Hezbollah will not directly sign the ceasefire agreement.

- US President Biden said an all-out war is possible in the Middle East, but there is also a possibility of a settlement and said there needs to be a two-state solution, according to an ABC interview.

- US-led talks for a potential de-escalation of the Israel-Hezbollah flare-up with an eye to a possible ceasefire saw “significant progress” and reached “a serious and advanced stage”, according to Lebanese news site LBCI reports citing sources.

- French Foreign Minister told the Security Council that the situation in Lebanon may reach the point of no return and that Lebanon which is already considerably weakened, will not be able to be restored after a war between Israel and Hezbollah. Furthermore, he said war is not inevitable and there is no alternative to diplomacy. The Foreign Minister also noted that important progress was recently made on a temporary ceasefire in Lebanon and efforts will continue.

- Israeli PM Netanyahu said they are delivering blows to Hezbollah that it could never imagine and doing that with force and by being clever. Netanyahu also said that he cannot give details on what they are doing, but they are determined to bring the citizens of the north home.

- Israeli PM Netanyahu gave the green light to discuss with the US side the cessation of attacks with Lebanon to give a chance for negotiations, according to Sky News Arabia citing a correspondent. It was separately reported that Netanyahu said any truce negotiations will be under fire and that they will continue to strike Hezbollah, according to Al Arabiya.

- Israeli officials said they are ready for efforts and proposals, but the chances of reaching an agreement are slim, according to Al Jazeera citing Israel's Channel 13. It was earlier reported that Israel’s cabinet members would discuss authorising PM Netanyahu and Defence Minister Galant to approve ground exercises in Lebanon, according to Al Jazeera citing sources.

- Israeli source said they are approaching a crossroads to make decisive decisions that will determine where the war is heading and noted that talks on the north aim to provide an opportunity for a settlement that prevents a major war, according to Israeli press.

- US Department of Defense believes Israel is not in a position to launch a ground invasion now and would need to move more troops into place, but it also thinks such an attack could come together in a matter of several days, according to WSJ sources.

- Israeli press Hayom cited an Israeli source stating there is no prospect of reaching a ceasefire at least in the next few days.

- Israeli UN envoy said Israel would prefer a diplomatic solution in Lebanon and if diplomacy fails, then Israel will use all means at its disposal. The envoy added that diplomacy will be better for Israel and Lebanese people, as well as noted that Israeli PM Netanyahu will arrive on Thursday and address the UN General Assembly on Friday while Israel's UN envoy also commented that Iran is the spider at the centre of the web of violence and there can be no peace in the region until we dismantle this threat.

- Iran's Foreign Minister said the region is on the brink of a full-scale catastrophe and Israel has crossed all red lines, while he added that the UN Security Council must intervene to restore peace and security. Furthermore, he said that Israeli leaders must understand their crimes won't go unpunished and Iran will not remain indifferent in case of a full-scale war in Lebanon.

- UN Secretary-General Guterres told the Security Council that 'hell is breaking loose' in Lebanon and diplomatic efforts have intensified to achieve a temporary ceasefire to allow for aid deliveries and pave the way for more durable peace. Guterres stated all parties must immediately return to a cessation of hostilities, while an all-out war must be avoided at all costs and that Lebanon cannot become another Gaza.

- Lebanon's PM told the Security Council that Israel is violating their sovereignty, while Lebanon's PM responded 'hopefully yes' when asked if a ceasefire can be reached soon, according to Reuters.

- Dozens of US troops have been deployed to Cyprus amid sharply escalating tensions between Israel and Hezbollah, and are preparing for a range of contingencies, according to CNN citing sources.

- Islamic resistance in Iraq said it targeted Israel's Eilat with drones. It was also reported that the IDF said they are following up on threats from Iraq and gathering information and will do what is necessary, according to Asharq News.

- White House's Kirby said there is no indication Iran is interested in an all-out war in the region, according to a Fox News interview.

- US Treasury sanctioned over a dozen entities and vessels for their involvement in transporting Iranian oil to Syria and East Asia, according to Asharq News.

OTHER

- US is reportedly preparing USD 8bln in arms aid packages for Ukrainian President Zelensky's visit, according to sources via Reuters. It was later reported that President Biden's administration announced USD 375mln for Ukraine defence aid which includes HIMARS, Javelin missiles and TOW missiles, according to the White House and State Department.

- Russian President Putin proposed to update Russia's nuclear strategy and said that a number of clarifications have been proposed with regard to the definition of conditions for the use of nuclear weapons. The proposal stated that aggression against Russia by any non-nuclear state, but with participation or support of a nuclear state, is proposed to be considered as their joint attack on the Russian federation, while Russia reserves the right to use nuclear weapons in case of aggression against Russia and Belarus.

- China's Foreign Minister said in meeting with EU's top official that China is committed to de-escalating the situation in Ukraine and China will not give up efforts to strive for peace in Ukraine.

- South Korea's National Intelligence Service said North Korea possesses enough plutonium and uranium to make at least double-digit nuclear weapons, while it added that North Korea could possibly conduct a 7th nuclear test, according to Yonhap.

EU/UK

NOTABLE HEADLINES

- UK car manufacturing output fell 8.4% Y/Y to 41,271 units in August, according to SMMT.