The leaders of CDU/CSU and SPD this evening announced an agreement on an even more significant fiscal expansion than what anyone had expected at the beginning of the week. The plan is to make three material changes to the debt brake in the very near term, convening the outgoing parliament in which the centrist parties still hold a constitutional majority:

- A EUR 500bn (11.6% of GDP in 2024) special purpose off-budget vehicle for infrastructure investment, that is planned to be disbursed over the next 10 years, and which amounts to roughly 1% of GDP in annual infrastructure spending (of which EUR 100bn will be allocated to the federal states).

- A reform of the debt brake to exempt any defense spending in the main budget’s "Einzelplan 14", the budget of the Ministry of Defence, over and above 1% of GDP, effectively permitting open-ended borrowing for defense. Currently the Einzelplan 14 amounts to EUR 53.25bn (1.25% of nominal GDP in 2024). The current off-budget fund adds another EUR 25bn of defence funding but this would not be relevant for this part of the proposal. Thus apart from removing any constitutional limit on additional defence spending, 0.25% of GDP (EUR 11bn) of spending in Einzelplan 14 that surpasses the 1% threshold is freed up to fund other measures, for example tax reductions.

- An increase in the structural deficit allowed for the states (Länder) from the current level of 0.0% of GDP to 0.35%, the same proportion as the federal level. Furthermore the proposal includes the formation of an expert commission tasked with creating a long-term reform proposal to structurally reform the debt brake by the end of 2025. This would have to be passed by the newly elected 21st Bundestag. It remains unclear if this reform proposal would supersede the announced measures to be passed in the 20th Bundestag or would add to them.

All elements require a two-thirds constitutional supermajority. The parties want to pass the agreed measures with the old 20th Bundestag parliament, before the newly elected 21st Bundestag (where the AfD has a potential blocking minority) is convened on March 25.

In keeping with recycled European aphorisms, party leaders, especially the Conservatives, explicitly referred to this decision as a "whatever it takes" moment and a determination to "rearm completely". According to DB's reading, tonight's robust rhetoric implies that the open-ended borrowing room for defense will be used at a pace that could bring German defence spending to at least 3% perhaps as early as next year (although the exact target may only be defined after the NATO summit in June).

There is, however, a catch and in this case it is that it has not yet been confirmed whether the Greens will agree to these constitutional changes. Still, DB assumes that this will be the case, with the infrastructure fund likely to satisfy their demands. After all it's only (lots and lots of) debt. It is also unlikely that CDU/CSU and SPD would have made this announcement without green-lighting it with the Greens. Nonetheless, this is an important source of uncertainty at the time of writing.

According to DB's Winker, and pending more clarity on this issue while being mindful of some execution risk, the German bank's strategists believe "this is one of the most historic paradigm shifts in German postwar history." Both the speed at which this is happening and the magnitude of the prospective fiscal expansion is reminiscent of German reunification — though the underlying geopolitical shift driving today's developments is far less benign than 35 years ago.

As a result of this paradigm shift, DB says that it will soon update its growth forecasts for the German economy once there is more clarity in the coming days, although it clarifies that at the time of writing "there is now meaningful upside risk to our 1.0% growth forecast for 2026." That said, the outlook for 2025 will likely be dominated by global trade policy, where the risks remain skewed to the downside of DB's 0.5% forecast.

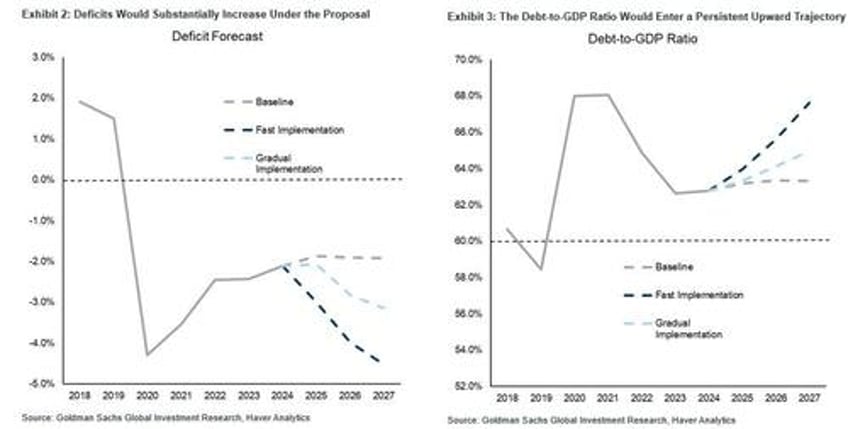

Goldman agrees, writing that the agreed measures imply significant upside risks to the bank's growth, deficit and debt forecasts, even under gradual implementation...

... but while it is debatable how much of the "defense" spending will trickle down to growth at the Federal level, one thing is certain: German deficits and debt are about to explode.

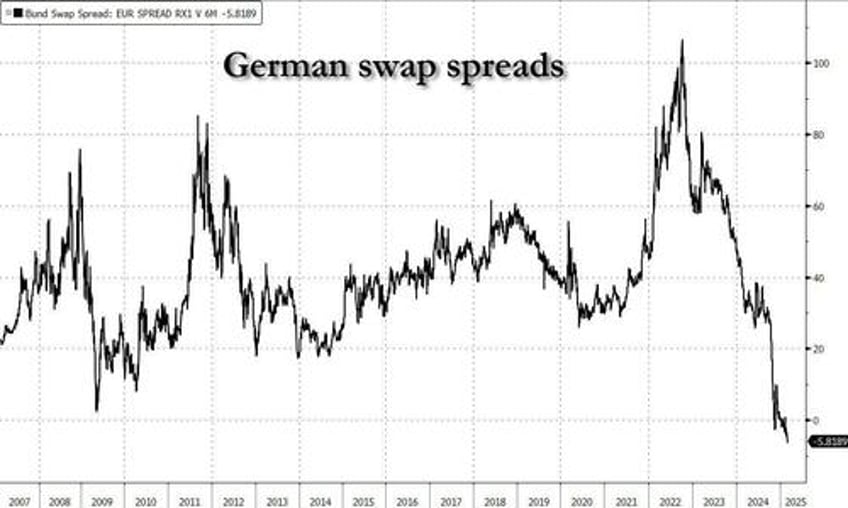

Indeed, a closely-watched gauge of the attractiveness of German debt fell to the most negative on record as German policymakers unveiled their unprecedented "whatever it takes" fiscal package meant supposedly to fund "defense" spending, but really just using the recent Ukraine fiasco as a pretext to flood the economy with debt.

As shown below, the German 10-year bond yield hit a record six basis points above comparable swaps, the most in data going back to 2007. The difference between yields and swap rates, known as the the swap spread, is a key yardstick of future issuance because bonds tend to weaken relative to swaps as the market anticipates more sales.

While some bond investors say Germany’s relatively small debt pile means it has the capacity to borrow more, they want higher yields to compensate for increased bonds outstanding. The latest leg of the move comes at a time when as noted above, Germany appears to have locked-in a gargantuan spending package equal to more than 10% of GDP!

“The German election aftermath is made more interesting by the twist from Merz that the outgoing parliament could be used to create space for extra borrowing,” according to Citigroup Inc. analysts, including Jamie Searle. “This keeps the near-term spotlight on funding for defense, which looks set to weigh further on swap spreads.”

Ironically, the German plans benefited from the catastrophic meeting last Friday between Zelensky and Trump, when it appears that the last bridge between the US and Ukraine had been burned, and Germany was on its own to fund the further defense of Ukraine. Well, now that we are hearing speculation that the US may implicitly provide security guarantees to Kiev under the guise of a commercial mineral development deal, suddenly the German plans looks far less solid: will the German people, famous for shunning any massive and not so massive new debt incurrence, agree to what is sure to be surge in the country's sovereign debt load if Trump would end up footing the bill for Ukraine anyway and Zelensky agrees with Trump's terms. We will find out in the next three weeks: the collapsed coalition only has until March 24 to pass the package before the new legislature sits for the first time, with the AfD now benefitting from a blocking position.

Investors had already started to price in the prospect of Germany dialing back its tight fiscal rules following the election, with the 10-year spread with swaps flipping negative for the first time in November. The 30-year swap spread, the equivalent gauge for ultra-long bonds, moved to more-deeply negative territory at about minus 50 basis points, compared to minus 46 basis points at Friday’s close.

The moves also reflect the growing volume of bonds that private investors must absorb as the ECB, once a major price-insensitive buyer, shrinks its crisis-era bond portfolios.

There also remains skepticism that Merz will be able to implement the debt brake reform in the near-future given political fragmentation. As noted above, the Left is in favor of ditching the debt brake entirely and kickstarting investment in infrastructure, but also wants to lower the defense budget. So only the possibility of horse trading that saddles Germany with even more debt is the most likely outcome.

Bottom line: Europe is well-known for suffering sovereign debt crises at the worst possible time, and should inflation remain stubbornly sticky, the yield on new German debt may soon become unmanageable... which means the ECB will have to step in and monetize German deficit spending, as it did for much of the past decade. The only problem: it will first need a market and/or deflationary shock to greenlight such an intervention. Although in light of events in the past 5 years, we doubt very much that the Frankfurt-based central bank will have any problems coming up with yet another fake crisis to capitalize on.

More in the full notes from Goldman and Deutsche Bank available to pro subscribers.