A new Redfin report Friday revealed the latest rumblings of a worsening housing affordability crisis. It showed the number of residential real estate deals that fell through in August surged to the highest level in a year. This is due to a combination of a 30-year fixed mortgage rate above 7% and rising home prices that has caused a 'homebuyer stickier shock.'

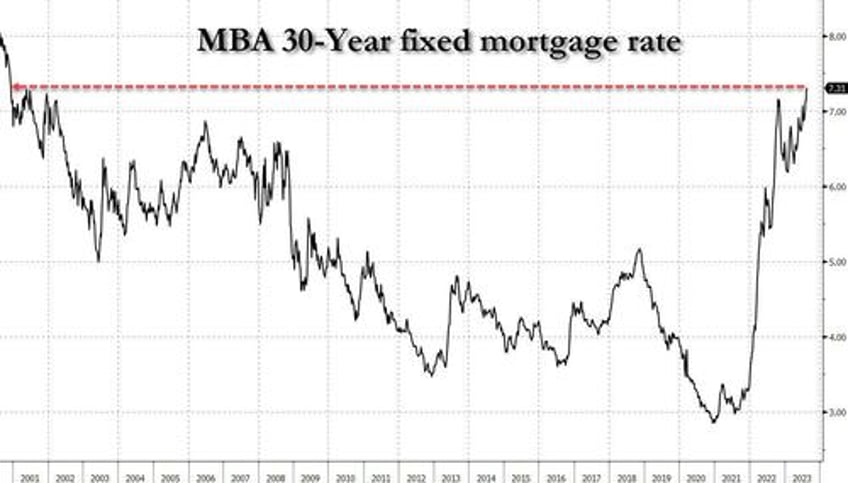

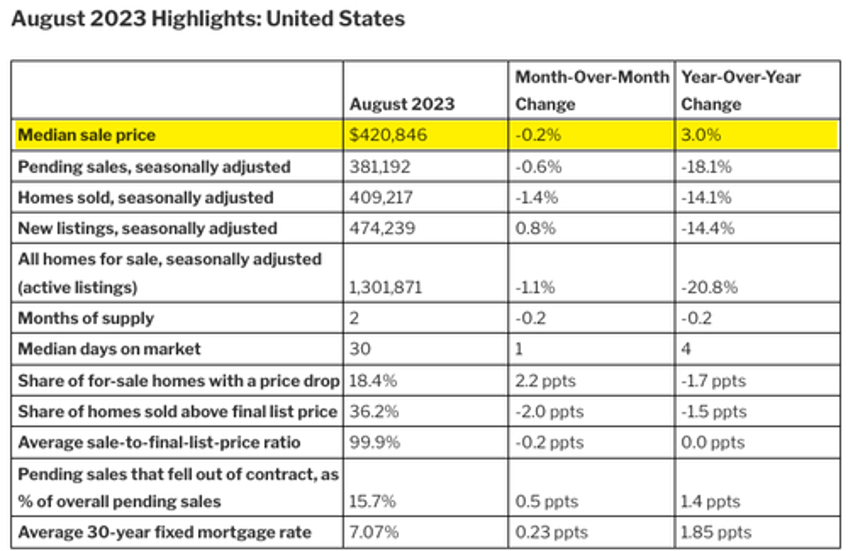

In August, around 60,000 home-purchase contracts fell through nationwide, accounting for 15.7% of homes under contract that month. This is an increase from 14.3% the previous year and represents the largest percentage since October 2022, when the 30-year fixed mortgage rate first rose above 7% for the first time since the Dot Com bust.

"I've seen more homebuyers cancel deals in the last six months than I've seen at any point during my 24 years of working in real estate. They're getting cold feet," said Jaime Moore, a Redfin Premier real estate agent in Reno, Nevada.

Moore said, "Buyers get sticker shock when they see their high rate on paper alongside extra expenses for maintenance, repairs and closing costs. Many of them would rather back out, even if it means losing their earnest money. A lot of sellers are also willing to let buyers slip away because they don't want to concede to repair requests."

The average interest rate on a 30-year-fixed mortgage is 7.27% this week.

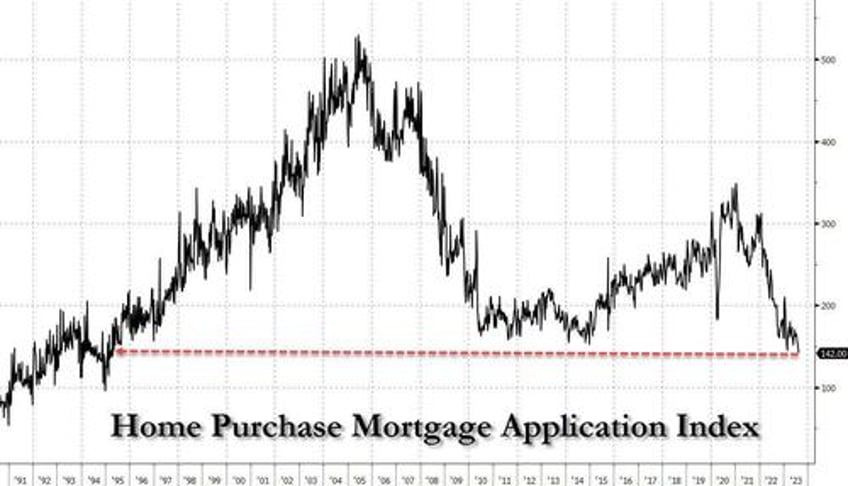

Soaring borrowing costs increased the average monthly payment by over 20% from a year ago. The result has sent home-purchase applications plunging to the lowest level since 1995.

The reason for the collapse is simple: With housing affordability at or near the lowest on record, the average monthly mortgage payment has exploded to $2,322, more than double from pre-Covid levels.

The median home price in August rose 3% from the previous year, reaching $420,846.

Meanwhile, Redfin Economics Research Head Chen Zhao doesn't expect the affordability crisis to wane anytime soon:

"Home prices will likely remain elevated for the foreseeable future.

"The Federal Reserve still has more work to do in its battle against inflation, which means mortgage rates are unlikely to come down anytime soon. As long as rates remain high, homeowners will be reluctant to sell. And that lack of homes for sale will keep prices high because it means buyers are duking it out for a limited supply of houses."

Zhao warned that the high rates have "handcuffed" homeowners to their homes. He said, "That means many of today's sellers are putting their homes on the market because they have to, in some cases due to divorce, family emergencies or return-to-office policies."

The increase in terminated home-purchase agreements signals the affordability crisis weighs heavily on demand. This will serve as a cooling effect on shelter costs, which is what the Fed wants.