With CPI and PPI both printing hotter than expected, import and exports prices rising more than expected, and the market's implied inflation expectation also soaring, this morning's much-watched UMich inflation expectations index should be a little moot.

Nevertheless, the survey respondents from the UMich survey saw inflation expectations plunging both short- and medium-term...

Source: Bloomberg

So sentiment is seeing slowing inflation, but the market is seeing re-acceleration...

Source: Bloomberg

The headline sentiment indicator for the preliminary September data declined from 69.5 to 67.7, with current conditions tumbling while future expectations inched higher...

Source: Bloomberg

Survey Director Joanne Hsu notes that "so far, few consumers mentioned the potential federal government shutdown, but if the shutdown comes to bear, consumer views on the economy will likely slide, as was the case just a few months ago when the debt ceiling neared a breach."

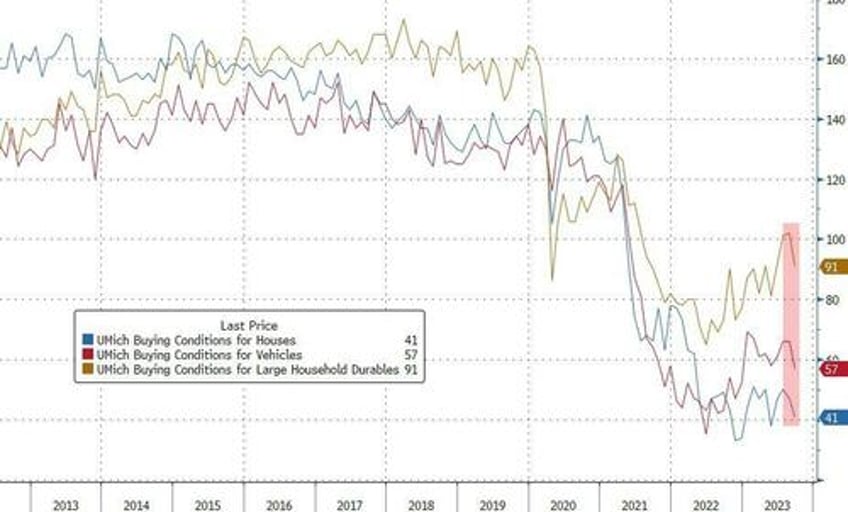

Buying conditions worsened across all cohorts...

So the consumer thinks that inflation is under control, and hope is high... but they are less willing to spend?