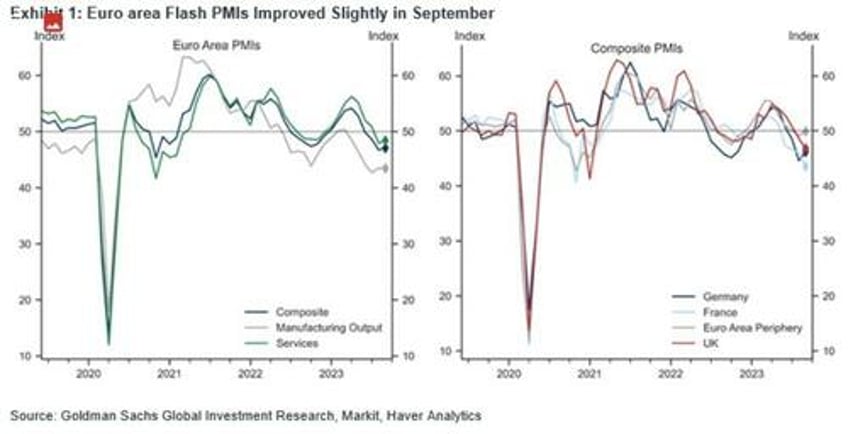

This morning started with a modest rise in Euro-area Composite PMI (+0.3 to 47.1) on the back of a pick up in Services.

The increase in the area-wide index was driven by an improvement in Germany and the periphery, offset by a deceleration in France. In the UK, the composite flash PMI decreased by 1.9pt to 46.8, meaningfully below consensus expectations.

Goldman saw three main takeaways from today's data.

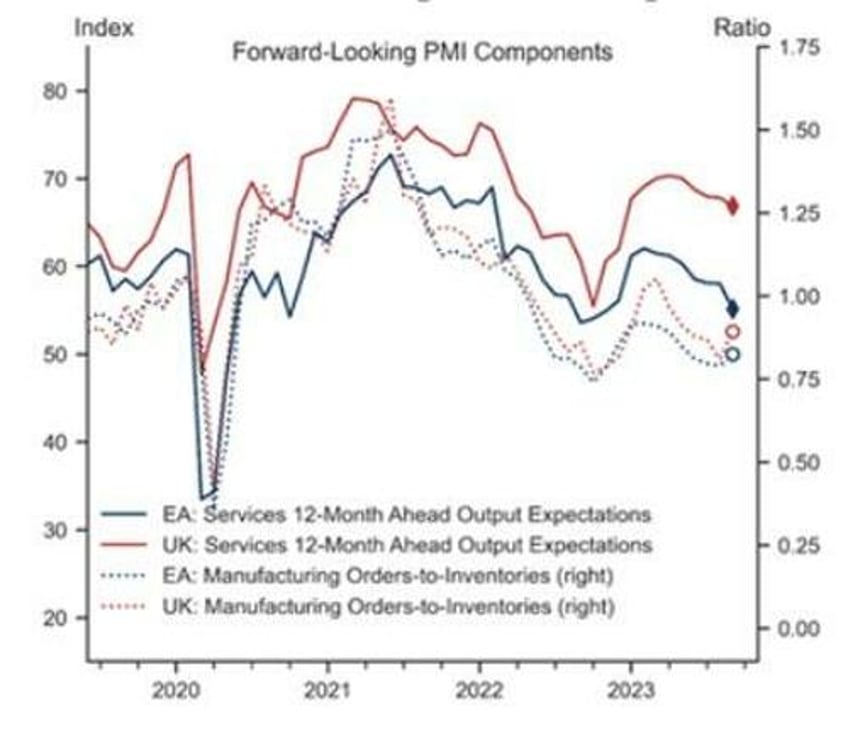

First, while marginally better than last month, Euro area growth momentum remains subdued across both sectors. Country press releases attributed this weakness to poor demand conditions, both domestically and abroad.

Second, inflationary pressures continue to moderate, as reflected by the continued decline in output prices, but the recent pickup in input prices points to upside risk going forward.

Third, growth momentum in the UK appears to be deteriorating at a faster-than-anticipated pace. This, in turn, is now being accompanied by a loosening in the labour market, and a cooling in underlying inflationary pressures

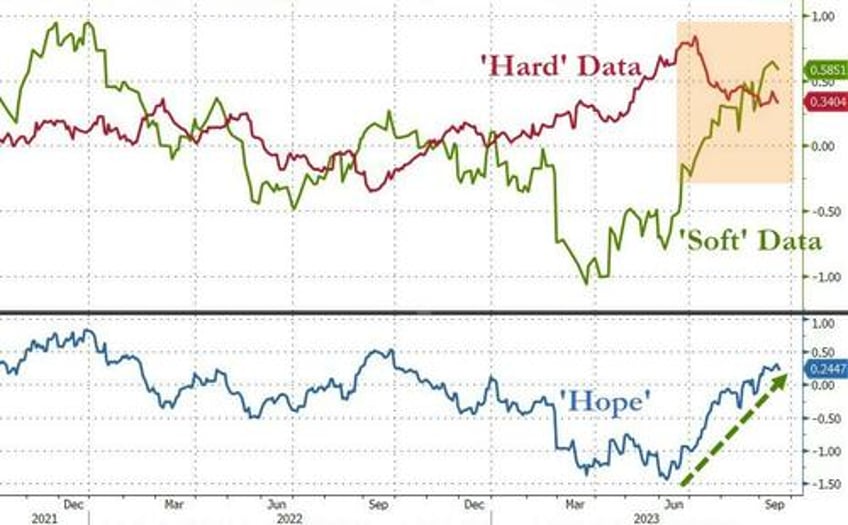

In the US, however, the last few months have seen 'hard' (real) macro-economic data serially disappoint, while at the same time, 'soft' (survey-based) economic data has dramatically outperformed, sending 'hope' - the spread between 'hard' and 'soft' - to two year highs...

Source: Bloomberg

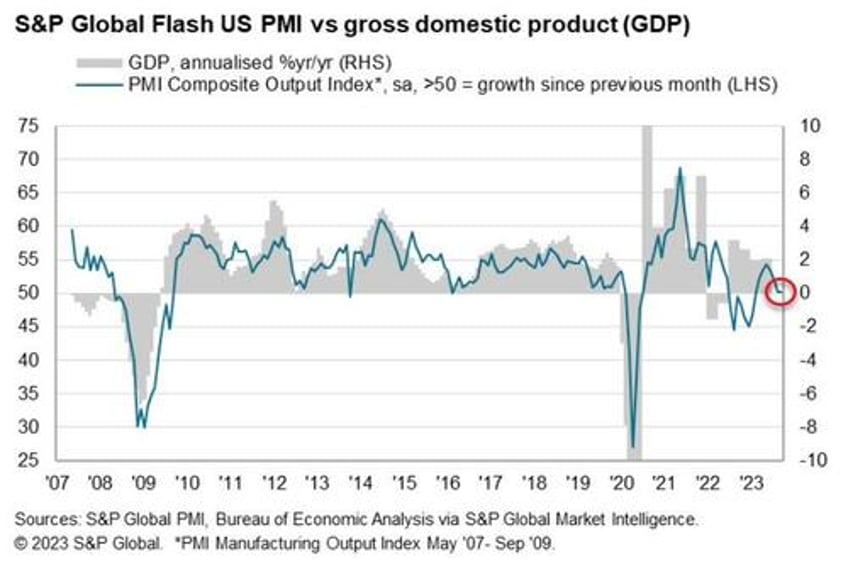

This morning's mixed PMI picture from Europe followed through into the US with Manufacturing PMI for September (preliminary) rising from 47.9 to 48.9 - the fifth straight month of contraction; while Services PMI disappointed, sliding from 50.5 to 50.2 - its lowest since January...

Source: Bloomberg

Commenting on the data, Siân Jones, Principal Economist at S&P Global Market Intelligence said:

“PMI data for September added to concerns regarding the trajectory of demand conditions in the US economy following interest rate hikes and elevated inflation. Although the overall Output Index remained above the 50.0 mark, it was only fractionally so, with a broad stagnation in total activity signalled for the second month running. The service sector lost further momentum, with the contraction in new orders gaining speed.

“Subdued demand did not translate into overall job losses in September as a greater ability to find and retain employees led to a quicker rise in employment growth. That said, the boost to hiring from rising candidate availability may not be sustained amid evidence of burgeoning spare capacity and dwindling backlogs which have previously supported workloads.

“Inflationary pressures remained marked, as costs rose at a faster pace again. Higher fuel costs following recent increases in oil prices, alongside greater wage bills, pushed operating expenses up. Weak demand nonetheless placed a barrier to firms’ ability to pass on greater costs to clients, with prices charged inflation unchanged on the month.”

So, slower growth, but rising prices - The Fed and ECB face their nemesis 'Stagflation' in the Sisyphean struggle against reality.