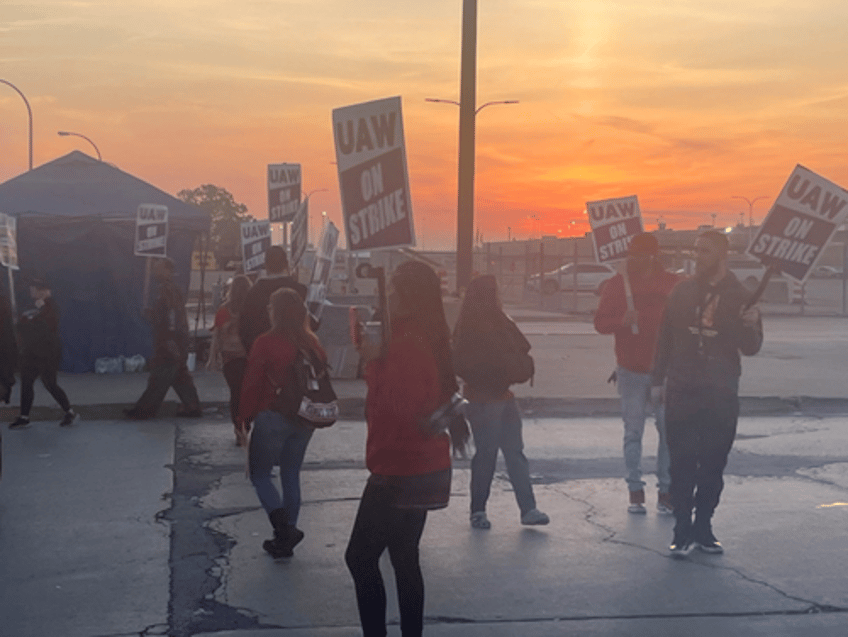

The strike by the United Auto Workers union against Detroit's three major automakers (Ford Motor Co., General Motors Co., and Chrysler-parent Stellantis) entered its third week on Monday, with seemingly little progress made. Notably, General Motors has activated a multi-billion dollar credit line from JPMorgan Chase Bank, an indication the automaker might be bracing for the strike to continue for an extended period.

GM issued a filing on Wednesday morning detailing how it "entered into a new 364-Day Revolving Credit Agreement with JPMorgan Chase Bank, NA" for "an available borrowing capacity of $6 billion" that matures on Oct. 1, 2024.

Bloomberg pointed out GM's total automotive liquidity was around $39 billion, and there is no fear of the automaker depleting funds anytime soon. However, it noted, "But the new credit line is a sign GM may be buckling in for a prolonged work stoppage by the United Auto Workers."

Last Friday, UAW boss Shawn Fain launched another wave of strikes against Ford and GM for failing to agree on a new four-year labor deal. Fain said Stellantis avoided additional strikes because of meaningful progress on a new labor contract.

On Tuesday, Ford and GM announced another 500 workers were laid off at four Midwestern plants because of the worsening impacts of labor actions. The Wall Street Journal said, "With the layoffs disclosed by GM and Ford on Monday, more than 6,000 factory workers are off the job because of spillover effects from the strike. That figure includes several suppliers who have cited furloughs directly tied to the walkouts."

As of mid-week, about 25,000 out of 146,000 UAW workers are on strike at plants operated by the three automakers. UAW Boss Fain will likely provide another update on Friday.

A recent report by Morgan Stanley's auto strategist, Adam Jonas, said automakers stand to lose $250 million in lost profit each day of the strike:

"The value of N. American light production of the D3 (F, GM, STLA collectively) is approximately $750mm per day (approx. 15k units per day). Applying slightly more than a 30% decremental (yes, mix is that high) implies around $250mm of lost profit per day (assuming 100% of production impacted)."

If GM pulling the credit line with JPM is any indication of what's to come, it appears the automaker is preparing for strikes to extend.