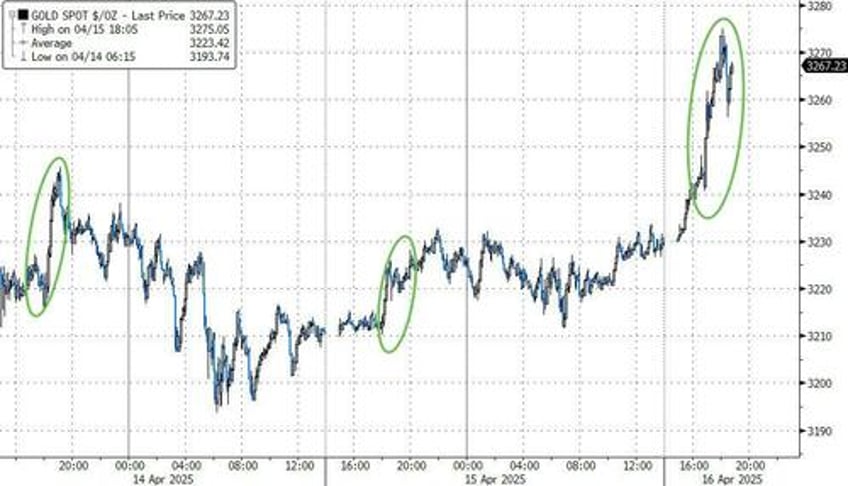

Ahead of tonight's grand unveiling of what Beijing wants the world to think about its economy, the market was active with Gold soaring at the China open for the third day in a row...

...and the Yuan fix notably lower again...

Ugly yuan fix: PBOC set CNY reference rate at 7.2133, much weaker than yesterday's 7.2096 and the weakest since Sept 2023, approaching weakest on record pic.twitter.com/XKjcn2Mwf7

— zerohedge (@zerohedge) April 16, 2025

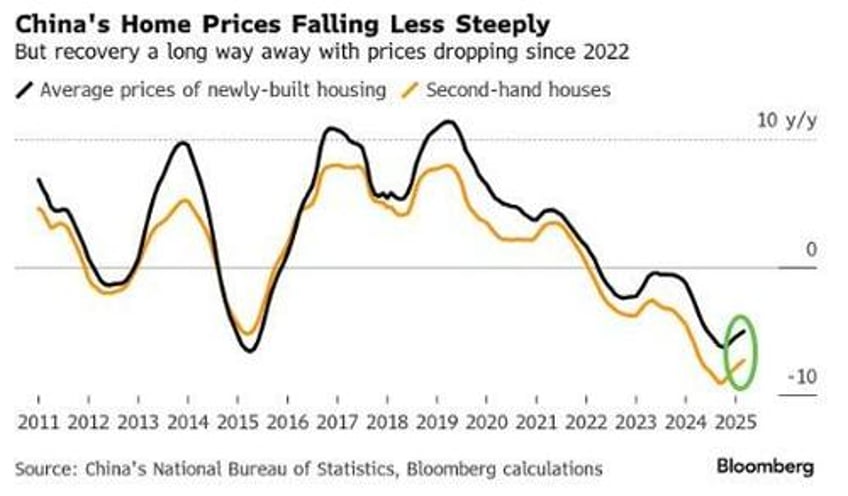

Ahead of the GDP print, we saw both new and existing home prices released by the statistics bureau for March showing price drops have slowed on a month-on-month basis...

China March New Home Prices Fall 0.08% M/M

China March Existing Home Prices Fall 0.23% M/M

Of course, tonight's data tsunami is pre-Liberation Day Tariffs so no excuses (aside from the 10% tariffs that Trump put on China at the start of February).

However, GDP was expected to show the economy slowing ahead of the tariffs given March's unevenness.

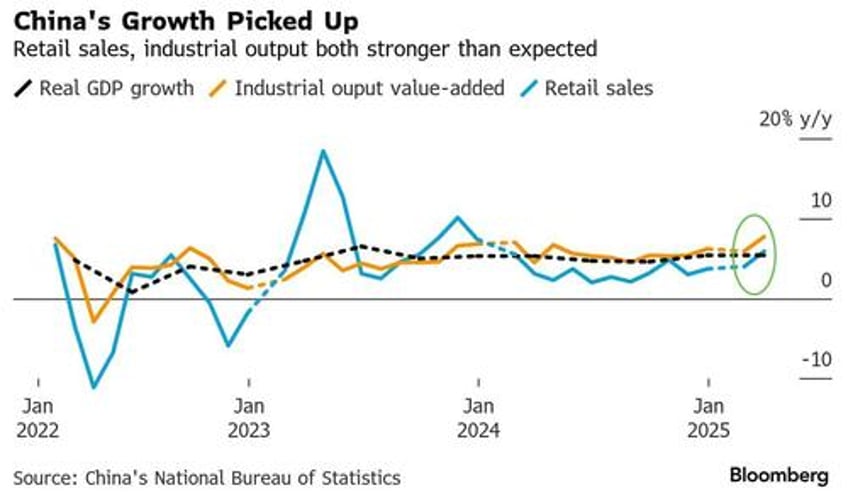

In reality, it didn't... China GDP growth beat expectations, rising 5.4% (+5.2% exp)...

The growth was in line with China’s growth rate in the fourth quarter and exceeded Beijing’s full-year growth target for 2025.

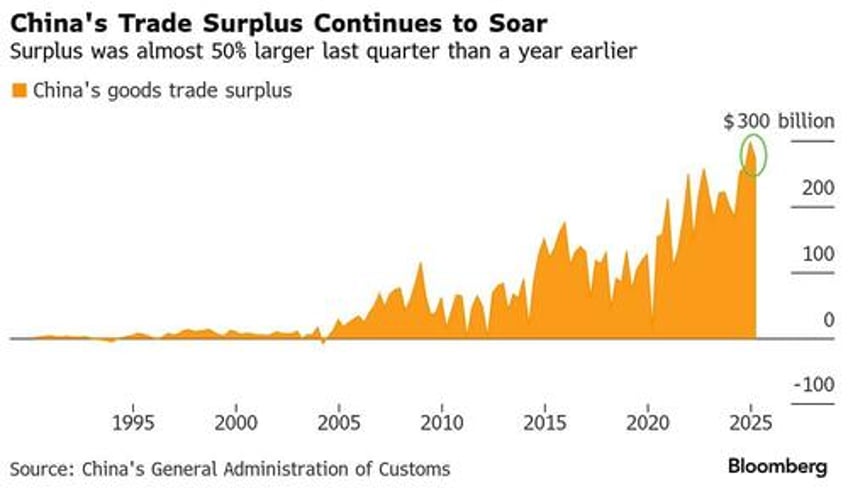

In the first quarter China’s trade surplus was over $270 billion, just below the record in the final three months of last year and almost 50% larger than a year ago. The record surplus last year of almost $1 trillion drove a third of China’s growth and the boost last quarter is likely to have been large.

Beijing has set a target of 5 per cent growth for this year and has backed this up with pledges to increase stimulus measures, setting a record budget deficit target for the central government.

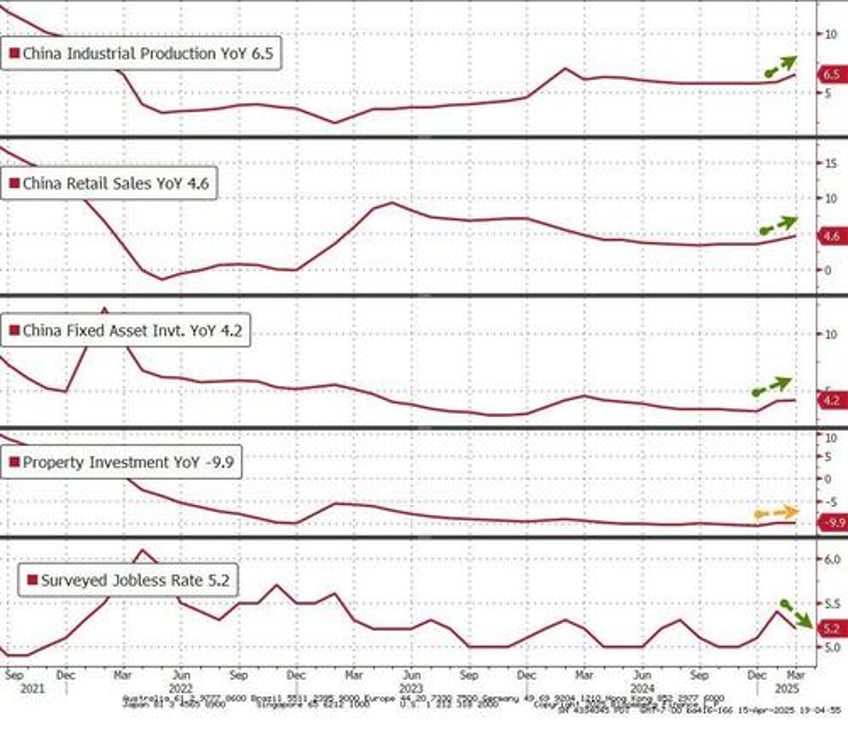

And just like the GDP figure, the rest of the data beat (or met) expectations too

China Retail Sales BEAT +4.6% YTD vs +4.3% exp vs +4.0% prior

China Industrial Production BEAT +6.5% YTD vs +5.9% exp vs 5.9% prior

China Fixed Asset Investment BEAT +4.2% vs +4.1% exp vs +4.1% prior

China Property Investment MEET -9.9% vs -9.9% exp vs -98% prior

China Unemployment BEAT 5.2% vs 5.3% exp vs 5.4%$ prior

Presumably these much better than expected data are due to tariff front-running.

“The most pleasant surprise is retail sales which shows that consumption subsidies are working,” said Michelle Lam, Greater China economist at Societe Generale SA.

“Industrial production was a beat but understandable after the strong export data. But that’s all in the past now.”

China is the world’s largest importer of oil, natural gas and coal, and Beijing has been putting pressure on energy firms in recent years to boost output and reduce the nation’s dependency on imports.

Diggers and driller responded in March, with output rising 9.6% for coal, 5% for natural gas and 3.5% for crude oil. Output increases in coal and oil are particularly higher than expected.

Of course, it's what happens next that really matters as US tariffs on China are now high enough to wipe out Chinese shipments to the US, according to Bloomberg estimates.

“Even with temporary exemptions, US duties will still be high enough to crush most of China’s exports to the US,” said Chang Shu and David Qu at Bloomberg Economics.

UBS this week cut its China GDP forecast with the most pessimistic outlook forecast among major banks, predicting the economy will expand just 3.4% this year as US tariffs choke exports.

Goldman Sachs and Citigroup are among global banks that cut their outlook for China in recent days, with most economists doubting Beijing can achieve the official target of about 5% growth this year.

“With the trade war with the US escalating sharply, the economy will face stronger headwinds. We expect policymakers to expedite stimulus," said Shu and Qu.

The NBS struck a note of caution even as it released the upbeat data, emphasizing the need for greater support for the economy.

“We should be aware that the external environment is becoming more complex and severe, the drive for growth of effective domestic demand is insufficient, and the foundation for sustained economic recovery and growth is yet to be consolidated,” the bureau said in a statement.

“We must implement more proactive and effective macro policies.”

Beijing is placing high hopes on domestic demand - particularly consumption - to drive economic growth this year, as external pressures mount under Donald Trump's second presidency.

In a bid to spur spending, leading bodies of China's state apparatus and the ruling Communist Party issued a 30-point plan aimed at stimulating consumer demand.