Despite all the chaos of yesterday's market, Goldman trading desk was "fairly quiet" (a 3 on 1 – 10 scale in terms of overall activity levels) which they suggested was reflective of a few things:

1) L/Os aren't ready to buy any breaks (still think 4200 handle is the call, which we are in territory now)

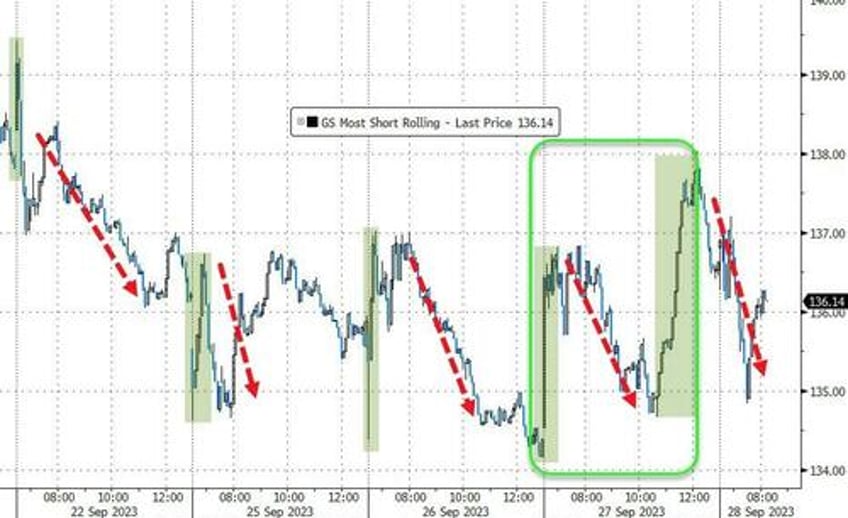

2) HFs taking their foot off the Short pedal relative to previous sessions (short ratios have come down substantially, tracking 36% today vs ~55% avg),

and 3) Market continues to trade with a technical feel to it (CTAs, Vol).

HFs finished +2% net buyers while L/Os finished -5% net sellers with supply being more broad based, we did NOT see the same level of acute supply in info tech and consumer disc that we saw the prior day.