Credit spreads are vulnerable to an abrupt repricing wider as trading conditions in equity markets become more volatile from negative gamma.

An old Swedish proverb warns that what is hidden in the snow, is revealed in the thaw. Things are heating up in equity markets, threatening to lay bare the true state of credit. That risks a sharp widening of credit spreads as they rapidly adjust to worsening underlying credit conditions. With bond yields rising too, markets are in a riskier spot than they have been for several months.

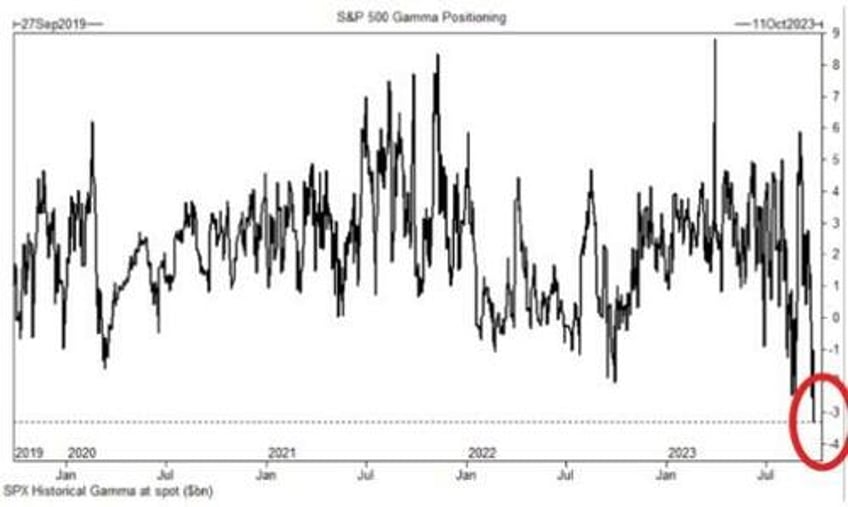

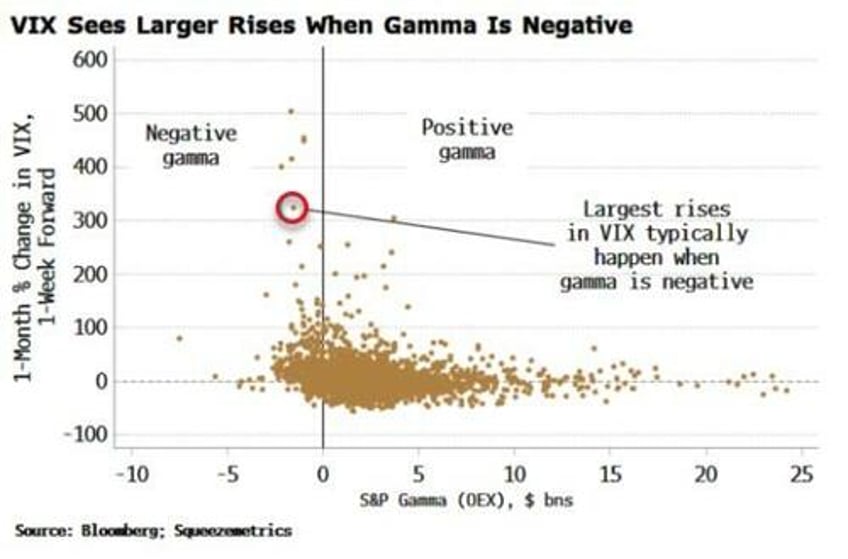

The catalyst for more upset might just be negative gamma. When positive, it’s associated with more stable, less volatile equity-market behavior. But according to Goldman Sachs, S&P gamma is now at a series low, opening up a veritable Pandora’s box of risk and the potential for much higher equity volatility and considerably wider credit spreads. The move is perhaps now getting started, with both the VIX and spreads higher in recent days.

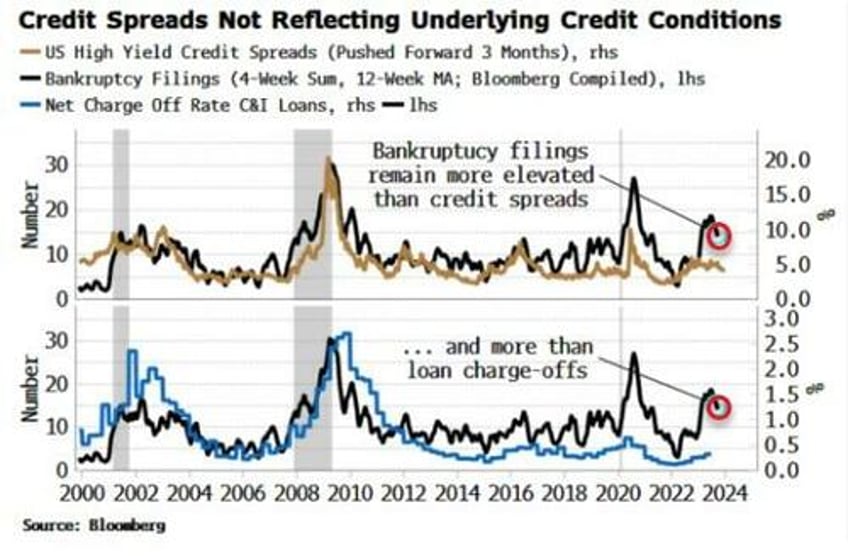

So far in this cycle, though, credit spreads have not hinted at any danger, remaining muted despite the fastest Federal Reserve rate-hiking cycle yet seen. But they have been an unreliable gauge of the credit-market’s true underlying state.

We don’t have to look far to find reasons why. Bankruptcy filings in the US have risen to levels previously associated with a recession. This would normally mean much wider spreads, yet they have been listless. Similarly, the rise in loan charge-offs has been timid in relation to the level of stress indicated by the number of companies on the financial precipice.

There are further cracks, from rising delinquencies in credit-card and auto loans, to a rapid increase in bond-default rates, with speculative-grade defaults rising from under 2% to over 4% since the Fed started raising rates.

What is going on?

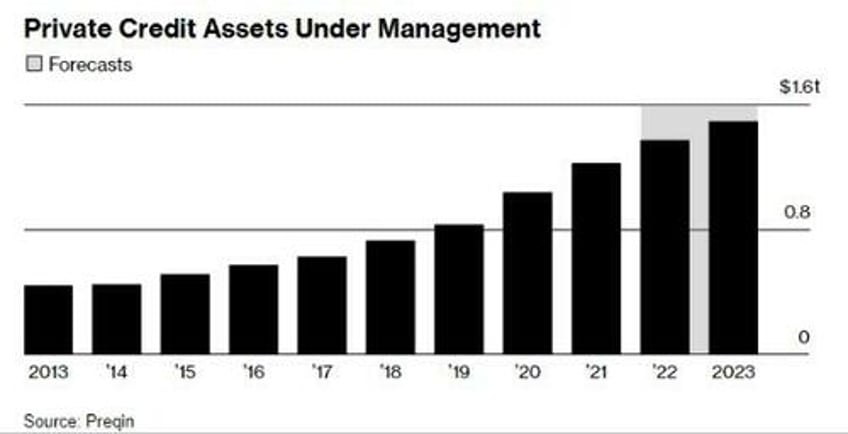

The rapid growth in private credit is undoubtedly one major factor. The US market is now $1.5 trillion, doubling in the last four years. With so much lending taking place off-market it is inhibiting price discovery, as loans’ true value can be obscured for much longer than if the loan or bond were traded on the open market.

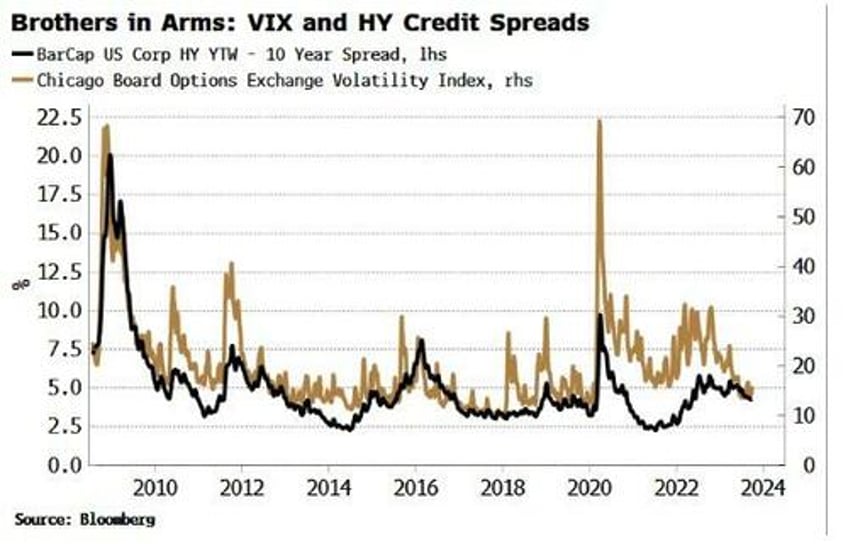

The other big driver has been the relentless fall in equity volatility despite a bear market and the highest policy rates seen for 15 years. Implied equity volatility, e.g. the VIX, has a close relationship with high-yield credit spreads, as equity and HY debt sit near each other towards the bottom of the capital structure, and both have to take the brunt of the adjustment when cash flows become stressed.

But credit spreads are also mechanically linked to equity vol by the model used to help deduce their value. The equity of a company is equivalent to a perpetual call option on the firm’s solvency. Taking the VIX or similar as an input, Black-Scholes can be used to infer a theoretical probability of default of the company (i.e. when the value of the firm’s asset becomes less than its debt), which is the basis of the value of a credit spread.

Lower implied equity vol, all other things equal, means lower credit spreads. It’s not a big surprise then to see that the VIX and HY credit spreads track each other very closely.

The VIX has been driven lower this year for two main reasons.

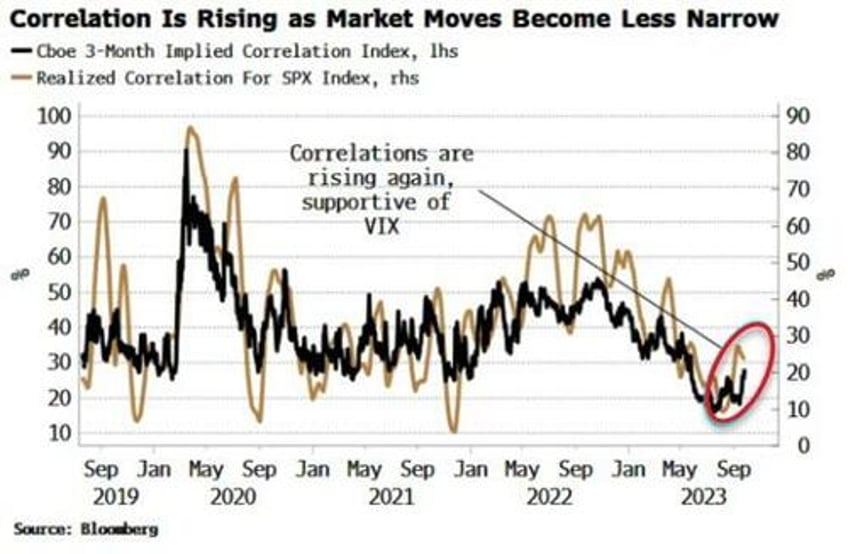

First, the implied correlation of the S&P ground lower as the rally was driven by only a sliver of stocks as AI mania gripped markets. Lower correlation means lower volatility as individual stock-price moves cancel each other out.

Implied correlations are rising again as the largest stocks are not dominating the move to the same extent, and this is likely to continue as the market sells off.

But an even more significant repressive influence on the VIX has been the hedging behavior of options dealers. A common strategy used by investors is to sell out-of-the-money (OTM) calls (i.e whose strike price is above the market) in companies whose stock they own, in order to earn extra income.

Options dealers sell investors these calls, and then “gamma hedge” by buying and selling the underlying stock to synthesize the option and make money between implied and realized volatility.

When dealers are mainly selling options to investors (ignoring the effects of time to expiry), gamma in the market is positive. When this is the case, dealers are rally sellers and dip buyers, repressing realized and ultimately implied volatility.

But when the market sells off, gamma can rapidly turn negative, as OTM calls the dealers are short become worthless, while the put options they are long suddenly become much less OTM. Dealers go from repressing volatility, to accelerating it, as they now have to chase market moves.

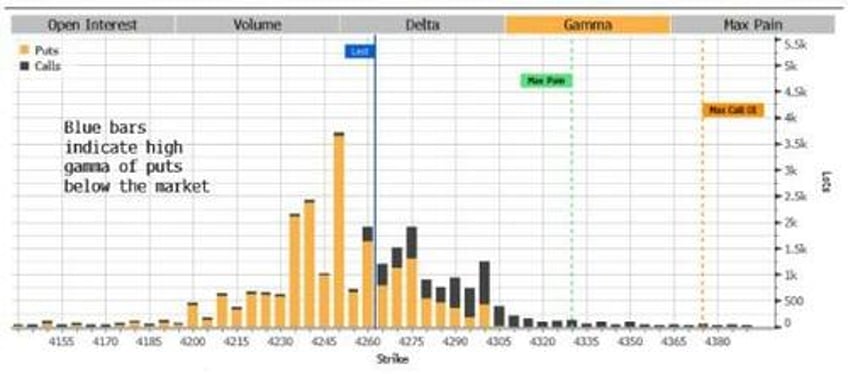

In recent days, gamma has dropped decisively into negative territory. When it is negative, it is frequently self-reinforcing, as now dealers must increasingly sell to hedge the wall of puts (see chart below) they will become shorter of, which means more selling, and rising market volatility.

As is often the case in markets, things go well slowly, but badly fast. The S&P is down over 5% this month, and both the VIX and credit spreads are rising. Vigilance is key, as a litany of extant risks has the potential to turn a garden-variety correction into a more serious credit event.