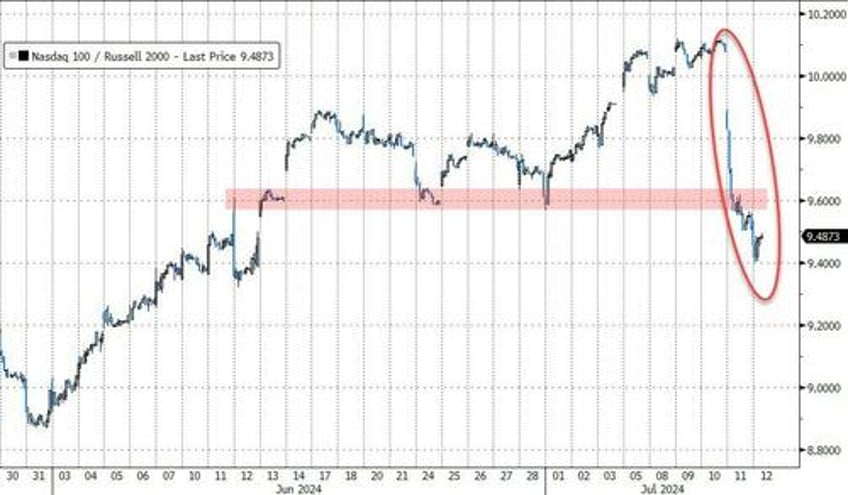

Ahead of yesterday's chaos, US equities had been up in 10 of the prior 11 sessions, but, as Goldman Sachs head of hedge fund coverage, Tony Pasuariello, points out in his latest note to clients, following a very friendly CPI print, however, that melt up was arrested - alongside a piercing reversal in the momentum factor (look no further than RTY outperforming NDX by nearly 6%, clearly suggestive of position reduction within the levered community).

However, he highlights that S&P is still marked higher on the week - and, if we take a slightly bigger step back, the index has generated a Sharpe ratio north of 3 since the lows of April.