Six years ago, when we first described Goldman's catastrophic foray into consumer banking, we joked that the Goldman of 2008 would be shorting the Goldman of 2018 for that ridiculous idea.

Here's Why The Goldman Of 2008 Would Be Shorting The Goldman Of 2018 https://t.co/SdcJs3i4zO

— zerohedge (@zerohedge) May 3, 2018

Fast forward to today when the joke is indeed on Goldman, and the bank's losses on its now defunct subprime, pardon, consumer lending unit have hit the stratosphere: according to the WSJ, Goldman is still looking to exit its partnership with Apple as losses continue to mount, and the bank is set to take a $400 million hit this quarter due to its floundering consumer business.

Speaking at a conference this week, Goldman Sachs CEO David Solomon explained that this $400 million hit comes from two primary things: selling off its General Motors credit card partnership and selling real estate loans. According to the report, the GM card business will be sold to Barclays, with around $2 billion in card balances.

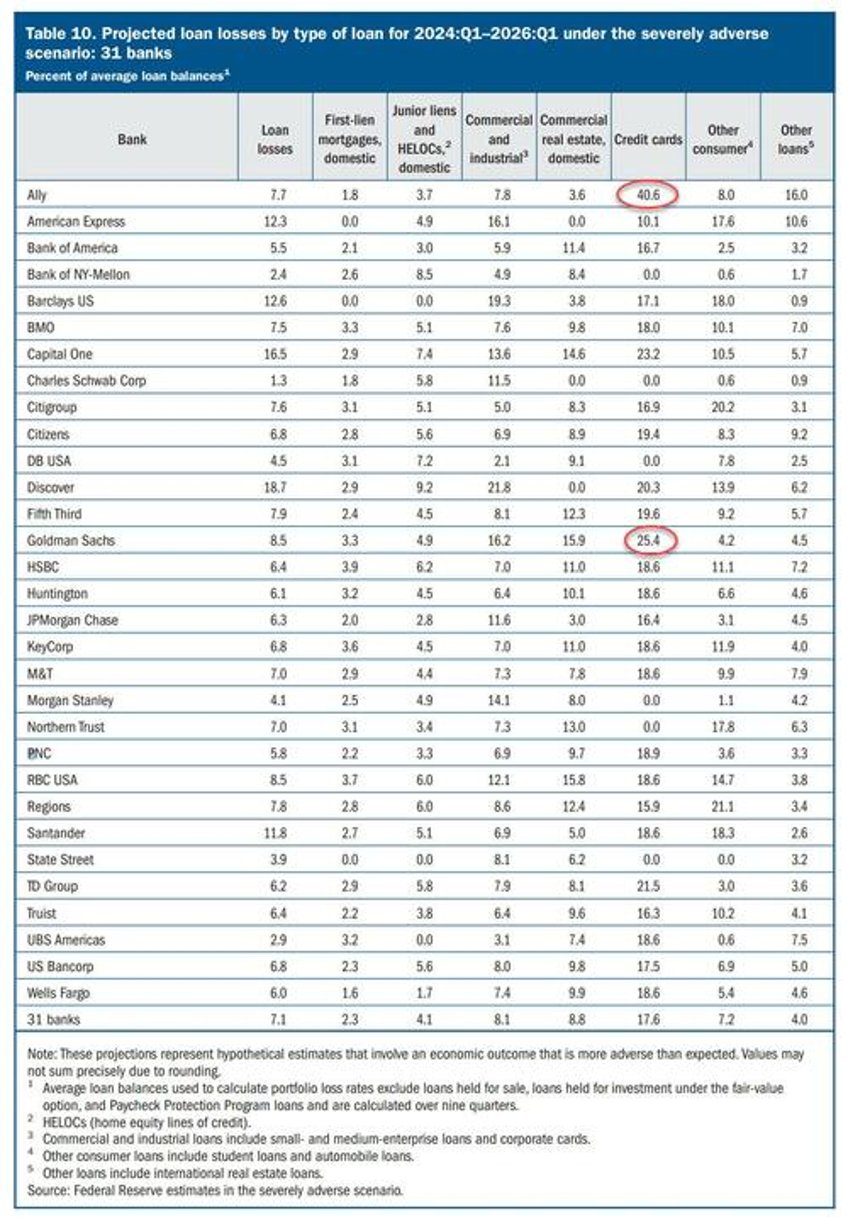

In total, Goldman Sachs has lost a staggering $6 billion pre-tax since the beginning of 2020 “on a big chunk of its consumer-lending businesses, including its credit cards", a sad confirmation of our 2018 warning. Several factors contribute to Goldman’s massive losses associated with Apple Card, including lax underwriting standards and the resulting charge-off rates that are nearly double those of other credit cards.

In fact the latest Fed stress test revealed that Goldman - the former master of the universe - now has the second crappiest, subprimiest credit card portfolio of all US banks; only Ally bank, whose stock got absolutely crushed last week, is worse.

In the years ahead of the covid crisis, Goldman had planned to its Apple Card to bolster the bank's efforts and expand into consumer banking. However, in the intervening years, the bank - which had exactly zero previous experience with consumer lending - bank began pivoting away from consumer-financing in 2022 after accumulating staggering losses, focusing its attention on its core strength: catering to big business and ultrarich clients.

Looking toward the future, Goldman Sachs is still looking to exit its partnership with Apple, which consists of the Apple Card and Apple Card Savings Account. Currently, Apple Card credit card balances total $17 billion. The Wall Street Journal says that Goldman Sachs could face even bigger losses when it offloads the Apple partnership than the losses associated with the GM sale to Barclays.

Last November, the WSJ reported that Apple had “sent a proposal to Goldman to exit from the contract in the next roughly 12-to-15 months.” The current fate of that proposal remains unclear. It’s previously been reported that Goldman has talked to American Express and Synchrony Financial about taking over the Apple Card business.