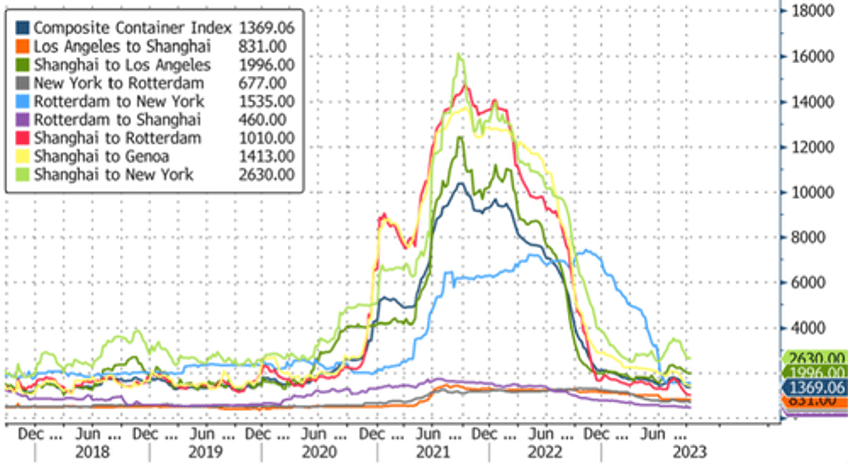

Since global shipping peaked during the Covid pandemic, A.P. Moller-Maersk has warned about an emerging downturn in the container shipping market.

Goldman now forecasts a lengthier and potentially more severe downturn for the shipping industry, recommending a sell for the Danish shipping giant:

"We believe market expectations are still too complacent on the depth and duration of the coming shipping recession," Goldman analyst Patrick Creuset told clients Monday morning.

Creuset said his fundamental perspective on the industry is that freight rates and earnings must continue to decline. This reduction is necessary until there's enough financial pressure to phase out expensive tonnage.

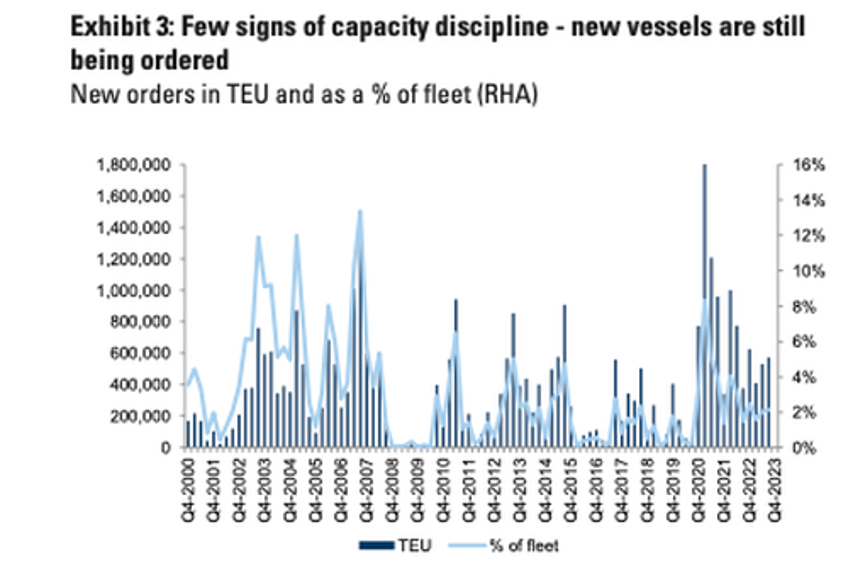

He said, "Even after the further rate drop in recent weeks, we see no sign of this: New vessel deliveries are running at c.1% of the global fleet/month with very little slippage, idling and scrapping remain low, and Nov active capacity is set to increase significantly vs. Oct on the main trades."

Creuset identified two major distinctions compared with previous bear markets, which might result in a steeper drop in EBIT margin than typically observed:

Industry balance sheets used to be highly levered meaning cash burn could not be sustained for long, whereas this time most carriers hold billions of USD in cash;

The erosion of the alliance structures means carriers are incentivized to make sure their network is large and strong enough to potentially sustain services on their own, e.g. MSC's strong growth on the back of the announcement of the 2M split. Point (2) is also likely to make the day-to-day management of overcapacity a lot harder in 2024/25.

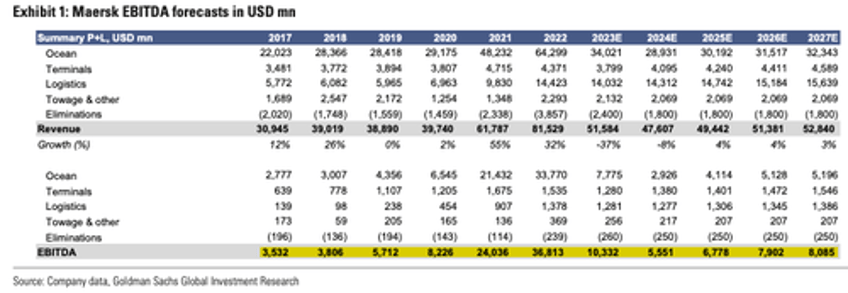

Goldman hit Maersk with a sell rating, expecting "2023-27 EBITDA estimates fall by 8% on average, reflecting lower freight rates."

The analyst shows carriers are still ordering new vessels, indicating the industry needs more tools to manage capacity.

Container rates on major shipping lines have roundtripped back to pre-Covid levels.

In August, Maersk warned about waning global demand for shipping containers by sea. The company transports Chinese-made goods for retailers such as Walmart, Nordstrom, Macy's, and Kohl's - all of whom have warned about a consumer slowdown.

Goldman's report offers even more evidence the global economy is on shaky grounds as the Western consumer appears to be sputtering amidst central banks' aggressive rate hiking cycle to tame the worst inflation in a generation.