This year, the long-running US exceptionalism trade has shown signs of fatigue as concerns over a potential economic slowdown mount. Top market strategists, including Goldman Sachs' William Hosbein and Nomura's Charlie McElligott, have voiced concerns that a growth scare scenario could unfold.

On Thursday, Goldman's Diana Asatryan provided clients with an updated take on the "Growth scare and tariffs" narrative that continues to flash alarm bells:

A sequence of disappointing prints—UMich, PMIs, consumer confidence, Walmart earnings—brought growth fears back to the forefront, right next to the ongoing tariff uncertainties:

Consumer health: Weaker consumer data and less optimistic earnings commentary from major retailers has lead to a major unwind in consumer names year-to-date, sparking renewed debates around the health of the consumer. Some of this pullback however can be attributed to weather and market seasonality, leading our consumer sector specialist to believe that the rapid negative shift in the narrative may be overblown. Watching March numbers, and clarity around tariffs/immigration reforms here.

Left tail: The Fed has made it clear that further monetary policy adjustment will be careful and deliberate. There is broad consensus, however, that the Fed can jump into action if there are signs of sustained economic weakness. Given the latest growth jitters, our rates desk already notes client interest in buying the left side tail, adding that there is likely room for the market to price deeper cuts.

Tariffs and DOGE: Policy continues to be the biggest driver of volatility this year. Specifically, the new administration's emphasis on growth-negative actions (tariffs, immigration restrictions), while growth-positive actions (tax cuts, deregulation) are taking longer, is weighing on market sentiment. Our Chief US Political Economist Alec Phillips provided a thorough rundown on everything from tariffs, to DOGE, to regulation, to tax cuts, and more in the latest episode of The Breaks of the Game—a must-listen.

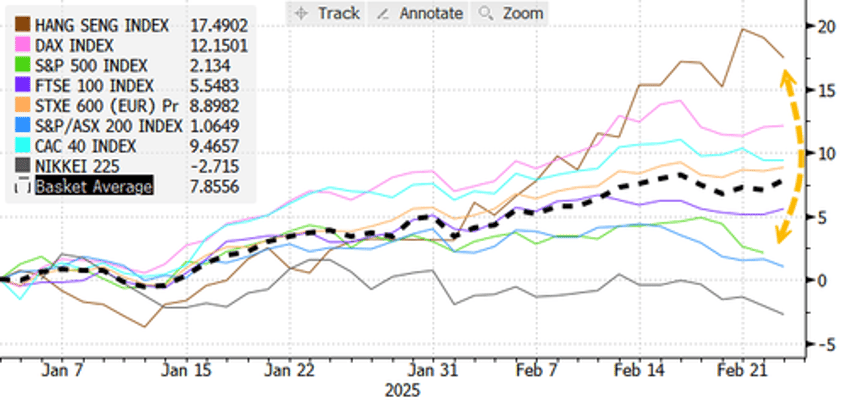

China sentiment: As outlined last week, Chinese equities are having their AI moment. But the trajectory of monetary policy, growth, and (again) tariffs, would be key to the sustainability of this rally. Join our APAC thought leaders this Friday for a discussion on China macro and policy outlook (replay to follow), and complete our latest client sentiment survey—you will receive the results as soon as you participate.

Asatryan provided clients with a chart pack focused on the trade policy and AI basket returns to offer a clearer view of the shifting economic landscape.

Here's part of that chart pack:

Where is the Trade Policy Uncertainty Index for the United States?

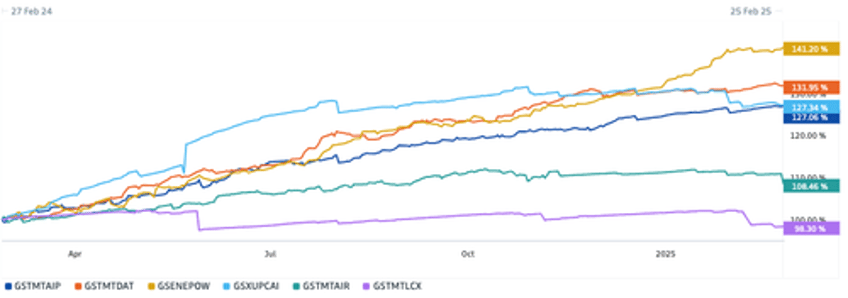

Where are the normalized earnings of AI Baskets?

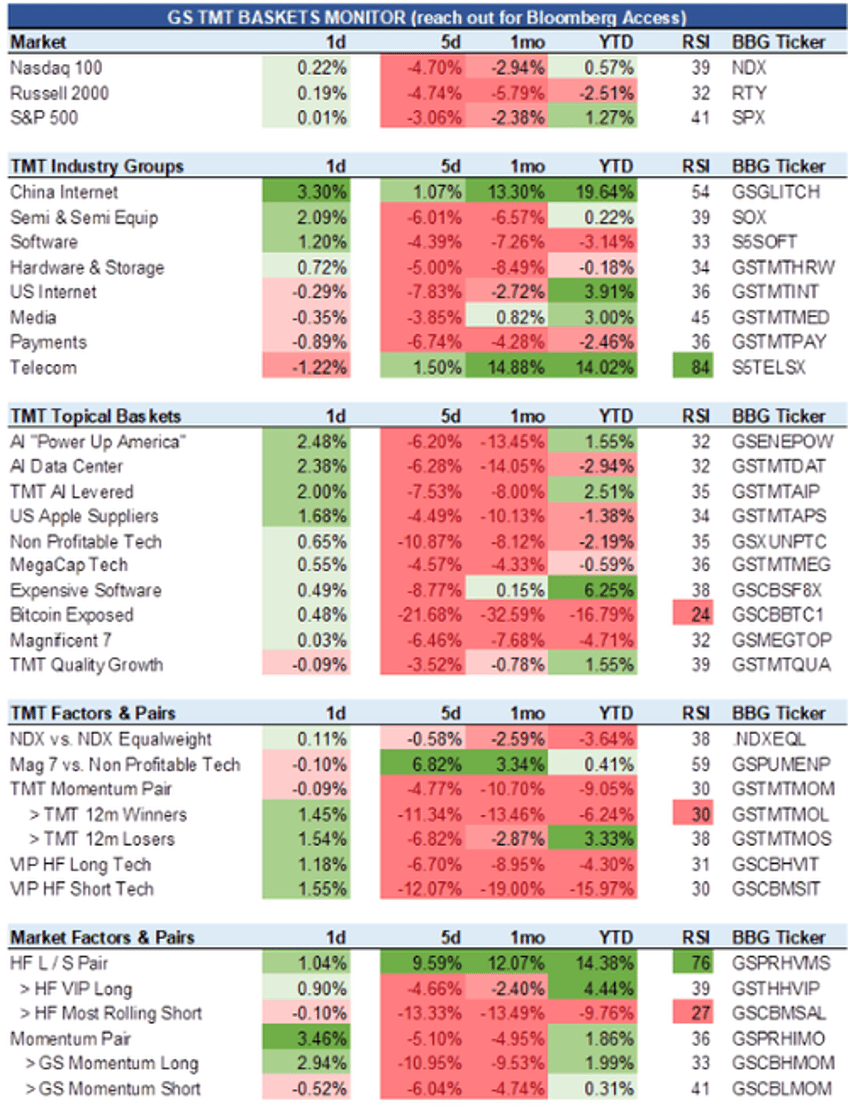

GS Sector / Basket Performance:

Our addition to the chart pack:

US Economic Surprise Indices are rolling over towards "misses" on average versus expectations...

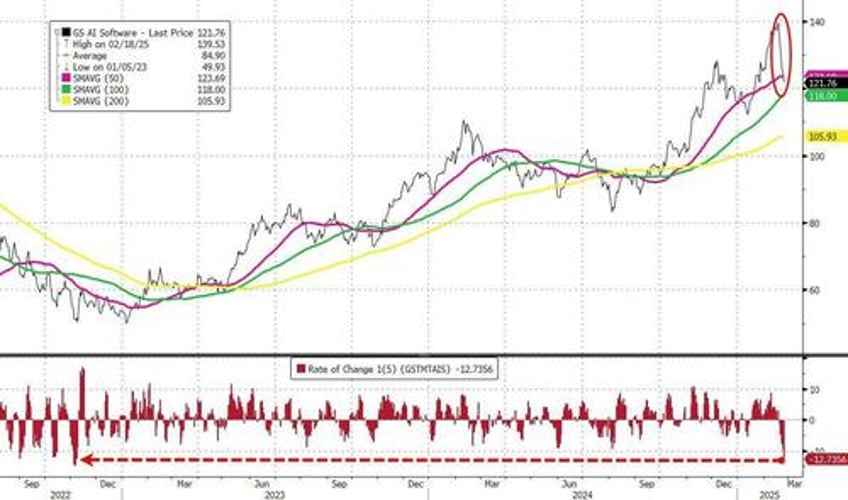

AI Software: After a blazing start to the year, the AI software basket (GSTMTAIS) has suffered its worst five-day move in two years (-13%).

The takeaway is that US exceptionalism is now on pause.

Will this be enough for TSY yields to slide, considering the Trump admin is laser-focused on bringing down borrowing costs?