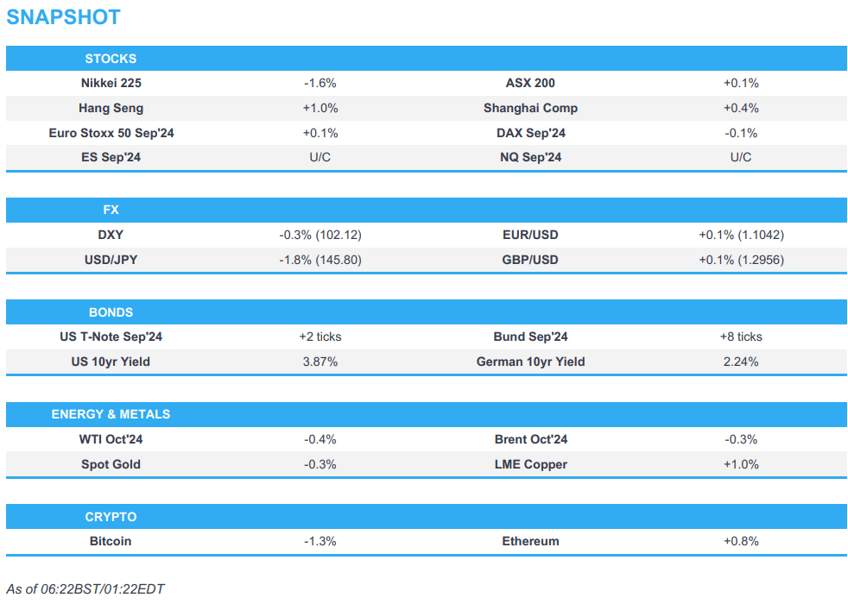

- APAC stocks were mixed with a somewhat cautious tone amid geopolitical uncertainty after Hamas rejected the latest ceasefire proposal.

- Fed’s Daly (voter) said it is time to consider adjusting rates from their current level, Goolsbee (non-voter) said inflation and the labour market are cooling faster than expected.

- European equity futures indicate a slightly positive open with the Euro Stoxx 50 future up 0.1% after the cash market finished with gains of 0.7% on Friday.

- DXY is on the backfoot alongside gains in the JPY, antipodeans are also notably firmer vs. the USD.

- Hamas on Sunday rejected an updated US proposal for a ceasefire and hostage deal in Gaza.

- Looking ahead, highlights include BoC SLOOS, NZ Trade Balance, US Democratic Convention, Comments from Fed’s Waller.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks eked marginal gains on Friday with the upside capped after mixed data releases and amid the ongoing geopolitical uncertainty, while participants also reflected on cautious rhetoric on the economy from Fed's Goolsbee.

- SPX +0.20% at 5,554, NDX +0.09% at 19,508, DJIA +0.24% at 40,659, RUT +0.27% at 2,141.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed’s Daly (voter) said recent data gave her more confidence that inflation is under control and it is time to consider adjusting rates from their current level, while she noted the Fed needs to take a gradual approach to reducing borrowing costs, according to FT.

- Fed's Goolsbee (non-voter) said on Friday that he has concerns for 2024 and that they have crosscurrents. Goolsbee added he is concerned that the Fed set this level of rates over a year ago and inflation and the labour market are cooling faster than expected, while he thinks the Fed should take a step back and think about it.

- Republicans warned Donald Trump to get serious on policy or he could lose and cautioned that his 'showman' tactics could cost him the chance of a second term in the White House, according to The Telegraph.

- Goldman Sachs cuts the probability of a US recession in the next 12 months to 20% from 25%; cites last week's Retail Sales and IJC metrics. Says could lower it to 15% in the event that the August jobs report "looks reasonably good".

APAC TRADE

EQUITIES

- APAC stocks were mixed with a somewhat cautious tone amid geopolitical uncertainty after Hamas rejected the latest ceasefire proposal and as participants await this week's key events including the Jackson Hole Symposium.

- ASX 200 traded rangebound as outperformance in gold miners and utilities was offset by weakness in consumer stocks.

- Nikkei 225 swung between gains and losses and traded on both sides of the 38,000 level after mixed Machinery Orders data, while the index was then pressured again later in the session alongside a firmer currency.

- Hang Seng and Shanghai Comp. gained amid stimulus hopes after Premier Li hinted on Friday at targeted measures to smooth the economic cycle and promote consumption, while a recent report noted weak Chinese data raised the pressure for Beijing to provide support and revived talk of regarding the idea of China issuing shopping vouchers.

- US equity futures kept afloat after last Friday's mild gains but with price action contained amid a lack of key drivers.

- European equity futures indicate a slightly positive open with Euro Stoxx 50 futures up 0.1% after the cash market finished with gains of 0.7% on Friday.

FX

- DXY remained subdued after last Friday's selling pressure and with comments from Fed's Daly over the weekend who stated recent data gave her more confidence that inflation is under control and it is time to consider adjusting borrowing costs.

- EUR/USD mildly extended on its recent advances after having reclaimed the 1.1000 status.

- GBP/USD marginally added to last week's gains albeit with upside capped near the 1.2950 level.

- USD/JPY experienced a dead cat bounce overnight with early upward momentum thwarted by resistance around 148.00, while the pair then continued to decline throughout the session and eventually slipped beneath the 146.00 handle.

- Antipodeans benefitted from the dollar weakness with prices also helped by Chinese stimulus hopes and recent gains in the metals complex.

- PBoC set USD/CNY mid-point at 7.1415 vs exp. 7.1548 (prev. 7.1464).

FIXED INCOME

- 10-year UST futures lacked direction ahead of this week's key events culminating with the Jackson Hole Symposium.

- Bund futures were rangebound after last Friday's whipsawing with short-term supply and the monthly Buba report scheduled later.

- 10-year JGB futures retreated from the open amid mild gains in Japanese yields despite mixed Machinery Orders data.

COMMODITIES

- Crude futures were little changed in the absence of any major catalysts and as geopolitical uncertainty lingered.

- Norway’s Equinor said production at Gullfaks C Platform in the North Sea is shut and it evacuated some workers from the platform as a precaution following a well incident, while it is unclear when production will restart but output at other Gullfaks platforms are running as normal.

- Algeria is to immediately supply Lebanon with fuel to operate electric power stations and return electricity to the country, according to Algerian state radio cited by Reuters.

- Iran said it is ready to tranship Russian gas through its territory, according to TASS.

- Spot gold took a breather after climbing to above the USD 2,500/oz level for the first time ever late last week.

- Copper futures remained underpinned following Friday's intraday rebound and alongside the positive mood in China.

- BHP Escondida workers union said it could relaunch a strike if the Co. does not rectify its position over contract talks as soon as possible.

CRYPTO

- Bitcoin gradually edged higher but remained beneath the USD 59,000 level after retreating from resistance at USD 60,000 over the weekend.

NOTABLE ASIA-PAC HEADLINES

- China’s Vice Premier is to co-chair a regular meeting between Chinese and Russian leaders with Russia’s Deputy PM on August 19th-20th, according to Chinese state media.

- Singaporean PM Wong warned that increasing tensions between the US and China will have an impact on Singapore’s economy and the broader region, according to FT.

DATA RECAP

- Japanese Machinery Orders MM (Jun) 2.1% vs. Exp. 1.1% (Prev. -3.2%)

- Japanese Machinery Orders YY (Jun) -1.7% vs. Exp. 1.8% (Prev. 10.8%)

GEOPOLITICAL

MIDDLE EAST

- Israeli military said it conducted an airstrike in Lebanon’s Nabatieh which targeted a Hezbollah depot, while it was separately reported that Israel targeted the towns of Houla and Beit Leif in Lebanon during airstrikes on Sunday night, according to Al Jazeera. Furthermore, an Israeli airstrike targeted agricultural land northeast of the Nuseirat refugee camp in the central Gaza Strip and it was also reported that 10 people were killed in an Israeli strike on central Gaza’s Zawaida.

- IDF said it detected the launch of a number of suspicious air targets from Lebanon towards areas in the Western Galilee.

- Israeli PM Netanyahu’s office said the Israeli negotiating team expressed cautious optimism in advancing a Gaza hostage deal. PM Netanyahu's office also said Israel is in complex negotiations and there are things it can and cannot be flexible about, according to Reuters.

- Hamas on Sunday rejected an updated US proposal for a ceasefire and hostage deal in Gaza and blamed Israeli PM Netanyahu for moving the goalposts and the US for indulging him, according to Axios.

- Hamas said the new ceasefire proposal presented by the US at talks in Doha responds to Israeli PM Netanyahu’s rejection of a permanent ceasefire and complete withdrawal from Gaza, while it added that the proposal placed new conditions in the issue of a hostages exchange and retracted other issues hindering a deal, according to Reuters.

- US President Biden said they will not give up and a Gaza ceasefire is still possible. It was separately reported that US Secretary of State Blinken arrived in Israel to renew the push for a Gaza ceasefire.

OTHER

- IAEA said nuclear safety at Ukraine’s Zaporizhzhia nuclear power plant is deteriorating following a drone strike that hit the road around the plant site perimeter, while it stated there were no casualties and no impact to equipment, but there was an impact to the road between the two main gates of the plant.

- Russia captured the village of Svyrydonivka in Ukraine’s Donetsk, according to TASS.

- Belarusian President Lukashenko said troops were deployed along the entire border with Ukraine, according to RIA.

- North Korea condemned Ukraine’s attack against Russian territory as an act of terror and invasion backed by the US and the West. North Korea said the anti-Russia policy of the US is driving the global security environment to the brink of World War 3, while North Korea will stand with Russia as it seeks to protect its sovereignty and realise international justice, according to KCNA.

- US, South Korean and Japanese leaders pledged to consult on regional challenges, provocations and threats, while they said they are resolved to maintain peace and stability in the Indo-Pacific.

- China's Coast Guard said Philippine Coast Guard vessels illegally intruded into the waters adjacent to Sabina Shoal without permission from the Chinese government and one of the Philippine vessels ignored China's repeated solemn warnings and deliberately collided with the Chinese vessel in an 'unprofessional and dangerous' manner. The Philippines later commented that the Philippine Coast Guard encountered 'unlawful, aggressive manoeuvres' in the South China Sea from Chinese Coast Guard vessels which resulted in structural damage to both Philippine Coast Guard vessels.