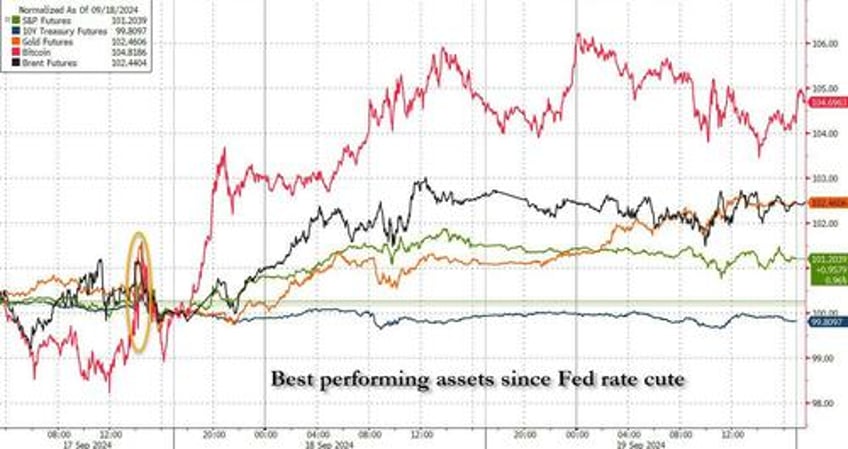

One week ago, anticipating a rate cut by the Fed and the ensuing inflation such a move would spark, BofA's Michael Hartnett said that the best hedge against inflation accelerating in 2025 would be gold, and one look at the best (and worst) performing assets since 2pm on Wednesday confirms that (with the exception of bitcoin) gold is indeed the best performing assets (along with crude but that is bouncing from a record oversold level).

Then again, pretty much everything is higher, with the exception of 10Y Treasuries, a bizarre reaction from a "flight-to-safety" asset class which traditionally outperforms when conditions get easier, and the last time Treasuries dropped after a 50bps rate cut was October 2008.