By Andrew Zatlin of Southbay Research

Summary

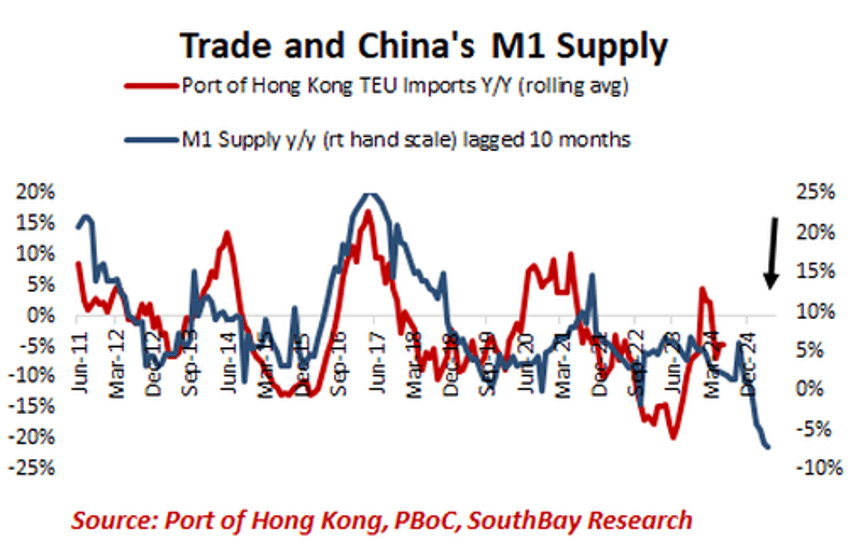

- Chinese money supply leads imports ~10 months

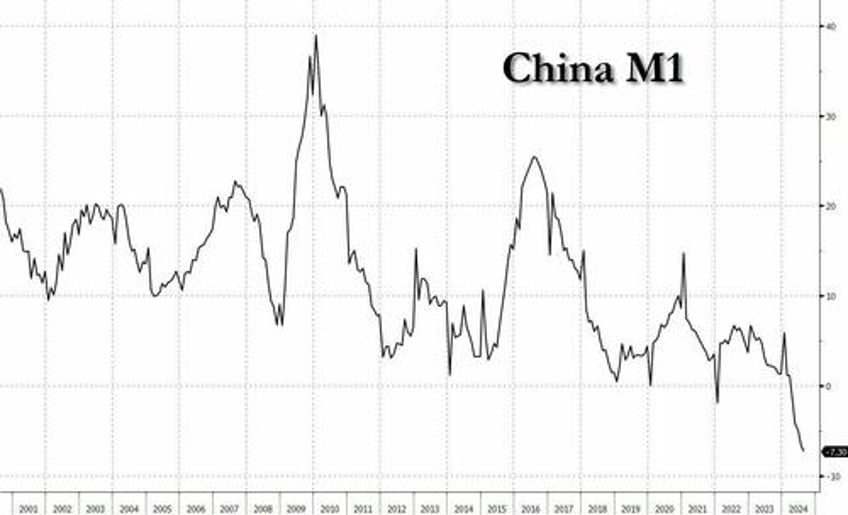

- M1 Supply y/y growth weakest/sharpest drop in decades

- Suggests 20% collapse in imports

Red Flag for Red China

The advantage of tracking container volumes is that we can bypass inflation and price distortions.

Simply put, on a container volume basis, Chinese imports are struggling: -7% y/y. Container throughput has fallen 20% in the last 2 years.

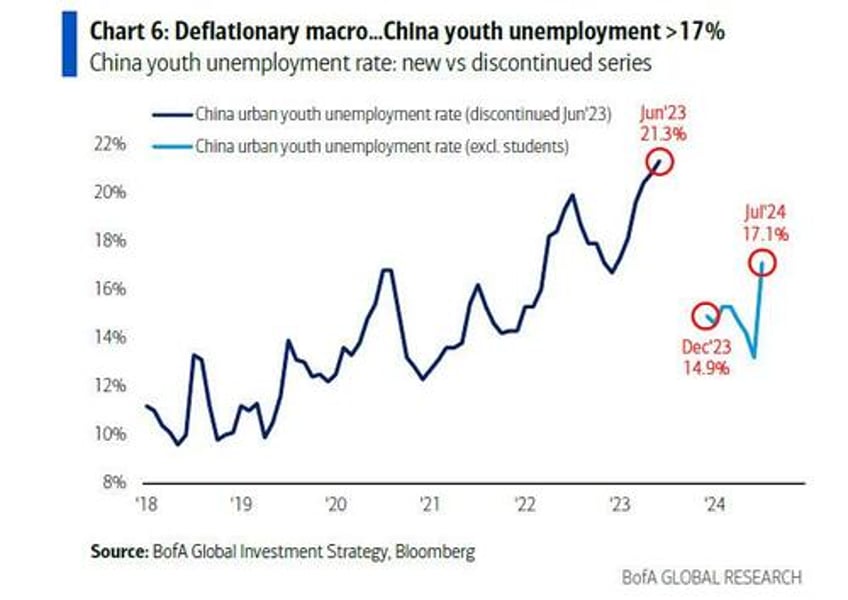

The Chinese economic miracle is fading. Unemployment is 5.3% in the cities and 17% among youth 17-24 years old (ex students). Goldman, Citi, JP Morgan are all expecting growth of <5%.

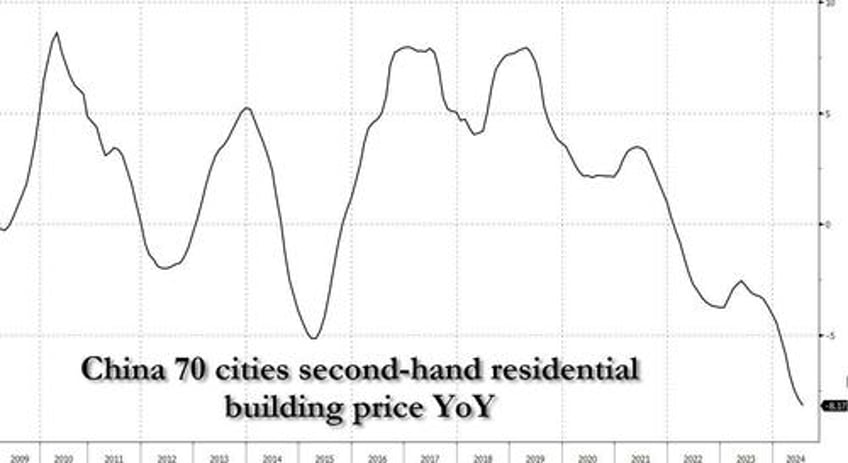

The housing sector is the point of focus. Housing asset values supported the consumer economy but prices have collapsed. The latest month: -7% y/y. The Chinese consumer won't spend until housing prices stabilize. The housing bubble must be reinflated.

Meanwhile, China's broadest monetary aggregate, M1, is falling at the fastest pace on record.

Deflationary Impulse

2025: a year of trade wars: Factories far and wide have excess capacity. Chinese factories will export whatever they can at whatever price they can get. We see that in commodities like steel, where prices are down 20% this year.

Sluggish exports to China are affecting other countries. Expect tariffs and other forms of trade wars to break out but the lag in restrictions means a lot of deflation is coming to the US.

China Stimulus is Coming

The only cards China can play are monetary: move the yuan to 7.5+ and stimulate the housing market. A Trump Presidency will fight the yuan devaluation and export initiatives. A Harris Presidency won't (they haven't under Biden). More deflation under Harris, less under Trump.

How to trade it: buy gold, buy crypto, buy anything the Chinese will use to evade the Chinese capital account firewall and coming currency devaluation.