By Russell Clark of the Capital Flows and Asset Markets substack

Has the Federal Reserve fucked up?

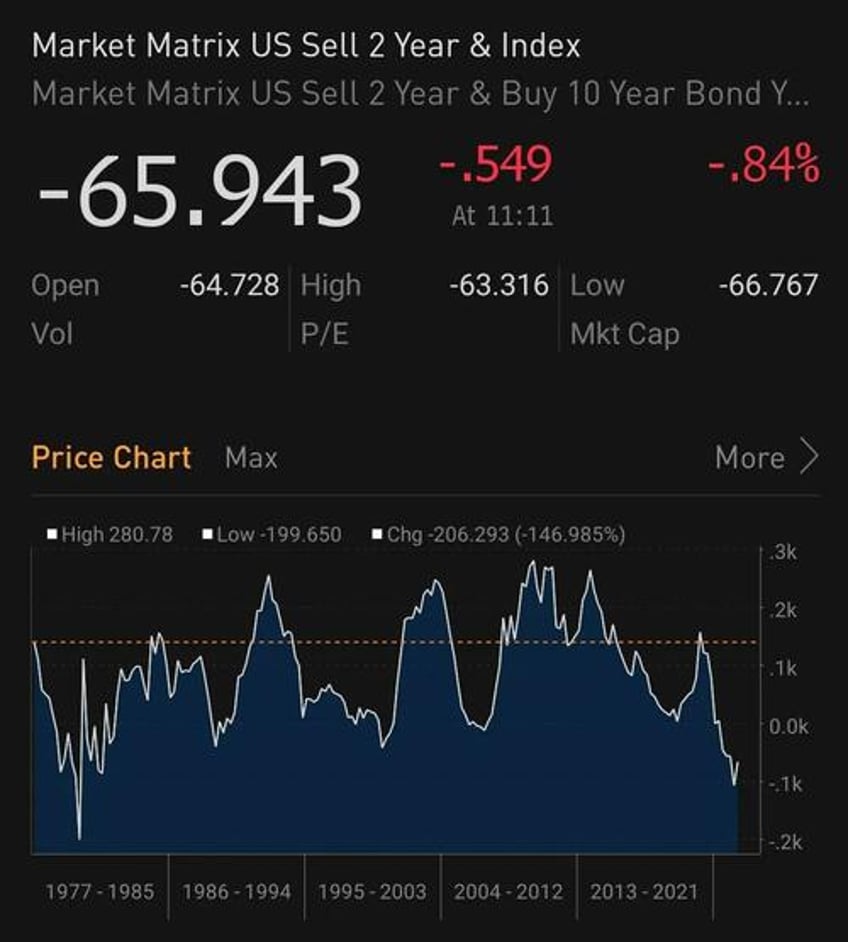

Markets were a bit unsure of what the decisions would be from the Federal Reserve. Looking at monetary policy history, they would have seemed wise to pause interest rates increases. Looking at the US bond market, with it deeply inverted, this has typically been seen as a sign of “over-tightening” by the Federal Reserve. The 2 year to 10 year spread is its most negative since the 1970s, and previous bouts of yield inversion have preceded financial problems.

And if you look around, there are loads of indicators that show the economy is beginning to roll over. US quits rates is one, but you have a huge choice in indicators to choose from to be honest. And with lag in monetary policy effects, it is easy to understand why the Federal Reserve chose caution over action.

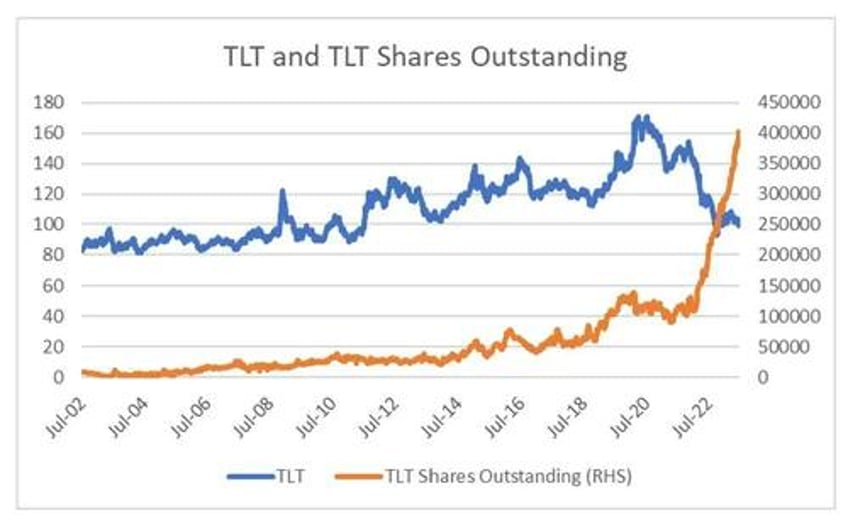

The economics and the back testing all tell you, now is the time to buy long dated bonds. Many market commentators also recommend bonds. And the market has responded. Inflows into TLT have been huge, even as TLT itself has been poor.

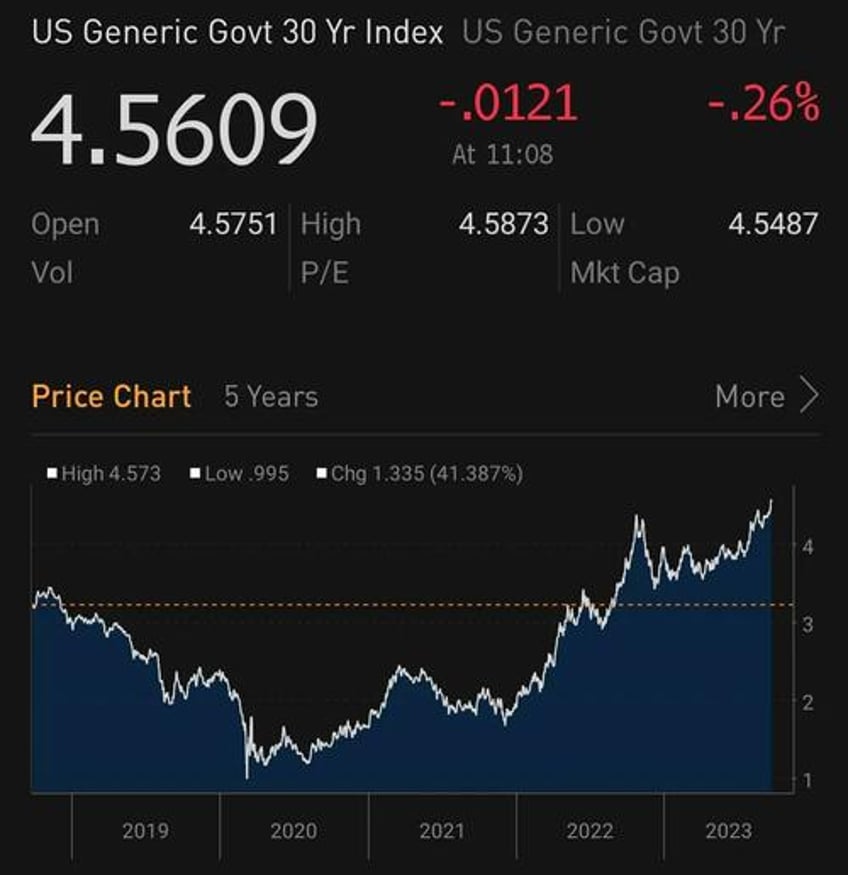

The problem with this analysis is not the economics, but the politics. If you think the US government is fully ok with rising unemployment, and/or constrained by fiscal deficits, and will act to reduce these deficit, then buying bonds is completely rational. The problem is that you know that the next Presidential election will be contested between Trump and Biden. Both are proven spenders. There is no more austerity in US politics because Trump proved it’s a losing electoral strategy, just as Reagan and Thatcher proved austerity in the 1980s could be an election winning strategy. In a new pro-labor world, central banks have to act as a restraint, and when they don’t the bond market rebels. You can see despite the pause, the 30 year US treasury yield hit new highs.

This is of course a problem, as the US housing market feeds directly off the yield on the 30 year Treasury. The Fed “pause” actually will do nothing much for the economy. I am fairly convinced we have moved back to a big-government, pro labor world, which puts the long end of the yield curve in a bear market. Buying at 4.5% makes very little sense to me. In reality, long dated Treasuries are a structural short, and I read steep inversion as a sign that it is a good time to short! An inverted yield cure, means you can sell a 30 year Treasury, put the proceeds in cash, and make a positive spread!

When I think about interest rate policy, the pressure not to increase rates must be intense. The amount of wealth that has been built on transforming credit to equity is vast, and where there is money, there is political power. But the votes are no longer with the wealthy, they are with the poor, so policy is pro-labor for as far out as I can see. My preferred trade of long GLD/Short TLT also took out new highs on the Fed pause.

One other trade I recommended for a new pro-labour world was Japanese banks. They continue to steam ahead. Historically speaking they have tended to act as deflationary canaries in the mine. Japanese banks are not point to an imminent slowdown requiring interest rate cuts!

In the new political environment, central banks need to be aggressive to keep inflation under control. The pause is already been seen as a mistake by bond markets. I expect the Fed to resume raising rates shortly. I ultimately suspect treasury yields get back to double digits.