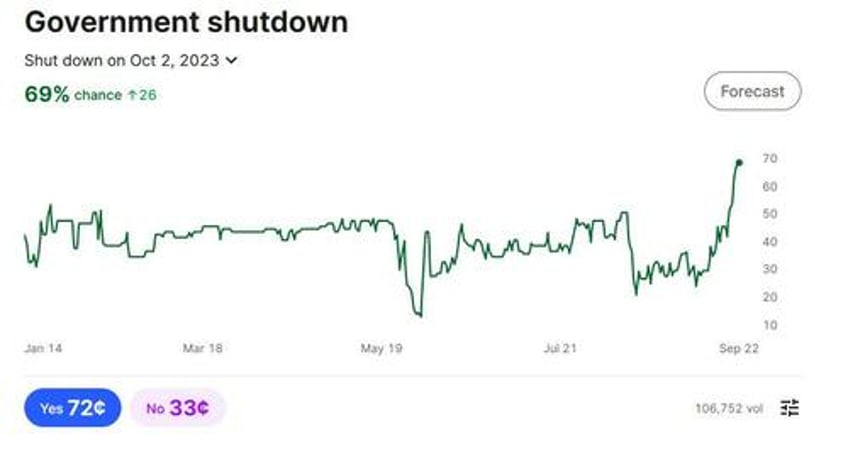

According to Bloomberg chief economist Anna Wong, online betting markets see a 69% chance of a federal government shutdown starting Oct. 1, when appropriations will lapse if lawmakers can’t agree on a funding bill (in reality, the odds of a shutdown are just about 100%, although after a few weeks all should go back to normal as it always does after people get bored with the theatrics).

What happens then?

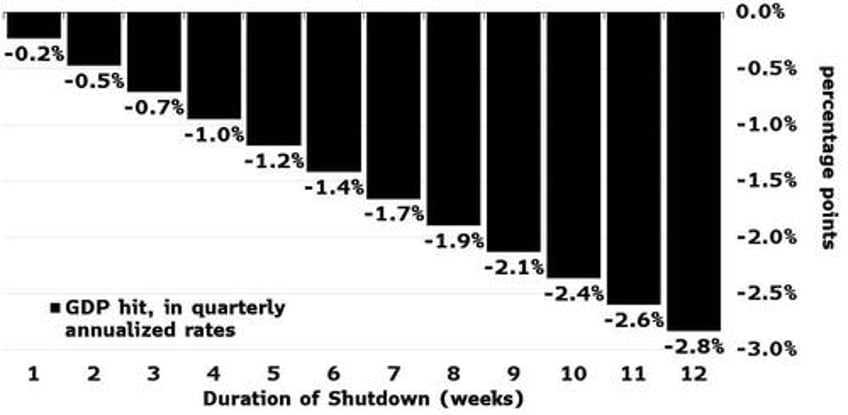

According to Goldman, a government-wide shutdown would reduce quarterly annualized growth by around 0.2% for each week it lasted after accounting for modest private sector effects. Goldman's baseline is that a shutdown could last for 2-3 weeks (the Trump government shutdown, the longest in history, lasted 35 days, from Dec 22, 2018 to Jan 25, 2019).

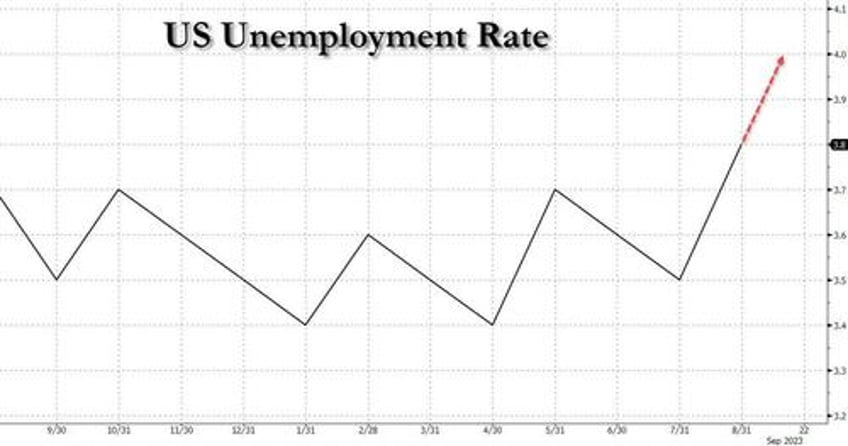

Meanwhile, Bloomberg Economics estimates a month-long government shutdown could temporarily push up the unemployment rate in October, triggering a popular rule for identifying the start of a recession.

And while the hit to unemployment and GDP growth will reverse once the funding impasse is resolved, Bloomberg's baseline is for the shutdown to have a mild negative impact overall due to forgone economic activity and uncertainty.

Bloomberg also speculates that in an extreme tail event, the maximum hit to 4Q GDP would be a drag of 2.8% if the shutdown lasts for the entire quarter.

Considering that the current Bloomberg survey median sees just 0.4% GDP growth for 4Q, a shutdown that lasts all quarter would push 4Q growth deep into negative territory, something we first said on Tuesday. However, as noted above, past shutdowns have, on average, been much shorter. The eight government shutdowns since 1982 have lasted an average of two weeks. The longest one — in 2018 — lasted five weeks.

Assuming a two-week duration, the shutdown will knock 0.5% off annualized quarterly GDP growth while it’s ongoing, and raise the unemployment rate by 0.1% in October. The effects will mostly reverse within 4Q once the funding stalemate is resolved, but forgone economic activity and the uncertainty from the shock could produce a net drag of 0.1% on 4Q GDP.

In the scenario of a month-long shutdown — and assuming the unemployment rate remains at 3.8% in September — October’s unemployment rate could increase to 4.0%. That would meet the Sahm Rule threshold for identifying a recession.

At the same time, a shutdown also would affect the Bureau of Labor Statistics’ ability to collect real-time unemployment statistics — potentially affecting the accuracy of those data when they’re ultimately released with a delay (not like that matters since most BLS data is already highly manipulated and "goalseeked"), to wit:

A shutdown beginning Oct. 1 and lasting two weeks — well within the normal range based on government shutdowns over the past 30 years — would likely delay the October jobs report, due Nov. 3. That might tip the scales toward an extended hold for a data-dependent Fed that won’t have all the data in hand.

Bloomberg's bottom line: In the event of a protracted government shutdown, the FOMC will face a uniquely uncertain economic environment at the Oct. 31-Nov. 1 meeting — and that may convince officials to hold rates steady again rather than hike.