From the end of October through the end of Q1, the S&P was higher in 18 of 22 weeks, for a cumulative return of 26% on the back of The Fed's "pivot" and belief that rate-cut-gasms are coming to save the world. Even more impressively, the Sharpe ratio along that path was a stunning 3.8 (think about that for a moment).

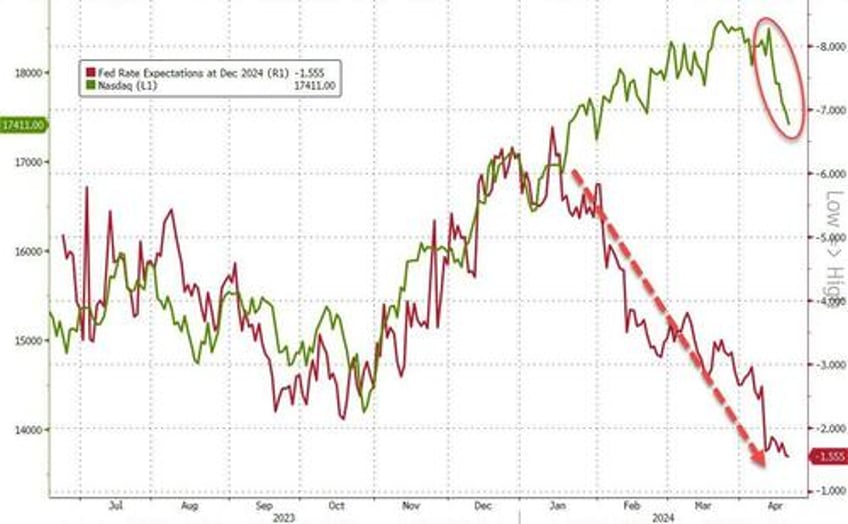

Since then, the index has sold off for three straight weeks - and NDX down six of the past seven - with the retracement marked by clear shifts in both market-tone and investor-positioning.